-

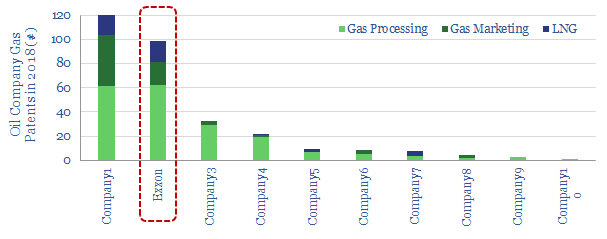

Greenfield LNG: Does Exxon have an edge?

ExxonMobil has developed industry-leading technology for greenfield LNG cosntruction, particularly in remote geographies. This conclusion follows from reviewing 3,000 patents. We analyse its edge the and resultant opportunities, as new projects progress in Mozambique, PNG and on the US Gulf Coast.

-

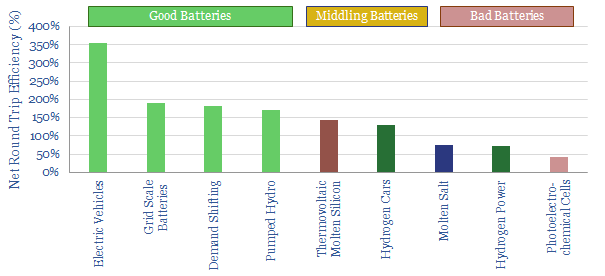

Good Batteries vs Bad Batteries?

A “good battery” enhances the efficiency of the total energy system. A “bad battery” diminishes it. Hence we have quantified battery quality, ranging from 3.5x efficiency gains for EVs to c30% efficiency losses for grid-scale hydrogen. This distinction must not be overlooked in the world’s quest for cleaner energy.

-

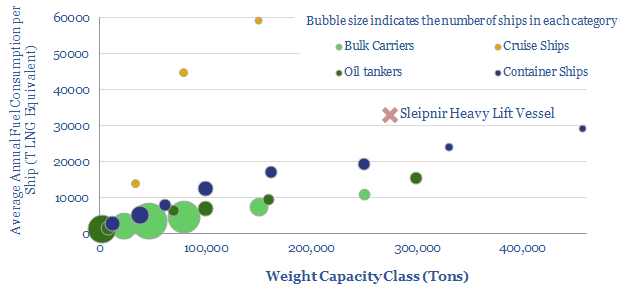

LNG Ships: a new record-setter?

Multiple records have just been broken for an LNG-powered ship, as construction completed at Heerema’s “Sleipnir” crane-lift vessel. It is a remarkable, LNG-powered machine, substantiating the 40-60MTpa upside we see for LNG demand, from fuel-intensive ships, after IMO 2020.

-

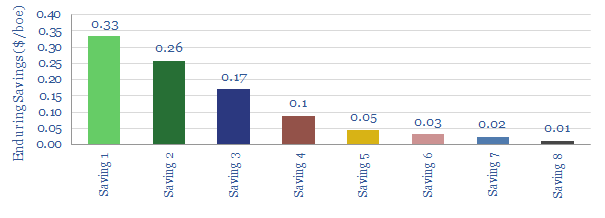

Digital Deflation: How Hard to Save $1/boe?

A typical operator can readily save $1/boe via continued, digital deflation. Our numbers are derived from a new case study from Cognite, which is among the leaders in oilfield digitization, collaborating with cutting-edge E&Ps. Digitization remains the most promising opportunity to improve offshore economics.

-

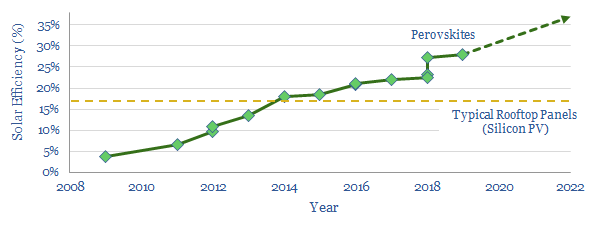

Perovskites: Lord of Light?

Perovskites are the fastest-improving innovation in solar. The best test-cells hit a new record of 28% efficiency last year, with line-of-sight to the mid-30s, i.e., 2x more efficient than today’s silicon photovoltaics. We review the opportunities and challenges. A Major is at the cutting edge.

-

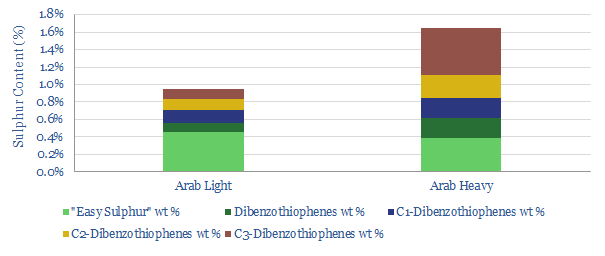

IMO 2020. Fast Resolution or Slow Resolution?

