Thunder Said Energy is a research firm focused on energy technologies and energy transition. We work with over 250 organizations, to help them find economic opportunities, which can improve the world’s energy system, and help the world reach ‘net zero’. We have two subscription tiers (details here). This page contains our most recent research reports (PDFs), available to clients with our written insights subscription. Please email us any time if you are looking for particular content, if we can field any questions, or focus our upcoming research into areas that will help you.

Written Insights

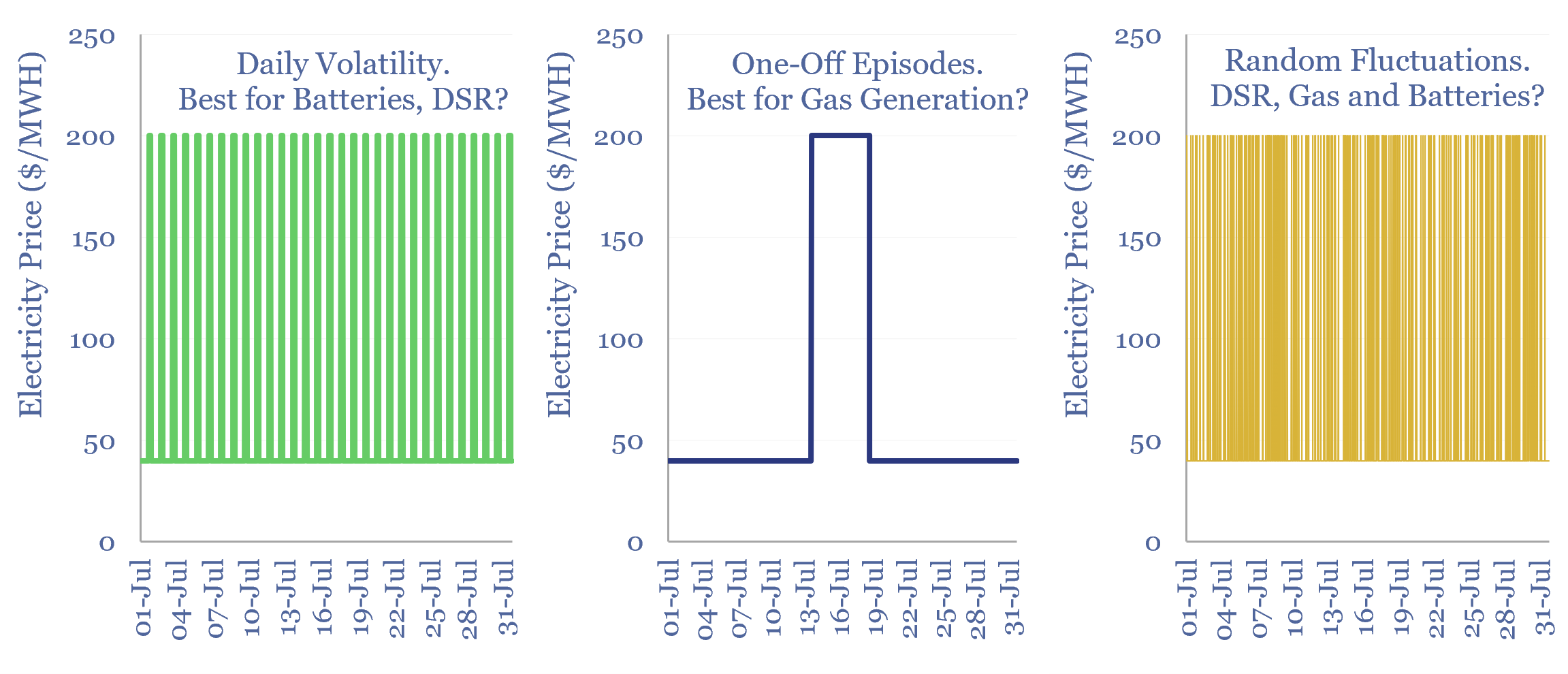

Power price volatility: where are the opportunities?

Does real-world power price volatility follow a regular daily pattern (suited to batteries), incur periodic and protracted price spikes (suited to gas back-ups), or fluctuate somewhat randomly in real time (suited to DSR, batteries and gas generation?). This 9-page report evaluates data from the UK grid in 2024, to disaggregate the prevalence of these three power price volatility patterns.

Read the Report?

Read the Report?

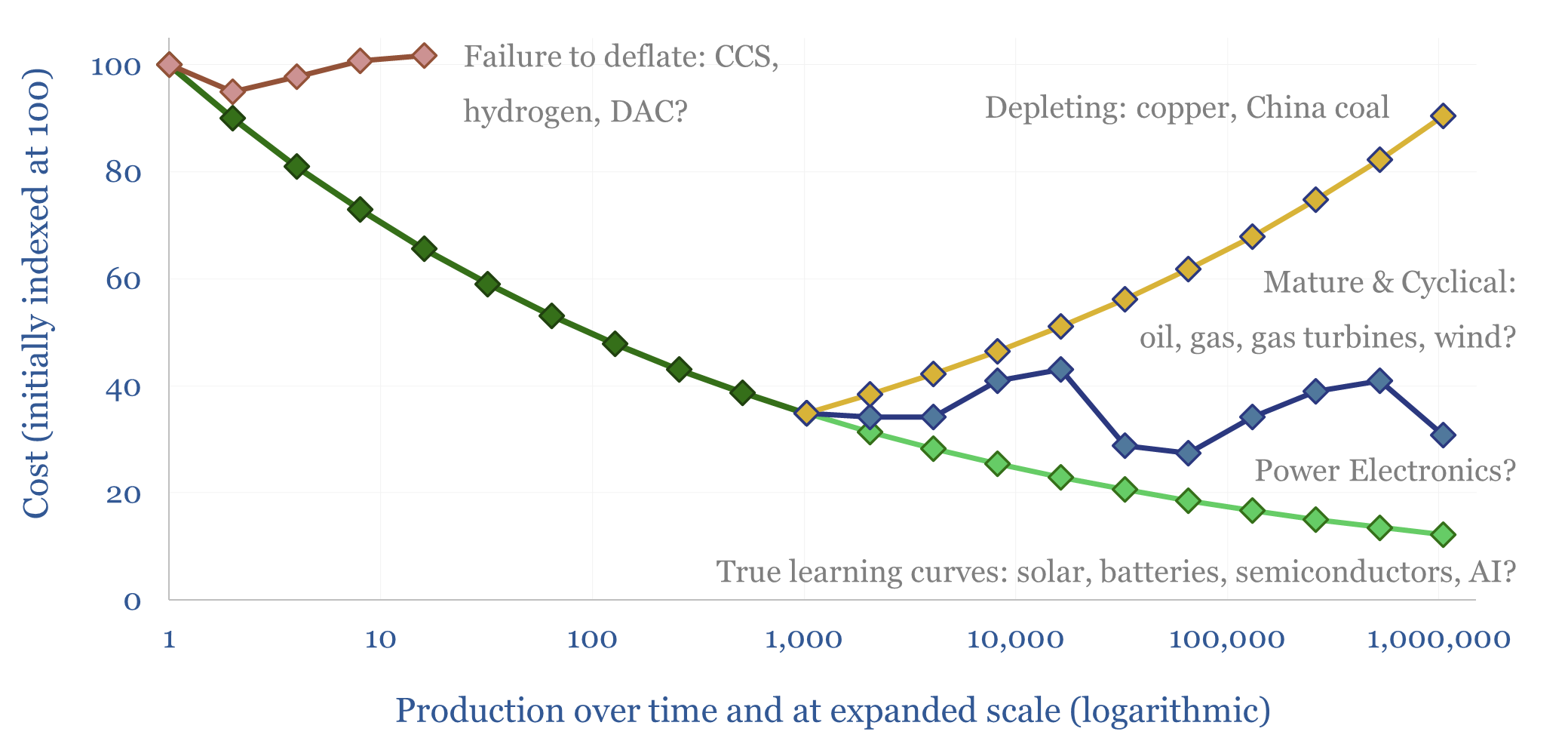

New energies deflation: myths and legends?

How much of the market’s current disenchantment with new energies can be attributed to persistently high costs, which failed to deflate as much as hoped? This 15-page report reviews the evidence. Cost trajectories have varied. CCS and hydrogen cost more than initially advertised. Wind costs recently re-inflated. Yet, solar, electronics and lithium ion batteries remain exceptional?

Read the Report?

Read the Report?

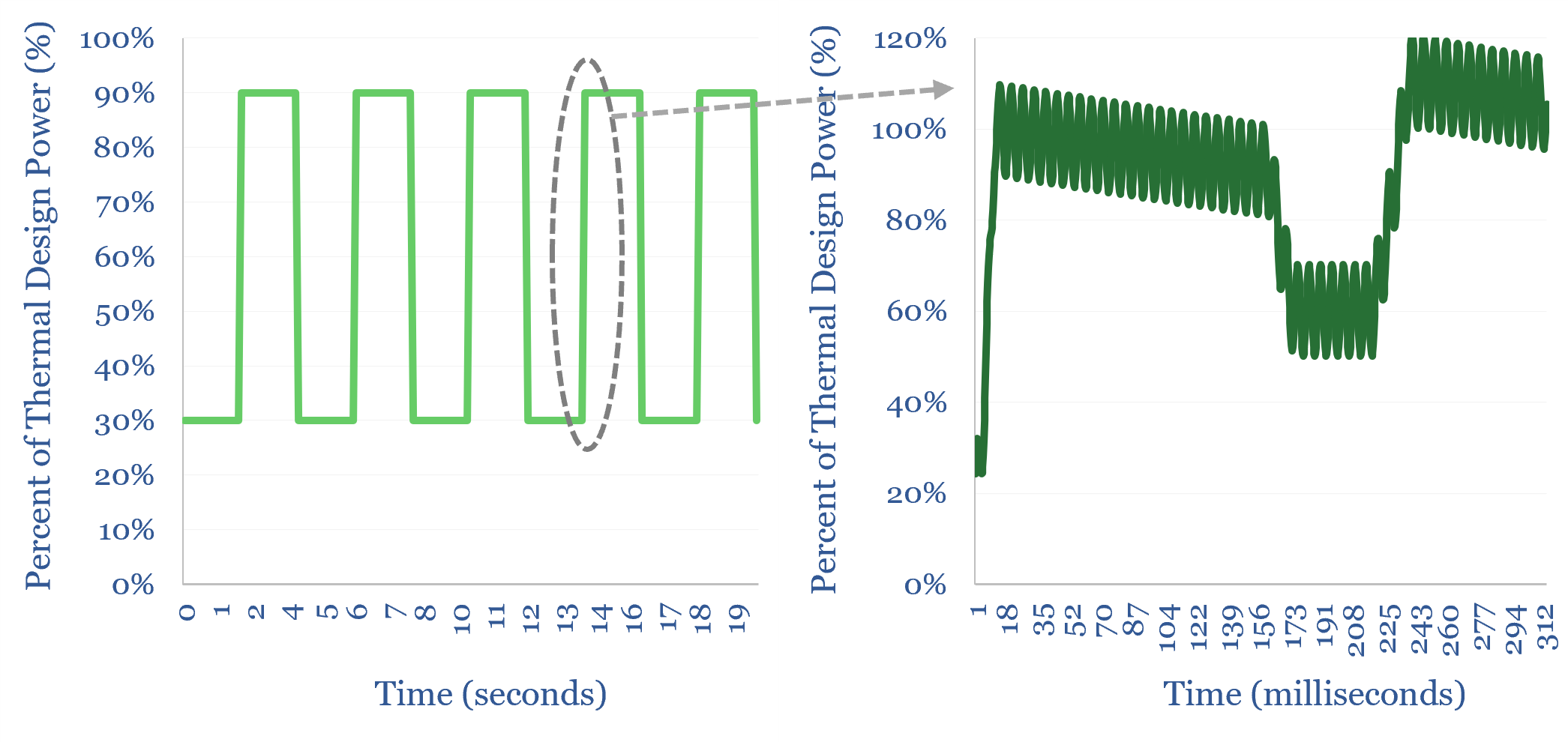

Data center energy: caps lock?

Everybody knows “AI data centers use round-the-clock power”. Yet one of the biggest power challenges for AI data data centers is precisely that they do not use round-the-clock power. They incur large load transients that cannot be handled by batteries, power grids or most generation. This 15-page report explores data center load profiles, which may require 5-10x more capacitors?

Read the Report?

Read the Report?

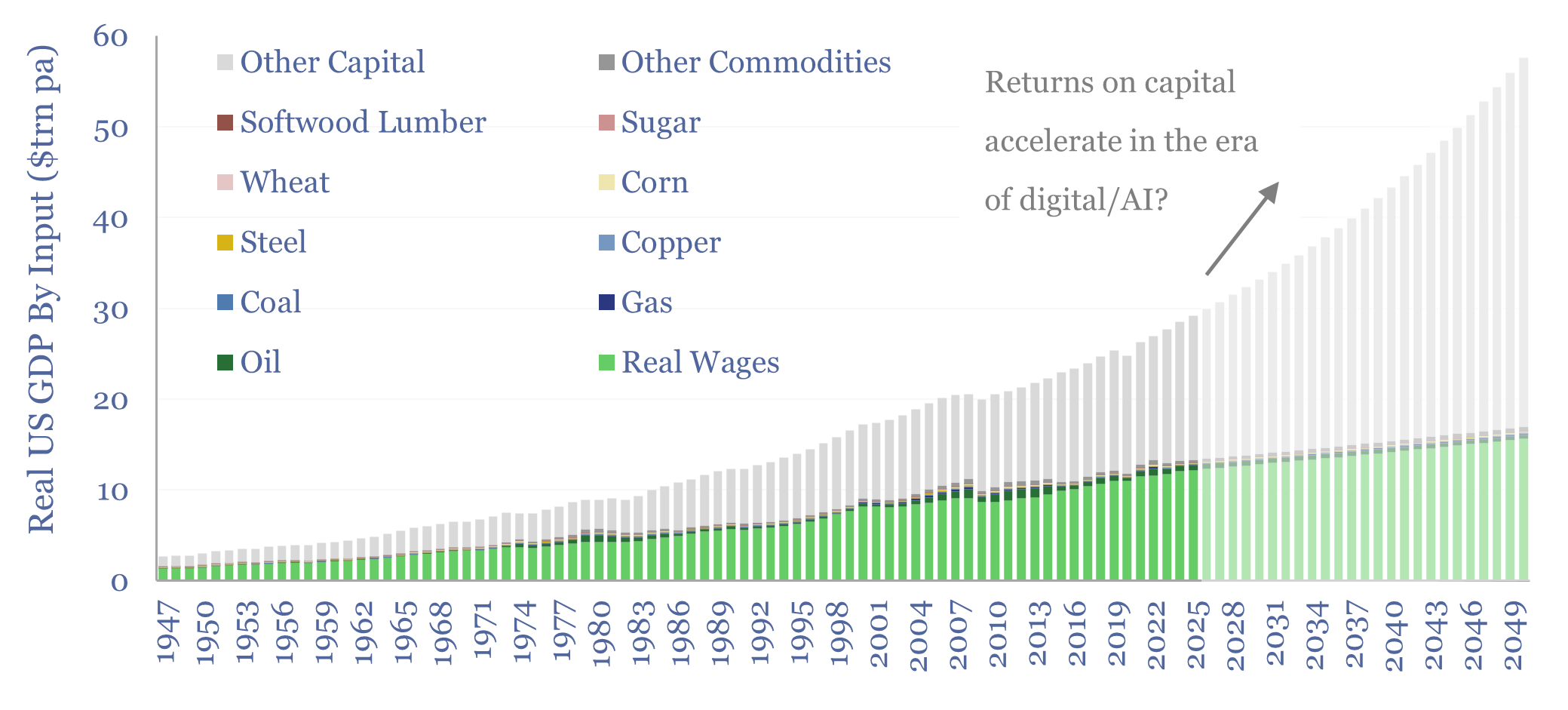

Energy transition: a new era? (driven by AI)

Energy transition remains among the most important and exciting topics in the world. But it is now less driven by Net Zero ambitions, and more so by digital and AI technologies. These offer world-changing possibilities; re-accelerating GDP, returns on capital, and commodities. This 13-page report captures our latest outlook on energy transition, and the opportunities therein.

Read the Report?

Read the Report?

Gas generation: what kind of bear is best?

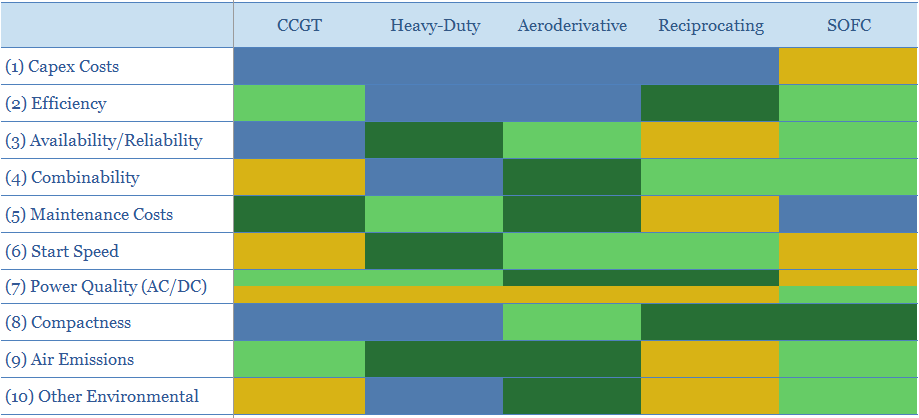

This 20-page report compares combined cycle gas turbines (CCGTs), heavy-duty gas turbines, aeroderivative gas turbines, reciprocating engines and solid oxide fuel cells (SOFCs), on ten dimensions. No one gas generation technology is best. But modular solutions may increasingly rival CCGTs, especially for energizing AI data-centers?

Read the Report?

Read the Report?

Wicked smart: what if AI re-shaped the power grid?

