Lithium ion batteries famously have cathodes containing lithium, nickel, manganese, cobalt, aluminium and/or iron phosphate. But how are these cathode active materials manufactured? This data-file gathers specific details from technical papers and patents by leading companies such as BASF, LG, CATL, Panasonic, Solvay and Arkema.

New energies are entering an age of materials, where an increasing share of costs are accruing to materials companies, while more advanced materials hold the key to continued efficiency gains and cost deflation (per our research note below).

There is a mild temptation to gloss over the complexity of manufacturing battery cathodes, as though you ‘just get some metals and wop them in’. The reality is a complex, ten step process, which also explains some of the challenges ahead for battery recycling.

Cathode manufacturing: ten-stage process?

(1) Lithium is sourced as lithium hydroxide or lithium carbonate in the first stage of manufacturing a lithium ion battery cathode.

(2) Lithium inputs are then combined with transition metals and other additives. The transition metals may include nickel, manganese, cobalt, or iron phosphate precursors. Different cathode chemistries and their resultant properties are covered in this data-file.

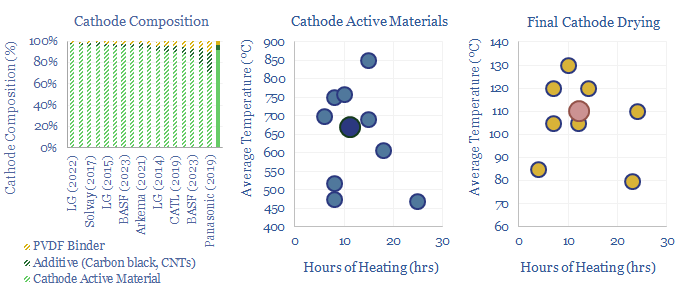

(3) Precursor cathode active materials are then typically heated in an oxygen enriched atmosphere for c12-hours at c700ºC. The aim is to calcine away impurities and form coherent metal oxide crystals. Energy use is likely 60-100 kWh/kWh of batteries, per our data-file here. Variations are discussed in the data-file.

(4) Next may follow various stages of sieving, crushing-grinding, acid-treating, dosing with additives, washing and drying, to modify the outer surface of the cathode active materials. The details also vary quite widely between patents in the data-file.

(5) Next the Cathode Active Materials, which are typically 92% of the weight of a finished battery cathode, are mixed with a conductive carbon additive, most often carbon black, but also potentially graphite or carbon nanotubes, which will typically form 5% of the cathode.

(6) A fluorinated polymer binder, most often PVDF is also sourced. This is an inert plastic that physically holds all of the other the active materials together and will typically form 4% of the cathode. PVDF is also used to bind graphite at the anode.

(7) All of these Cathode Active Materials are then dissolved in a solvent, typically N-Methyl-2-Pyrrolidone (NMP), to form a mixed slurry of c60% solids, c40% NMP.

(8) The slurry is deposited onto a 10-20μm thick aluminium current collector (for contrast, the anode side of the cell tends to use a thinner, copper current collector).

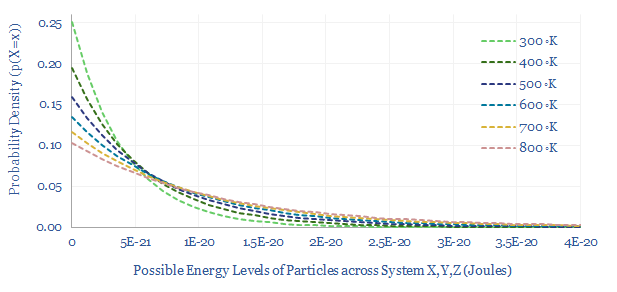

(9) The NMP is then evaporated and recovered by heating for 12-hours at 110ºC. Note this is below the 200ºC boiling point of NMP, because PVDF binder is only rated to 120ºC. Hence the process may require a mild vacuum and long heating times so evaporation can occur via Boltzmann statistics (chart below). Energy use is likely 20-40 kWh/kWh, again per our data-file here.

The resultant battery cathode will typically have a thickness of 70μm, containing 15 mg/cm2 of active material.

(10) Half-cell manufacturing. To prevent oxidation of the cathode, some processes then immediately manufacture half-cells under an inert atmosphere (e.g., nitrogen, argon). Electrolyte is added to the half-cell, most often by dissolving the ionic salt LiPF6 at 1M concentration in a mixed solvent of ethylene carbonate, ethyl methylene carbonate, di-ethylene carbonate, propylene carbonate, et al. Then a polymer separator is added. The average finished battery cell is 3.5mm thick.

Cathode manufacturing: leading companies?

Two companies stood out as having filed the most patents into battery cathode active materials and manufacturing, often departing quite materially from the simplified description above, suggesting a proprietary process? Details in the data-file.

Materials companies also stood out in the patents and technical papers, as the same companies were often listed as supplying high-grade materials. For example, PVDFs from Solvay, and carbon black from Imerys, although we also wonder about using Huntsman’s new MIRALON product here. Details of metals suppliers, NMP suppliers, separator suppliers and niche equipment suppliers are in the data-file.