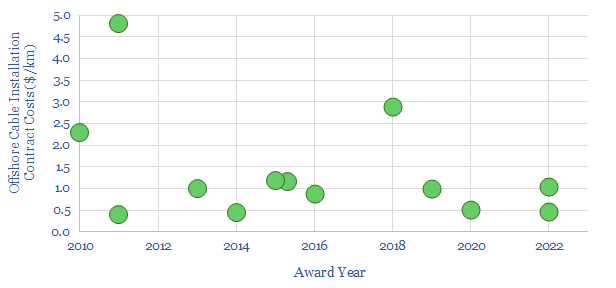

This is a database of cable installation vessels for offshore wind and power transmission; tabulating costs (in $M), contract awards (in $/km), capacity (in tons), installation speeds (in meters per hour), power ratings (in MW), crew sizes, positioning systems and leading companies. But there is a paradox in the past decade’s cost data?

The paradox is that the world’s fleet of offshore cable installation vessels have become ever more sophisticated over time, and yet the costs of offshore cable laying do not appear to have risen to reward this build-out?

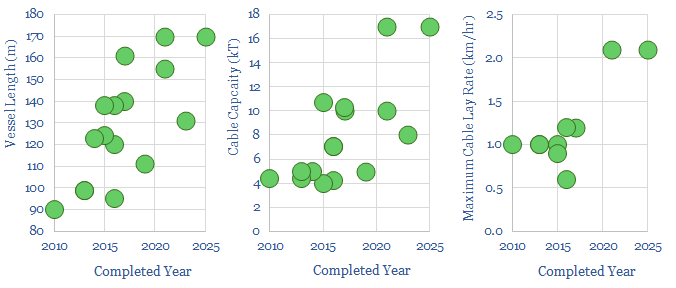

For example, at the cutting edge, Prysmian’s Leonardo Da Vinci vessel cost around $200M to build, has 21MW of total power, 180 tons of lifting capacity, and thus can lay a staggering 2.1 km of cables per hour, in water depths up to 3,000 meters, with ultra-redundant DP3 positioning. Similarly, Van Oord’s new Calypso vessel will be able to lay two cables at once.

Generally these cutting edge vessels also boast improved environmental performance, with less CO2, NOx, hybridization or readiness to run on biofuels. The details are noted in the data-file, vessel by vessel.

By contrast, many of the cable laying vessels built a decade ago only had 7-8MW of total power on average, 110 tons of lifting capacity, maximum lay rates of 1km of cables per hour, in water depths up to 800m, with DP2 positioning. So the industry has truly transformed its capabilities.

And yet the contract awards that we have aggregated for offshore cable installation have hardly changed. Laying the inter-cabling at an offshore wind project might cost $0.5M/km, offshore interconnectors (such as HVDCs) cost $1-2M/km, and complex projects with erratic seabed terrain cost as much as $3-5M/km.

Is it possible that attempts to accelerate offshore wind and renewables more broadly will pull on the supply chain for cable installation vessels, and rescue what has thus been a relatively challenging industry? If our energy supply-demand numbers are right, there could even be another offshore cycle in the conventional energy industry?

The full database of cable installation vessels covers assets owned by Prysmian, Van Oord, Nexans, Deme, NKT, Jan de Nul, Seaway, Boskalis et al; and contracts whose details have made it into the public domain.