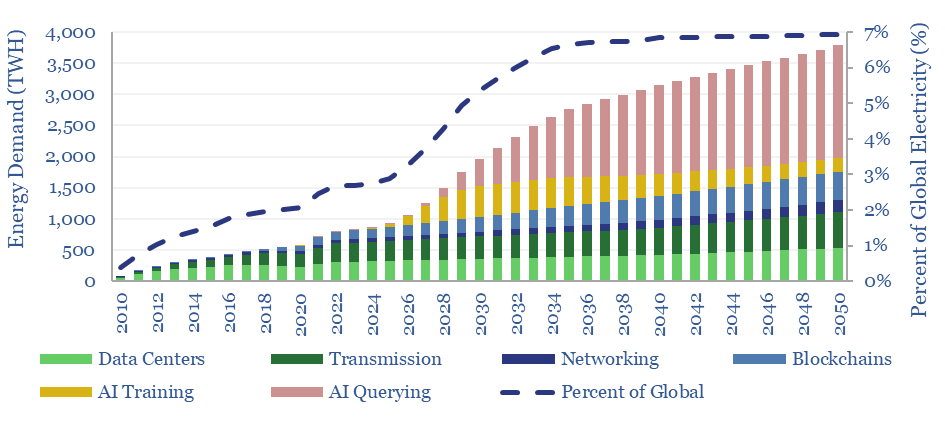

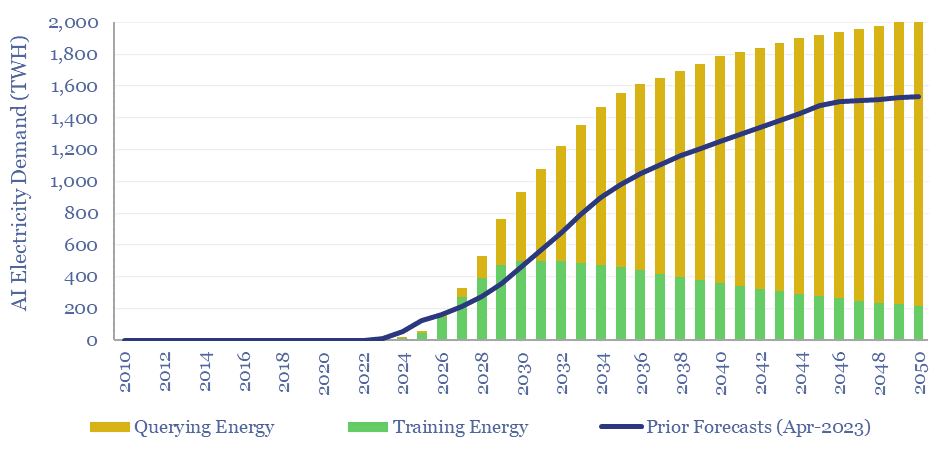

This data-file forecasts the energy consumption of the internet, rising from 800 TWH in 2022 to 2,000 TWH in 2030 and 3,750 TWH by 2050. The main driver is the energy consumption of AI, plus blockchains, rising traffic, and offset by rising efficiency. Input assumptions to the model can be flexed. Underlying data are from technical papers.

Our best estimate is that the internet accounted for 800 TWH of global electricity in 2022, which is 2.5% of all global electricity. Despite this area being a kind of analytical minefield, we have attempted to construct a simple model for the future energy demands of the internet, which decision-makers can flex, based on data and assumptions (chart below).

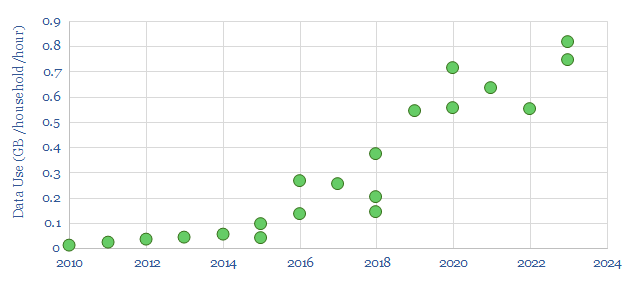

Internet traffic has been rising at a CAGR of 30%, as shown by the data use of developed world households, rising to almost 3 TB per user per year by 2023. The scatter also shows a common theme in this data-file, which is that different estimates from different sources can vary widely.

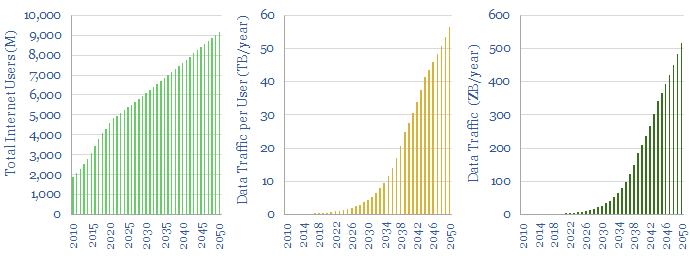

Future internet traffic is likely to continue rising. By 2022 there were 5bn global internet users underpinning 4.7 Zettabytes (ZB) of internet traffic. Users will grow. Traffic per user will likely grow. We have pencilled in some estimates, but uncertainty is high.

