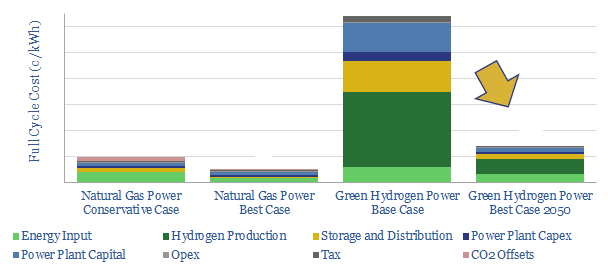

This 16-page note models the green hydrogen value chain: harnessing renewable energy, electrolysing water, storing the hydrogen, then generating usable power in a fuel cell. Today’s end costs are very high, at 64c/kWh. Even by 2050, our best case scenario is 14c/kWh, which would elevate average household electricity bills by $440-990/year compared with the superior alternative of decarbonizing natural gas.

Voltaire famously slated the Holy Roman Empire for being neither holy, nor Roman, nor an Empire. The same criticism may apply to the Green Hydrogen Economy. Well over 80% of 2050’s hydrogen market is likely to be blue hydrogen. This is ultimately derived from natural gas energy (increasing gas demand). And it is still not economical, costing 39c/kWh today and 11c/kWh in our best case by 2050.

Our baseline costs to decarbonize natural gas power are presented on page 2.

Renewable energy inputs to green hydrogen production are costed on pages 3-4,

Electrolyser costs, and potential future improvements, are covered on pages 5-7.

Distributing and storing hydrogen is surprisingly challenging. We review 5 key reasons and derive base- and best-case cost estimates on pages 8-11.

Generating electricity from green hydrogen is costed on pages 12-13.

What do you have to believe to be constructive on green hydrogen costs, in the best case scenario in the 2040s and 2050s? We answer this question on page 14.

Relative advantages of blue hydrogen are discussed on pages 15-16, although we still think decarbonized natural gas will be a superior option for the energy transition.