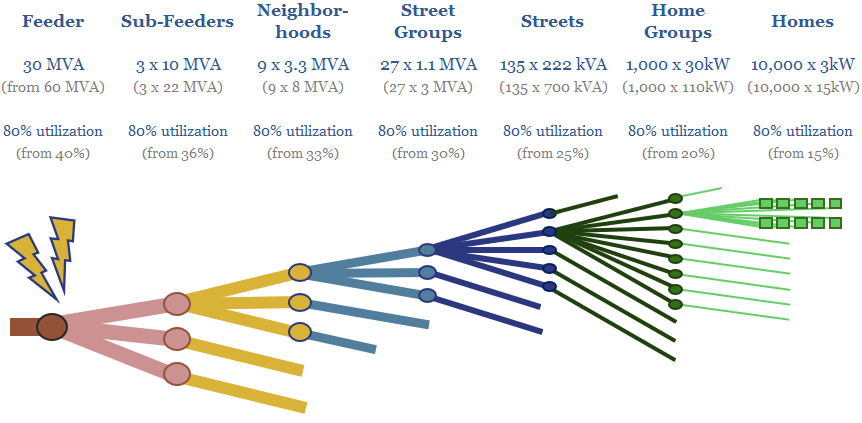

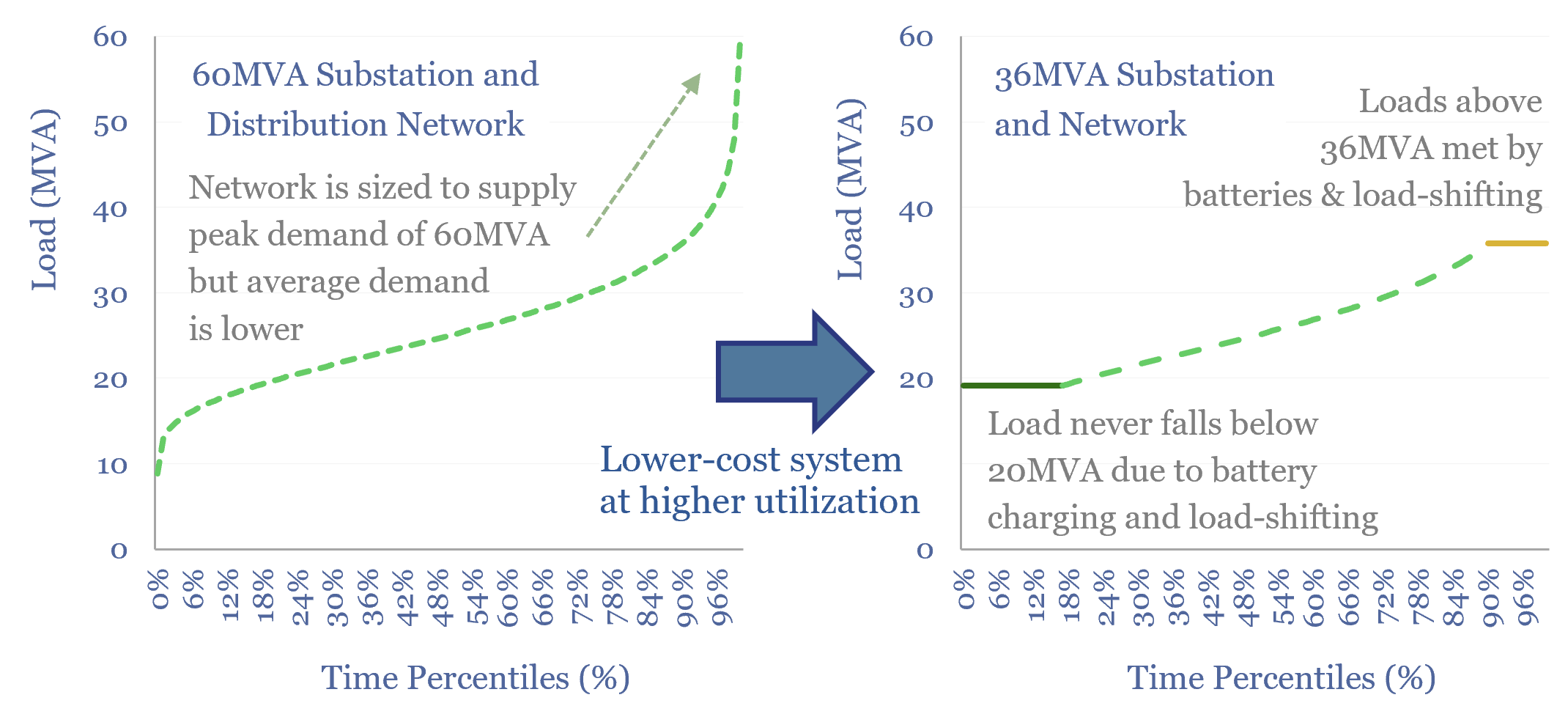

What if AI re-shaped the power grid? This 16-page report sees potential to halve levelized T&D costs; de-bottleneck 4.5% pa of global electricity demand growth; and shift over $100bn pa of spending away from high-voltage capital goods to low-voltage smart devices and networking equipment.

Read the Report?

Read the Report?

Sustainable aviation fuel: flight path?

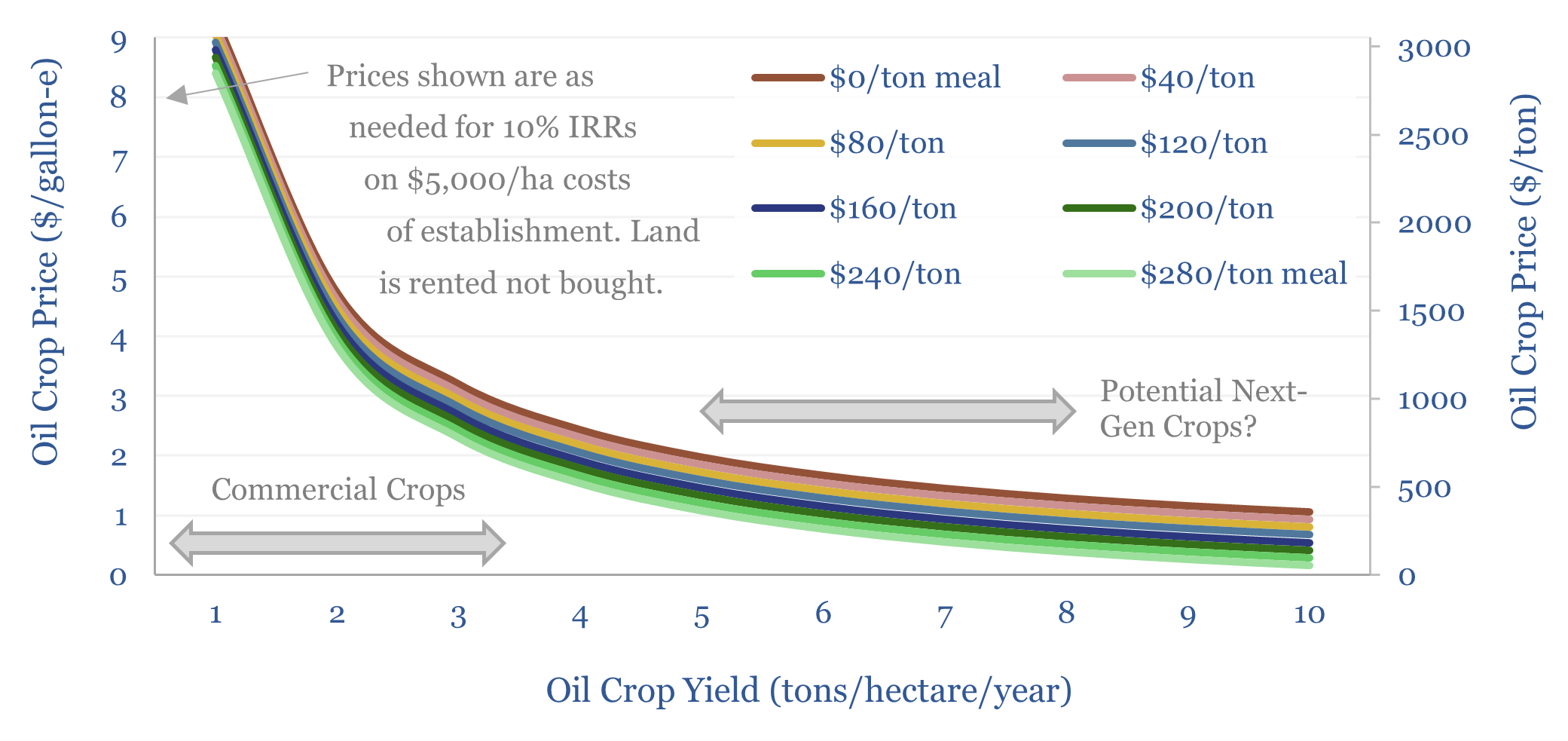

As things stand, we argue Europe will be forced to scale back its SAF targets, due to Sustainable Aviation Fuel costs and land constraints. However, our 17-page report asks what could improve the outlook. Specifically, what yields, costs and other properties would we need to see from an oil crop to get excited about unlocking cost-competitive HEFA-SAF? And could any novel crops, such as Pongamia or Carinata, take flight?

Read the Report?

Read the Report?

Commodity demand: how sensitive to GDP growth?

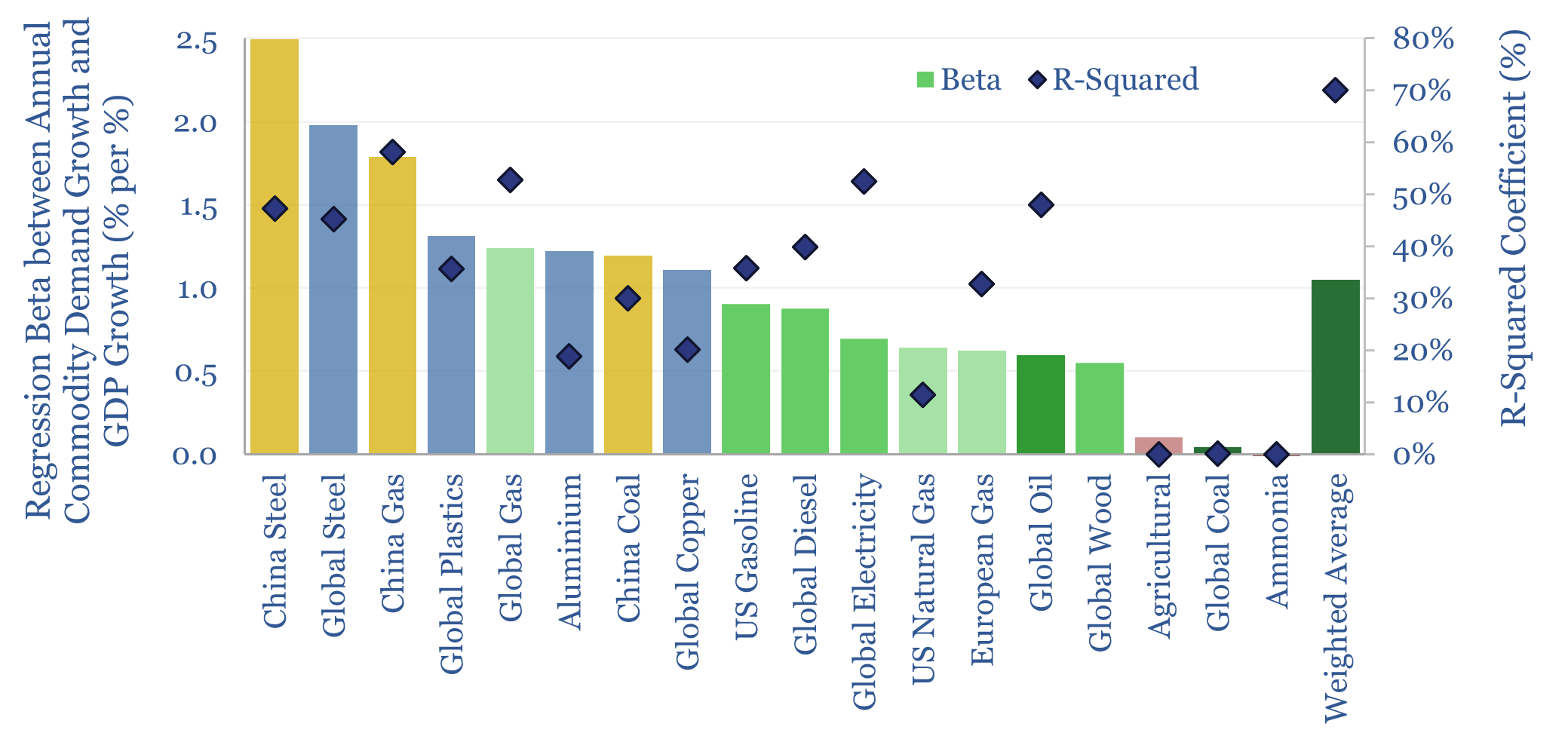

How sensitive is global commodity demand to GDP growth? This 15-page report runs regressions for 25 commodities. Slower GDP growth matters most for oil markets, which are entering a new, more competitive, era. China is also slowing. But we still see bright spots in gas, metals, materials in our 2025 commodity outlook.

Read the Report?

Read the Report?

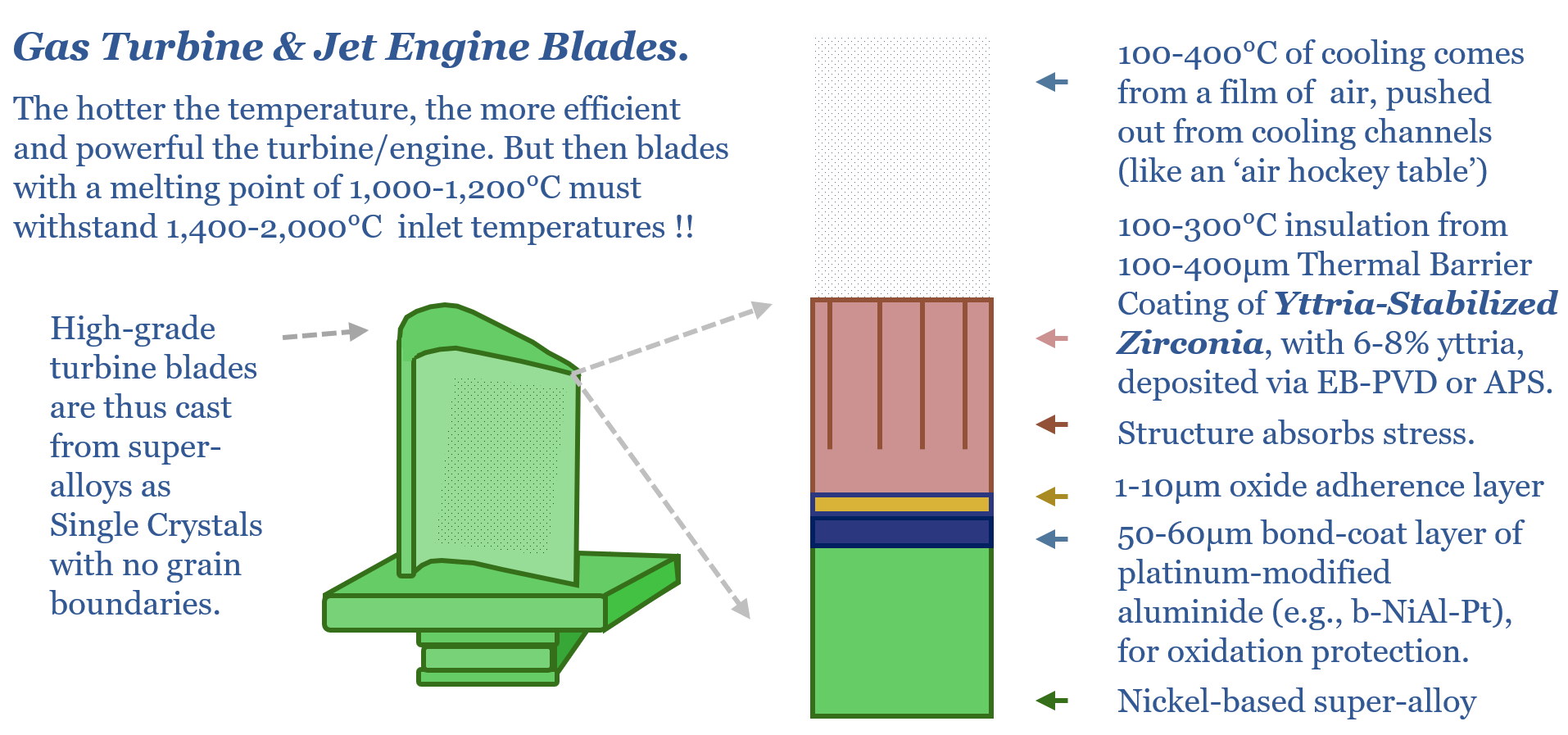

Yttria-stabilized zirconia: sticker shock?

Global yttrium output is just 10-15kTpa, worth $100M pa, of which c90% is controlled by China. Yet a supply disruption for this critical metal could have ripple effects comparable to an oil shock: de-railing developed world load growth, aircraft manufacturing and the rise of AI? This 15-page report tells the story of yttria-stabilized zirconia, explores supply risks, and their implications.

Read the Report?

Read the Report?

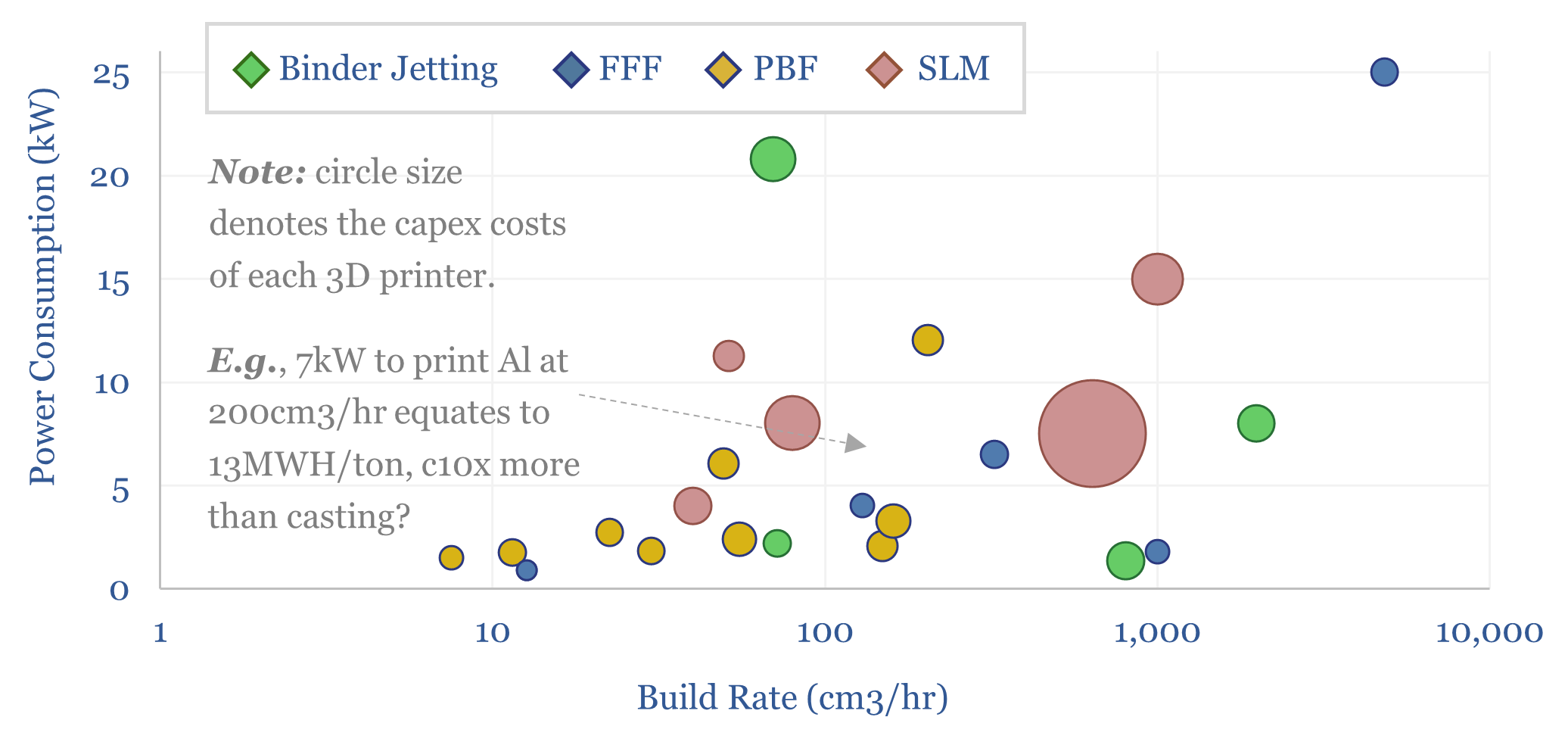

Additive manufacturing: fine print?

