Global uranium production is broken down by company and by country in this data-file, which also screens 20 of the most noteworthy companies in uranium mining, the reserves, production and operational details. This matters as another contracting cycle is underway in the uranium industry, due to rising power demand, next-gen nuclear, but also supply disruptions linked to geopolitics.

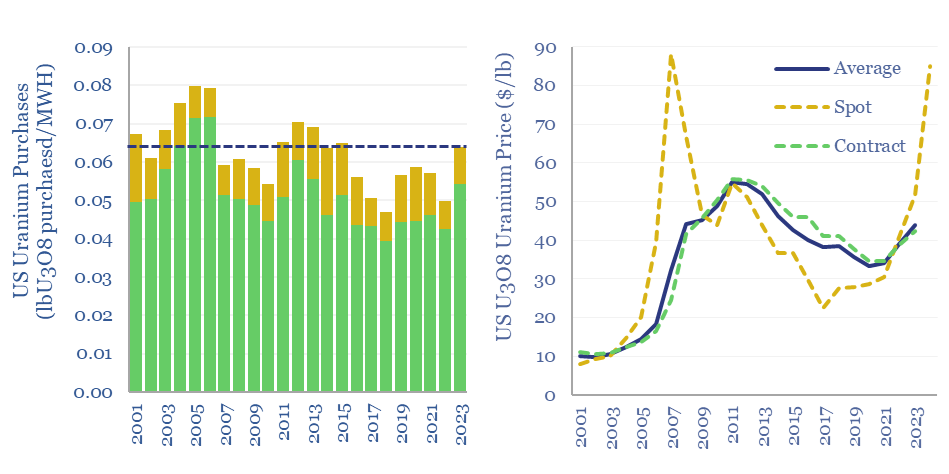

An up-cycle is underway in uranium markets. A typical nuclear power plant generates about 9 MWH of electricity per kg of U3O8 purchased, which requies purchasing 0.06 lbs of U3O8 per MWH. In 2016-22 the industry was oversupplied, generation facilities ran down their inventories (chart below left) and spot prices lagged contract prices (chart below right). But in 2023-24, it looks like a restocking cycle has started.

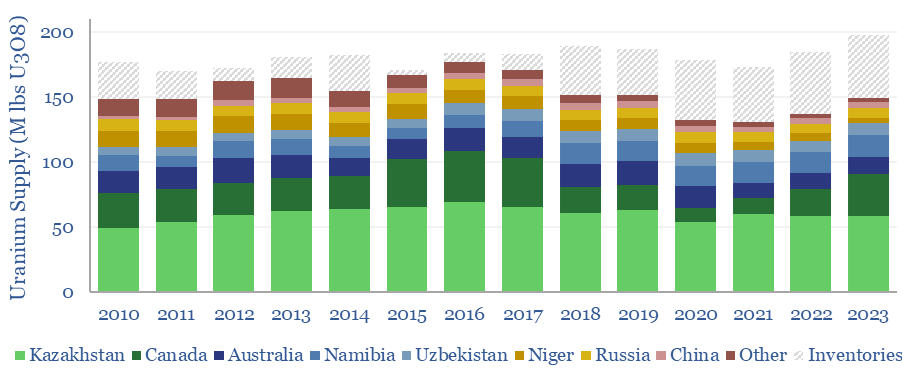

Global uranium production reached 200M lbs of U3O8 ‘yellow cake’ in 2023, a new record level. The largest three producers are Kazakhstan (c40%), Canada (20%) Australia (10%) and Namibia (10%). There has been growing fear of supply disruptions linked to geopolitical tensions linked to Russian aggression, and including a coup d’etat in Niger in 2023.

