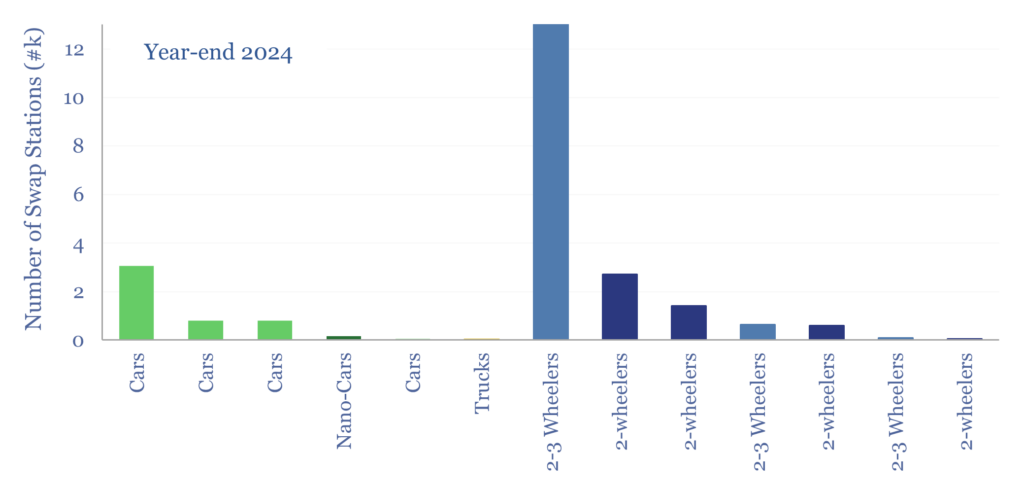

Leading companies in battery swapping are covered in this data-file, with the dozen largest companies operating around 25,000 stations by the end of 2024 (80% for 2-3 wheelers, 20% for cars or larger vehicles). Rapid expansion is guided. CATL says swap stations could meet the needs of one-third of electric vehicles by 2030. This data-file compares the companies and their offerings.

Battery swapping can replenish the charge of an electric vehicle in 0.5 – 5 minutes, across the sample of leading companies in battery swapping, which are shown in this data-file. An average of 2.5 minutes is quoted for car-sized vehicles.