Can additive manufacturing overcome bottlenecks in gas turbine components, aerospace-related capital goods, and custom products that are unlocked by AI? This 16-page report re-evaluates the outlook for 3D printing, its economics, energy use, and company implications.

Read the Report?

Read the Report?

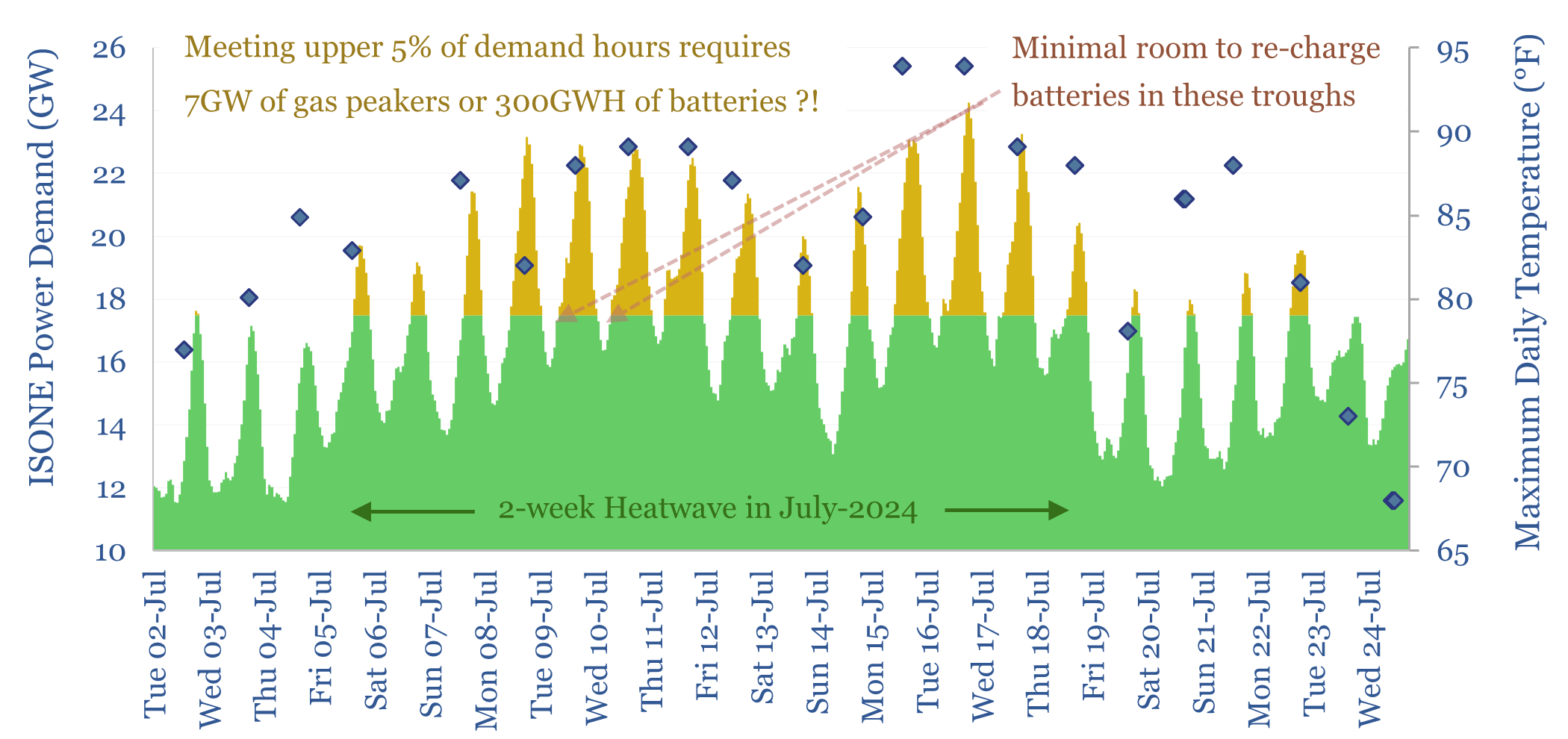

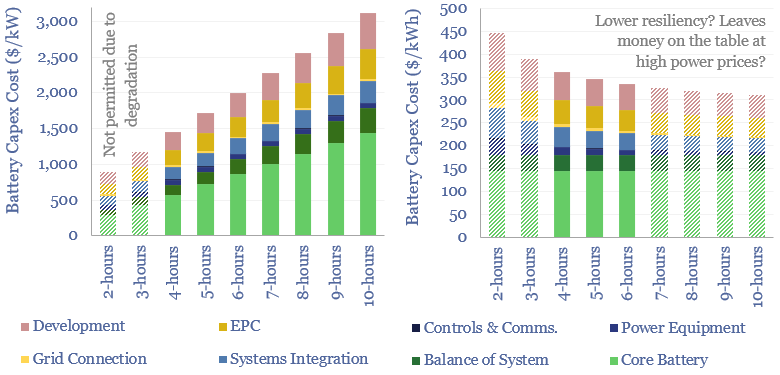

Peak loads: can batteries displace gas peakers?

Peak loads in power grids are caused by heatwaves (in the US) and cold snaps (in Europe), which last 2-14 days. This 16-page report finds that very large batteries would be needed to ride through these episodes, costing 2-20x more than gas peakers. But the outlook differs interestingly between the US vs Europe.

Read the Report?

Read the Report?

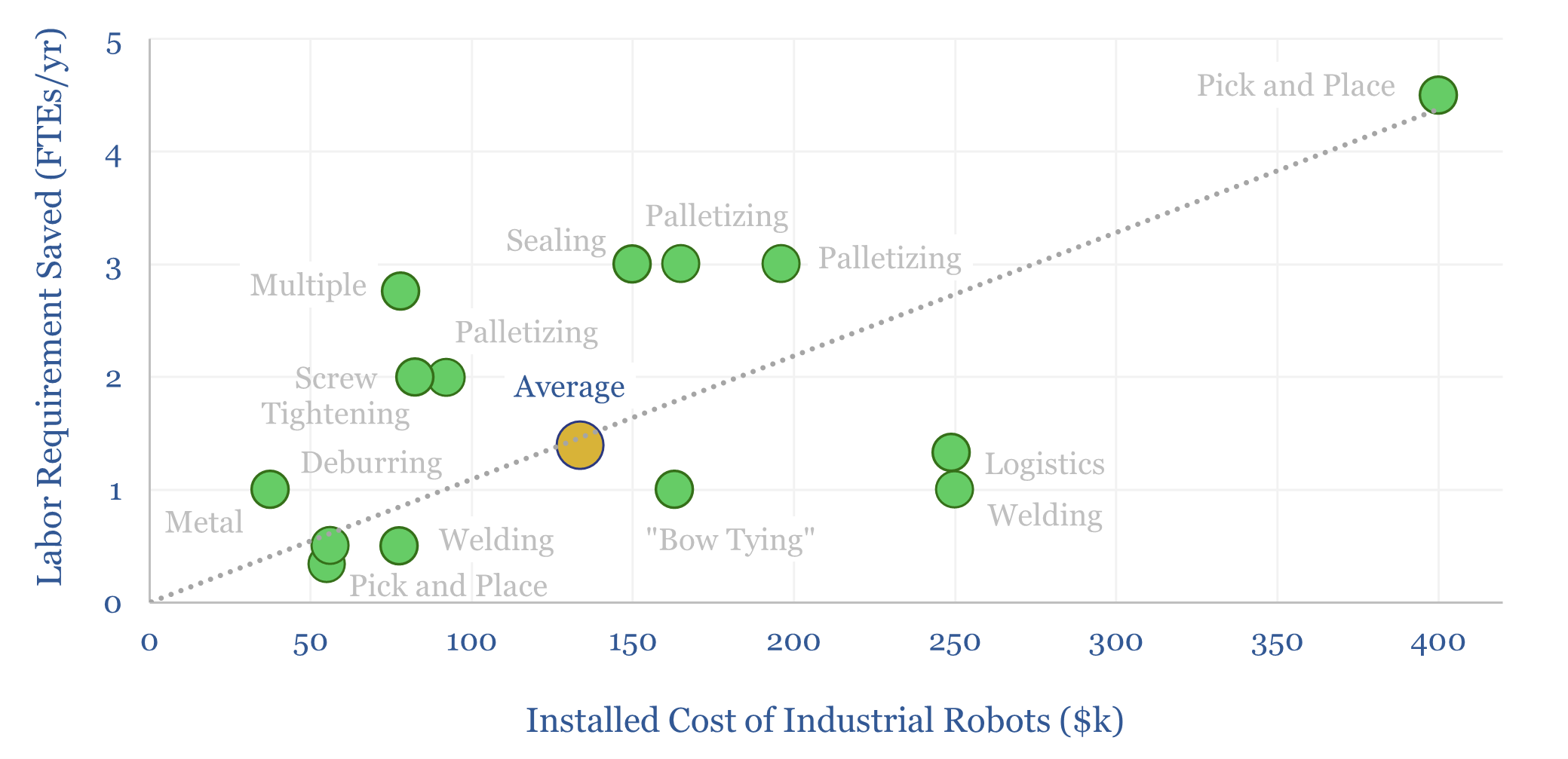

Industrial robots: arm’s reach?

5 million industrial robots have now been deployed globally, in an $18bn pa market. But growth could inflect, with the rise of AI, and to solve labor bottlenecks, as strategic value chains are re-shored. Robotics effectively substitute labor inputs for electricity inputs. Hence today’s 18-page report compiles 25 case studies, explores the theme and who benefits?

Read the Report?

Read the Report?

Power grid bottlenecks: flattening the curve?

Will persistent grid bottlenecks de-rail electricity growth? This 18-page report explores using batteries and smart energy systems to reduce the need for new power lines. This option can be surprisingly economical, when back-tested on real-world load profiles. Hence we are upgrading our battery outlook.

Read the Report?

Read the Report?

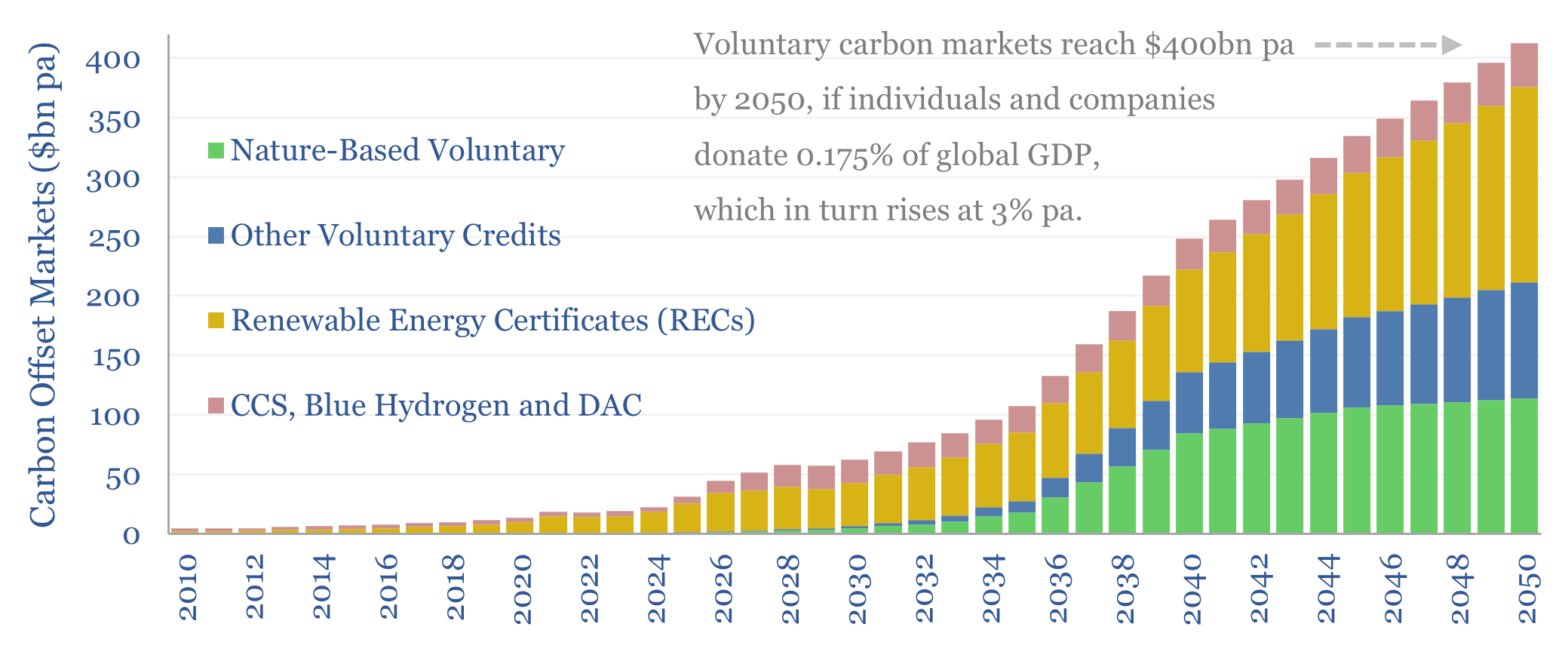

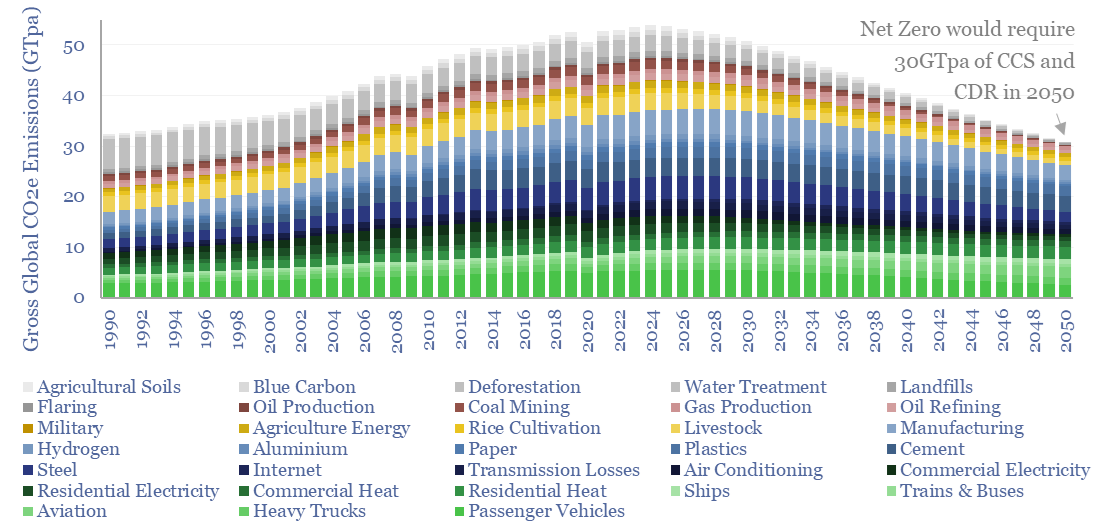

Carbon markets: charity case?

Carbon markets incentivize renewable energy, CCS, DAC, nature-based solutions and other CO2 offsets. In the past, we naïvely assumed these would grow as much as needed to reach Net Zero by 2050. This 14-page note revises our forecasts, by analogy to other forms of charitable giving. We see voluntary carbon markets reaching $400bn pa by 2050, while the EU ETS could be scaled back?

Read the Report?

Read the Report?

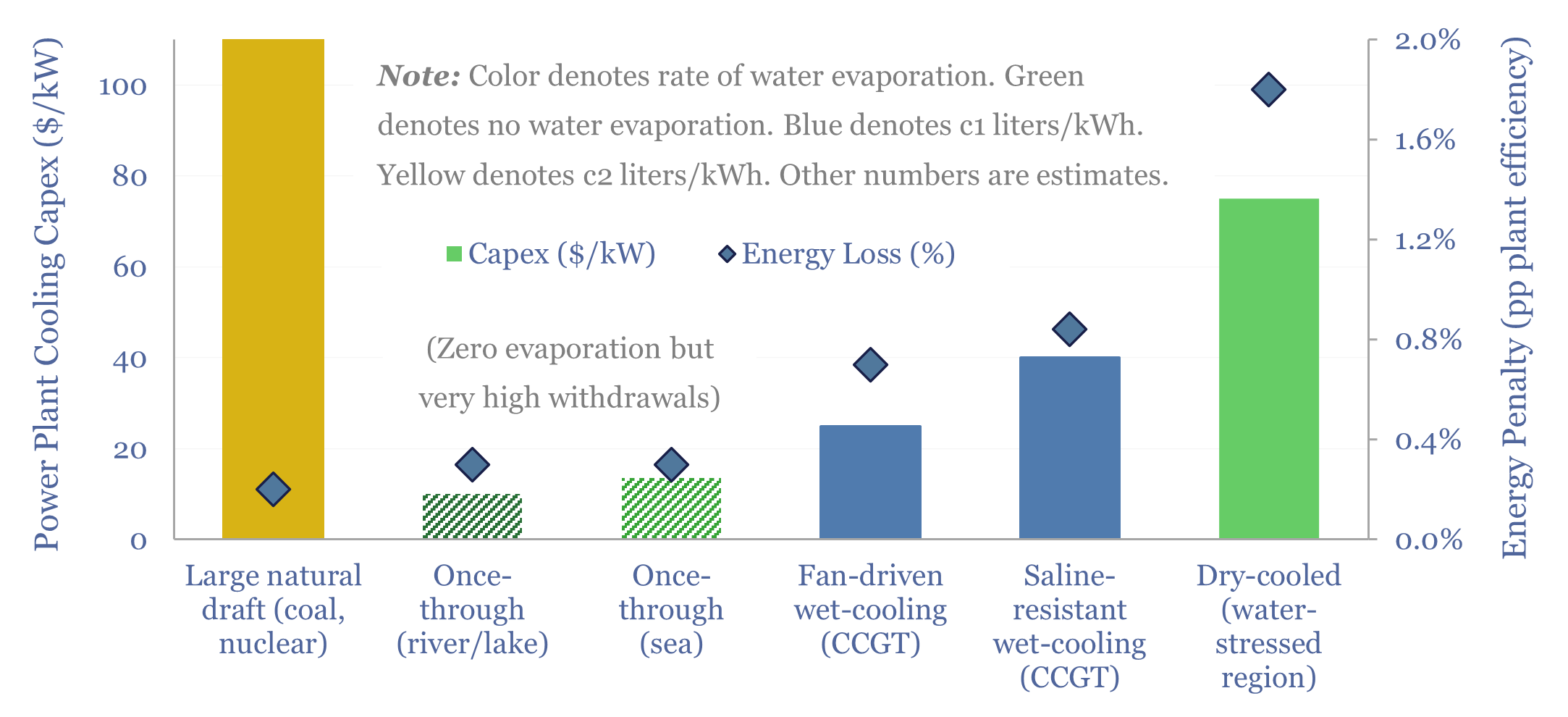

Power plant cooling: adapting for water scarcity?

