Company Diligence

-

TSE Patent Assessments: a summary?

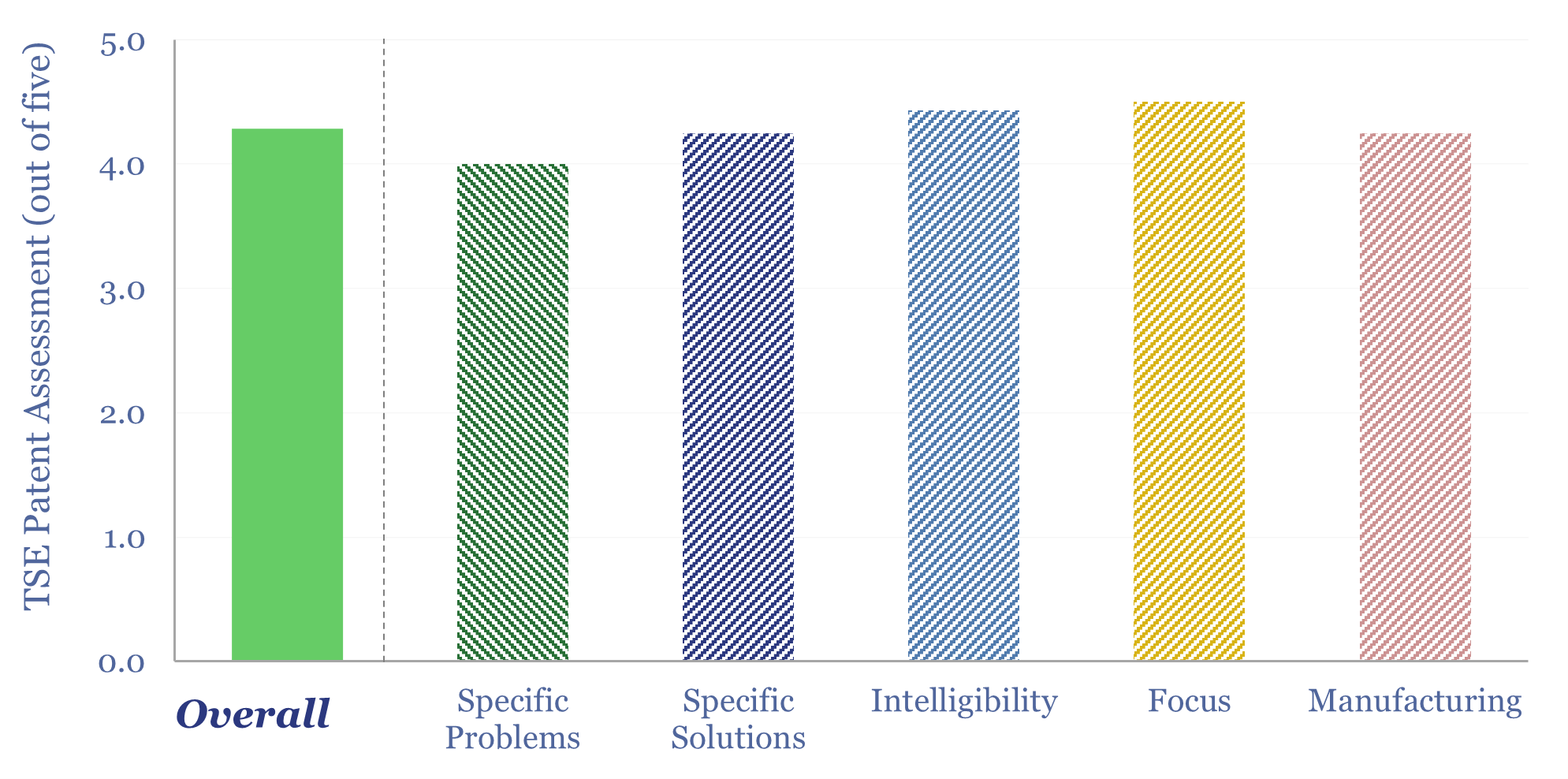