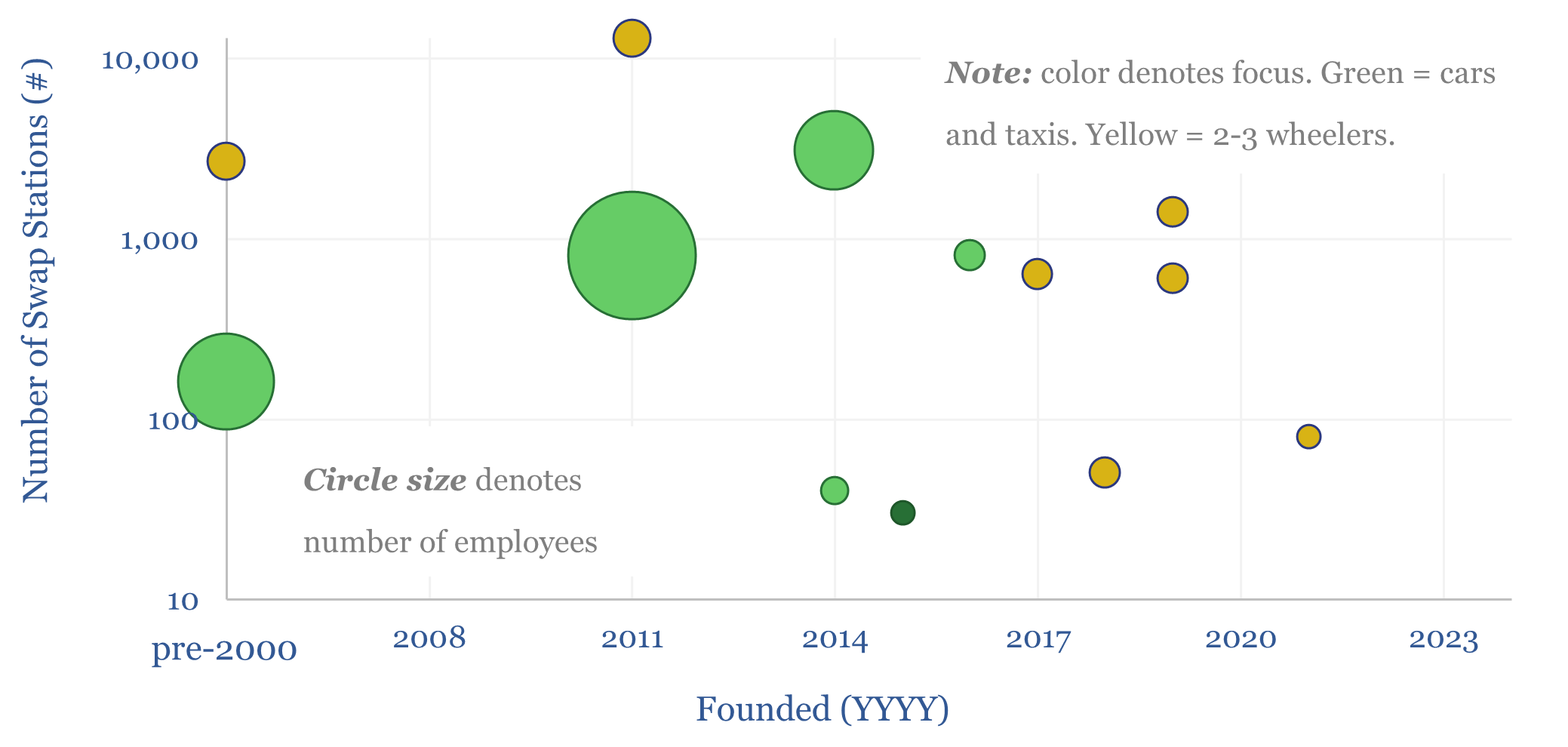

Network effects may allow the companies that build the largest swap networks first to dominate this market. Hence half-a-dozen companies in China are vying to build large networks of swap stations, led by Nio, Aulton and CATL.

Western companies are following, albeit still at pilot stages, with few swap stations running. Although Ample has been making headlines, including pilots with Uber in the US, and MK Taxi and Yamato in Japan in 2024.

Otherwise, there are c700M 2-3 wheelers in the world, which can be particularly well suited to battery swapping, as 5-10 kg batteries are easily handled by most people. By YE24, Gogoro estimates it is energizing 7% of Taiwan’s total two-wheeler market, while interesting start-ups are focusing on battery swapping across emerging world geographies, from Africa to Bangladesh.

Leading companies in battery swapping are tabulated in this data-file, covering when they were founded, where they are headquartered, employee counts, patent counts, focus (e.g., cars, 2-wheelers), number of swap stations, and our notes.

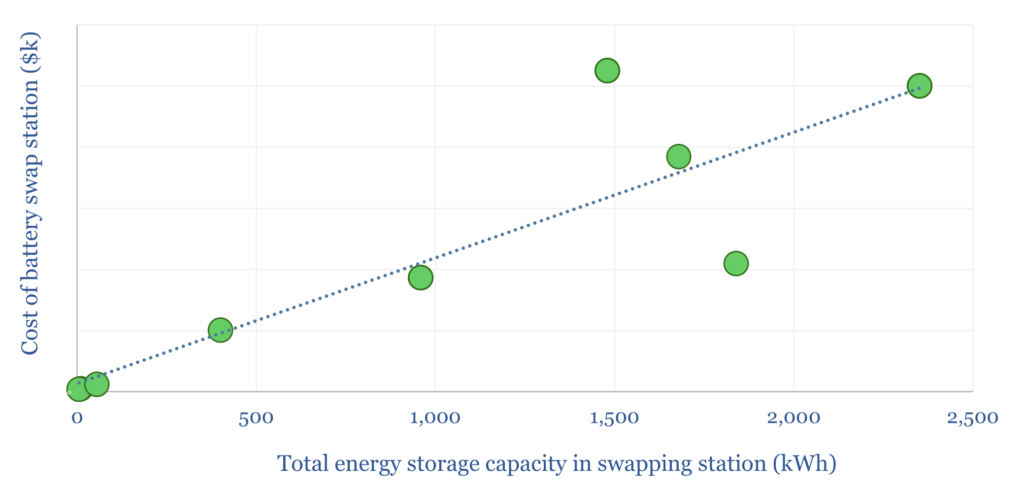

What does a battery swap station cost and how does this depend on battery sizing, grid connection sizing, and total facility sizing. To answer this question, we have compiled stated costs from some of the companies in our screen (chart below). The costs can also be compared with grid-scale batteries on $/kW and $/kWh metrics.

The economics of battery swapping can also be estimated based on the capex costs of swap stations and other input variables, per the build-up tab of the model, and based on the parameters disclosed by our battery swapping companies.

The role of battery swapping in the next phase of electric vehicles is discussed in our recent research note, entitled “Battery swapping: off to the races?“.