Water is needed to condense steam, downstream of the steam turbines, in nuclear, coal and CCGT power plants. But thermal power demands and fresh water scarcity are both structurally rising. Hence this 16-page report explores how the energy industry might adapt, trends in power plant cooling, and who benefits.

Read the Report?

Read the Report?

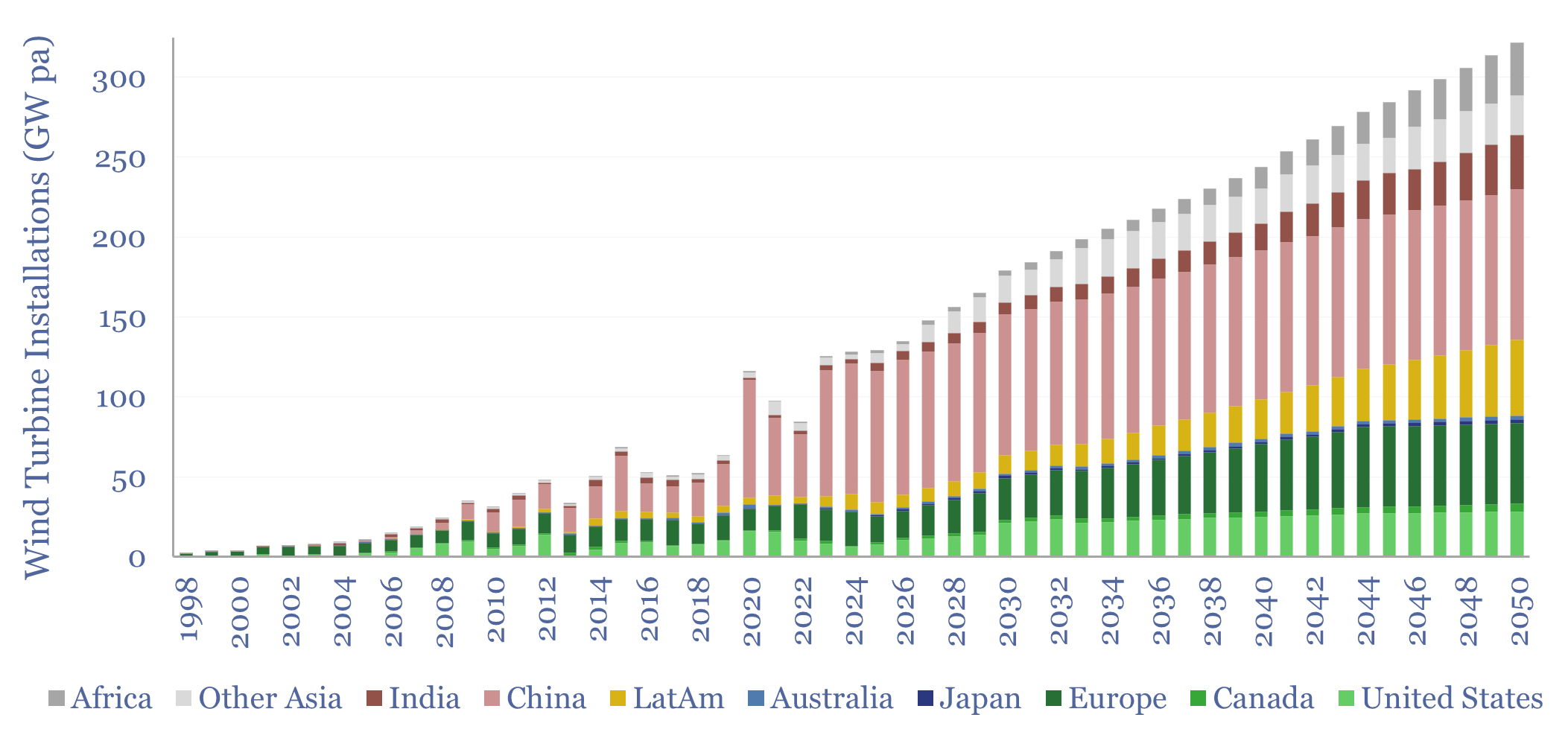

Wind energy: beyond good and evil?

Wind economics are not good or bad in absolute terms. They depend on capacity factors, which average 26% globally, but can range from 10% to 60%. In the best locations, levelized costs are below 4c/kWh. Hence this 16-page note explores global wind capacity factors and updates our wind outlook by region throgh 2050.

Read the Report?

Read the Report?

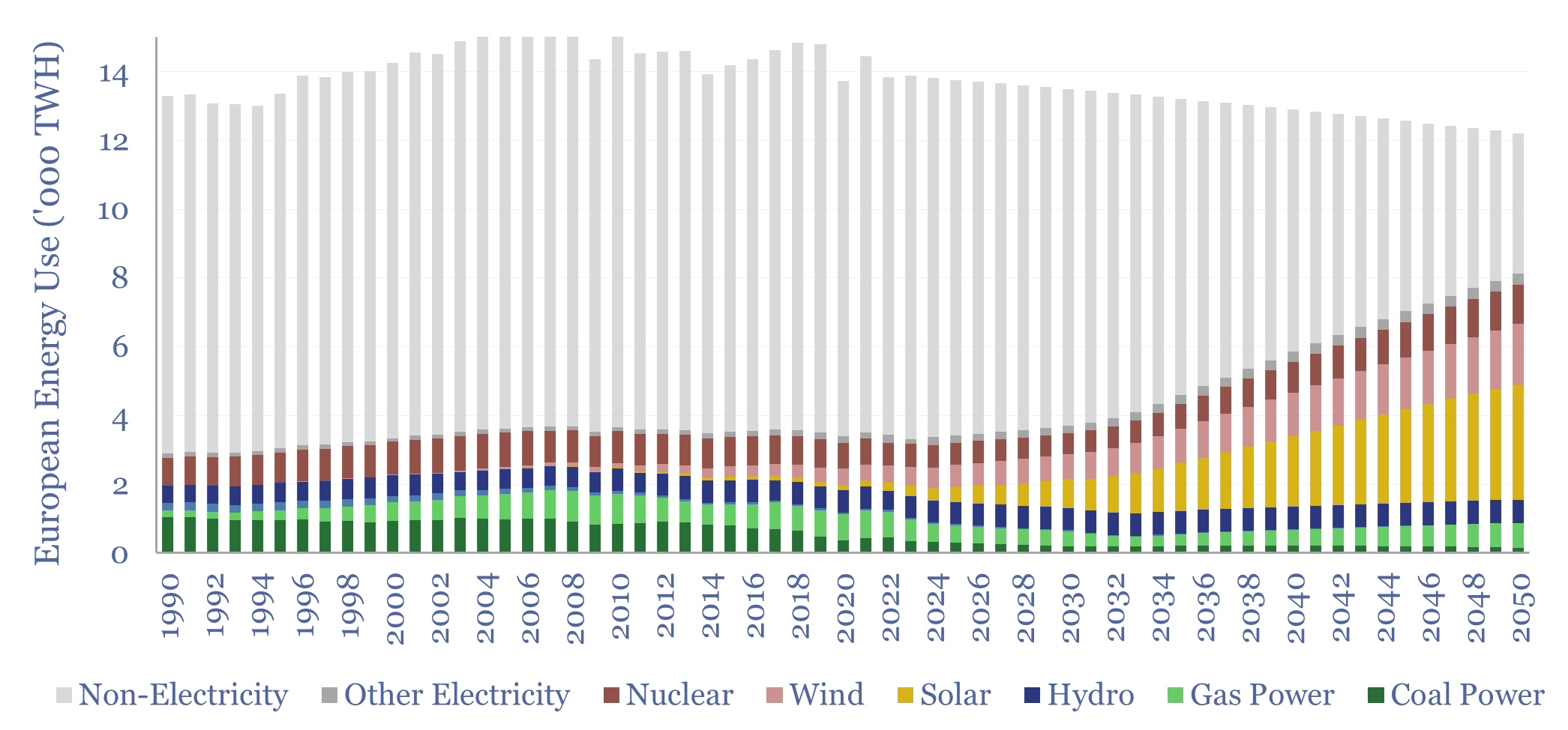

European energy: the burial of the dead?

Europe’s energy ambitions are now intractable: It is just not feasible to satisfy former climate goals, new geopolitical realities, and also power future AI data centers. Hence this 18-page report evaluates Europe’s energy options; predicts how policies are going to change; and re-forecasts Europe’s gas and power balances, both to 2030 and to 2050.

Read the Report?

Read the Report?

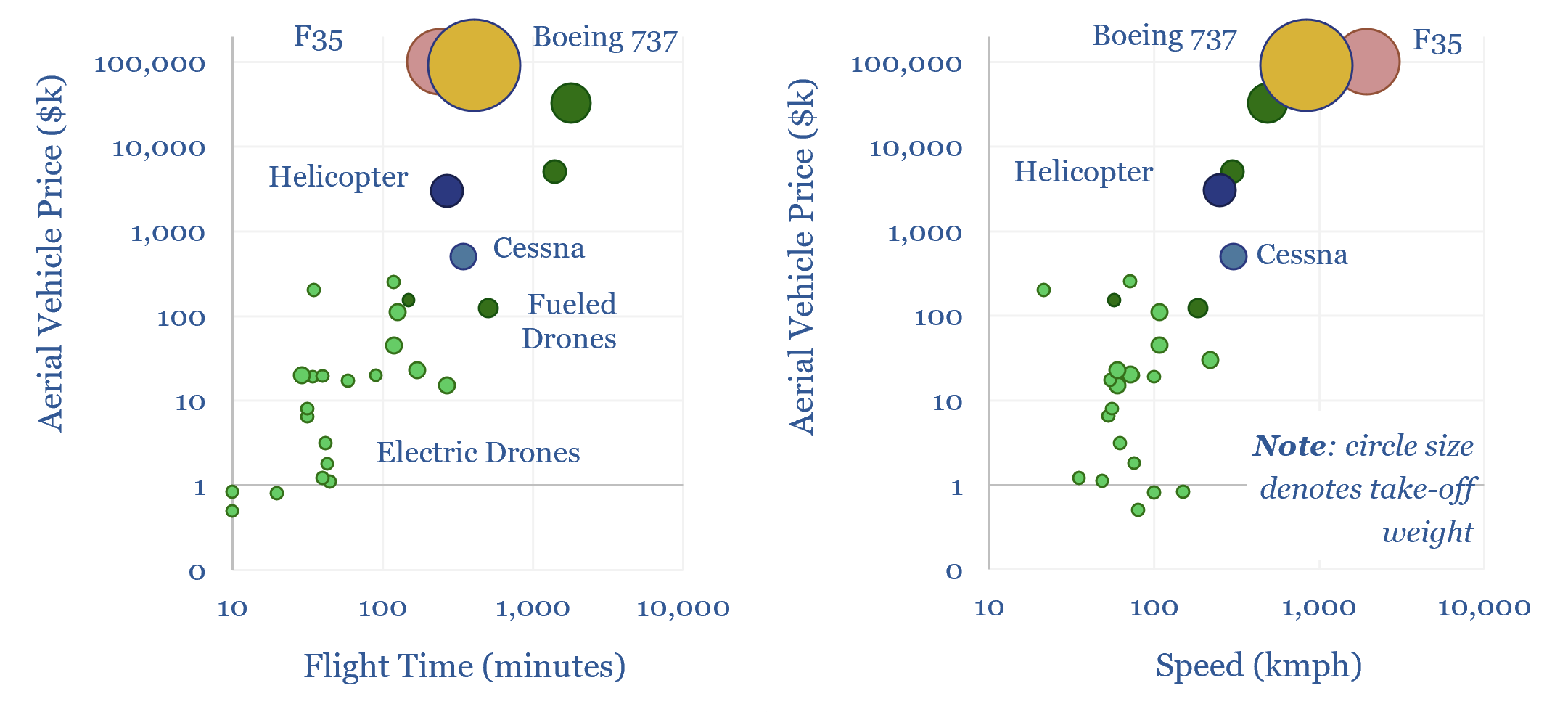

Drone deployment: vertical take-off?

Drones cost just $1k-100k each. They may use 95-99% less energy than traditional vehicles. Their ascent is being helped by battery technology and AI. Hence this 14-page report reviews recent progress from 40 leading drone companies. What stood out most was a re-shaping of the defense industry, plus helpful deflation across power grids, renewables, agriculture, mining and last-mile delivery.

Read the Report?

Read the Report?

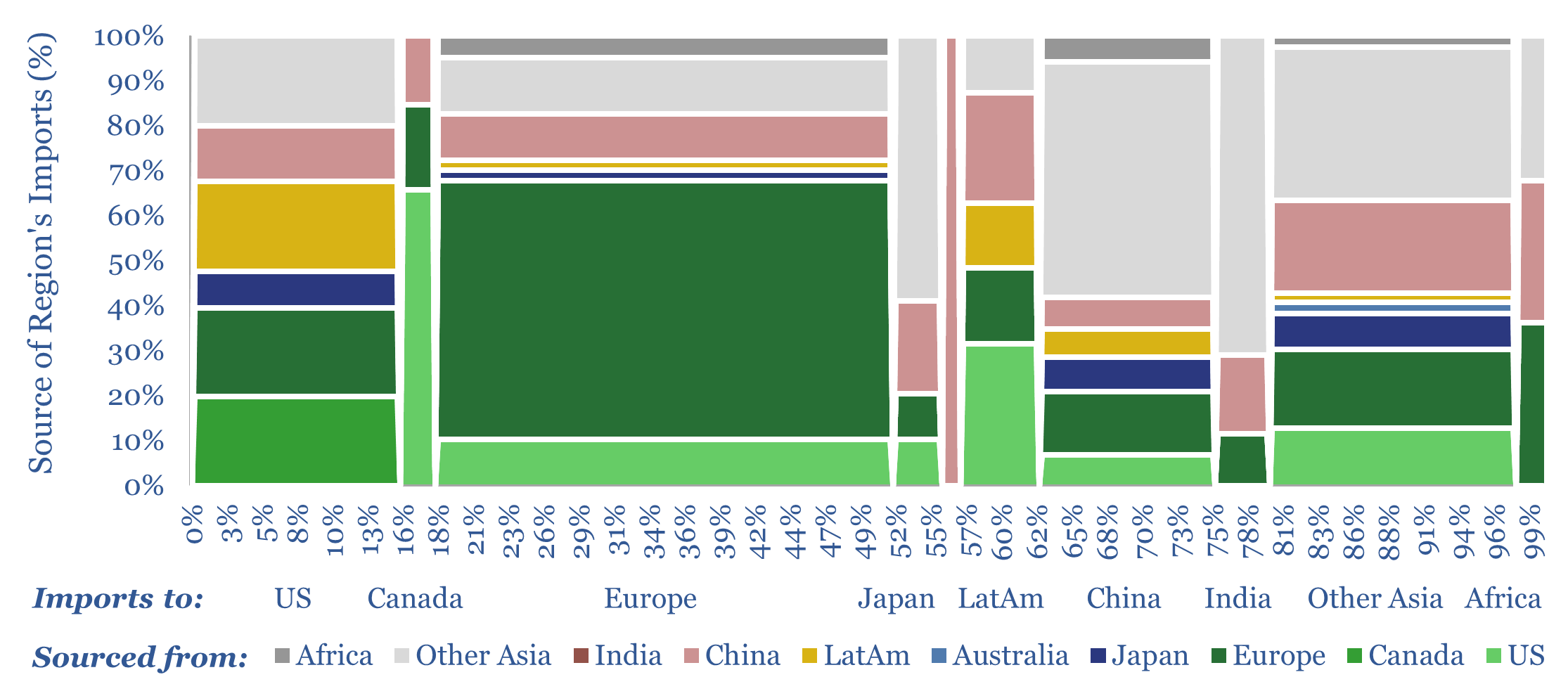

Global trade: balance or darkness?

Global trade has been growing more adversarial. US foreign relations are also shifting. Hence this 16-page note maps 20 trade categories, across energy, materials and capital goods; in each case, breaking down global imports by source, and global exports by destination. Our top ten conclusions follow.

Read the Report?

Read the Report?

