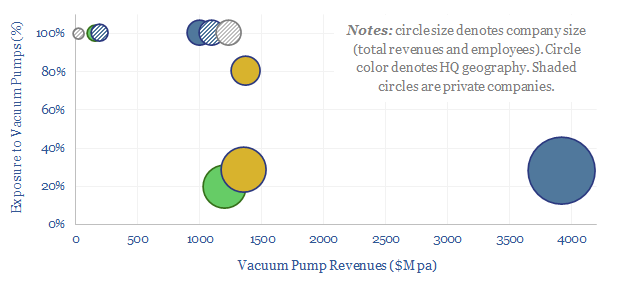

The global market for vacuum pumps is worth $15bn per year, with growing importance for making semiconductors, solar panels and AI chips. This data-file reviews ten leading companies in vacuum pumps, including one European-listed capital goods leader, a European pure-play and a Japanese-listed pure-play.

The vacuum pump market is worth $15bn per year, and some sources imply that over half of the market now comprises semiconductor applications, such as the vacuum chambers used for vapor deposition and sputtering, when manufacturing AI chips and solar cells.

Other applications, back in the traditional industrial landscape, use vacuum pumps. Ranging from the food manufacturing industry (one company website that we reviewed comprehensively lists how their technology is used in making cheese), through to gas separations via swing adsorption, membranes or petrochemicals.

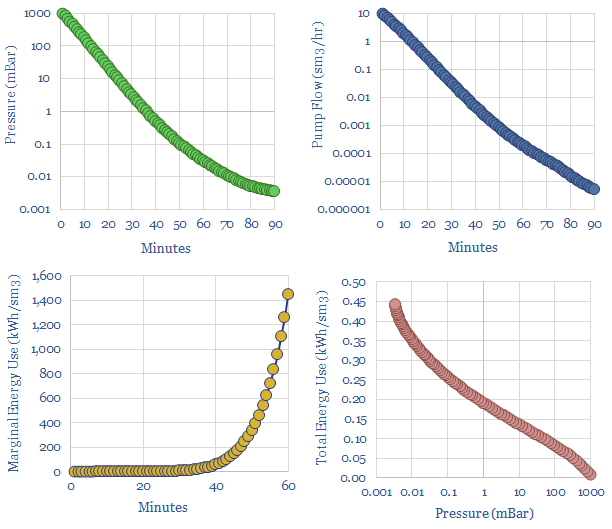

Many processes in the semiconductors are remarkable because they use vacuum chambers to prevent contamination from, and reaction with, atmospheric air, when depositing thin film layers of 5-250 nm. If normal pressure is 1 bar, some of these processes can occur at 0.001 mBar, i.e., 1 millionth of an atmosphere.

Evacuating a vacuum chamber down to 0.1-0.001 mBar can take 90+ minutes, while the pump continues working, pumping out ever smaller quantities of air, which equates to an exponentially rising energy consumption per unit of sm3 of air that is pumped. As a rule of thumb, we think that reaching 0.1-0.01 mBar will require 0.3-0.5 kWh of electricity per m3 of volume in the vacuum chamber (charts below).

Atlas Copco is the industry leader in vacuum pumps. Its market share, and recent acquisitions are explored in the data-file. But total group operating margins were 21% in 2022 and ROCE was 29%. Vacuum pumps comprise 28% of the company’s revenues. In its vacuum pump business, Atlas Copco’s 2022 orders were 65% electronics and semiconductors, 21% chemicals/process industries including the food packaging industry and 12% general manufacturing. More via the Atlas Copco website. But this is interesting, as Atlas Copco has screened well in other areas of TSE research, such as in compressors, increasingly important for industrial gases and CCS value chains.

Other leading companies in vacuum pumps? Listed pure-plays in both Germany and Japan also feature in the data-file. Plus industrial conglomerates in the US, Europe and Japan, with varying concentration.

There are some interesting data-points in the commentary about who leads in supplying vacuum pumps to the semiconductor industry.