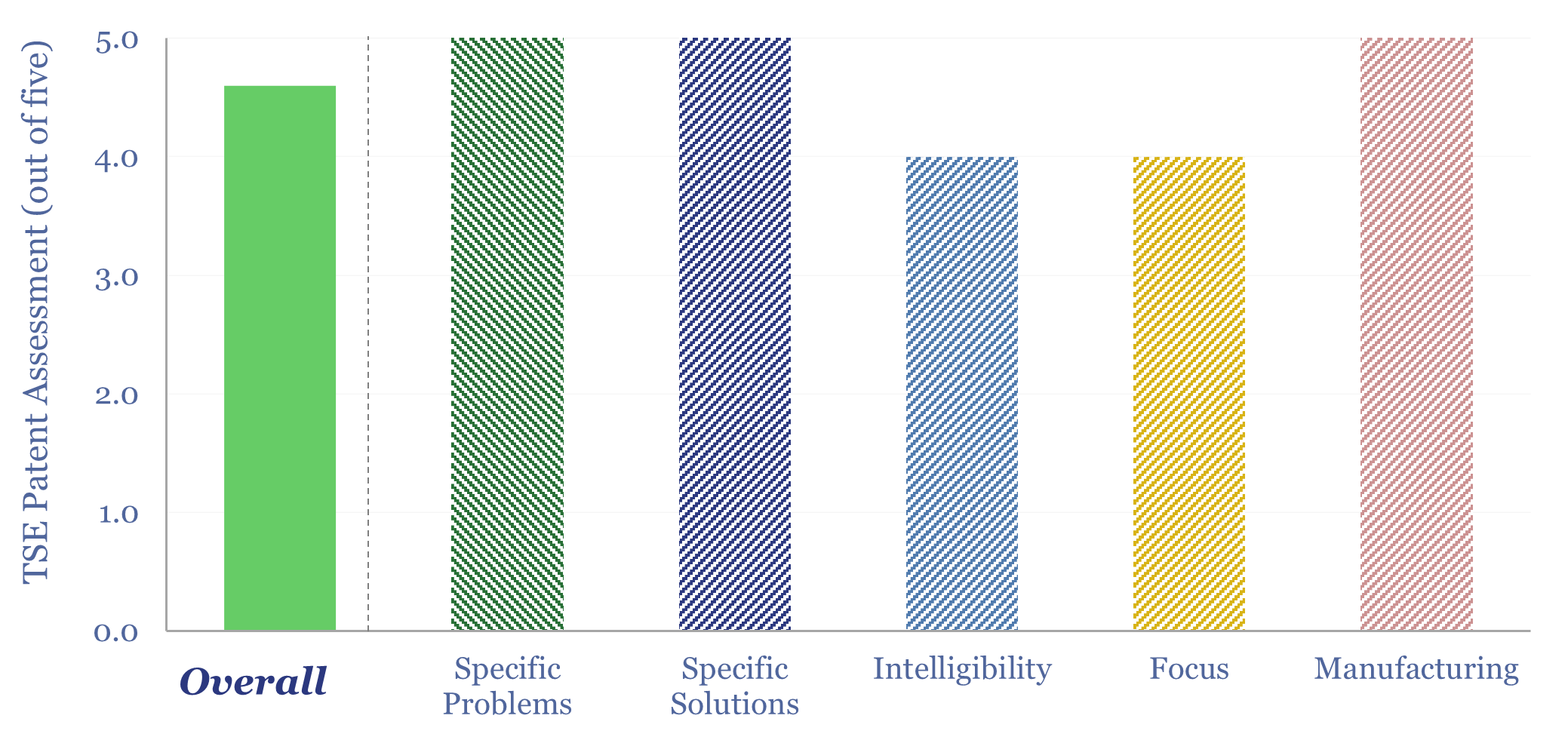

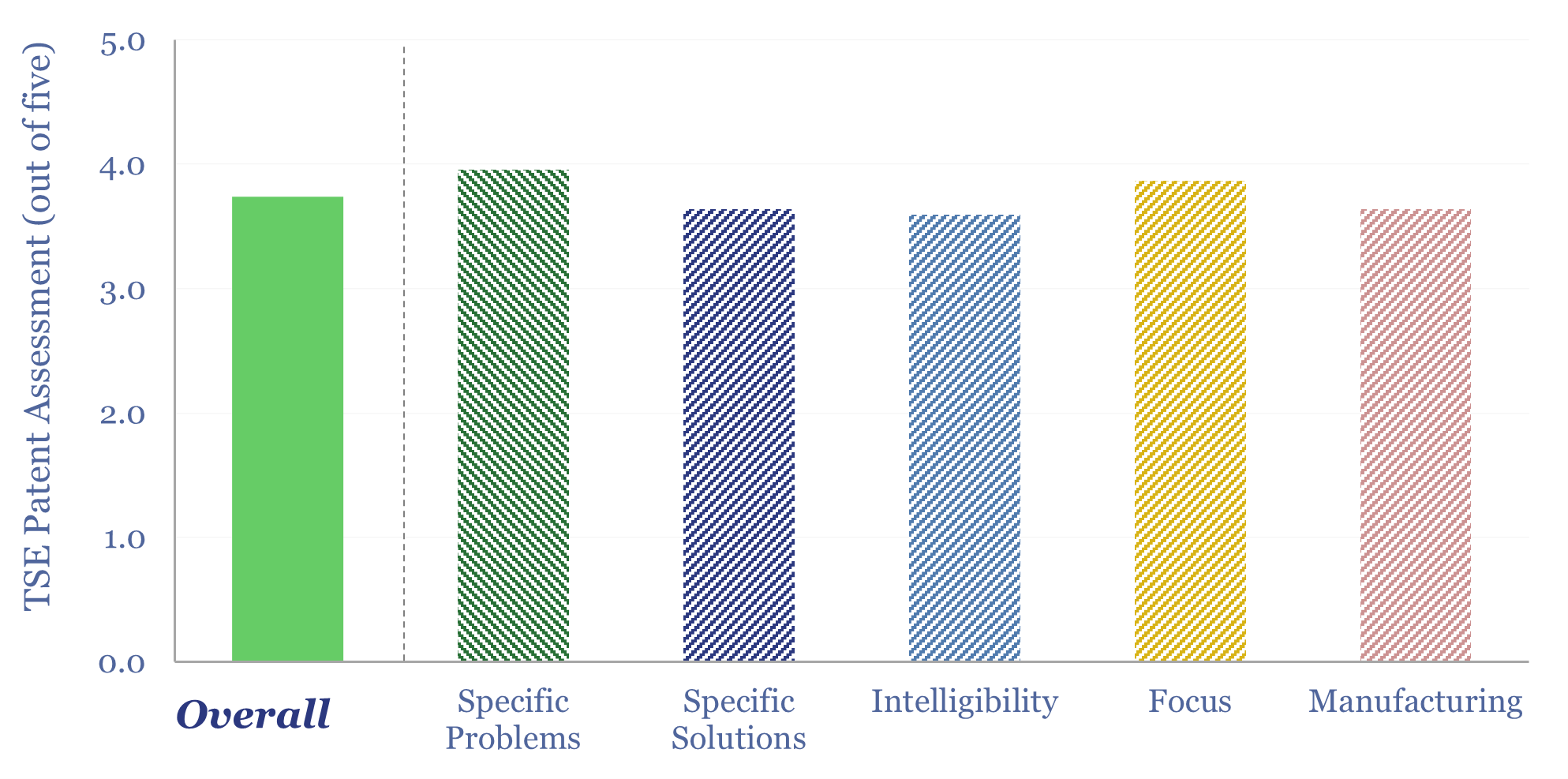

