Electric motors were selected, in lieu of industry-standard gas turbines, to power the main refrigeration compressors at three of the four new LNG projects that took FID in 2024. Hence is a major change underway in the LNG industry? This 13-page report covers the costs of e-LNG, advantages and challenges, and who benefits from shifting capex.

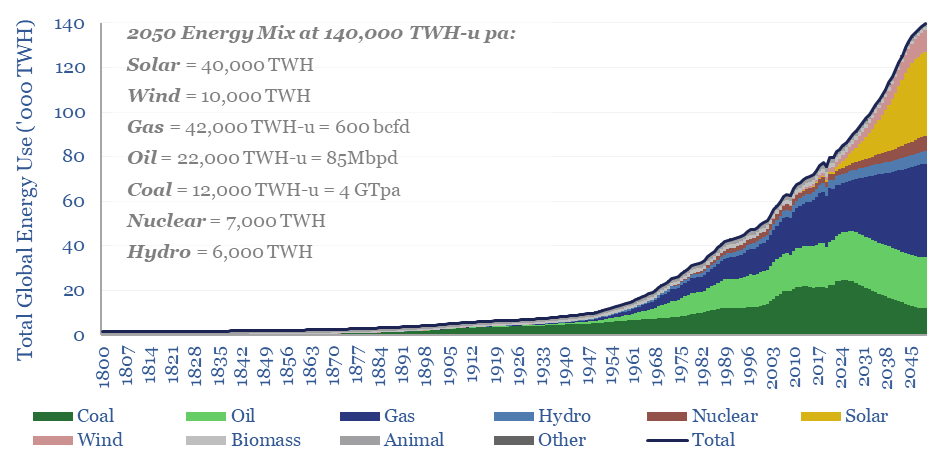

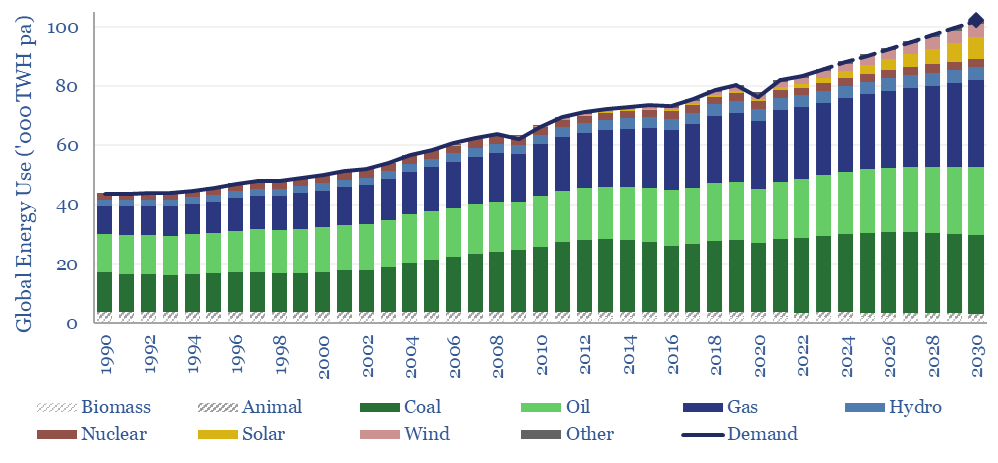

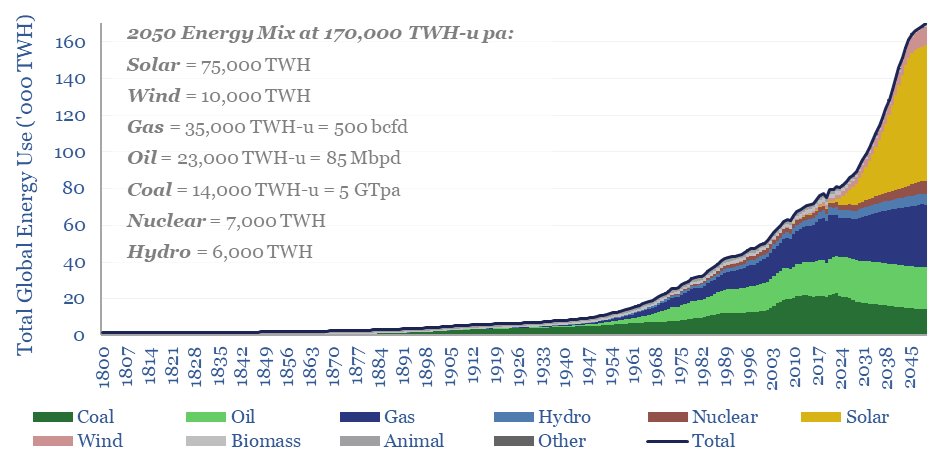

Another capex cycle appears to be underway in global LNG, as the pace of new LNG project additions accelerates from 10MTpa/year in 2022-25 to 55MTpa/year on average from 2027-30. Annual LNG capex forecasts, and where the money goes, are thus summarized on pages 2-3.

