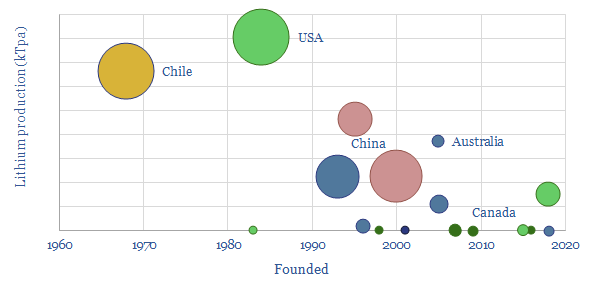

This data-file is a screen of lithium producers and lithium technology companies, capturing 35 companies, their output (in kTpa), their size and their recent progress. Which companies benefit from the structural ascent of lithium ion batteries for electric vehicles?

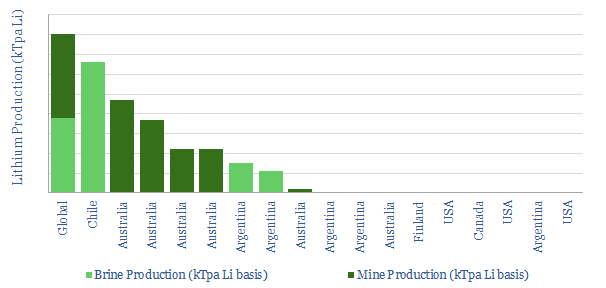

Our first conclusion is that the current lithium industry is heavily concentrated, as eight companies effectively control 90% of global supply.

While lithium demand is expected to grow 30x on our numbers (model here), there is intense competition to expand existing lithium assets and develop new production, across 10 earlier-stage development companies, many listed in Canada and Australia.

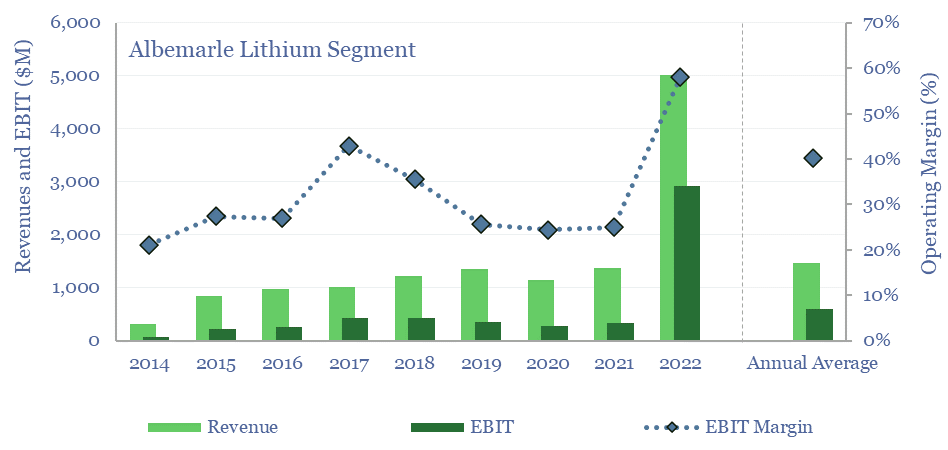

Albemarle is the largest lithium producer in our screen and has generated a 40% operating margin across its mine and brine assets since 2014 (chart below). We have also screened Albemarle’s patents.

Other mature lithium mining and lithium brine companies are captured in our screen of lithium producers, many are publicly listed lithium producers, and are headquartered in Chile, China and Australia.

Five of the early-stage companies in our data-file underwent financial restructurings in 2020-22, or outright lawsuits over misleading disclosures. To some, this might be a reminder for the high risks of early-stage companies; while to others, weak progress might entrench strong returns for incumbents.

For our outlook on lithium in the energy transition, please see our broader lithium research, battery research and vehicle research.