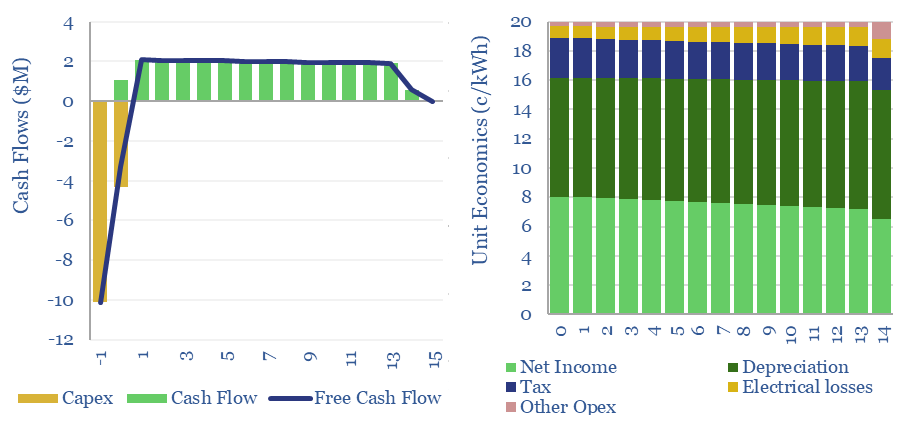

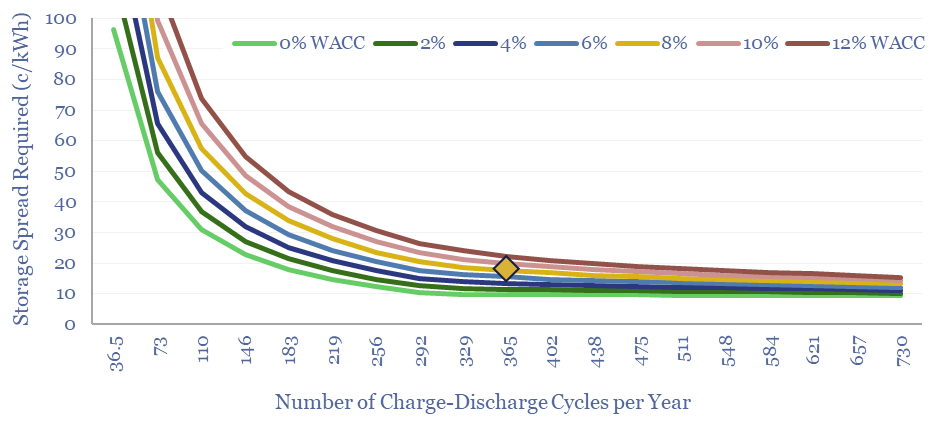

Grid-scale batteries are envisaged to store up excess renewable electricity and re-release it later. Grid-scale battery costs are modeled at 20c/kWh in our base case, which is the ‘storage spread’ that a LFP lithium ion battery must charge to earn a 10% IRR off c$1,000/kW installed capex costs. Other batteries can be compared in the data-file.

Grid-scale batteries are often envisaged to store up excess renewable electricity at one part of the day, and re-release the electricity at times when the wind is not blowing and the sun is not shining. The costs of grid-scale battery storage are captured in this data-file.

