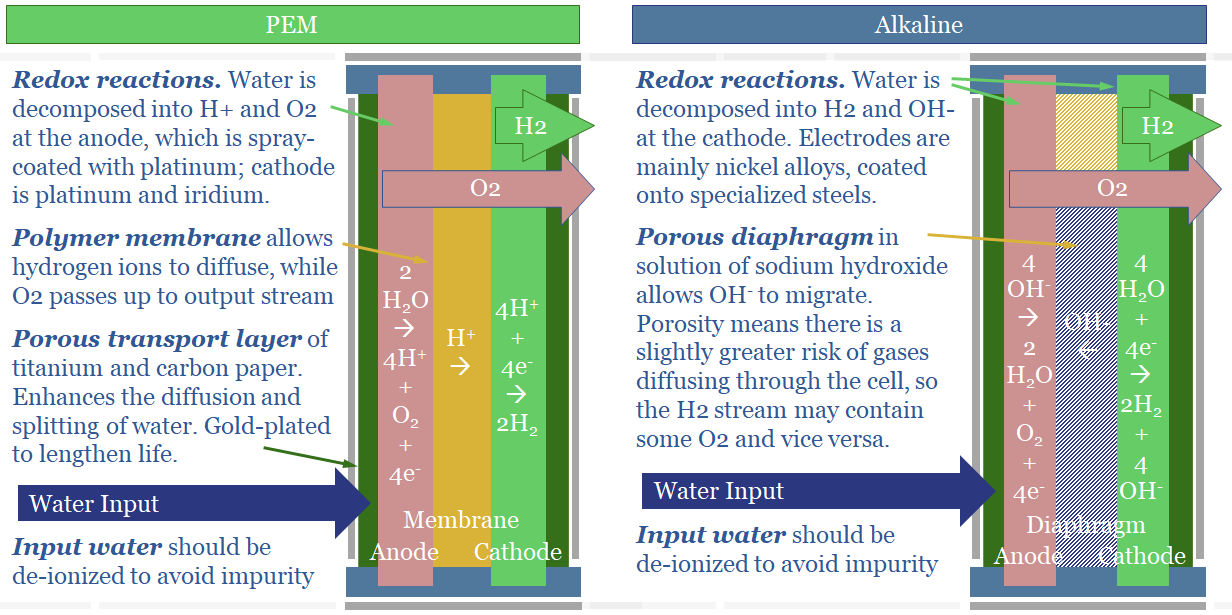

The key difference between an alkaline electrolyser and a proton exchange membrane electrolyser (PEM) is what ion diffuses between the anode and cathode side of the cell. In an alkaline electrolyser, alkaline OH- ions diffuse. In a PEM electrolyser, protons, H+ ions, diffuse. Ten fundamental differences follow.

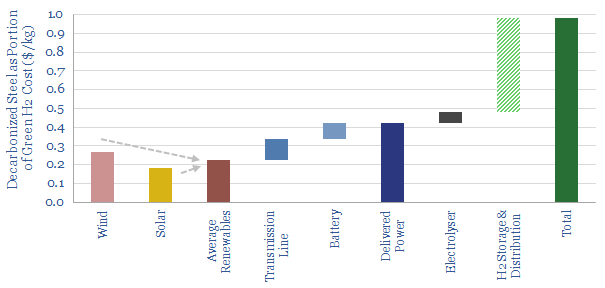

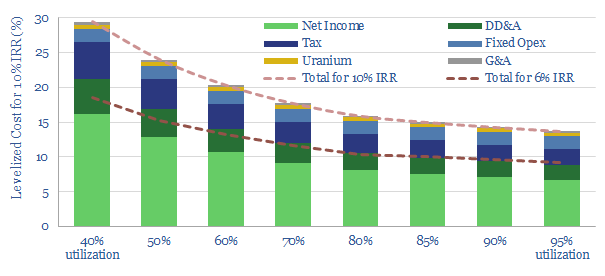

The lowest cost green hydrogen will come from alkaline electrolysers run at high utilizations, powered by clean, stable grids with excess power (e.g., nuclear, hydro).

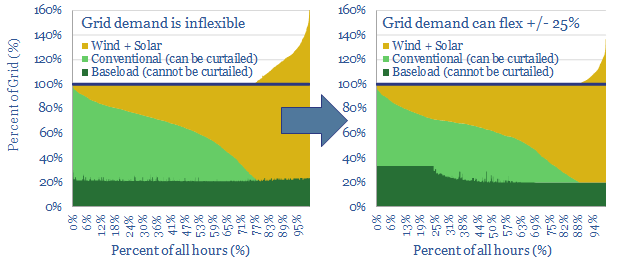

PEMFCs are more suited for backstopping renewables, although there is still some debate over the costs, longevity, efficiency and whether intermittent wind/solar can be put to better use elsewhere.