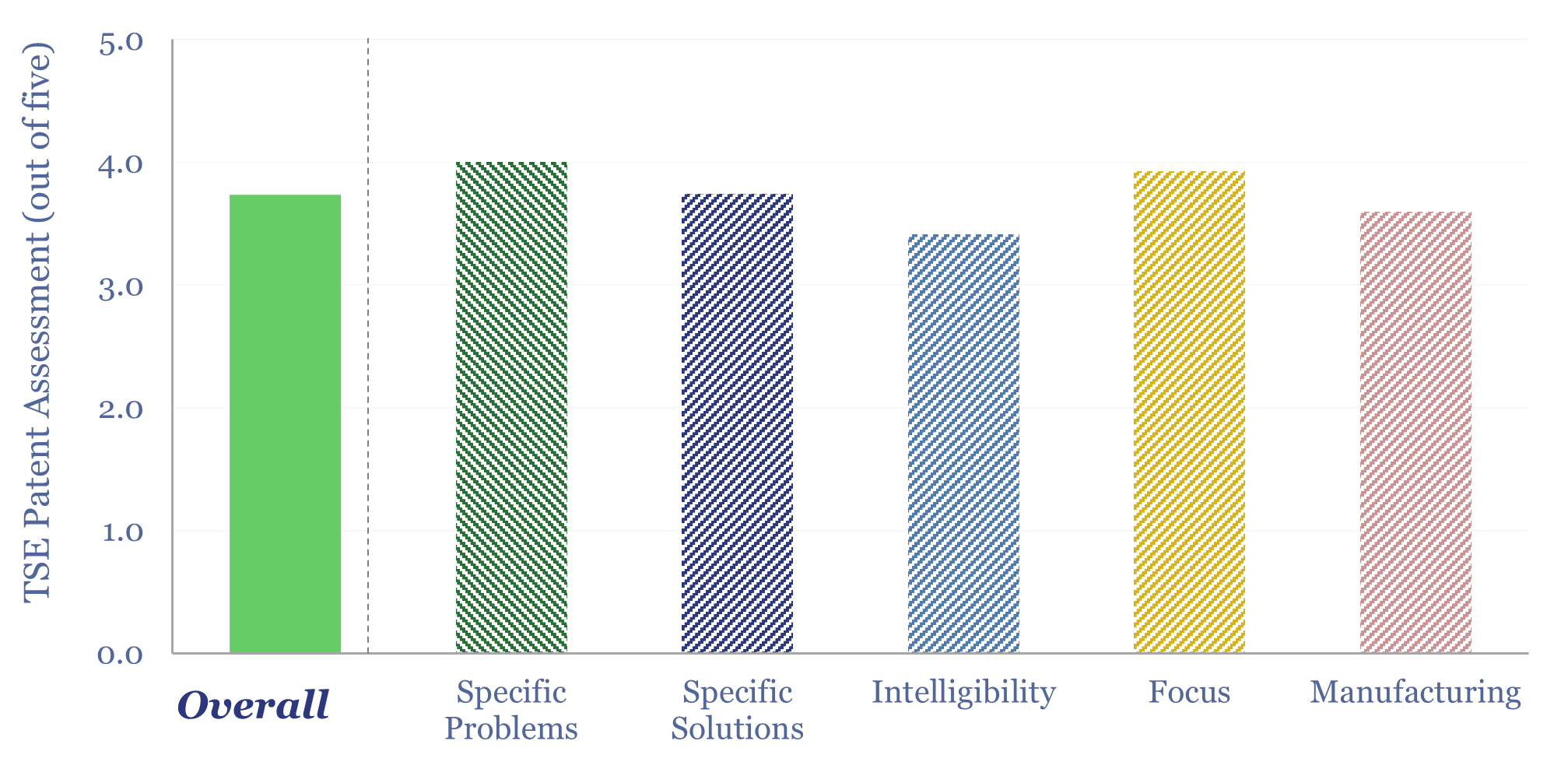

