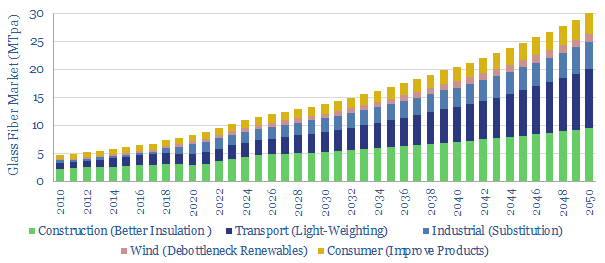

What opportunities for glass fiber in the energy transition? Glass fiber makes up 50% of a wind turbine blade, lightens vehicles and insulates homes for 30-70% energy savings. Hence we see demand rising 3.5x in the energy transition. To appraise the opportunity, this 13-page note assesses the market, costs, CO2 intensity and leading companies.

6% of the global glass market is sold in the form of fibers, a mesh of 4-40μm thick filaments. They can be used directly as an insulation material, or woven into a fabric and embedded in a polymer resin matrix, yielding ‘fiberglass’. These production processes are summarized on pages 2-3.

Applications in the energy transition are then quantified on pages 4-7, including for wind turbine blades, insulation of homes, light-weighting vehicles and substituting for higher-cost and higher-carbon alternative materials. This underpins our forecast for 3.75x market growth.

The energy economics of producing glass fiber are modelled on pages 8-10, in order to quantify the marginal cost, cost breakdown, energy intensity and CO2 emissions of glass fiber product.

The biggest challenge for the industry is industrial leakage, as we find that some product made in the emerging world can undercut the West by c50% on price, despite having 2x higher CO2 intensity (page 11).

The company landscape is summarized on pages 12-13. There are four main listed companies (2 in China, 2 in the West). Interestingly, private equity firms have recently been buying up European pure-plays.