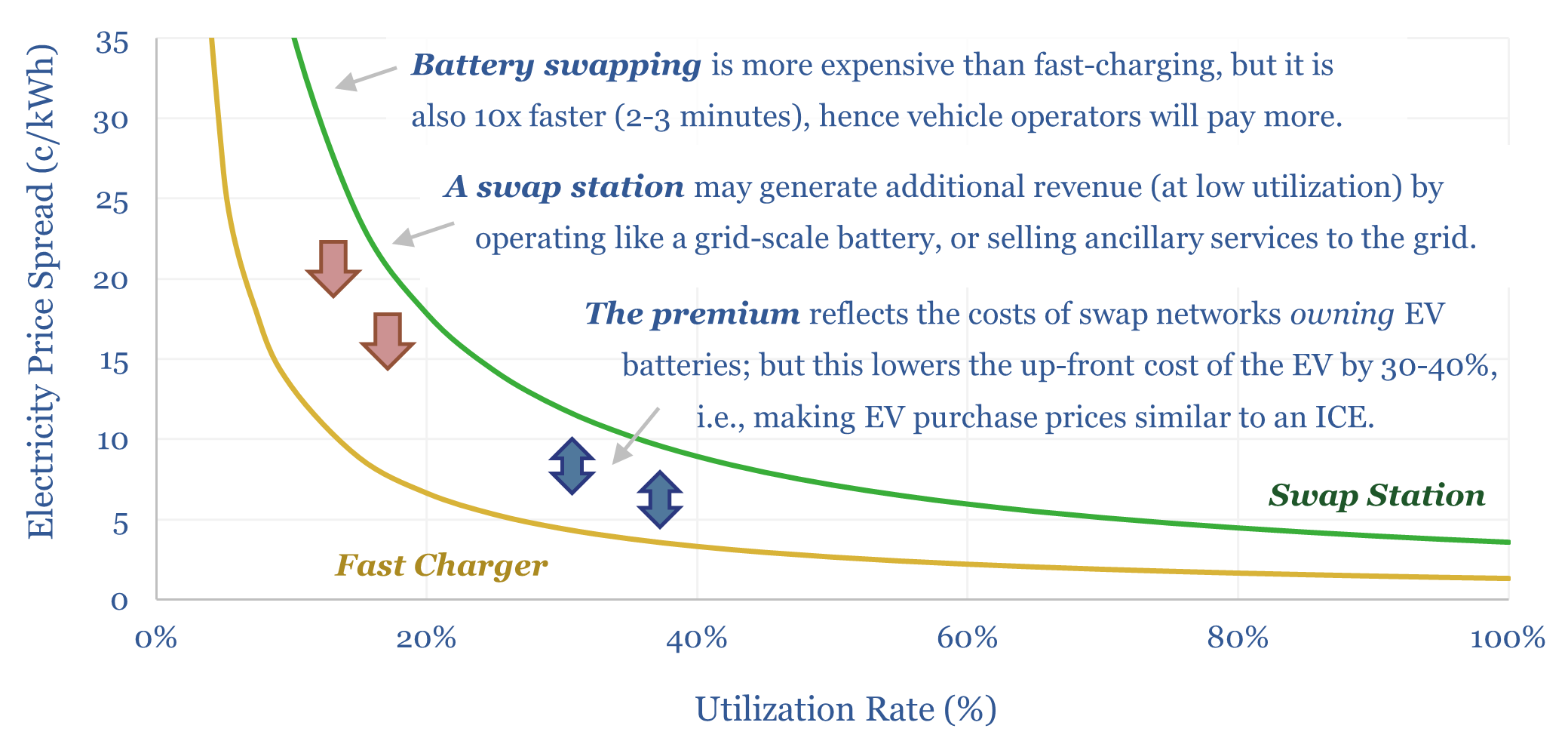

Battery swapping: off to the races?

Battery swapping has seen a sudden surge of interest, especially for cars in China, some heavy vehicles, and two-wheelers throughout emerging markets. Can the theme re-accelerate EVs? This 19-page report finds many advantages, controversies over costs, and profiles leading companies.

Read the Report?

Read the Report?

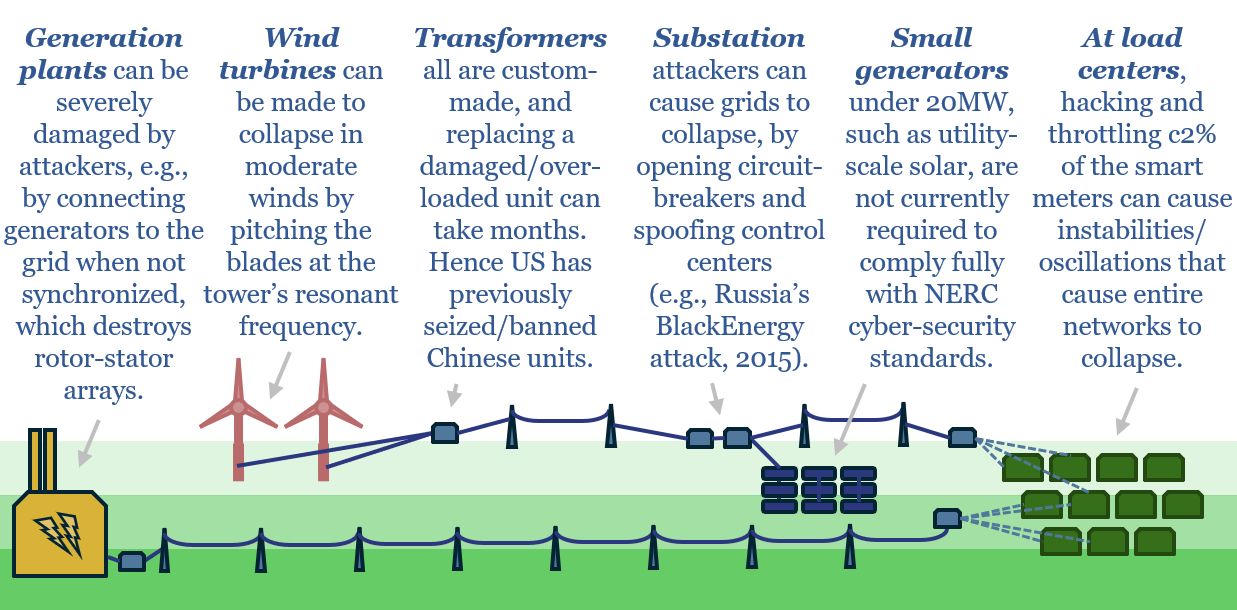

Energy and national security: network risk?

National security risks are rising in developed world energy systems, as geopolitics grow more adversarial, and cyber-attacks are at new highs. This 16-page report finds that electrification is on balance making energy systems more vulnerable, then outlines mitigation measures, and opportunities?

Read the Report?

Read the Report?

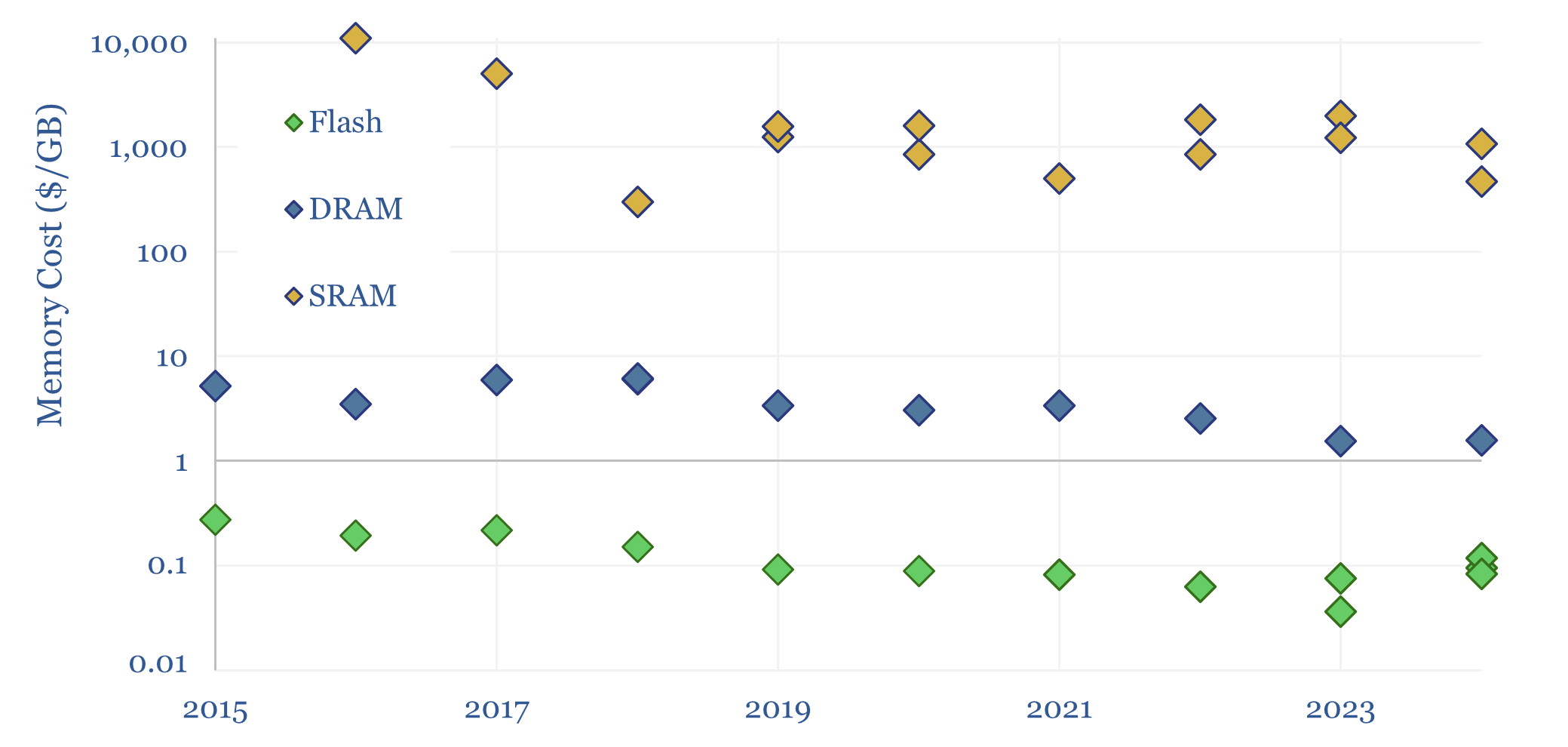

Computer memory: aide memoire?

Three types of computer memory dominate modern information processing: Flash, DRAM and SRAM. This 5-page note simply covers each one, how it works, what it costs, advantages, disadvantages, market sizes and leading companies. AI likely boosts all three, but can more SRAM unlock big efficiency gains?

Read the Report?

Read the Report?

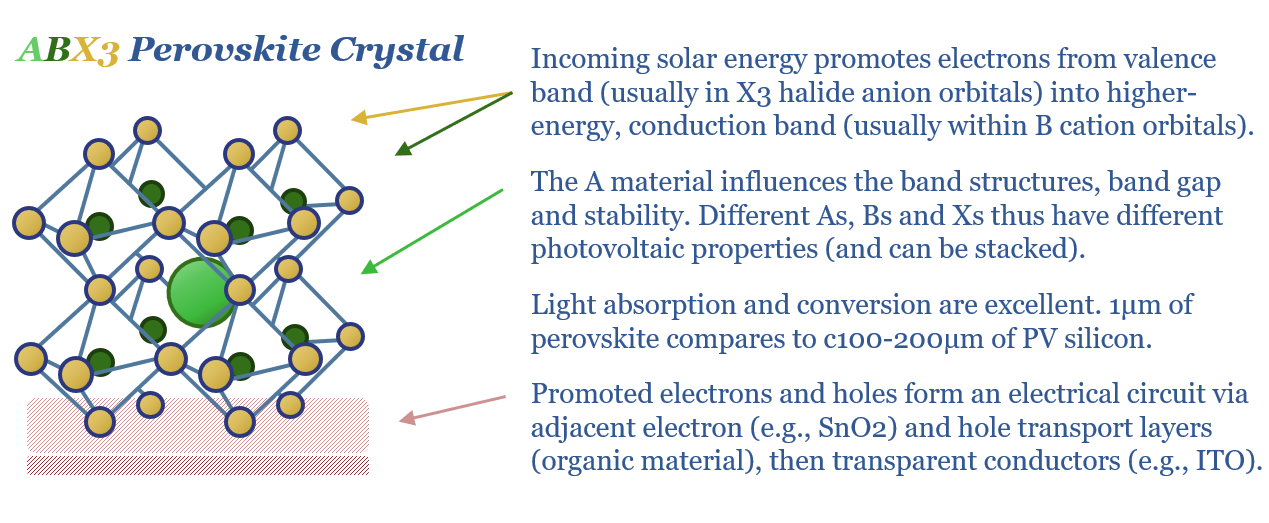

Perovskite solar: beyond silicon?

Will the next chapter of solar’s ascent come from perovskite-tandem cells, followed by perovskite-on-perovskites? This 18-page report finds more momentum than we expected. There is potential for 30% cost deflation, new solar applications (in buildings/vehicles), and a disruption of PV silicon?

Read the Report?

Read the Report?

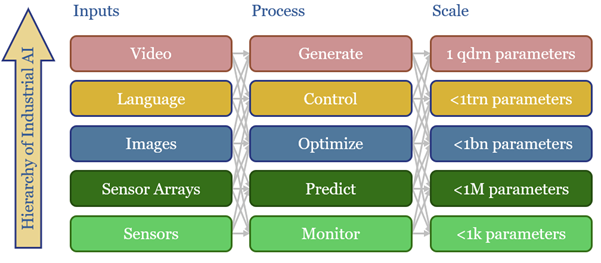

AI energy: industrial demand and the Jevons effect?

Increasingly efficient AI should unlock ever more widespread and more sophisticated uses of AI. This is shown by reviewing 40,000 patents from 200 industrial companies. This 15-page report summarizes notable companies, patent filings, and updates our 2030 forecasts for AI energy.

Read the Report?

Read the Report?

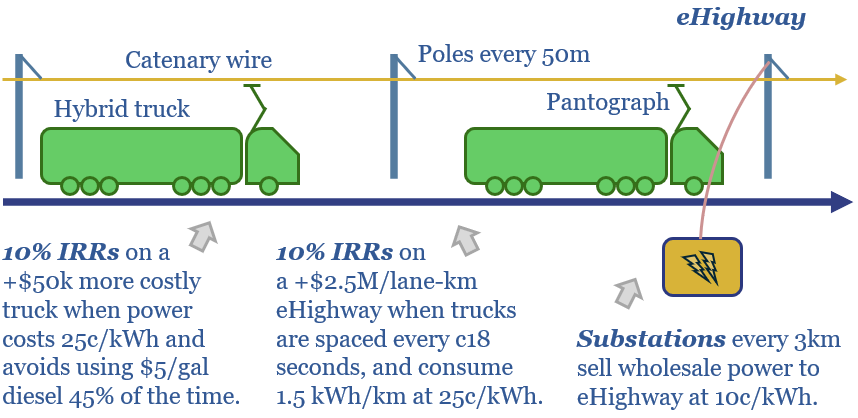

eHighways: trucking by wire?

eHighways electrify heavy trucks via overhead catenary wires. They have been de-risked by half-a-dozen real-world pilots. High-utilization routes can support 10% IRRs on both road infrastructure and hybrid trucks. This 15-page report finds benefits in logistics networks and for integrating renewables?

Read the Report?

Read the Report?

Photons vs electrons: laser quest?

Some commentators say the 21st century will be the ‘age of the electron’. But in computing/communications, the photon has long been displacing the electron. This 17-page note gives an overview. It matters as moving data is 50-90% of data center energy use. We contrast fiber vs copper; and explore AI power, optical computing, and a boom for laser photonics?!

Read the Report?

Read the Report?

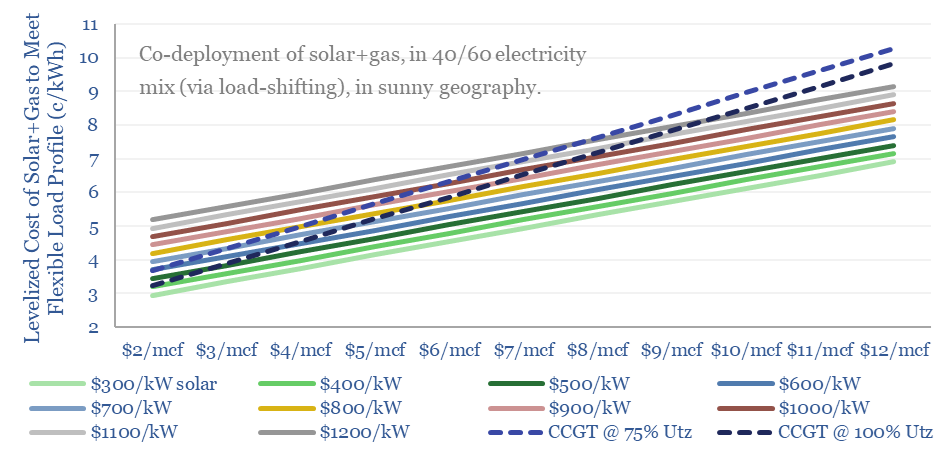

Load bearing: will solar+gas be cheaper than gas alone?

The costs to power a real-world load – e.g., a data center – with solar+gas will very often be more expensive than via a standalone gas CCGT in the US today. But not internationally? Or in the future? This 9-page note shows how solar deflation and load shifting can boost solar to >40% of future grids.

Read the Report?

Read the Report?

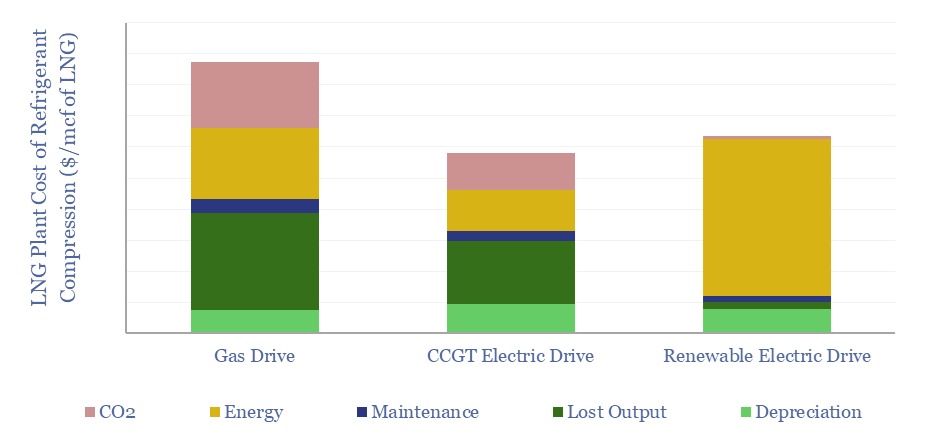

LNG plant compressors: chilling goes electric?

Electric motors were selected, in lieu of industry-standard gas turbines, to power the main refrigeration compressors at three of the four new LNG projects that took FID in 2024. Hence is a major change underway in the LNG industry? This 13-page report covers the costs of e-LNG, advantages and challanges, and who benfits from shifting capex.

Read the Report?

Read the Report?