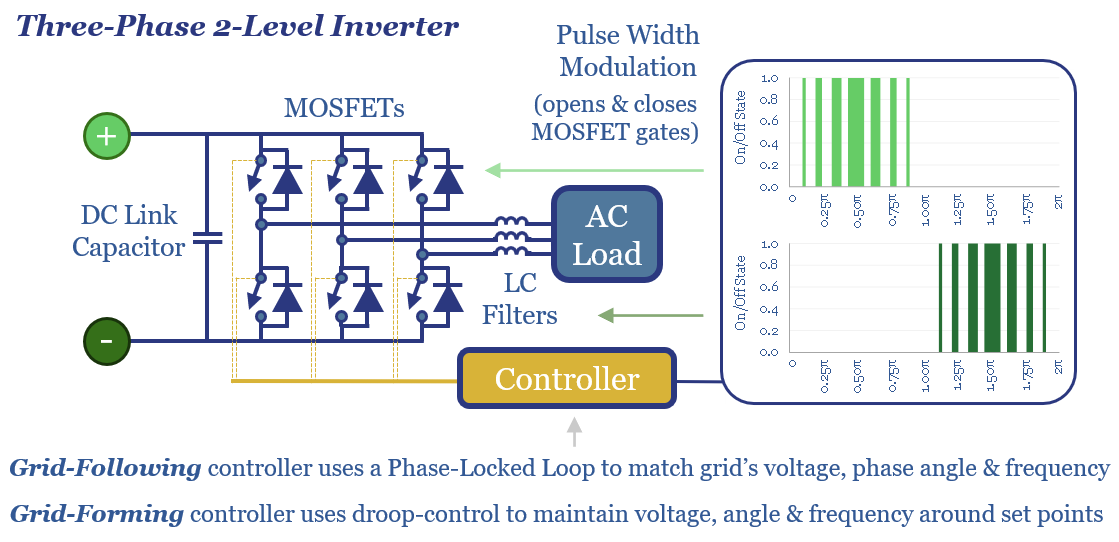

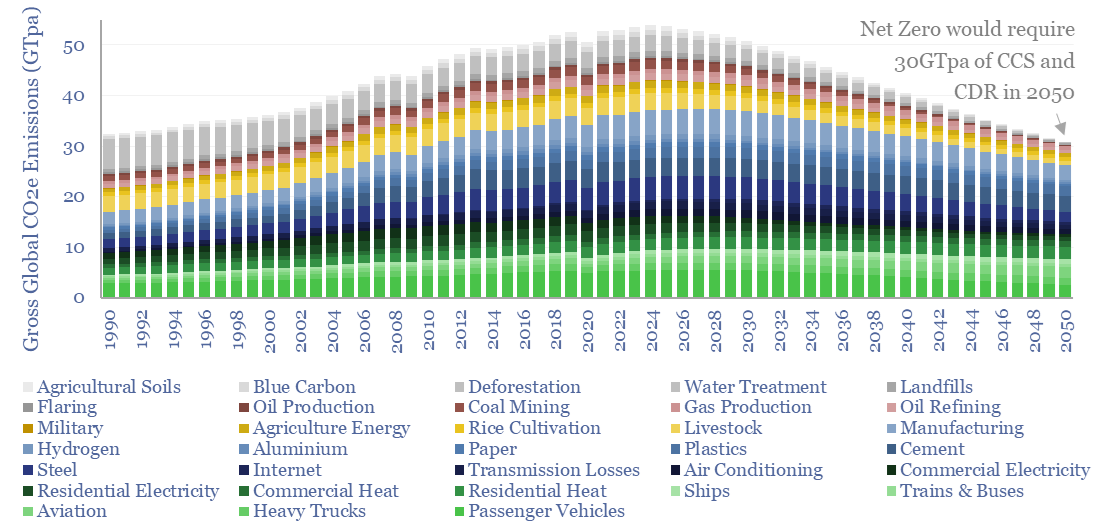

Yet a shift also appears to be underway on the equipment side: electric motors are gaining share over gas turbines, to power the compression trains at LNG plants. An overview of how an LNG plant works, covering the Joule Thomson effect, LNG plant compressors’ energy use (in kWh/ton) and CO2 intensity (in tons/ton) are given on page 4.

Electric motors were selected, in lieu of industry-standard gas turbines, to power the main refrigeration compressors at three of the four new LNG projects that took FID in 2024. Specific examples of electric LNG plants (eLNG), and who won the order flow, are given on pages 5-6.