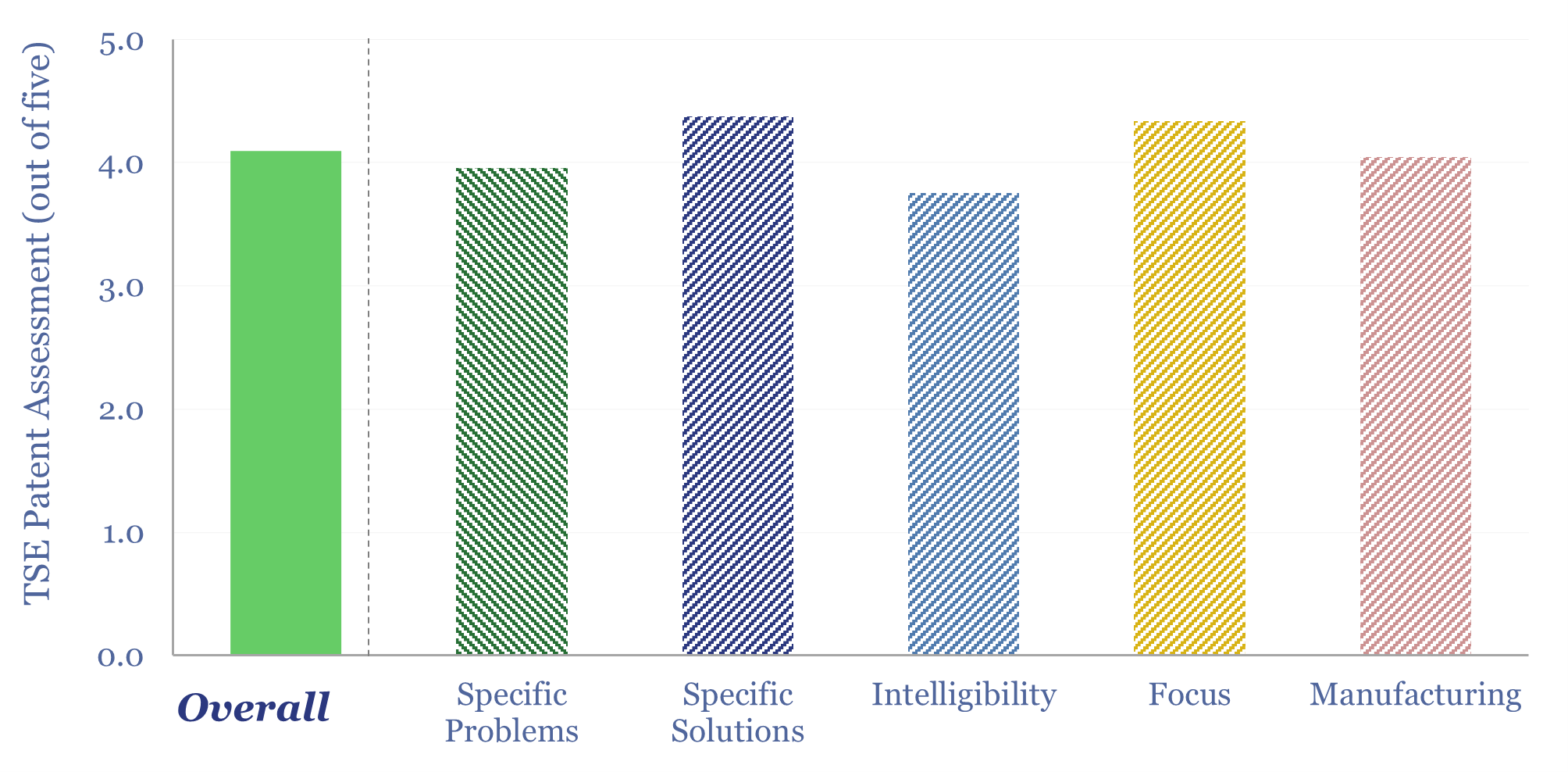