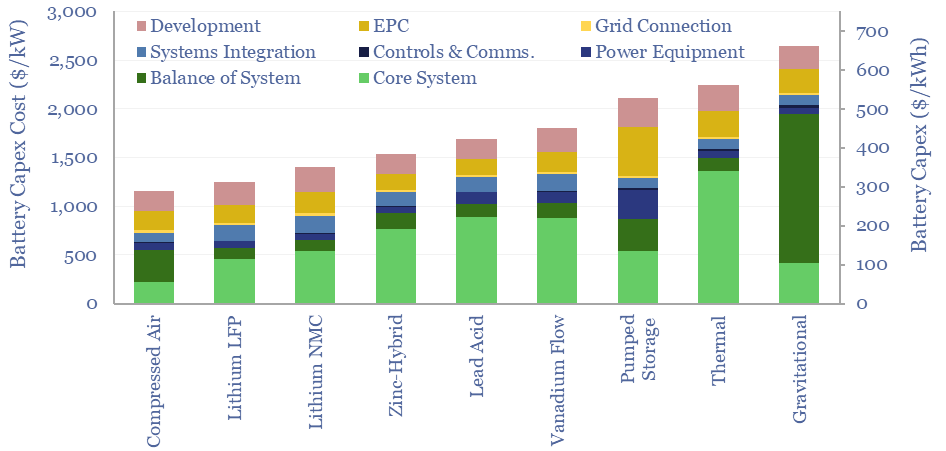

Different grid-scale battery types include lithium ion, redox flow, lead acid, pumped hydro, compressed air, thermal and other gravitational systems.

Capex costs of grid-scale batteries depend on what you build. But a nice apples-to-apples comparison is charted below, using third-party data from PNNL. This is assuming a 10MW system with 4-hours duration, across the board. We have also written a longer note explaining the strange duality of measuring battery costs in both $/kW and $/kWh.

The costs of a grid-scale battery are generally around 2x higher than the underlying battery, after reflecting the balance of system, power equipment, controls and communication, systems integration, grid installation, EPC concentrators and development costs. For example, a lithium ion battery might cost around $150/kWh ($600/kW), but a grid-scale lithium ion battery is shown at $300/kWh ($1,200/kW).

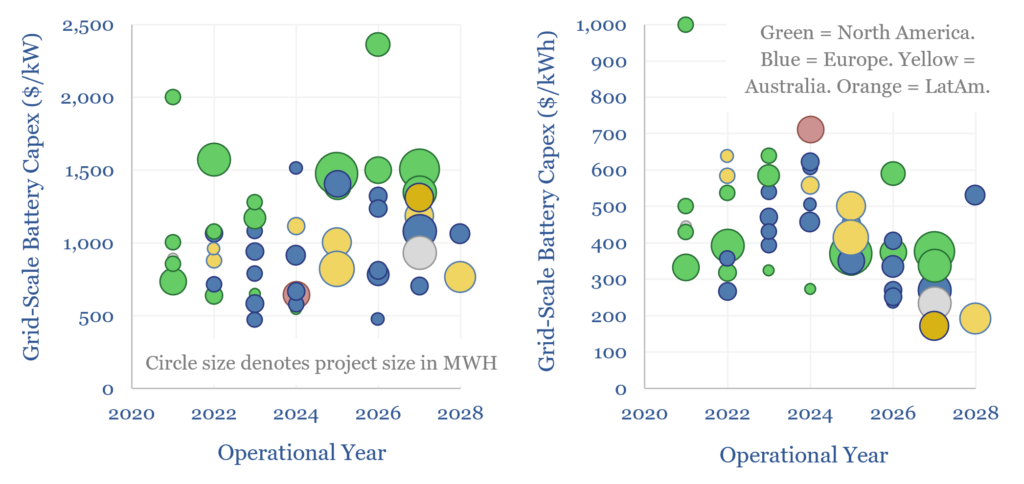

These estimated capex costs for grid-scale batteries are also supported by tabulating actual data into 50 grid battery projects, in different countries globally (chart below). It is interesting to cross-correlate the costs with size, geography and battery duration.

Utilization also strongly determines the costs of grid-scale storage. A nice simplifying assumption for benchmarking different batteries is that they might be lucky to charge and discharge precisely once per day (this is even specified as a limit in the warranties of some battery suppliers). This means 365 charge-discharge cycles per year. But there may not be sufficient supply or demand on all days. Especially for larger batteries. This inflates costs (chart below).

Longevity and degradation. The total number of charge-discharge cycles will determine the life of the battery, and the period over which it can generate cash flows. We have argued that battery degradation is the single most important variable to debate for battery economics. The cycle life in real-world systems, standing for 10+ years, may be quite different from the results of accelerated cycling tests in the lab.

Other variables can be stress-tested in the data-file, such as different battery types, their capex costs, efficiency, operating costs, depth of discharge, degradation factors, hurdle rates and storage spreads. For our key battery conclusions, please see our overview of energy storage.