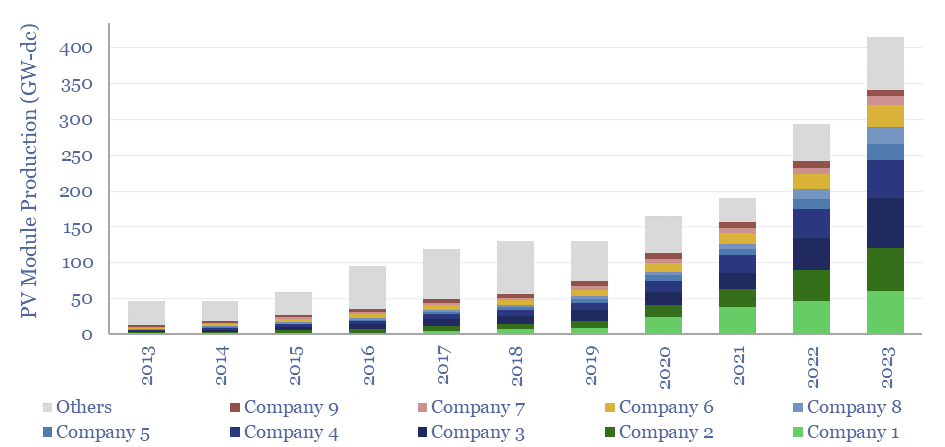

The world produced over 400GW of solar modules in 2023, which is up 10x from a decade ago. This data-file breaks down solar module production by company and over time, comparing the companies by solar module selling prices ($/kW), margins (%), efficiency (%), transparency, and technology development.

Solar modules are produced when photovoltaic silicon (model here, company screen here) is sliced into wafers, then processed into cells using semiconductor manufacturing techniques, and then finally combined with front contacts, encapsulants, frames, reinforced glass, backsheets and wiring (cost build-up here).

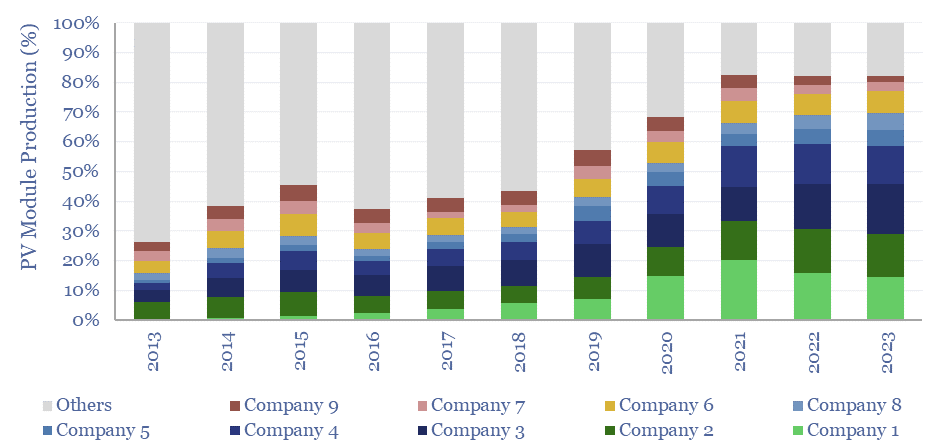

Six Chinese companies (e.g., Longi, Trina) now produce two-thirds of the world’s solar modules, with 2023 output of 20-70GW each. Their growth has been enormous, ramping up by 7x in the past half-decade, and doubling their collective market share (chart below).

