Autonomous mining trucks have been gaining share since 2010, and now number almost 2,000 in total, across dozens of mines globally. So this data-file presents some case studies of autonomous mining trucks, and provides yet another example of digital progress. The work also shows leading companies in autonomous mining trucks, among adopters and mining equipment companies.

Around 50,000 mine trucks are in operation globally, with the largest units weighing 350-450 tons, and operating costs reflected in our economic model of mine trucks. 15-20% of the costs are labor. Hence what opportunities in autonomous mine trucks?

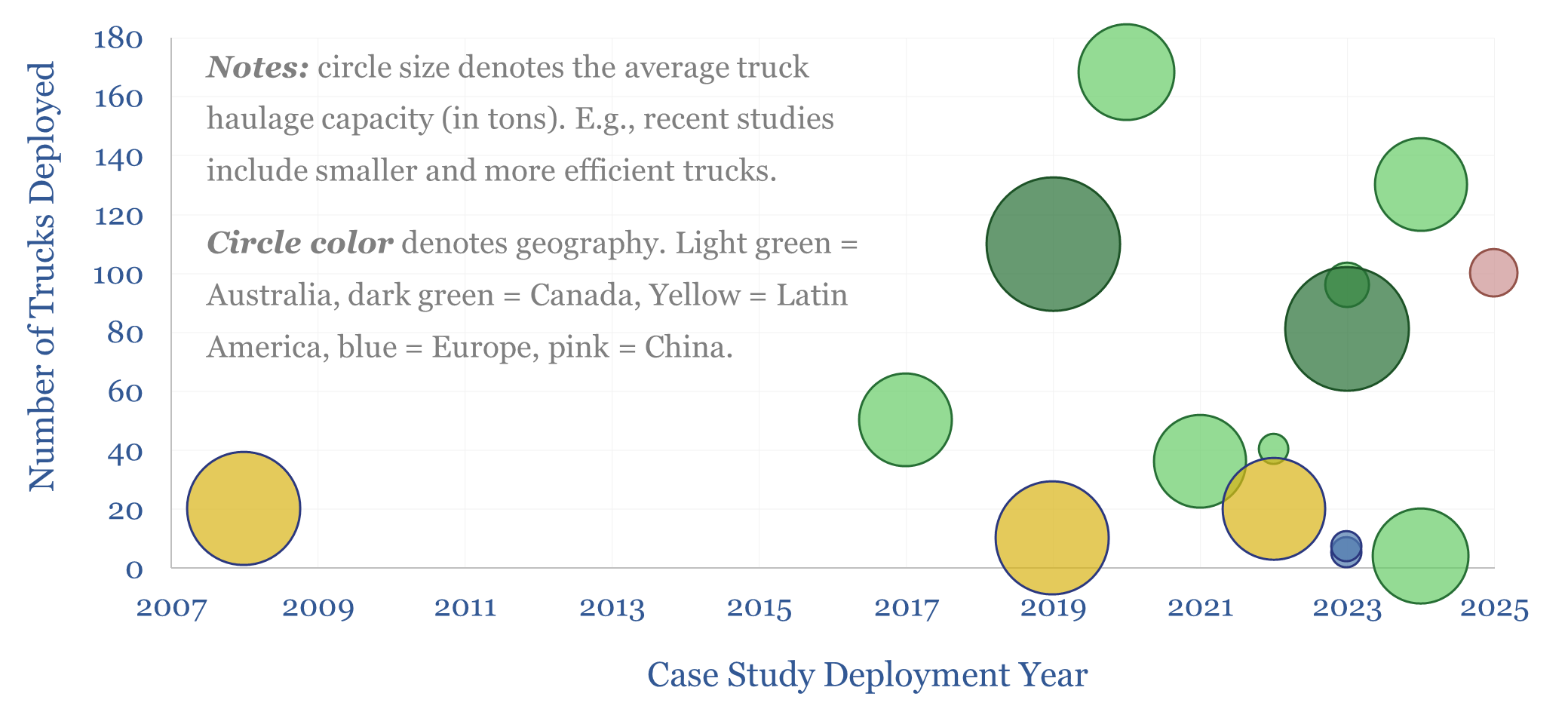

This is not science-fiction, but a fast-growing area, with deployments going back to 2008, and accelerating rapidly in recent years. This data-file captures case studies of autonomous mining trucks, and profiles leading suppliers.

Findings in the data-file allow us to estimate typical costs of mine truck conversions, typical productivity gains, cost declines, maintenance cost declines, fuel savings, co-benefits from optimizing traffic routes, and <1-year paybacks.

Better for people? Frankly many people do not want to work 2-week shifts, living at a man camp, away from their families, so they can drive a truck for 8-hours per day, in the blistering heat of the Australian summer. Life at a remote ops center in Perth is also safer.

Progressively broadening scope. The first applications were generally in “easy” operating conditions, for iron ore in Australia’s Pilbara, with a warm climate and good roads. More recent deployments include Canada’s snow-prone, soft-rock oil sands, where Imperial Oil has said its autonomous haul fleet could achieve a full $1/bbl open reduction.

Progressively deepening scope. From autonomous trucks, mining companies are now also evaluating and deploying autonomous carts, graders, dozers, excavators, railways, drills and blasting units.

Ripple effects. Scania, whose 40T trucks have been deployed by Rio Tinto highlighted that “smaller and more fuel-efficient trucks make sense when the labor cost no longer scales with operators”. This also allows for building smaller, less costly roads. And smaller trucks are also easier to convert to battery power.

Low voltage electronics are another enabler, including sensors, cameras and GPS. An autonomous coal hauling operation in Mongolia leans on a 5G network from Huawei, with 500Mbps uplink and 20ms latency.

Leading companies in autonomous mining trucks are also profiled in the data-file. The pattern of AI/digital technologies is becoming familiar, simultaneously requiring more mined materials, while also facilitating the mining process, as part of an AI-driven energy transition.