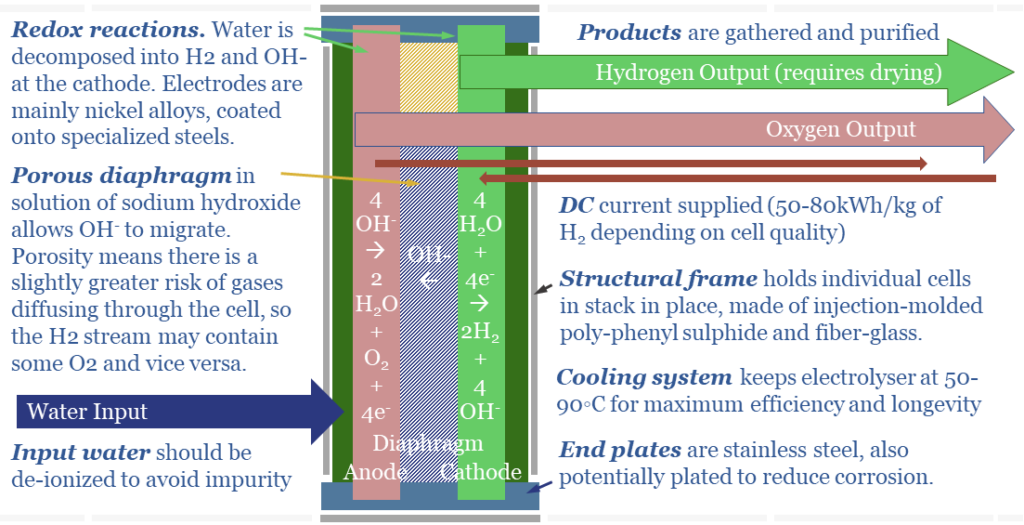

(1) In an alkaline electrolyser, water is broken down at the cathode. 4 x H2O molecules gains 4 x e- and become 2 x H2 + 4 x OH- ions. The OH- ions then diffuse across the cell to the anode. To complete the electrical circuit, 4 x OH- ion surrender 4 x e- at the cathode and become 2 x H2O molecules + 1 x O2 molecule. A schematic is below.

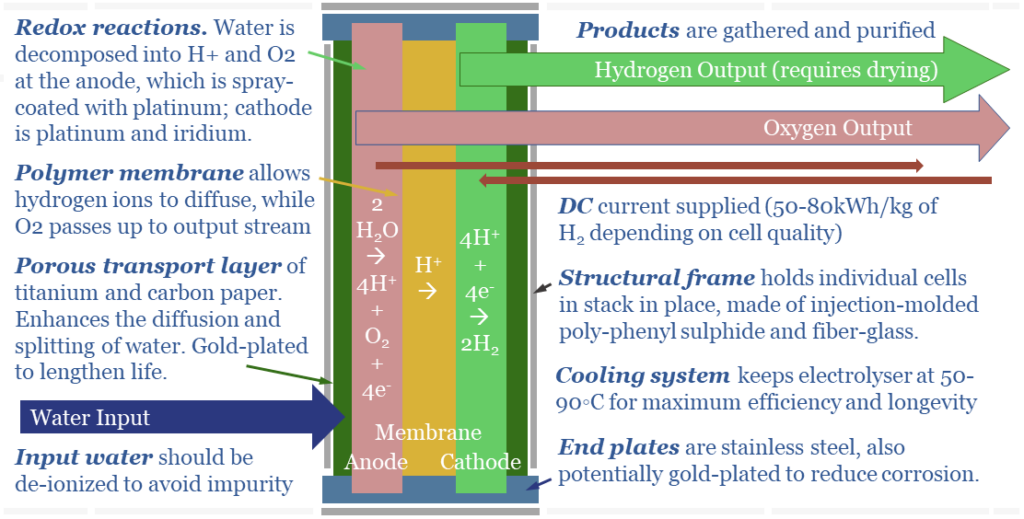

(2) In a PEM electrolyser, the chemistry is very different. Water is broken down at the anode. 2 x H2O molecules surrender 4 x e- and become an O2 molecule + 4 H+ ions (protons). The H+ ions then diffuse across the cell to the cathode. To complete the electrical circuit, at the cathode, 4 x H+ ions gain 4 x e- and become 2 x H2 molecules.