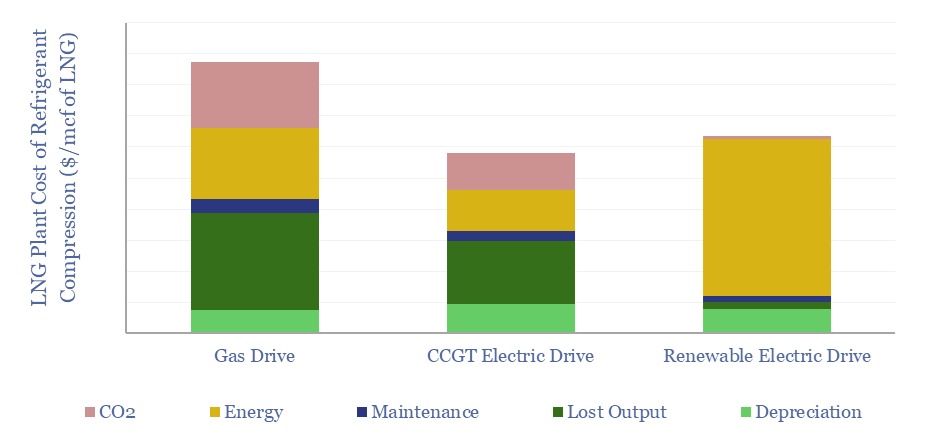

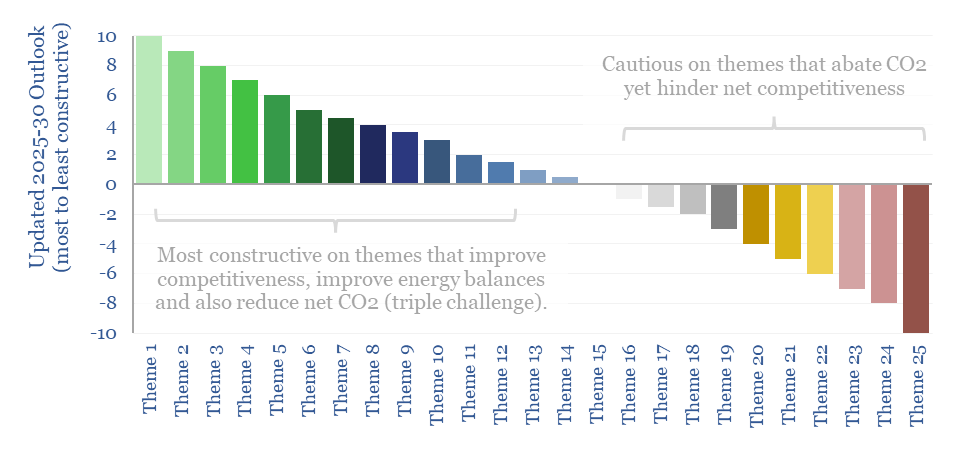

Economic costs of eLNG are modeled on page 7 (in $/mcf terms), with a sensitivity to CO2 costs, power prices and transmission distances on page 8; and a breakdown of the capex (in $/Tpa terms) on page 10, including the leading companies winning order flow on page 11.

Advantages and challenges of eLNG are discussed on page 9 and pages 12-13. Some proponents claim higher reliability, flexibility, lower maintenance costs, better start-up times and the chance to lower LNG emissions 50-90% below typical facilities. But past projects to electrify LNG plant compressors have not always performed perfectly.

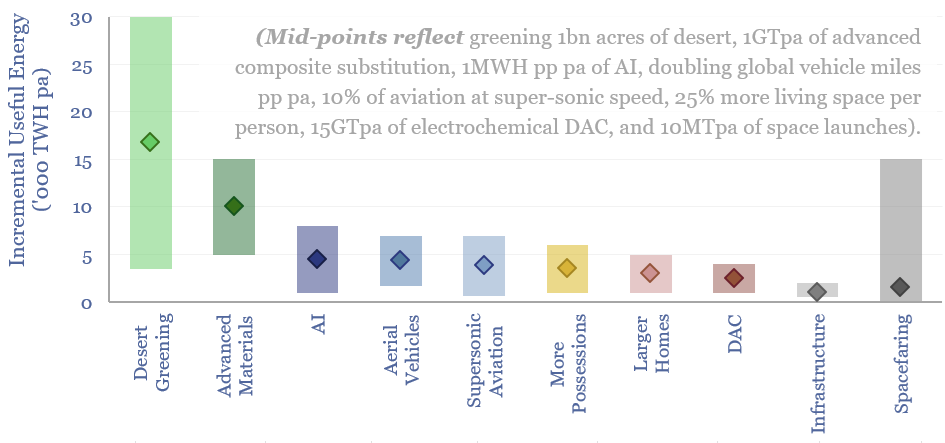

Overall, a new LNG cycle is set to be a major theme for 2025, as are power grid bottlenecks, as ever more processes electrify. We will be looking for opportunities across the board in these process technologies.