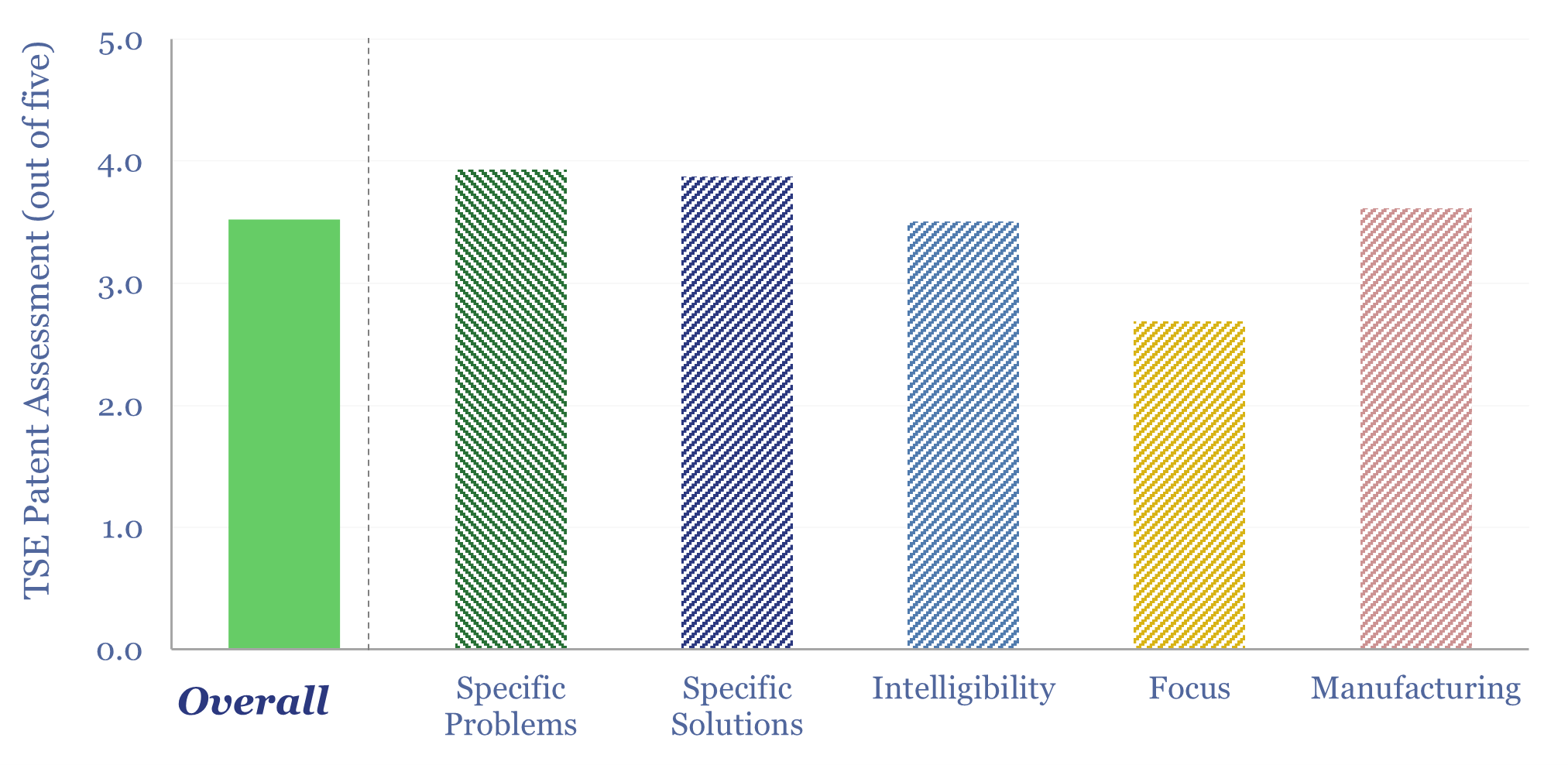