(3) PEMs have Membranes. H+ ions are the smallest ions in the Universe, measuring 0.0008 pico-meters (comparable with other ionic radiuses below). This means protons can diffuse through solid polymers like Nafion, which otherwise resist electricity and resist the flow of almost all other materials; totally isolating the anode and cathode sides of the cell in a PEMFC.

(4) Alkaline Electrolysers have Diaphragms. OH- ions are larger, at 153 pm (which is actually quite large, per the chart above). Thus they will not diffuse through a solid polymer membrane. Consequently, the anode and cathode are separated by a porous diaphragm, bathed in an electrolyte solution of potassium hydroxide, produced via a variant of the chlor-alkali process. This (alkaline) electrolyte also contains OH- ions. This helps, because more OH- ions makes it faster for excess OH- ions to diffuse from high concentration on the cathode side of the cell to low concentration on the anode side of the cell (see (2)).

(5) Safety implications. Alkaline electrolysers are said to be less safe than PEMs. The reason is the porous diaphragm. Instead of bubbling out as a gas on the anode side, very small amounts of oxygen may dissolve, diffuse ‘in the wrong direction’ across the porous diaphragm, and bubble out alongside the hydrogen gas at the cathode side. This is bad. H2 + O2 make an explosive mixture.

(6) Footprint implications. One way to deal with the safety issue above is to place the anode and cathode ‘further apart’ for an alkaline electrolyser. This lowers the chances of oxygen diffusing across the diaphragm. But it also means that alkaline electrolysers are less power-dense.

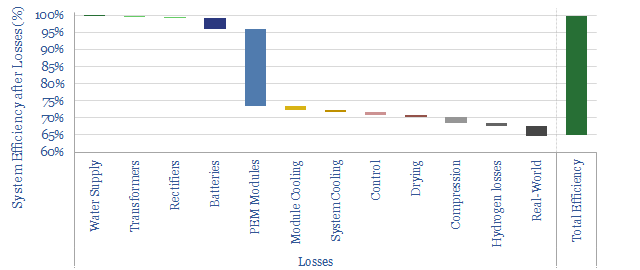

(7) Efficiency implications. Small amount of current can leak through the KOH solution in an alkaline electrolyser, especially at very large current densities. When a direct current (e-) is added to the cell, we want it to reduce 2 x H+ into H2. However, a small amount of the current may be wasted, converting K+ into K; and a small amount of ‘shunt current’ may flow through the KOH solution directly from cathode to anode. We think real-world PEMs will be around 65% efficient (chart below, write-up here) and alkaline electrolysers will be multiple percentage points lower.

(8) Cost implications. An alkaline electrolyser may be a few $100/kW cheaper than a PEM electrolyser. Because the diaphragm is cheaper than the membrane. The electrodes are cheaper too. Our overview of electrolyser costs is below.

(9) Longevity implications. Today’s PEMs degrade 2x faster than alkaline electrolysers (40,000 hours versus 90,000 hours, as general rules of thumb). This is primarily because the membranes are fragile. And H+ ions are, by definition, acidic. But as with all power-electronics, the rate of degradation is also a function of the input signal and operating conditions.

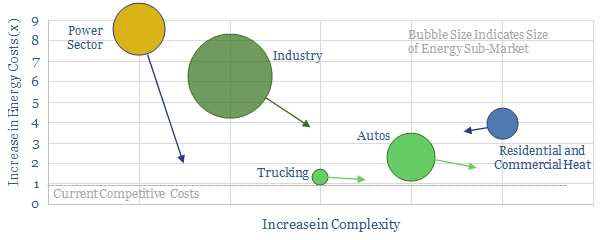

(10) Flexibility implications. Alkaline electrolysers are not seen to be a good fit for backstopping renewables (chart above). According to one technical paper, “It is well known that alkaline water electrolysers must be operated with a so-called protective current in stand-by/idle conditions (i.e., when no power is provided by renewable energy sources) in order to avoid a substantial performance degradation”. When ion flow stops, there is nothing driving OH- ions across the cell, and pushing the H2 and O2 out of the cell. In turn, this means O2 and H2 bubbles can form. They may accumulate around electrode catalysts. Then when the cell starts up again, the gas bubbles block current flow. In turn, overly large resistance or current densities can then degrade the catalysts.