The downstream industry is debating whether IMO 2020 sulphur regulations will be resolved quickly or slowly. We think the market-distortions may be prolonged by under-appreciated technology challenges, which mandate large, increasingly hard-to-finance refinery overhauls.

-

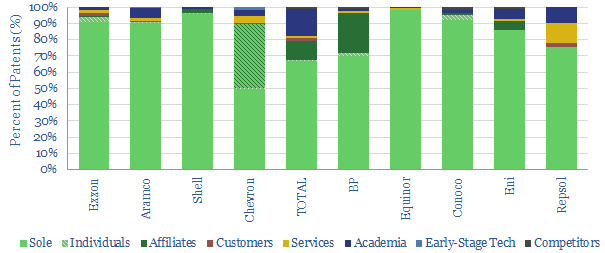

Patent Partners: Pairing Up?

This note contains our ‘Top Five’ conclusions about the Oil Majors’ research partnerships, drawing off our database of 3,000 oil company patents. Different companies have importantly different approaches. We can quantify this, by looking at the number of patents co-filed with partners (chart above). (1) Working with Academia. TOTAL stands out as collaborating most closely…

-

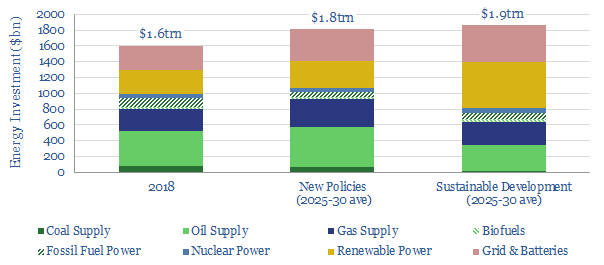

Is the world investing enough in energy?

The IEA has cautioned that global energy investment may be falling short. Spending of $1.6trn in 2018 may need to rise $220-270bn pa by 2025-30. We argue the best way to attract this capital is through the opportunities in better energy technology.

-

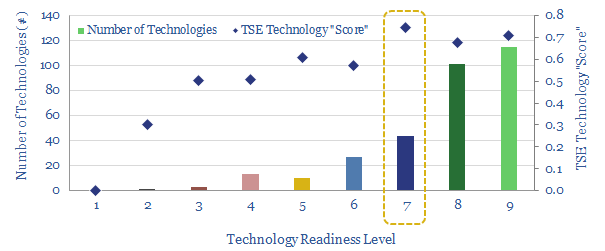

TRLs: When does technology get exciting?

We categorised 300 of the Oil Majors’ technologies according to their technical maturity. The most exciting are those on the cusp of commercialisation, not simply the most mature. We found Majors that work on earlier-stage technologies also had better overall technologies. Value can be maximised by a rich funnel of opportunities.

-

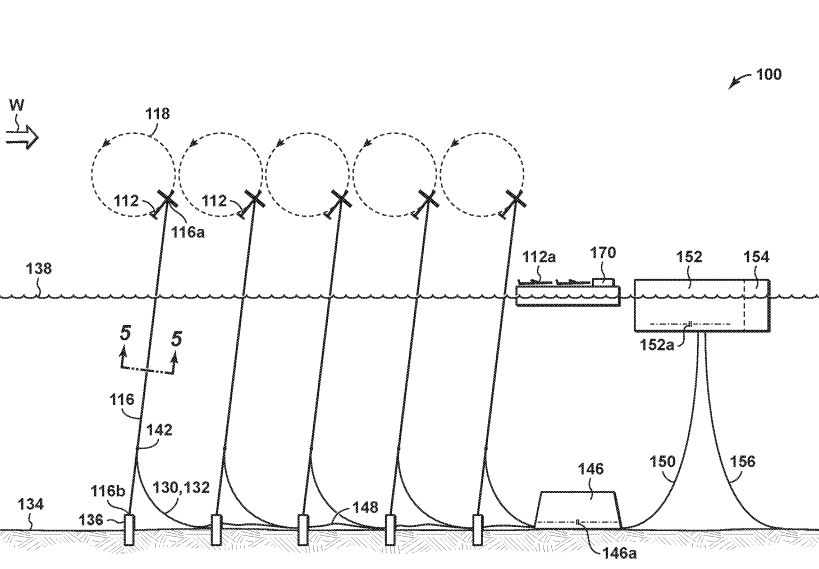

Two Majors’ Secret Race for the Future of Offshore Wind?

Tethered kites access 2-4x more wind-power at 50-90% lower costs than turbines. Intriguingly, Exxon and Shell are now at the forefront of the new opportunity.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (355)