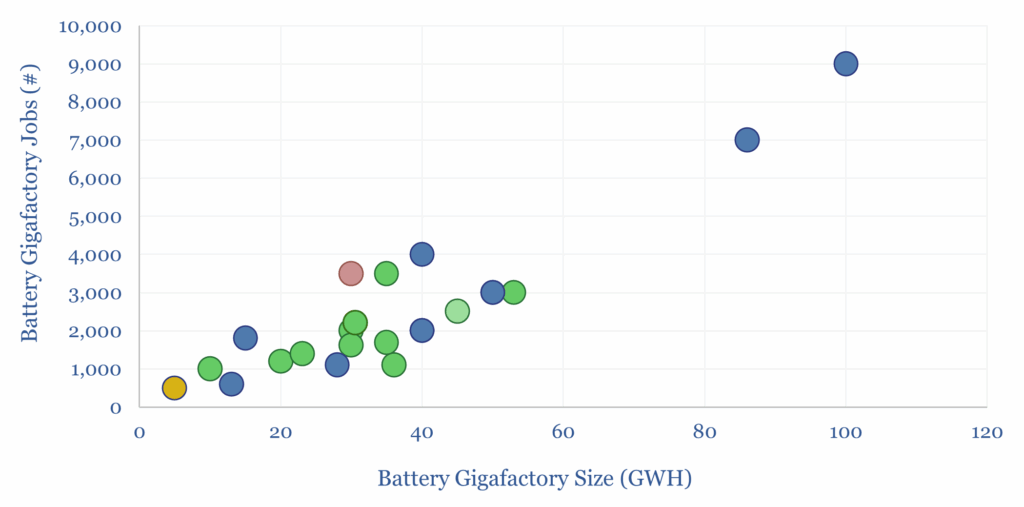

This data-file captures battery Gigafactory capex costs, by region, by chemistry, by company and over time, by looking across a sample of 40 major projects. Capex costs average $80/kWh-pa of capacity. Each GWH pa of capacity is associated with 70 full-time employees.

The capex costs of battery manufacturing and assembly facilities, tabulated in this data-file, imply that around $8/kWh of battery cell costs go on amortizing capex, and another $8-12/kWh go on capital costs, to reach a 10% return on this up-front investment, which dovetails with our battery cost build-ups.

Labor costs also matter. 70 full employees at battery gigafactories per GWH-pa of capacity, would equate to $6/kWh of labor costs, at Western labor rates of $85k pp pa, but only $1-2 /kWh of labor costs, at Chinese and other emerging world labor rates of $15-20k pp pa.

