Six leading companies in turbochargers control two-thirds of the $15-20bn pa global turbochargers market. 55% of ICE vehicles now have turbochargers, which can improve fuel economy by as much as 10%, by enabling smaller and better-utilized engines to achieve higher peak power ratings. What opportunities ahead, to adapt for vehicle electrification, or even if EV sales accelerate less than expected in 2025-30?

Turbochargers unlock higher power output from smaller, lighter, lower-friction and thus more efficient combustion engines, by compressing the air that enters the engine cylinders to 1.5-2 atmospheres, and thus increasing the overall quantity of oxygen burned alongside the fuel.

Turbochargers may be powered by expanding hot exhaust gases from the engine, thereby minimizing their energy costs. Or relatedly, superchargers may be electrically powered, by drawing from the low-voltage (e.g., 48V) power supply of a vehicle.

The key reason that turbochargers increase fuel economy is that most engines are inefficient under light loads, therefore it is more efficient to run a smaller engine at medium-high loads, than a larger engine at low loads. Some studies have quoted CO2 savings of up to 10% on turbocharged vehicles.

The global automotive turbocharger market has been estimated at $15-20bn, as 55% of light vehicles have turbochargers today. Individual units cost $100-10,000 depending on size. Including heavier commercial vehicles, ships, aircraft, agricultural and construction machinery, some studies estimate the total turbocharger market as $30-60bn pa.

Disadvantages of turbochargers are that higher pressures and temperatures in a vehicle engine increase the amount of wear, and raise complexity, including for circulating high-grade engine oil to remove the excess heat.

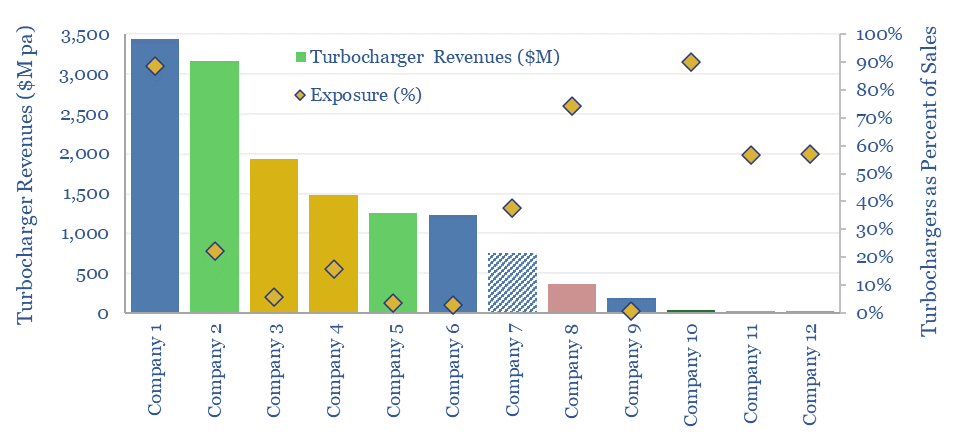

Leading companies in turbochargers? Six companies control about two-thirds of the global turbocharger market, based on our screen. Garrett Motion is most exposed, with turbochargers comprising over 80% of its business.

For those that enjoy special situations, Garrett is emerging from bankruptcy and the overhang of asbestos liabilities, Continental is spinning out its automotive division in 2024, Cummins was fined $1.7bn in 2023 for using defeat devices (and we have also reviewed Cummins recent patents), and IHI is working through a whistleblower accusation that it falsified data affecting 4,000 engines since 2003.

Electrification is cited as an opportunity? Across the peer group, many of the leading companies in turbochargers are expanding to supply pumps and compressors for heat pumps to provide coolant to EV batteries. BorgWarner notes that the content opportunity for light vehicles rises by almost 5x in a BEV. Likewise, Valeo which is most exposed to electrification of the suppliers in our screen is citing a “spectacular” growth opportunity from EVs, while also aiming to expand margins. This may not entirely augur for deflation in electric vehicles.

Leading companies in turbochargers and other engine technologies may also be impacted if electric vehicle sales accelerate more slowly in 2025-30, as discussed in our recent research into EV market saturation. Numbers and details on each company are in the data-file.