-

Ten Themes for Energy in the 2020s

We presented our ‘Top Ten Themes for Energy in the 2020s’ to an audience at Yale SOM, in February-2020. The audio recording is available below. The slides are available to TSE clients.

-

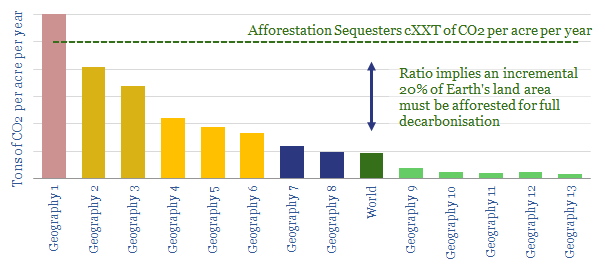

Lost in the Forest?

In 2019, Shell pledged $300M of new investment into forestry. TOTAL, BP and Eni are also pursuing similar schemes. But can they move the needle for CO2? In order to answer this question, we have tabulated our ‘top five’ facts about forestry. We think Oil Majors may drive the energy transition most effectively via developing…

-

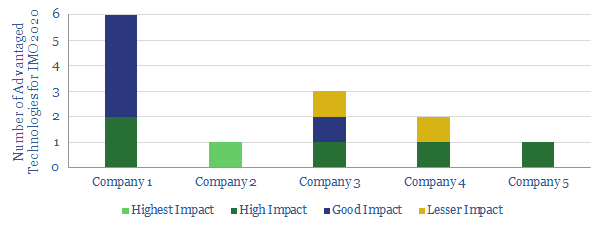

Our Top Technologies for IMO 2020

We review a dozen of the top, proprietary technologies that we have seen to capitalise on IMO 2020 sulfur regulation, across five of the world’s leading refiners.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)