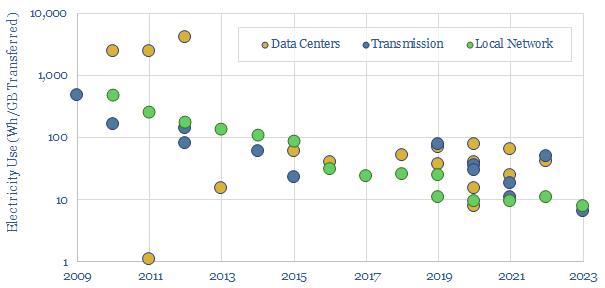

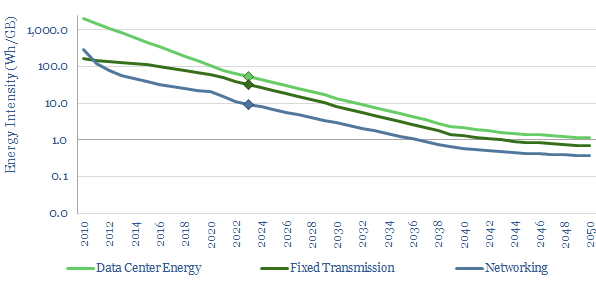

The energy intensity of internet traffic spans across data-centers, transmission networks and local networking equipment. Again, different estimates from different technical papers can vary by an order of magnitude. But a first general rule is that the numbers have declined sharply, sometimes halving every 2-3 years.

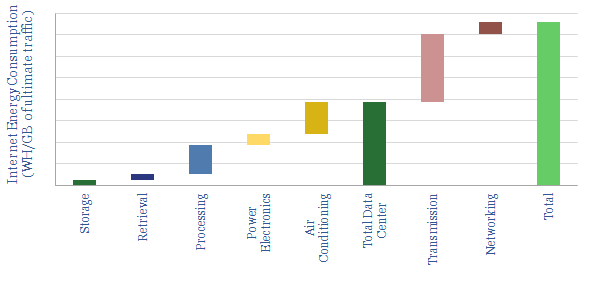

The current energy intensity of the internet is thus estimated at 140 Wh/GB in our base case, broken down in the waterfall chart below, using our findings from technical papers and the spec sheets of underlying products (e.g., offered by companies such as Dell).

Energy intensity of internet processes will almost certainly decline in the future, as traffic volumes rise. Again, we have pencilled in some estimates to our models, which can be flexed.

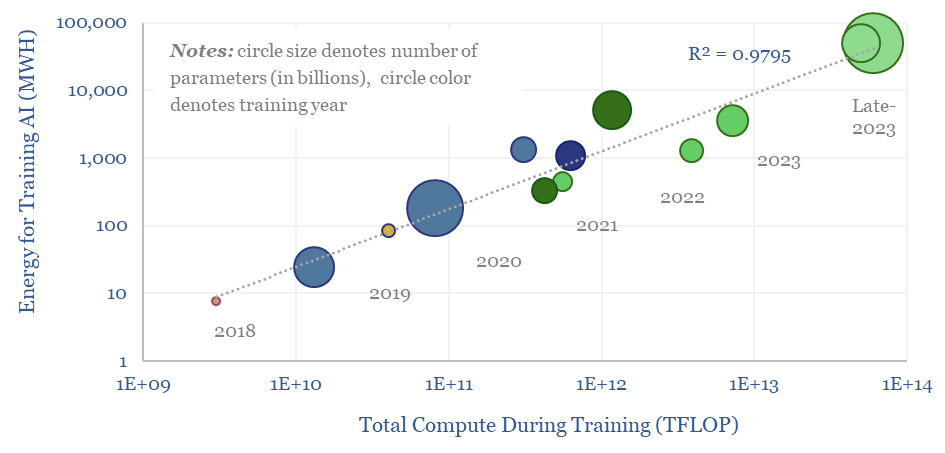

However the energy needed for AI is now rising exponentially. Training Chat GPT-3 in 2020 used 1.3 GWH to absorb 175bn parameters. But training chat GPT-4 in 2023 used 50 GWH to absorb 1.8trn parameters. We find a 98% correlation between AI training energy and the total compute during training.

AI querying energy is also correlated with the complexity of the AI model, and thus will likely continue rising in the future. Average energy use is estimated at 3.6 Wh per query today, which is 4x more than an email (1 Wh) and 10x more than a google search (0.3 Wh).

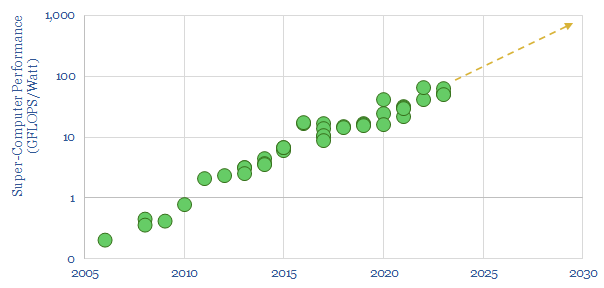

Muting the impacts of larger data-processing volumes, we expect a 40x increase in future computer performance in GFLOPS per Watt (chart below). This yields 900 TWH of AI demand around 2030, revised up from 500 TWH in April-2023 (chart above).

Please download the model to stress-test your own estimates for the energy intensity of the internet. It is not impossible for total electricity demand to ‘go sideways’ (i.e., it does not increase). It is also possible for the electricity demand of the internet to exceed our estimates by a factor of 2-3x if the pace of productivity improvements slows down.