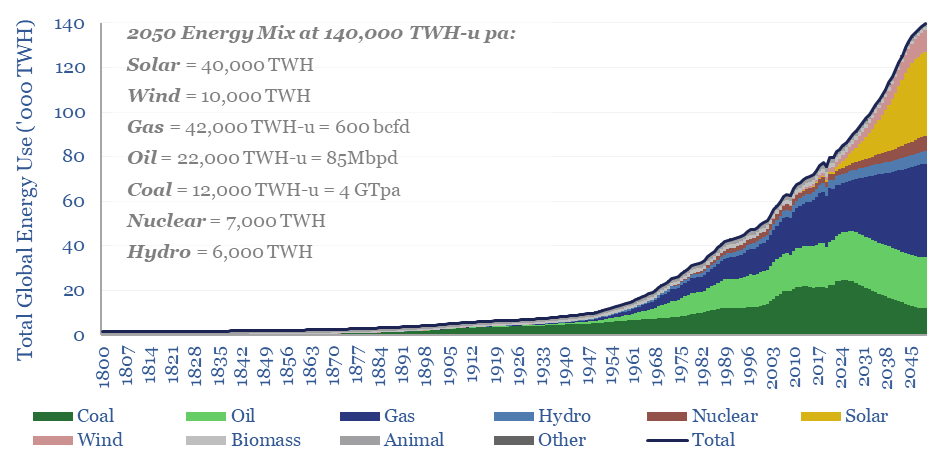

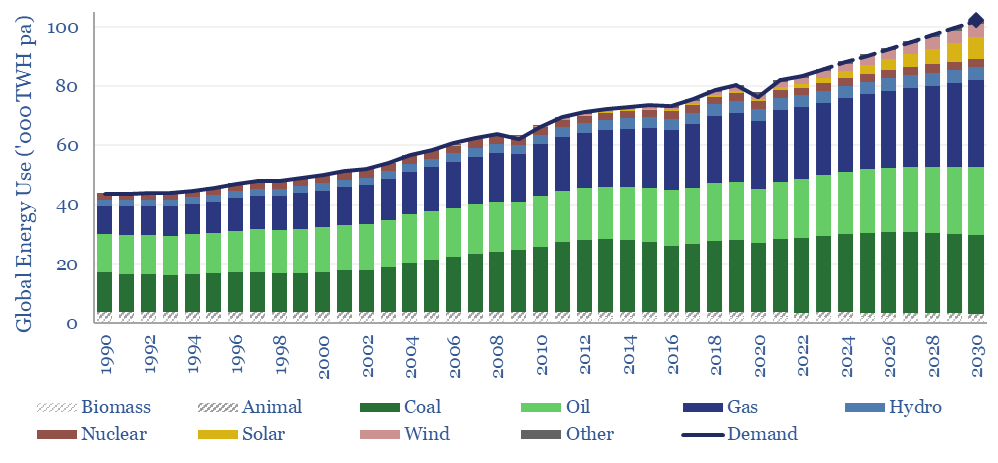

Energy transition: solar and gas -vs- coal hard reality?

This 15-page note outlines the largest changes to our long-term energy forecasts in five years. Over this time, we have consistently underestimated both coal and solar. Both are upgraded. But we also show how coal can peak after 2030. Global gas is seen rising from 400bcfd in 2023 to 600bcfd in 2050.

Read the Report?

Read the Report?

Ten Themes for Energy in 2025?

This 11-page report sets out our top ten predictions for 2025, across energy, industrials and climate. Sentiment is shifting. New narratives are emerging for what energy transition is. 2025-30 energy markets look well supplied. The value is in regional arbitrage, volatility, grids, AI and solar.

Read the Report?

Read the Report?

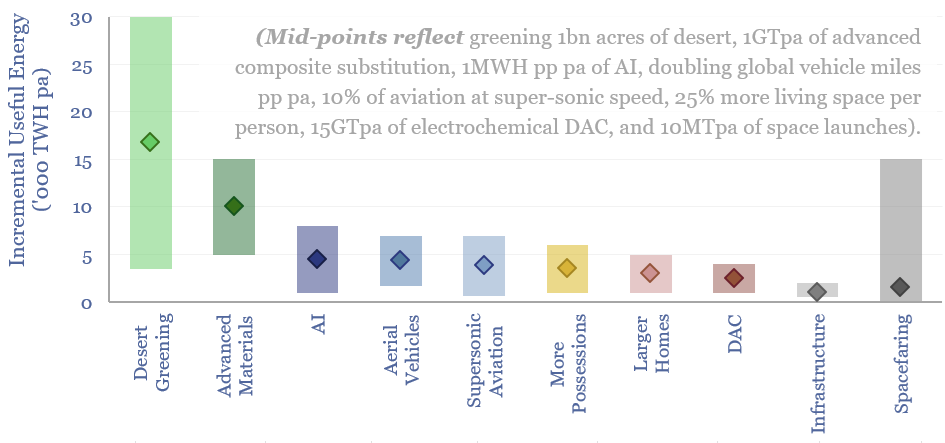

Kardashev scale: a futuristic future of energy?

A Kardashev scale civilization uses all the energy it has available. Hence this 16-page report explores ten futuristic uses for global energy, which could absorb an additional 50,000 TWH pa by 2050 (60% upside), mainly from solar. And does this leap in human progress also allay climate concerns better than pre-existing roadmaps to net zero?

Read the Report?

Read the Report?

Cool concept: absorption chillers, data-centers, fuel cells?!

Absorption chillers perform the thermodynamic alchemy of converting waste heat into coolness. Interestingly, their use with solid oxide fuel cells may have some of the lowest costs and CO2 for powering and cooling AI data-centers. This 14-page report explores the opportunity, costs and challenges.

Read the Report?

Read the Report?

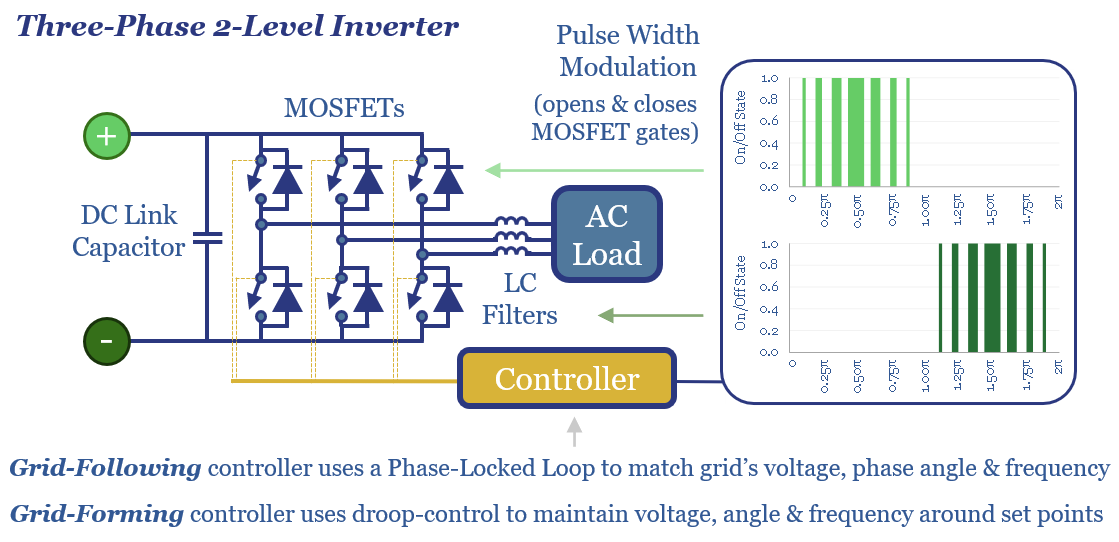

Grid-forming inverters: islands in the sun?

The grid-forming inverter market may soon inflect from $1bn to $15-20bn pa, to underpin most grid-scale batteries, and 20-40% of incremental solar and wind. This 11-page report finds that grid-forming inverters cost c$100/kW more than grid-following inverters, which is inflationary, but integrate more renewables, raise resiliency and efficiency?

Read the Report?

Read the Report?

Energy transition: losing faith?

What if achieving Net Zero by 2050 and/or reaching 1.5ºC climate targets now has a 3% chance of success, for reasons that cause decision-makers to backtrack, and instead focus on climate adaptation and broader competitiveness? This 14-page report reviews the challenges. Can our Roadmap to Net Zero be salvaged?

Read the Report?

Read the Report?

Solar trackers: following the times?

Solar trackers are worth $10bn pa. They typically raise solar revenues by 30%, earn 13% IRRs on their capex costs, and lower LCOEs by 0.4 c/kWh. But these numbers are all likely to double, as solar gains share, grids grow more volatile, and AI unlocks further optimizations? This 14-page report explores the theme and who benefits?

Read the Report?

Read the Report?

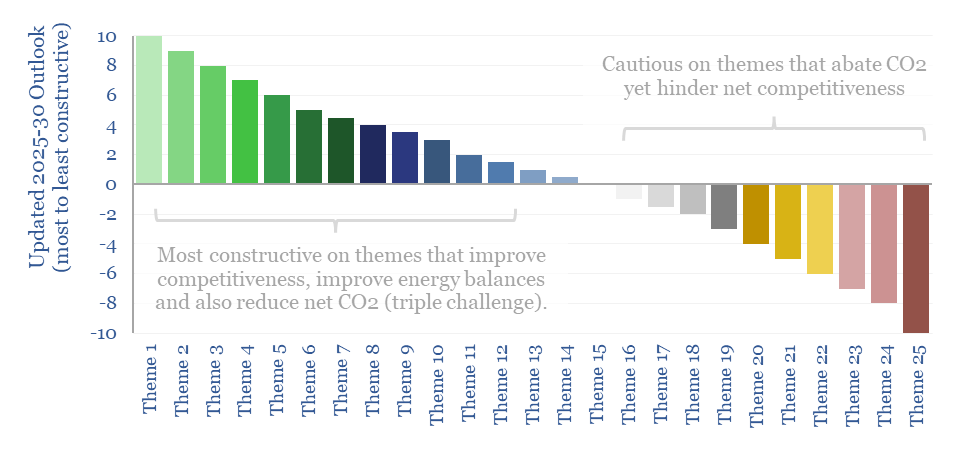

Energy transition: the triple challenge?

Energy transition is a triple challenge: to meet energy needs, abate CO2 and increase competitiveness. History has now shown that ignoring the part about competitiveness gets you voted out of office?! We think raising competitiveness will be the main focus of the new administration in the US. So this 15-page report discusses overlooked angles around energy competitiveness, and updates our outlook for different themes.

Read the Report?

Read the Report?

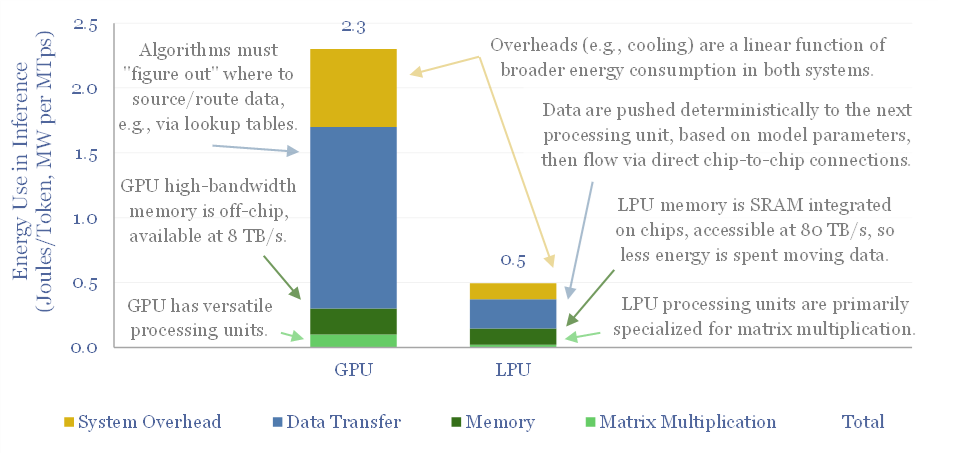

Groq: AI inference breakthrough?

Groq has developed LPUs for AI inference, which are up to 10x faster and 80-90% more energy efficient than today’s GPUs. This 8-page Groq technology review assesses its patent moat, LPU costs, implications for our AI energy models, and whether Groq could ever dethrone NVIDIA’s GPUs?

Read the Report?

Read the Report?

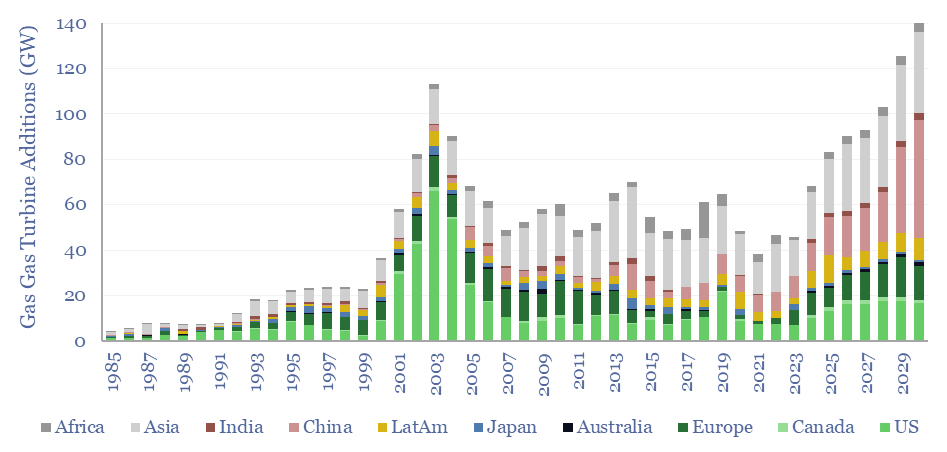

Gas turbines: what outlook in energy transition?

Gas turbines should be considered a key workhorse for a cleaner and more efficient global energy system. Installations will double to 100GW pa in 2024-30, and reach 140GW in 2030, surpassing their prior peak from 2003. This 16-page report outlines four key drivers in our outlook for gas turbines, and their implications.

Read the Report?

Read the Report?

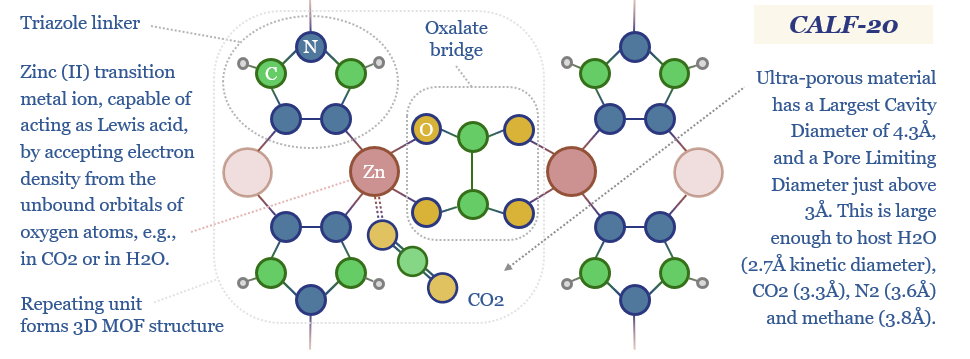

Metal Organic Frameworks: sorting hat?

Metal Organic Frameworks (MOFs) are a game-changer for industrial separation, which consumes c10% of global energy. Activity is surging. This 18-page report reviews MOFs’ recent progress and future promise. As a case study, CALF-20 can deflate CCS costs by c50%, per Svante’s TSA process.

Read the Report?

Read the Report?

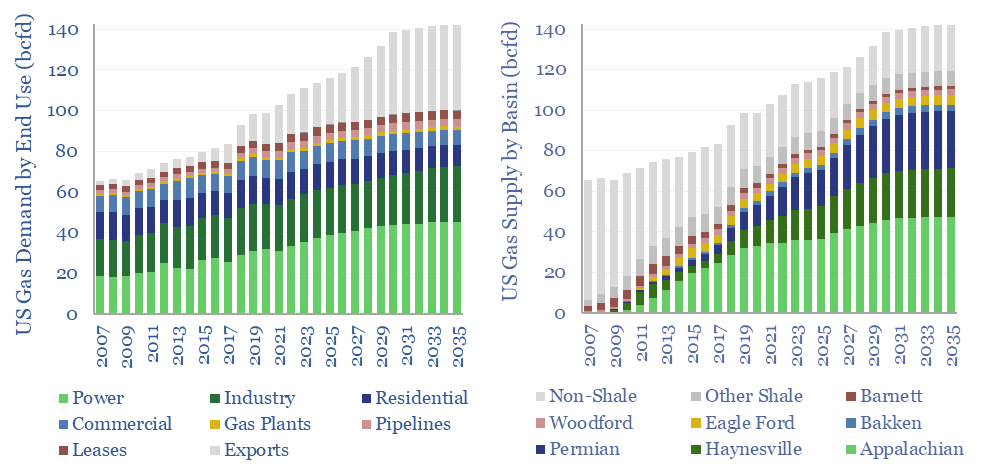

US natural gas: the stuff of dreams?

Modeling US gas supply and demand can be nightmarishly complex. Yet we have evaluated both, through 2035. This 13-page report outlines the largest drivers of demand, requires a +3% pa CAGR from the key US shale gas basins, and argues the balance of probability lies to the upside.

Read the Report?

Read the Report?

Shorter Insights

Energy transition: classic blunders?!

Classic blunders famously include “never start a land war in Asia” and “never go up against a Sicilian when death is on the line”. But this video sets out what we believe are the three classic blunders that should be avoided by energy analysts, and in the energy transition, based on our own experiences over the past 15-years.

Read More?

Read More?

Grid-forming inverters: islands in the sun?

The grid-forming inverter market may soon inflect from $1bn to $15-20bn pa, to underpin most grid-scale batteries, and 20-40% of incremental solar and wind. This 11-page report finds that grid-forming inverters cost c$100/kW more than grid-following inverters, which is inflationary, but integrate more renewables, raise resiliency and efficiency?

Read More?

Read More?

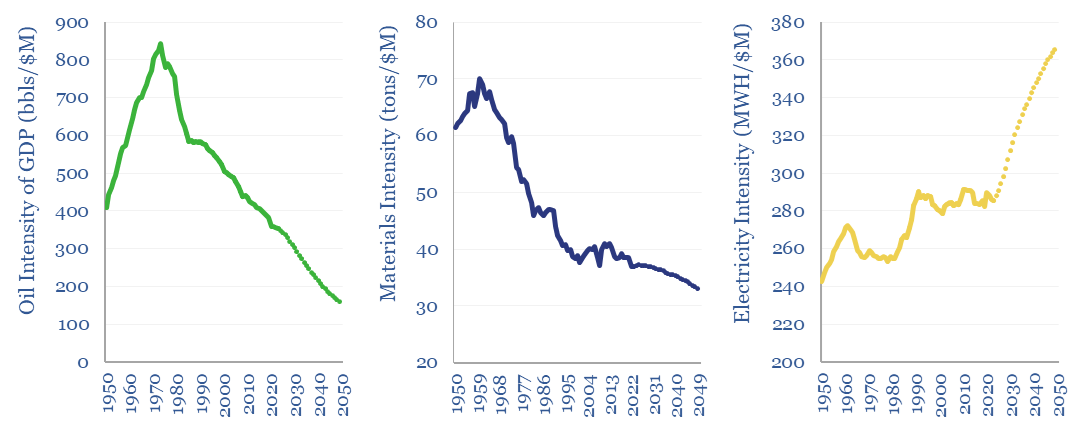

Commodity intensity of global GDP in 30 key charts?

