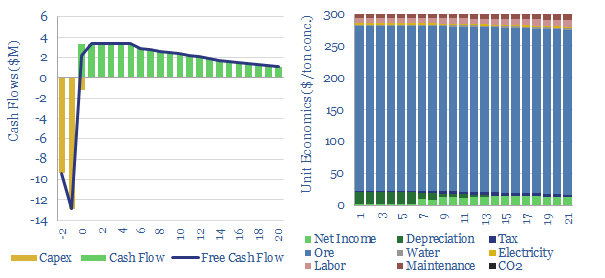

The costs of froth flotation are aggregated in this data-file, building up the typical capex costs (in $/Tpa), energy costs (in kWh/ton) and other opex lines (in $/ton) of one of the most important processes for the modern metals and materials industry. A good rule of thumb is $10/ton costs to concentrate ore by over 4x (this excludes underlying ore costs).

Flotation processes are used to concentrate several billion tons of materials each year globally (estimates that have crossed our screen range from 2GTpa to 10GTpa). This includes substantively all of the world’s metals, from copper, to lithium, to nickel, to graphite, to iron ore, to PGMs, to Rare Earths. It also includes over 1GTpa of ‘clean coal’, where ash and metal impurities have been removed prior to combustion.

Concentration saves energy. A good rule of thumb is that commercial flotation processes will make a valuable mineral 2x more concentrated, sometimes over 20x more concentrated, which greatly reduces the waste and energy cost of further processing. It is for this reason that flotation has been lauded as one of the most important innovations in the modern materials industry.

How does flotation work? The flotation process separates useful mineral ores from their impurities, based on their differing hydrophobicity. The ores are crushed and ground, then slurried with water, then agitated in a tank, through which air bubbles are blown. More hydrophobic particles will adhere to the bubbles, rise to the surface and can thus be skimmed and separated out.

The energy economics and costs of froth flotation are aggregated in this data-file. Our data covers the capex of flotation processes (in $/Tpa) and energy costs (in kWh/ton). Generally, this is one of the least capex-intensive and energy-intensive processes across all of our models.

The economics, by contrast, are dictated mainly by the effectiveness of the flotation process: by what factor are ore concentrated, and how much of the material of interest is lost (i.e., due to low recovery rates).

This suggests upside in the mining services industry, including equipment manufacturers and specialty chemical companies, which can improve concentration, improve product recoveries in the concentration, and improve waste material rejection. This area gains importance in the energy transition, due to rising metals demand and decarbonization.