The front contacts in today’s solar cells are made of screen-printed silver. Thus solar cells absorbed 11% of 2021’s silver market, and growing. Solar silver contacts can be substituted with copper. But manufacturing is more complex and c5x more costly. So we expect a silver spike, then a switch. This 16-page note explains our outlook, and who benefits?

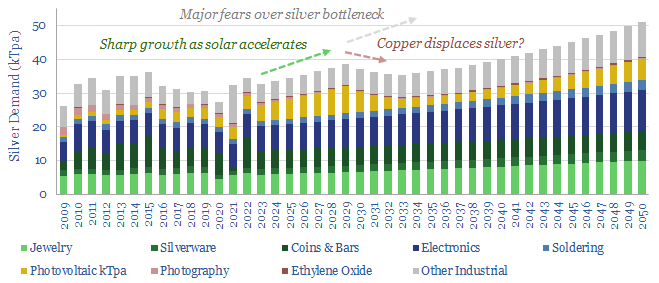

Silver demand in the solar industry is currently running at 3.6kTpa, or 11% of the total global silver market, and growing. The use of silver in the front contacts of solar cells is explained on pages 2-4. We envisage that silver is going to become a bottleneck.

Silver’s advantages are that it is the most conductive metal in the world, it is unreactive, and it is easy to screen print. These advantages are explained on pages 5-8, including an overview of the screen printing process for manufacturing front contacts, and a quantification of the costs (in $/kW).

Copper is 100x cheaper and 1,000x more abundant than silver. However, there are two key challenges for replacing silver with copper in the front contacts of solar cells. It diffuses into the silicon, where it is an “efficiency killer”. And it cannot readily be screen-printed. These issues are spelled out on pages 8-9.

But copper contacts can be manufactured. It is simply a more complex and costly process. Examples of different processes, and their approximate costs, are outlined on pages 10-11.

In particular, we focus in upon SunDrive, a private company based in Australia, which made headlines in 2021, and we have reviewed its patents (pages 12-13).

Our outlook on silver and copper solar contacts is therefore that silver prices will spike, then this will ultimately motivate the industry to dampen the inflationary impacts, by switching out silver for copper. This view, and our best guesses on timings, are presented on pages 14-15.

Finally, the note ends with a review of leading silver mining companies, which will clearly be impacted by the solar industry’s whipsawing silver demand (page 16).

To read about our outlook on PV silicon costs, please see our article here.