The commodity intensity of global GDP has fallen at -1.2% over the past half-century, as incremental GDP is more services-oriented. So is this effect adequately reflected in our commodity outlooks? This 4-page report plots past, present and forecasted GDP intensity factors, for 30 commodities, from 1973->2050. Oil is anomalous. And several commodities show rising GDP intensity.

Read More?

Read More?

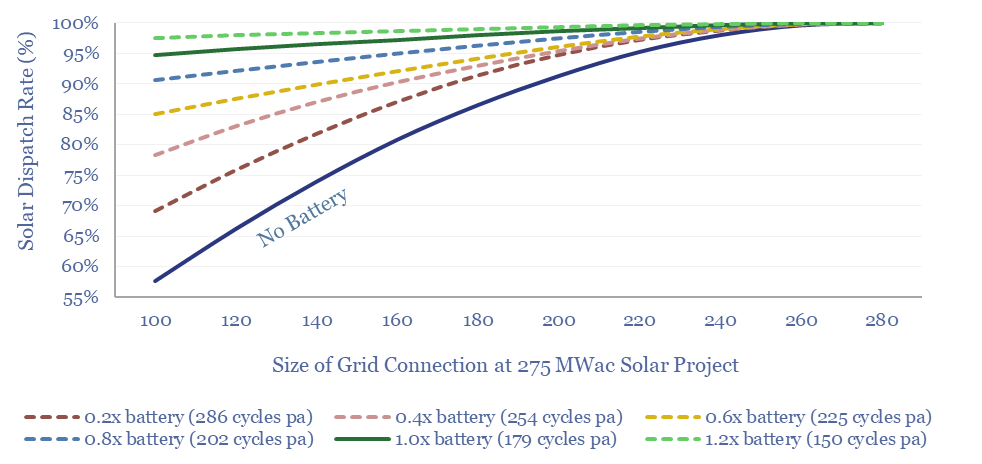

Solar plus batteries: the case for co-deployment?

This 9-page study finds unexpectedly strong support for co-deploying grid-scale batteries together with solar. The resultant output is stable, has synthetic inertia, is easier to interconnect in bottlenecked grids, and can be economically justified. What upside for grid-scale batteries?

Read More?

Read More?

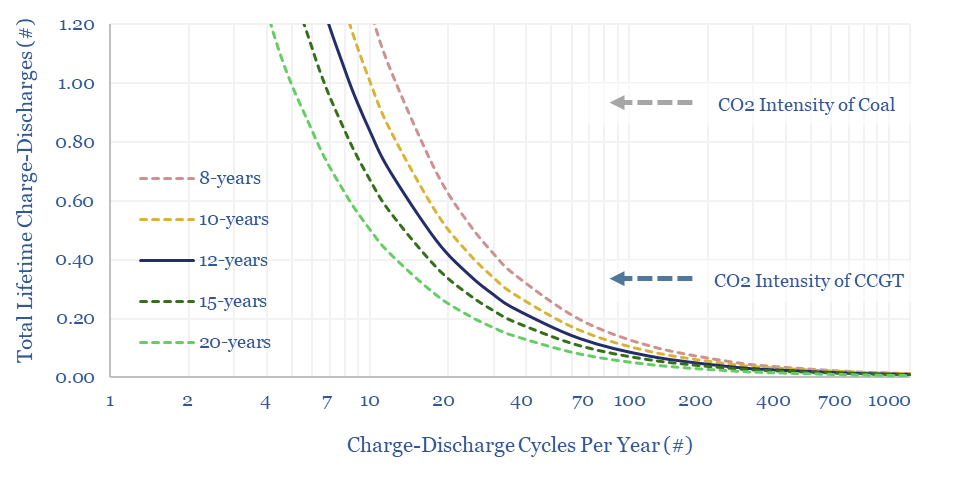

Long-duration storage: dirtier than gas peakers?

The CO2 credentials of long-duration batteries may be as bad as 0.35-2.0 kg/kWh, which is worse than gas peakers, or even than coal power. Grid-scale batteries are best deployed in high-frequency applications, to maximize power quality, downstream of renewables. But we were surprised to find that there is almost no net climate benefit from turning off gas peakers in favor of long-duration, low-utilization batteries.

Read More?

Read More?

Energy research in the age of AI?

How will AI change the research and investment worlds? Our view is that large language models (LLMs) will soon surpass human analysts in assimilating and summarizing information. Hence this video explores three areas where human analysts can continue to earn their keep, and possibly even help decision-makers beat the ‘consensus engines’.

Read More?

Read More?

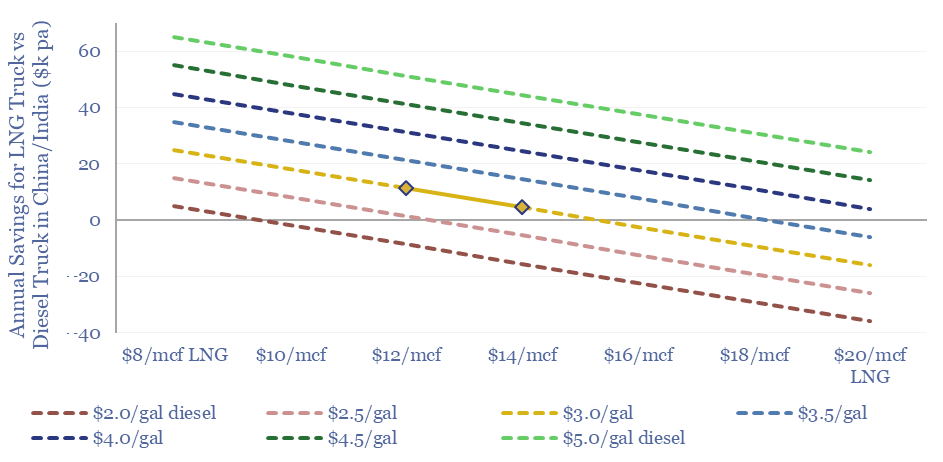

LNG trucks: Asian equation?

LNG trucking is more expensive than diesel trucking in the developed world. But Asian trucking markets are different, especially China, where exponentially accelerating LNG trucks will displace 150kbpd of oil demand in 2024. This 8-page note explores the costs of LNG trucking and sees 45MTpa of LNG displacing 1Mbpd of diesel?

Read More?

Read More?

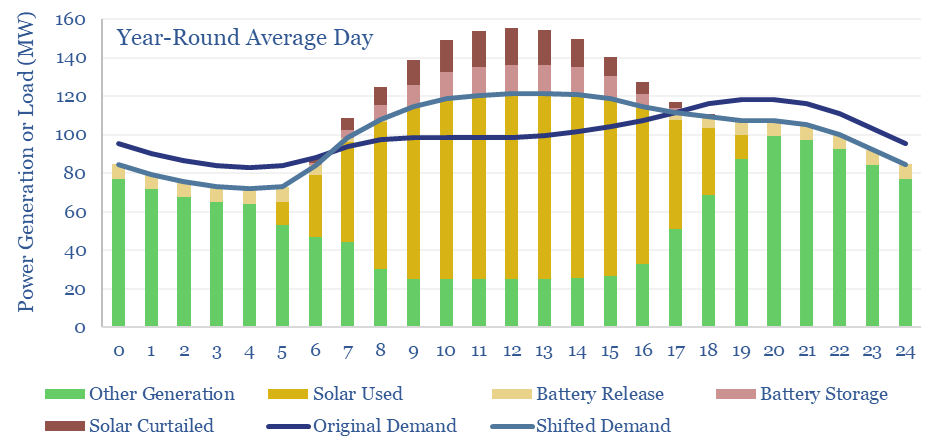

Can solar reach 45% of a power grid?

Can solar reach 45% of a power grid? This has been one of the biggest pushbacks we received on a recent research note, scoring solar potential by country, where we argued that the best regions – California, Australia – would reach 45% solar by 2050. Hence today’s short article explores what a 45% solar grid might look like, using data from our solar insolation model.

Read More?

Read More?

AI and power grid bottlenecks?

The number one topic in energy this year has been the rise of AI. Which might not seem like an energy topic. Yet it is inextricably linked with power grid bottlenecks, the single biggest issue for energy markets in the mid-late 2020s. The goal of today’s video is to recap our key conclusions. There is an accompanying presentation for TSE clients, plus links to our underlying work.

Read More?

Read More?

Methane leaks: by gas source and use

Methane leakage rates in the gas industry vary by source and use. Across our build-ups, the best-placed value chains are using Marcellus gas in CCGTs (0.2% methane leakage, equivalent to 6kg/boe, 1kg/mcfe, or +2% on Scope 3 emissions) and/or Permian gas in LNG or blue hydrogen value chains (0.3%). Residential gas use is likely closer to 0.8-1.2%, which is 4-6kg/mcfe, or higher as this is where leaks are most likely under-reported.

Read More?

Read More?

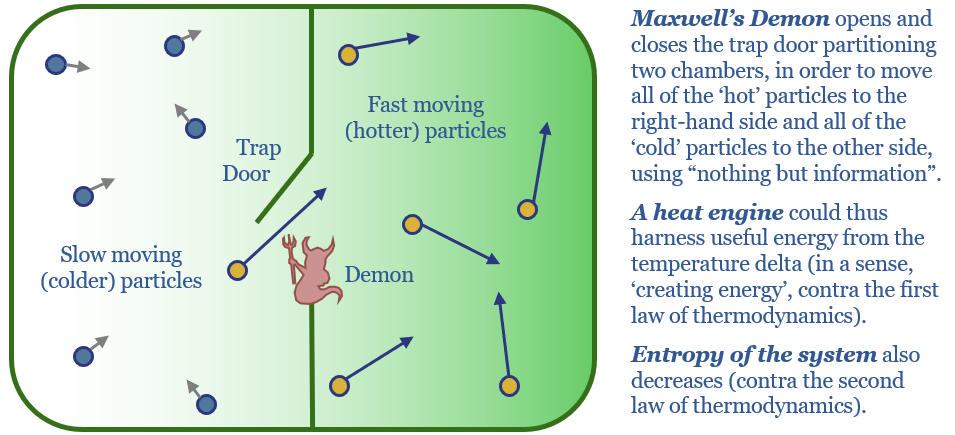

Maxwell’s demon: computation is energy?

Computation, the internet and AI are inextricably linked to energy. Information processing literally is an energy flow. This note explains the physics, from Maxwell’s demon, to the entropy of information, to the efficiency of computers.

Read More?

Read More?

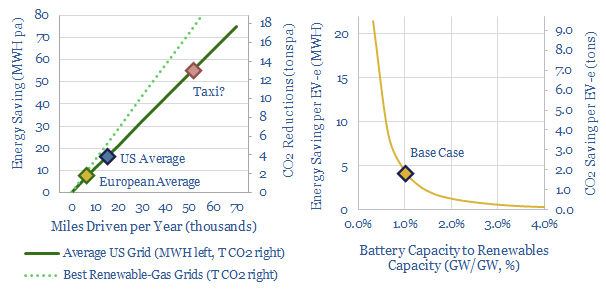

Electric adventures: conclusions from an EV road trip?

It is a rite of passage for every energy analyst to rent an electric vehicle for an EV road trip, then document their observations and experiences. Our conclusions are that range anxiety is real, chargers benefit retailers, economics are debatable, power grids will be the biggest bottleneck and our EV growth forecasts are not overly optimistic.

Read More?

Read More?

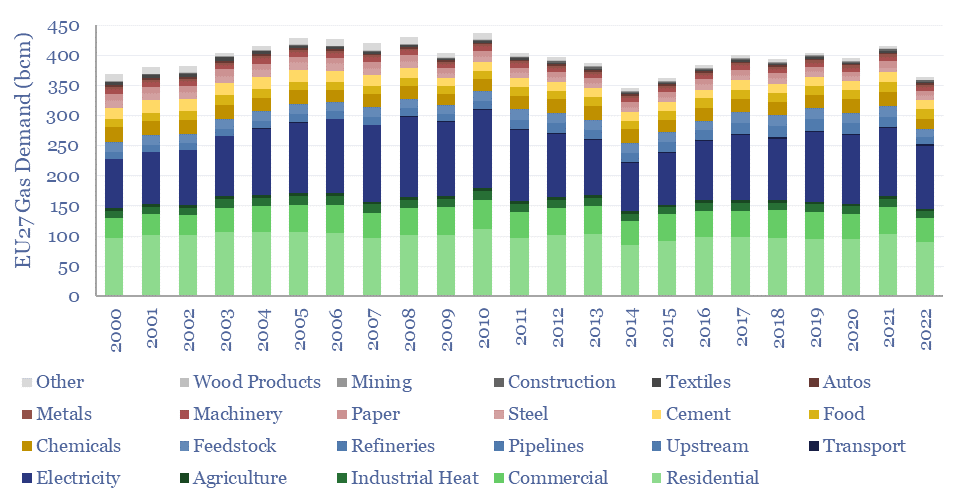

European gas: anatomy of an energy crisis?

Europe suffered a full-blown energy crisis in 2022, hence what happened to gas demand, as prices rose 5x from 2019 levels? European gas demand in 2022 fell -13% overall, including -13% for heating, -6% for electricity and -17% for industry. The data suggest upside to for European gas, global LNG and gas as the leading backup to renewables.

Read More?

Read More?

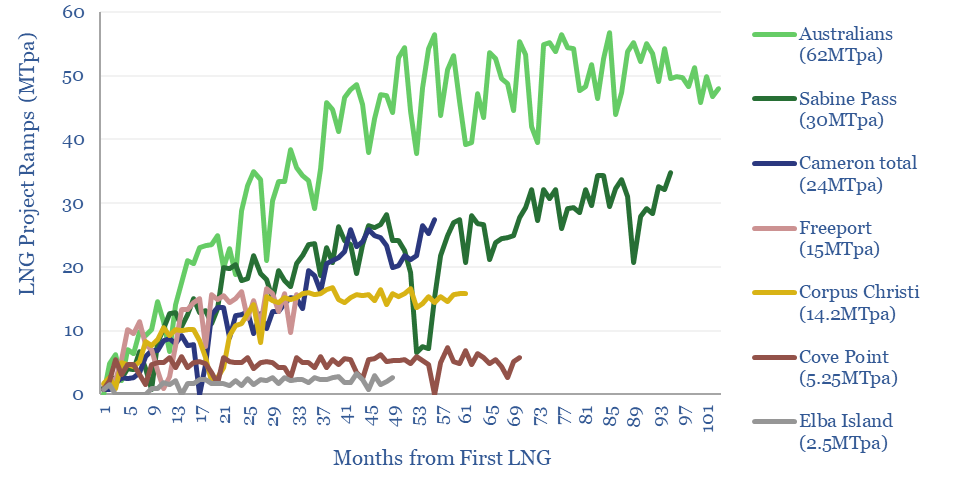

LNG ramp-rates: MTpa per month and volatility?

What are the typical ramp-rates of LNG plants, and how volatile are these ramp-ups? We have monthly data on serveral facilities in our LNG models, implying 4-5MTpa LNG trains ramp at +0.7MTpa/month, with a +/- 35% monthly volatility around this trajectory. Thus do LNG ramps create upside for energy traders?

Read More?

Read More?

Email deliverability: who broke the internet?

This video explains email mailing lists, SPF, DKIM, DMARC, lessons learned over 15-years, and an unfortunate issue from December that prevented 4,000 subscribers from receiving our research. We’re sorry. We’ve fixed it! And some comments follow below to make sure important research reaches you.

Read More?

Read More?

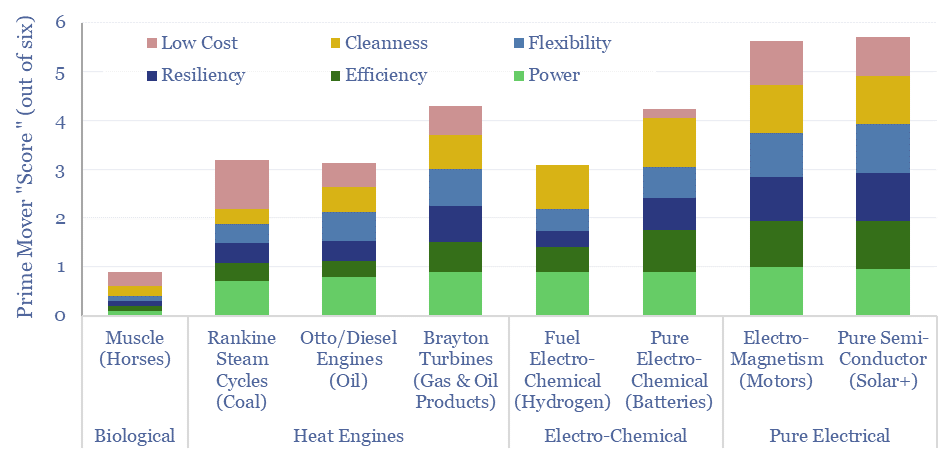

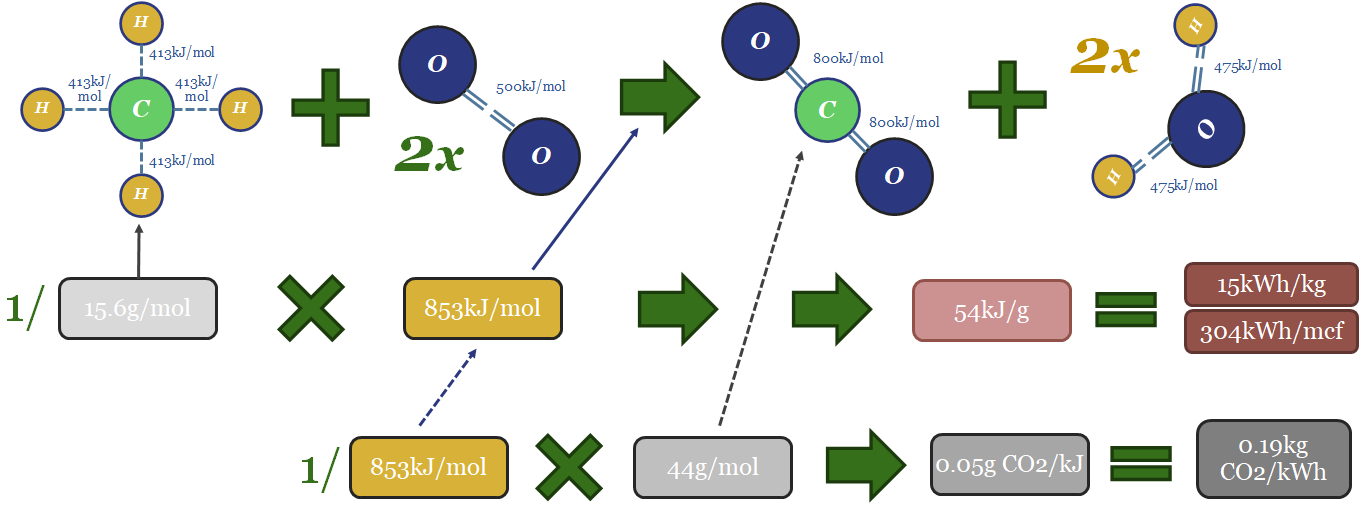

Energy transition from first principles?