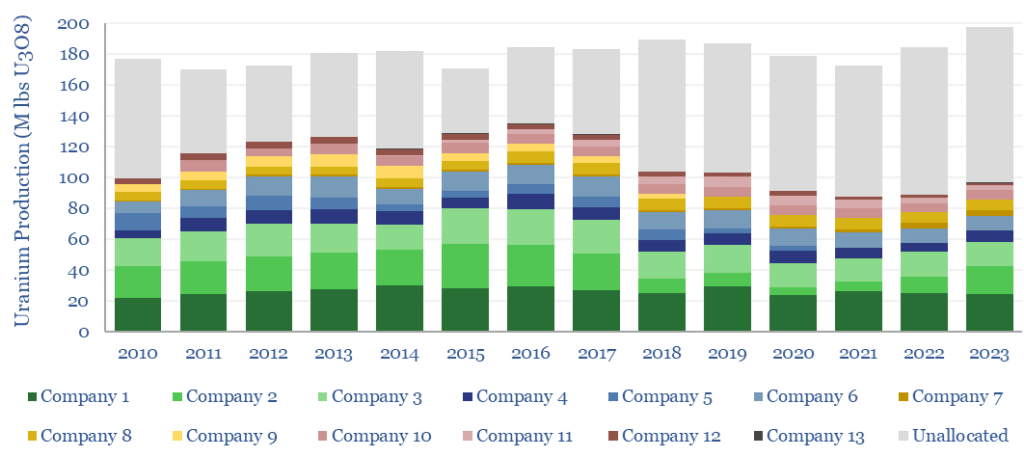

Global uranium production by company is also broken down in the data-file. Equity production from a dozen companies explains over half of the market. The largest four companies explain one-third of the market, including Kazatomprom, Cameco, BHP and Orano. The data-file contains recent notes and data on each company.

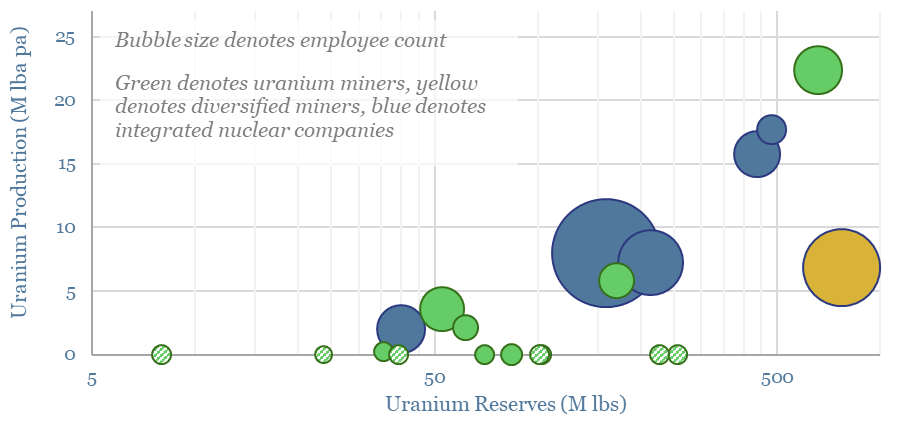

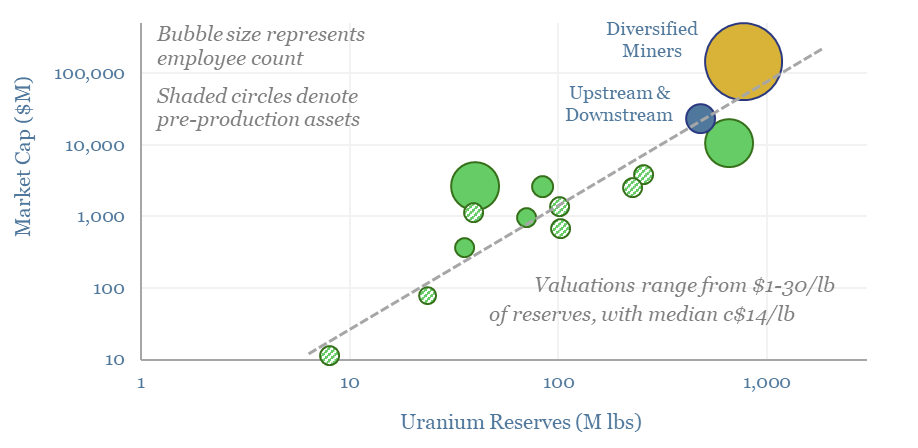

Earlier-stage uranium companies are also screened, aiming to develop uranium projects, especially in Canada, the US and Australia. Market caps versus uranium reserves/resources are cross-plotted below. Growth projects are also necessary as large producers have an average RP ratio of 27-years. Two earlier-stage companies stood out.

Interestingly, many of the projects in the data-file also co-produce other important metals, such as copper, vanadium or Rare Earths such as neodymium for magnets.

Other companies in the data-file are seeking to revive production at uranium mines that were shuttered — partially or fully — amidst weak industry conditions in 2018-2021. Numbers are in the data-file.

All of our research into nuclear in the energy transition can also be viewed chronologically. There is also a read across to mining equipment companies and upside for mining in the energy transition.