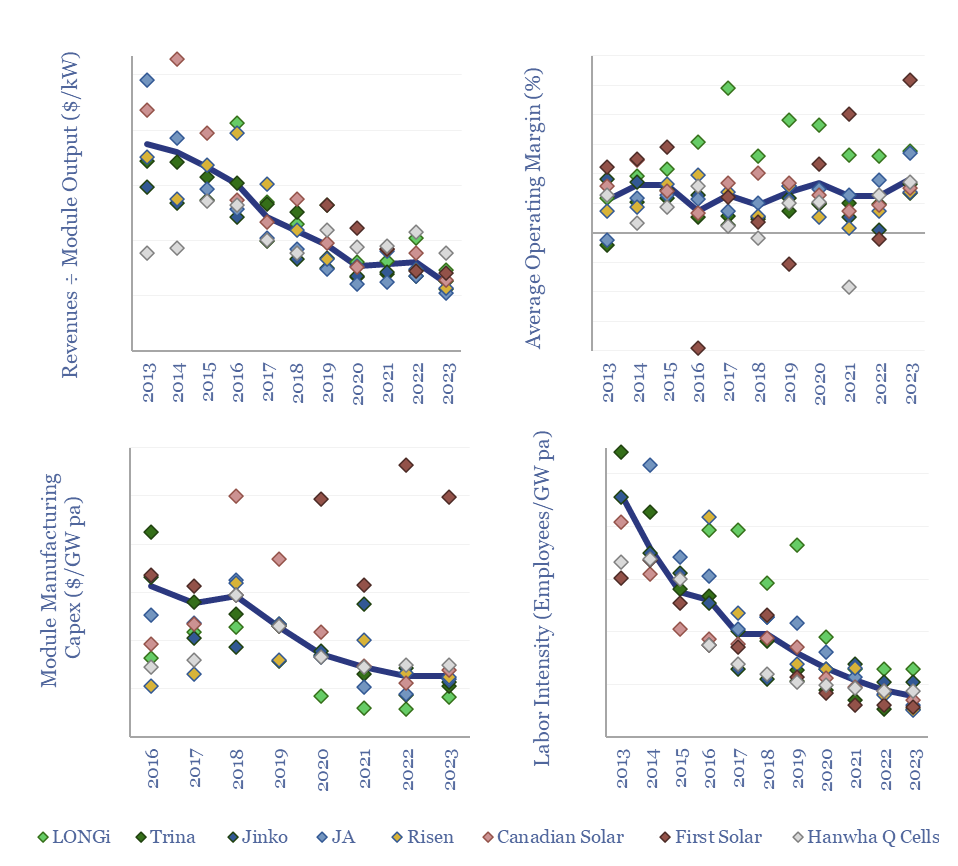

High levels of competition are shown by similar module selling prices across the companies in the screen ($/kW numbers in the data-file), and low EBIT margins (numbers also in the data-file by company).

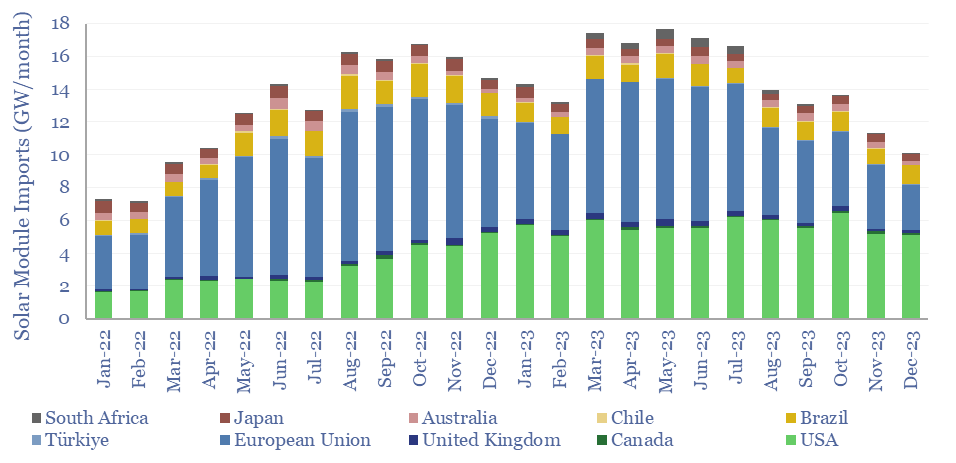

The data also strongly imply that module shipments exceeded module sales in 2021-23, perhaps by as much as 5-10%, creating an overhang for the industry. The overhang was worst in 2021-22 and may have softened in 2023, as the excess was drawn down.

Hence 2023 was a terrible year for the solar industry, with many large PV module manufacturers seeing share price declines of 40-70%, due to interest rates and an overhang of modules, as the US and Europe imported 30-100% more modules than they deployed (chart below). Interestingly, companies with better reporting transparency were more resilient.

Another trend is the shift from P-type towards N-type solar cells, such as TOPCons and HJTs, often to boost efficiency. Different numbers are noted for different companies in the data-file.

The full data-file aims to break down solar module production by company, annually, back to 2013, including useful metrics into their revenues per GW of module production, operating margins, capex intensity and labor intensity (charts below).

Companies can be differentiated by their technology focus and their geographic focus, with some prioritizing US expansions, and others retrenching to China.