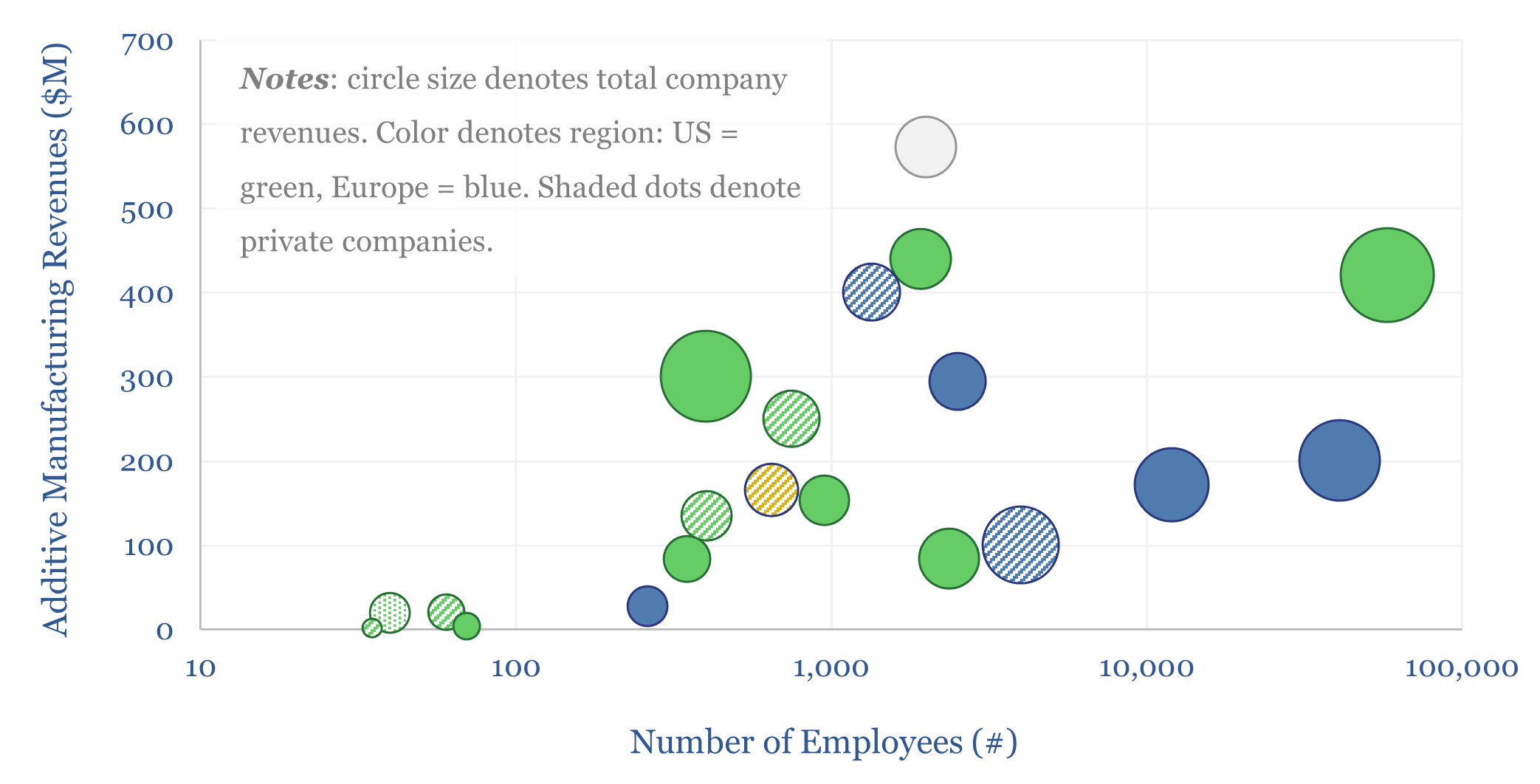

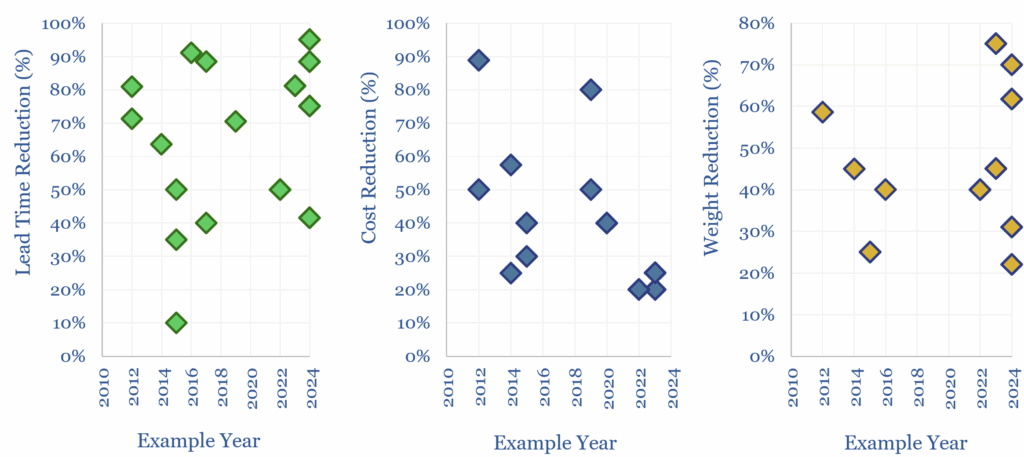

Additive manufacturing companies are screened in this data-file, across 20 technology leaders. We have also tabulated 25 case studies, where AM reduces weight by 40%, cost by 50%, and lead-time by 60%. The industry remains highly competitive. But could it be turning a corner? Especially for metal components in capital goods and aerospace?

Additive manufacturing is cool, but also fragmented. The global market today is $15bn pa, while the ‘top twenty companies’ in our screen below only generate $4bn in AM revenue, or 25% of the market. Conversely, in the average value chain we have screened, the top five companies alone have 50% share. And even in the hyper-competitive auto industry, the top five companies have 33% share.

Profitability. 75% of the companies in our screen have recently been loss-making. Those that are profitable make 1-4% EBIT margins. The highest number is from private company EOS, which claimed margins above 10%, back in 2019.

Deflation. The majority of the companies in our screen saw lower revenues in 2024 vs 2023. Volumes are growing, but pricing power is not?

Exits. Shapeways went bankrupt in 2024. Voxeljet de-listed in April-2024. Desktop and Markforged, both went public via SPAC in 2020/21, both valued at c$2bn, and have since collapsed by 97%. Sandvik said in 2024 it would write down its stake in Italy’s BEAMIT by SEK 140M.

Nevertheless, it can be interesting when historically tough industries turn a corner. In 2025, many manufacturing value chains are bottlenecked, from gas turbine components, to defence-tech, to transformers; and there is a growing desire to re-shore strategic supply chains, which has not been possible in the past due to high-cost labor constraints.

In this data-file, we have screened 20 leading companies in additive manufacturing, capturing their size, age, geographic exposures, employee counts, patent filings, revenues (in $M), exposure to additive manufacturing (%), Additive Manufacturing revenues by company (in $M), and EBIT margins (in %). We have also compiled interesting notes on each company.

We have also compiled 25 case studies, which are highlighted by additive manufacturing companies as success stories. In the average case study, additive manufacturing reduces weight by 40%, cost by 50%, and lead-time by 60%, while producing shapes that are challenging to machine. Details are on the ‘Examples’ tab.

Finally, we have quantified the number of patents filed on additive manufacturing, by geography and over time. After a rapid ascent in 2015-20, the pace of technology gains has slowed down.