Our top three questions in the energy transition are depicted above. Hence we have become somewhat obsessed with analyzing the energy transition from first principles, to help our clients understand the global energy system, understand new energy technologies and understand key industries.

Read More?

Read More?

Energy transition: three reflections on 2023?

In October-2022, we wrote that high interest rates could create an ‘unbridled disaster’ for new energies in 2023. So where could we have done better in helping our clients to navigate this challenging year? Our new year’s resolutions are clearer conclusions, predictions over moralizations, and looking through macro noise to keep long-term mega-trends in mind.

Read More?

Read More?

Thermodynamics of prime movers: energy from first principles?

A highlight of 2023 has been going back to first principles, to explain the underpinnings of prime movers in the global energy system. If you understand the thermodynamics of prime movers, you will inevitably conclude that the world is evolving towards solar, semi-conductors, electro-magnetic motors, lithium batteries and high-grade gas turbines.

Read More?

Read More?

Grid-scale battery costs: $/kW or $/kWh?

Grid-scale battery costs can be measured in $/kW or $/kWh terms. Thinking in kW terms is more helpful for modelling grid resiliency. A good rule of thumb is that grid-scale lithium ion batteries will have 4-hours of storage duration, as this minimizes per kW costs and maximizes the revenue potential from power price arbitrage.

Read More?

Read More?

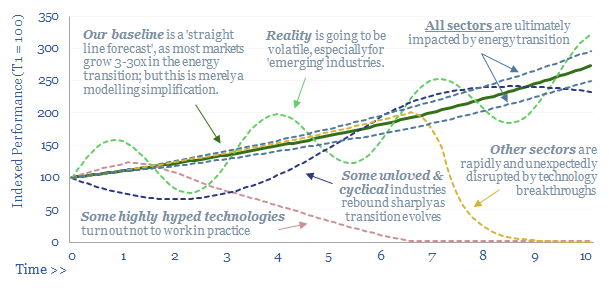

Energy transition: active duty?

After five years researching the energy transition, we believe it favors active managers. Within the energy transition, active managers can add value by ranging across this vast mega-trend, balancing risk factors in a portfolio, timing volatility, understanding complexity, unearthing specific opportunities and benchmarking ESG leaders and laggards.

Read More?

Read More?

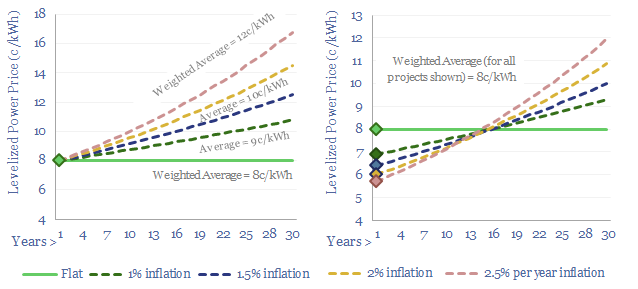

Levelized costs: real issues?

Real levelized costs can be a misleading metric. The purpose of today’s short note is simply to inform decision-makers who care about levelized costs. Our own modelling preference is to compare costs, on a flat pricing basis, using apples-to-apples assumptions across our economic models.

Read More?

Read More?

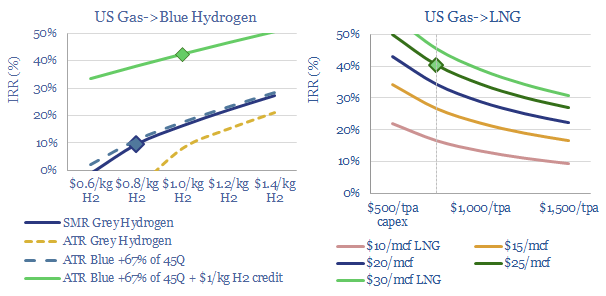

US natural gas: blue hydrogen tightens global LNG markets?

Blue hydrogen value chains are starting to boom in the US, as they are technically ready, low cost, and are now receiving enormous economic support from the Inflation Reduction Act. But will this divert gas away from expanding US LNG, raise global LNG prices above $20/mcf and impact global energy markets more than expected?

Read More?

Read More?

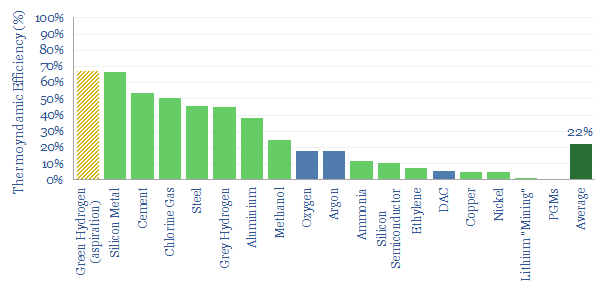

Industrial materials: thermodynamic efficiency?

The thermodynamic efficiency of materials production averages 20%, within an interquartile range of 5% to 50%. There is most room for improvement in complex value chains. And very different energy costs for blue vs green H2.

Read More?

Read More?

Energy economics: engineering wonders?

Many questions that matter in the energy transition are engineering questions, which flow through to energy economics: which technologies work, what do they cost, what energy penalties they have, and which materials do they use? We see an intersection for economics and engineering in our energy transition research.

Read More?

Read More?

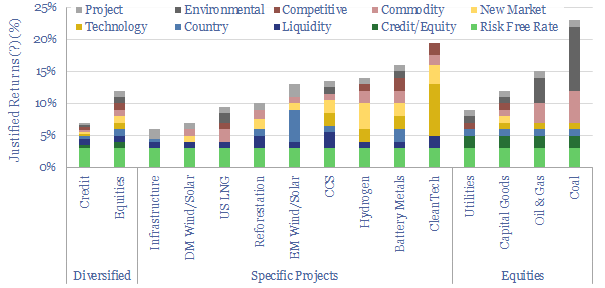

Energy transition: investment strategies?

Investing involves being paid to take risk. And we think energy transition investing involves being paid to take ten distinct risks, which determine justified returns. This note argues that investors should consider these risk premia, which ones they will seek out, and which ones they will avoid.

Read More?

Read More?

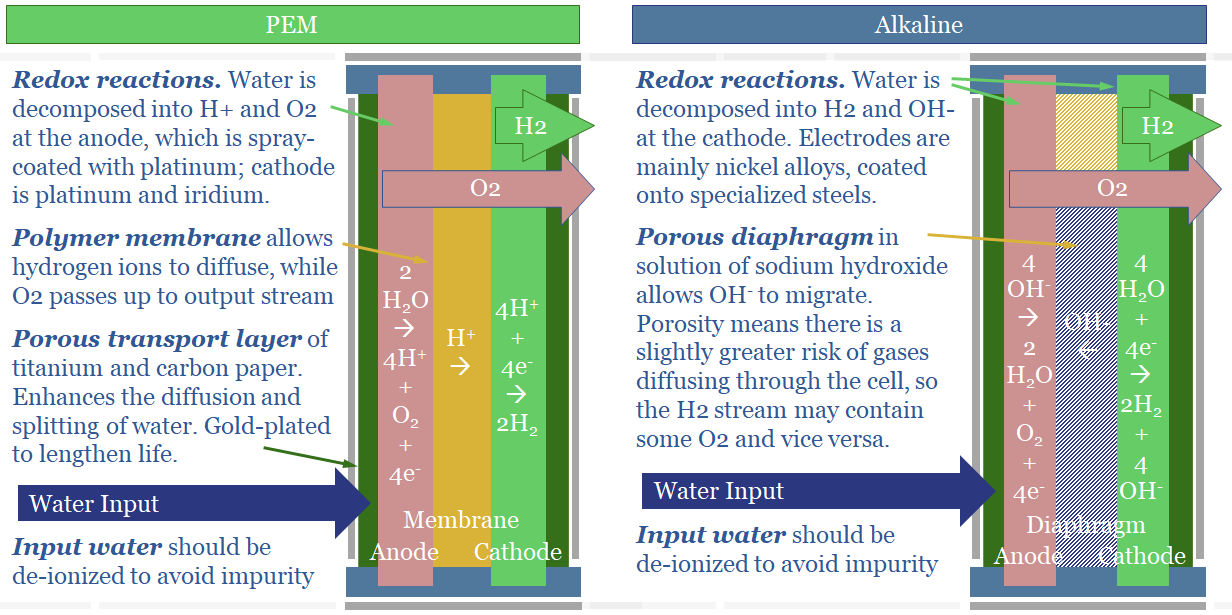

Green hydrogen: alkaline versus PEM electrolysers?

This note spells out the top ten differences between alkaline and PEM electrolysers. The lowest cost green hydrogen will likely come from alkaline electrolysers in nuclear/hydro-heavy grids. If hydrogen is to back up wind/solar, it would likely require PEMs.

Read More?

Read More?

Research philosophy: what makes great research?

One of TSE’s clients asked if Rob would present to their team on the topic of “what makes great research?”. We do not have any delusions of grandeur on this front. But this video nevertheless makes for a nice summary. (1) Ask simple questions, (2) Make complex issues simpler (3) Earn trust (aka be wrong for the right reasons).

Read More?

Read More?

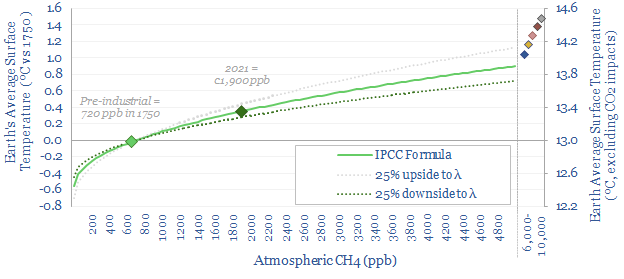

How does methane increase global temperature?

How does methane increase global temperature? This article outlines the theory. The formulae suggest 0.7 W/m2 of radiative forcing and 0.35ºC of warming has occurred due to methane leaks, which is 20-30% of the total. There are controversies and uncertainties. But ramping gas is still heavily justified in a practical roadmap to net zero.

Read More?

Read More?

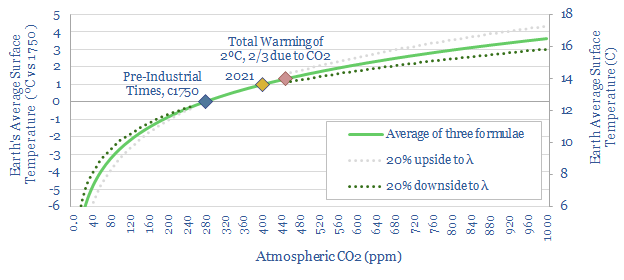

How does CO2 increase global temperature?

The purpose of this short article is to explain mathematical formulas linking global temperature to the concentration of CO2 in the atmosphere. In other words, our goal is to settle upon a simple equation, explaining how CO2 causes global warming. In turn, this is why our roadmap to net zero aims to reach ‘net zero’ by 2050, stabilize atmospheric CO2 below 450ppm, and we believe this scenario is compatible with 2ºC of warming.

Read More?

Read More?

Energy transition: a six page summary from summer-2022?

“It provokes the desire, but it takes away the performance.” That is the porter’s view of alcohol in Act II Scene III of Macbeth. It is also our view of 2022’s impact on the energy transition. Our resultant outlook is captured in six concise pages, published in the Walter Scott Journal in Summer-2022.

Read More?

Read More?

Energy transition: five reflections after 3.5 years?

This video covers our top five reflections after 3.5 years, running a research firm focused on energy transition. The greatest value is found in low-cost decarbonization technologies, resource bottlenecks and hidden nuances and bottom-up opportunities.

Read More?

Read More?

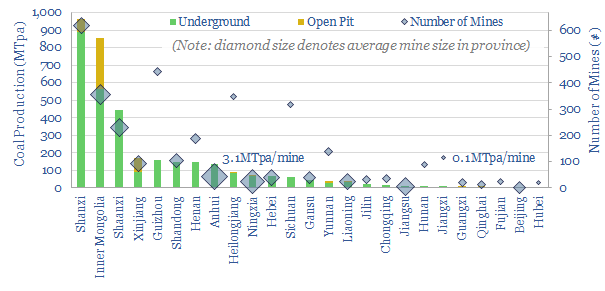

All the coal in China: our top ten charts?

Chinese coal provides 15% of the world’s energy, equivalent to 4 Saudi Arabia’s worth of oil. Global energy markets may become 10% under-supplied if this output plateaus per our ‘net zero’ scenario. Alternatively, might China ramp its coal, especially as Europe bids harder for renewables and LNG post-Russia? This note presents our ‘top ten’ charts.

Read More?

Read More?

Battle of the batteries: EVs vs grid storage?

Who will ‘win’ the intensifying competition for finite lithium ion batteries, in a world that is hindered by shortages of lithium, graphite, nickel and cobalt in 2022-25? Today’s note argues EVs should outcompete grid-scale storage by a factor of 2-4x.

Read More?

Read More?

Energy shortages: medieval horrors?

Energy shortages are gripping the world in 2022. The 1970s are one analogy. But the 14th century was truly medieval. Today’s note reviews its top ten features. This is not a romantic portrayal of pre-industrial civilization, some simpler time “before fossil fuels”. It is a horror show of deficiencies. Avoiding energy shortages should be a core ESG goal.

Read More?

Read More?

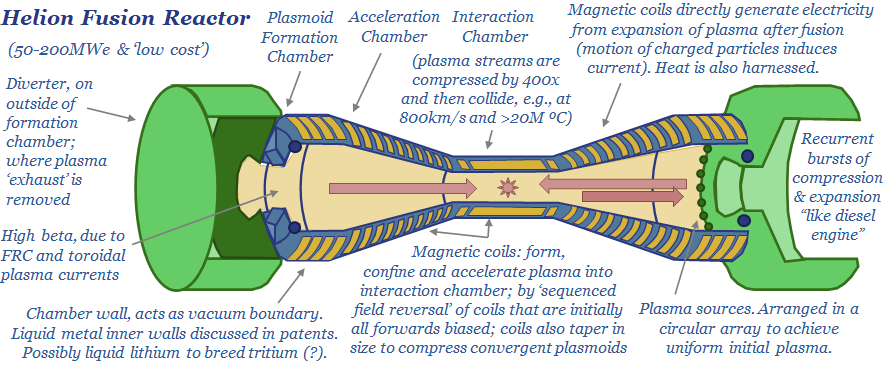

Helion: linear fusion breakthrough?

Helion is developing a linear fusion reactor, which has entirely re-thought the technology (like the ‘Tesla of nuclear fusion’). It could have costs of 1-6c/kWh, be deployed at 50-200MWe modular scale and overcome many challenges of tokamaks. Progress so far includes 100MºC and a $2.2bn fund-raise, the largest of any private fusion company to-date. This note sets out its ‘top ten’ features.

Read More?

Read More?

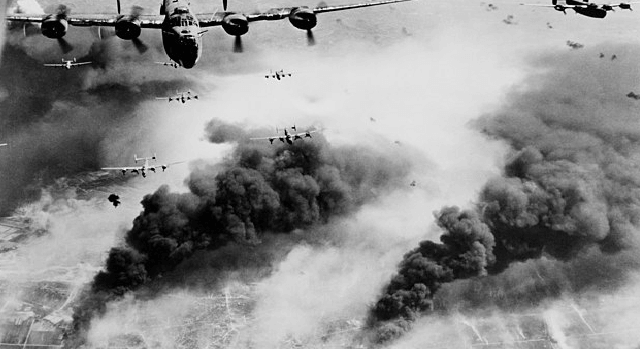

Oil and War: ten conclusions from WWII?

The second world war was decided by oil. Each country’s war-time strategy was dictated by its availability, quality and attempts to secure more of it, including by rationing non-critical uses of it. Ultimately, halting the oil meant halting the war. Today’s short note outlines out top ten conclusions from reviewing the history.

Read More?

Read More?

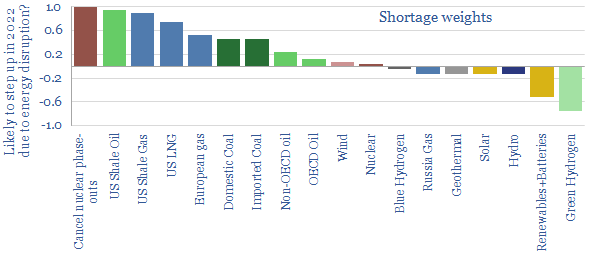

Russia conflict: pain and suffering?

This 13-page note presents 10 hypotheses on Russia’s horrific conflict. Energy supplies will very likely get disrupted, as Putin no longer needs to break the will of Ukraine, but also the West. Results include energy rationing and economic pain. Climate goals get shelved in this war-time scramble. Pragmatism, nuclear and LNG emerge from the ashes.

Read More?

Read More?

Energy transition: hierarchy of needs?

This gloomy video explores growing fears that the energy transition could ‘fall apart’ in the mid-late 2020s, due to energy shortages and geopolitical discord. Constructive solutions will include debottlenecking resource-bottlenecks, efficiency technologies and natural gas pragmatism.

Read More?

Read More?

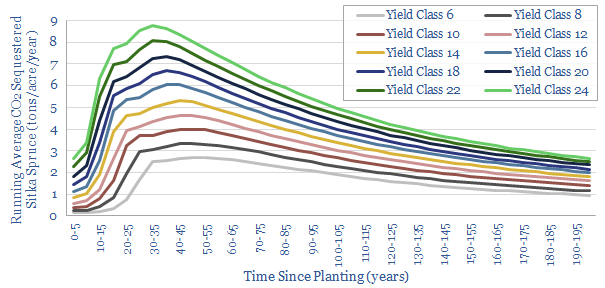

Sitka spruce: our top ten facts?

Sitka spruce is a fast-growing conifer, which now dominates UK forestry, and sequesters net CO2 up to 2x faster than mixed broadleaves. It can absorb 6-10 tons of CO2 per acre per year, at Yield Classes 16-30+, on 40 year rotations. This short note lays out our top ten conclusions, including benefits, drawbacks and implications.

Read More?

Read More?

Coal versus gas: explaining the CO2 intensity?

Coal and gas both provide c25% of all primary global energy. But gas’s CO2 intensity is 50% less than coal’s. This short note explains the different carbon intensities from first principles, including bond enthalpies, production processes and efficiency factors.

Read More?

Read More?