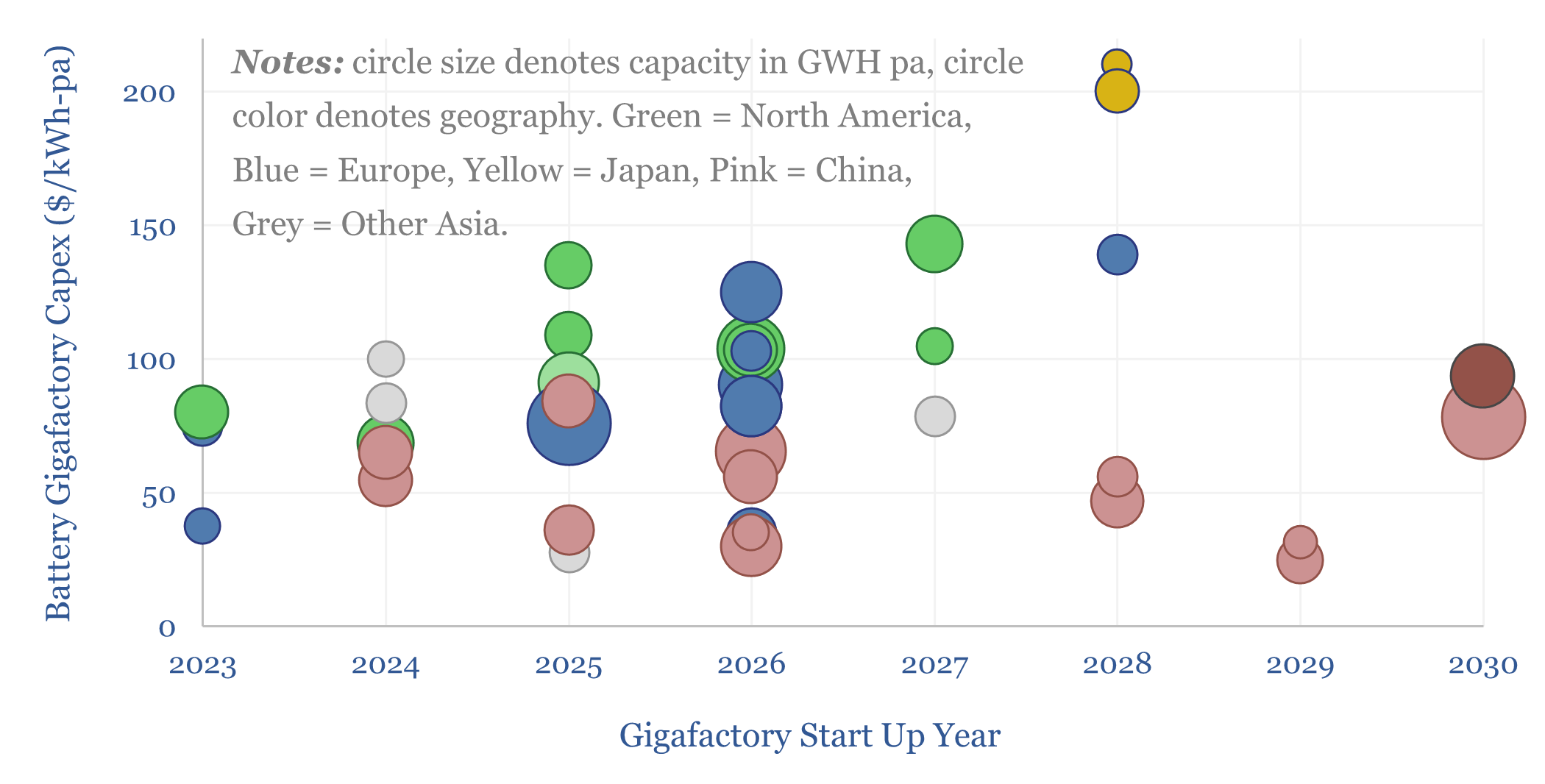

Battery Gigafactory capex costs differ starkly by region. Average capex costs are lowest in China, higher in Other Asia, even higher in Europe, and highest in the US and Japan, where costs can be well over 2x the levels of Chinese battery gigafactories. Numbers in the data-file.

Moreover, trend-lines in the data seem to imply Chinese battery plant capex costs declining from 2023-2030, while Western battery plant capex costs have steadily risen.

One interpretation could be that Chinese producers are finding ways of accelerating throughput, which lowers unit costs; while multi-billion dollar subsidies in the West, with governments often funding over one-third of total construction costs, have been inflationary?

Battery gigafactories based on LFP cathode chemistry had c5% lower capex than non-LFP gigafactories in China, while there was no significant capex cost-difference ex-China.

Several Western battery plants originally designed for NMC have switched to LFP (e.g., LG-GM in Tennessee, Samsung-Stellantis in Indiana, ACC at future European projects). Another data-file captures our forecasts for the future market share of LFP vs NMC.

Other Western gigafactories have delayed their growth plans due to lower demand for batteries, especially in electric vehicles, after 2023-24 EV sales disappointed. This includes LG-GM in Michigan, ACC in Germany and Italy, Nissan in Japan.

What we wanted to test in this data-file is whether any particular battery manufacturers had “better technology” allowing them to produce higher-throughput facilities, which could be proxied by lower capex costs. It is quite challenging to find apples-to-apples comparisons, but the data do possibly show an edge for CATL and continued high costs for LG.

The full data-file contains 40 examples of battery gigafactory capex costs, capacities, total costs ($/kWh-pa), labor requirements, start-up year, cell chemistry, and our notes on each project.