So far we have reviewed 400 patents in the downstream oil and gas industry (ex-chemicals). A rare few prompted an excited thought — “that could be really useful when IMO 2020 comes around”.

Specifically, from January 2020, marine fuel standards will tighten, cutting the maximum sulphur content from 3.5% to 0.5%. It will reduce the value of high-sulphur fuel oil, and increase the value of low-sulphur diesel.

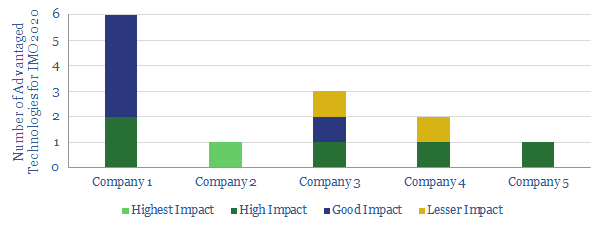

This note summarises the top dozen proprietary technologies we have seen to capitalise on the shift, summarised by company (chart below).

[restrict]

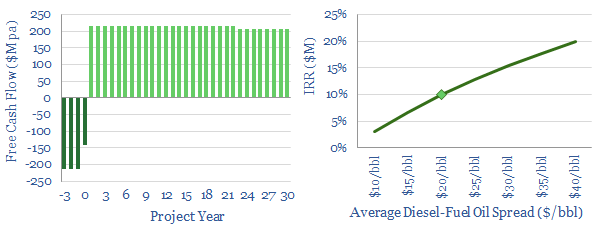

(1) Eni Slurry Technology (EST). Advertised as “the best worldwide technological solution for operators who wish to completely convert the bottom of the barrel”, EST converts >97% of heavy inputs into more valuable fractions. It is a hydroconversion process, which upgrades fuel oil or other heavy crudes, using a slurried, nano-dispersed zeolite, impregnated with Molbdenum/Nickel sulphide salt catalyst, run at 380-440C. $4.5/bbl uplifts to refining margins are cited by the company. It has been licensed by two Chinese refiners (Sinopec, Zhejian), for their own upgrading processes. We estimate EST will yield 10-20% returns, at $20-40/bbl upgrading spreads (chart below, model here).

(2) – (7). ExxonMobil refining technology. So far, ExxonMobil has the most advanced refining technology, out of the patents we have reviewed across the industry (chart below). For IMO 2020, this includes:

(2) Exxon. Hydrocracking. In its public disclosures, Exxon has alluded to using a proprietary catalyst in the $1bn hydrocracker at its 190kbpd Rotterdam refinery expansion, upgrading lower-value vacuum gasoil into Group II base stocks (see below) and ultra-low sulfur diesel.

(3) Exxon. Hydroprocessing. 5 patents were filed in 2018, for hydroprocessing and purifying heavy oil, coker oil or deasphalted slurry oil, to remove sulphur and nitrogen impurities, using a proprietary catalyst prepared from Group VI and Group VIII metals.

(4) Exxon. Lubricants from Fuel Oil. Exxon has filed patents to create Group I-III base oils for its lubricants business using FCC slurry, thermally cracked resids or other “disadvantaged feeds”. Requires high-pressure hydrofinishing to reduce aromatic saturation.

(5) Exxon. Dewaxing Catalysts. In 2018, Exxon patented a new de-waxing process that was achieving “unexpectedly high hydrogenation of feedstocks” without unwanted cracking. The proprietary catalyst combines noble metals and base metals on a zeolite framework. It can be used to improve heavier fuels, such as fuel oil.

(6) Exxon. Reduced Severity FCC. In 2018, Exxon patented a new combination of desaphalting and hydroprocessing. These steps are performed prior to fluid catalytic cracking (FCC). This allows the FCC to be run at less severe conditions. In turn, this reduces the production of light paraffins. It is seen to increase gasoline/diesel yields and lower fuel oil yields.

(7) Exxon. Diesel Range Fuel Blends. Some elastomers in vehicle fuel systems are known to swell when exposed to highly aromatic fuels and to shrink when exposed to renewable diesel components. The elastomers can fail when renewable components surpass 10%, limiting use of renewable diesel. Hence Exxon has tested and patented diesel blends (typically with 20+ components) that can tolerate >20% renewable inputs without shrinking fuel-systems’ elastomers.

(8) Shell. Ebullated Bed Processes. Shell has filed three patents to overcome the problem of sediment-fouling when upgrading heavy, asphaltene-rich hydrocarbons in an ebullated bed reactor. Shell’s solution is a reactor design with an ‘upper section’ and a ‘lower section’, each with its own catalyst composition.

(9) Shell. Hydrodesulfurisation Catalysts. Uses molybdenum-disulfide nano-particles supported on a titanium framework.

(10) Shell. Fuel Oil Composition. Shell has patented its own blend of fuel oil with 0.100% sulphur concentration, suggesting it is gearing up to compete within the fuel oil segment.

(11) Chevron. Improved hydro-conversion catalysts. Chevron filed c35 distinct patents for zeolite catalyst systems in 2018, largely aimed at hydrocracking, and improving energy efficiency. One formulation achieves 37% middle distillate yields from heavy oil, at 193C. Another can yield up to 83% middle distillates, when running C5s at 140-370C. Yields on average heavy inputs are c50%.

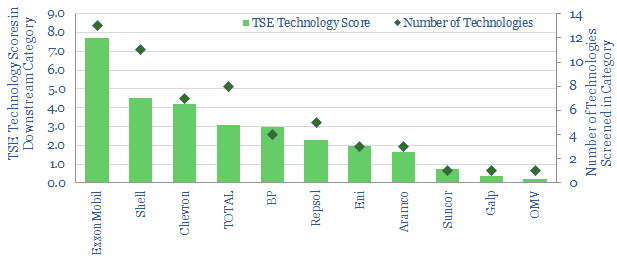

(12). Aramco. Advanced Hydrocracking Catalyst. Aramco has patented a system that is achieving higher yields of middle distillate, by avoiding “over-cracking” kerosene and gasoil. It works via a zirconium-hafnium zeolite, which encourages heavier oil into the zeolite mesopores. Do not be surprised to find Aramco in this list: it is a clear technology leader across the 1,440 patents we have reviewed so far.

If you have any questions about this list, or think we’ve missed anything that should be on here, then please let us know: [email protected]

[/restrict]