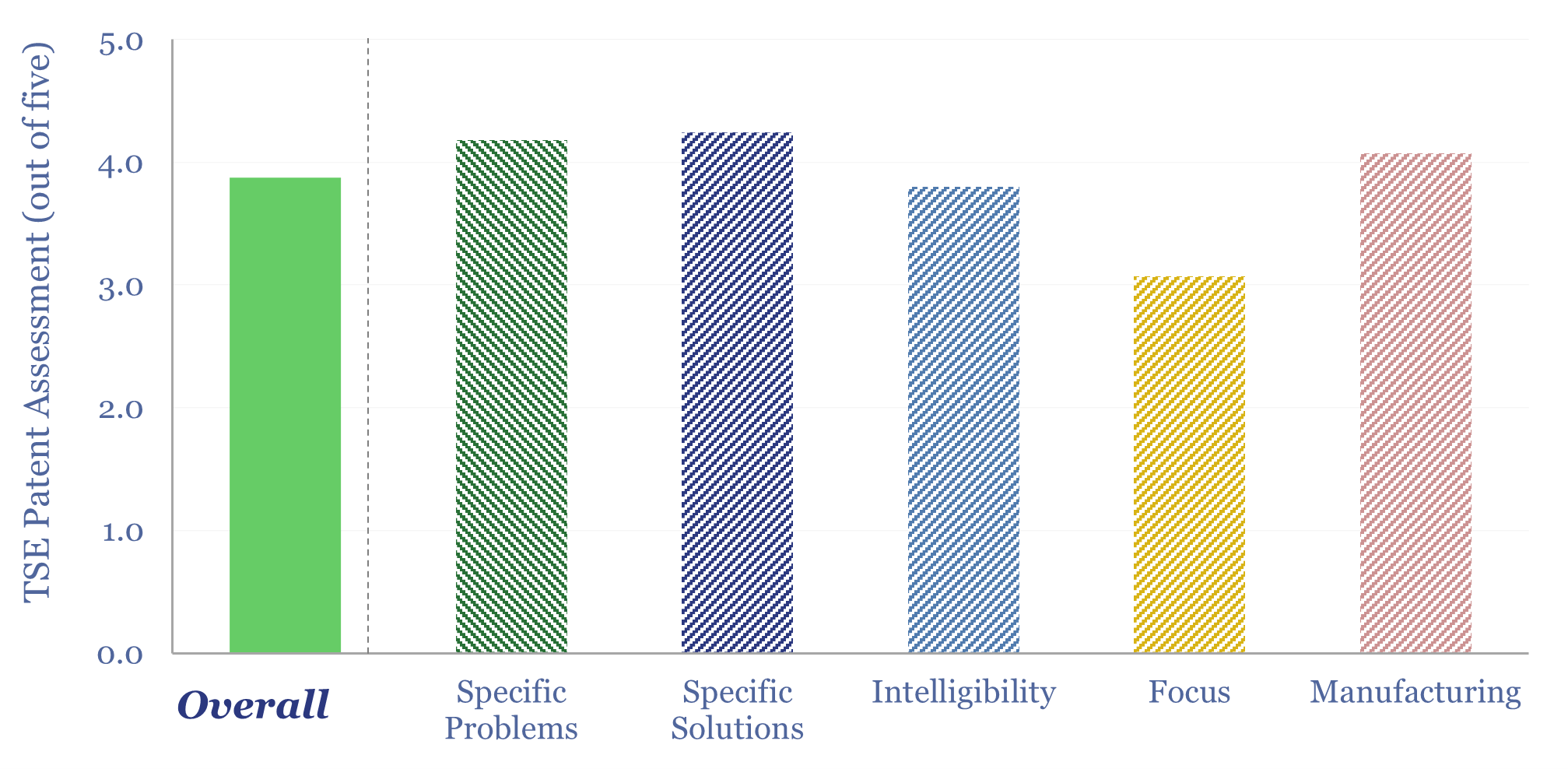

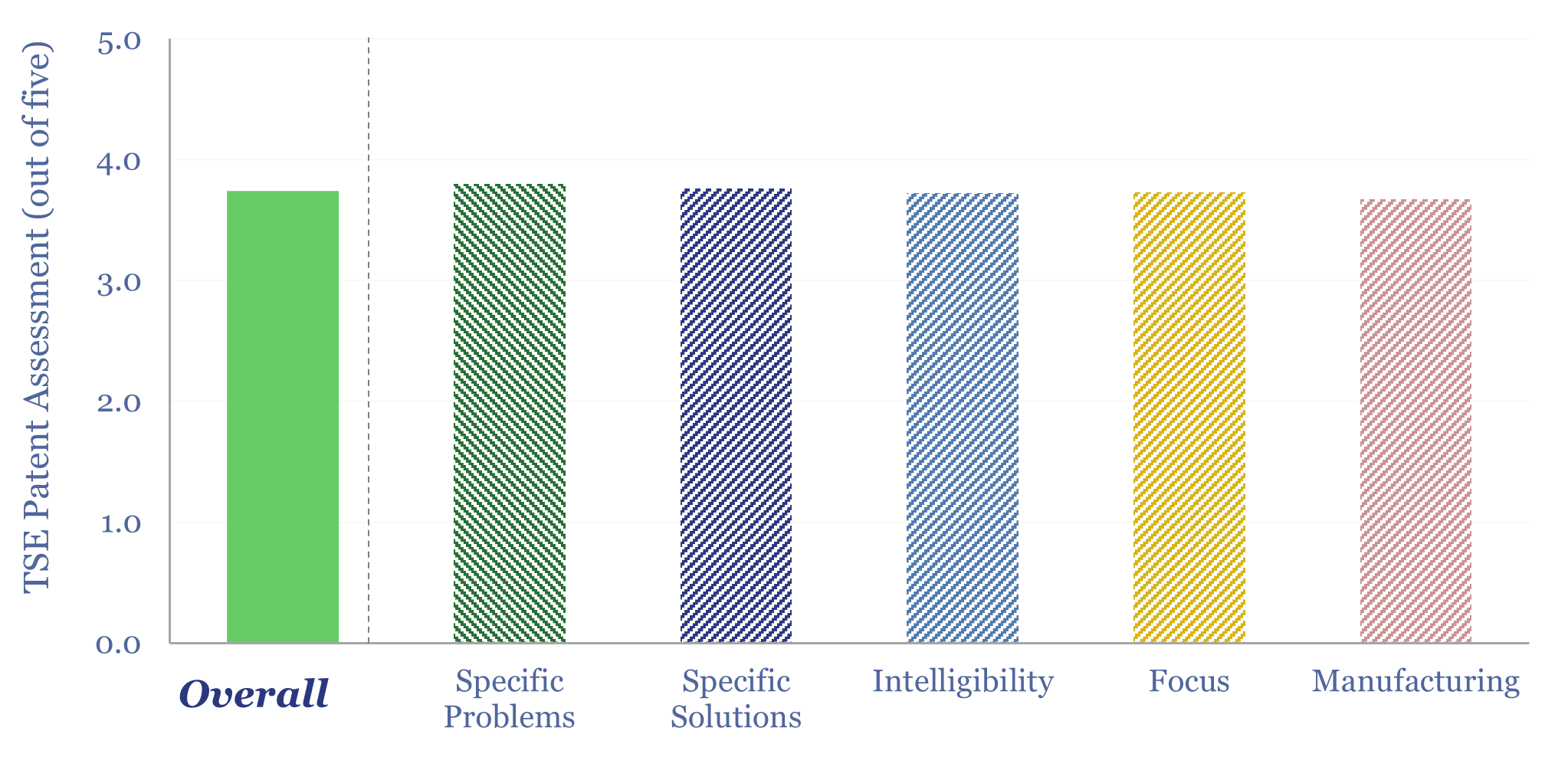

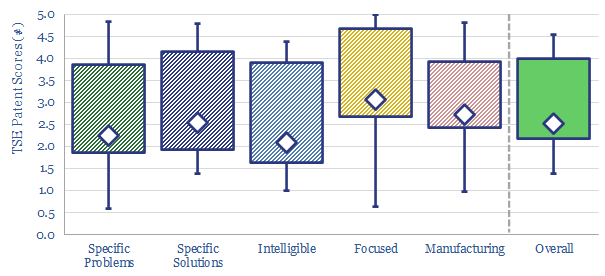

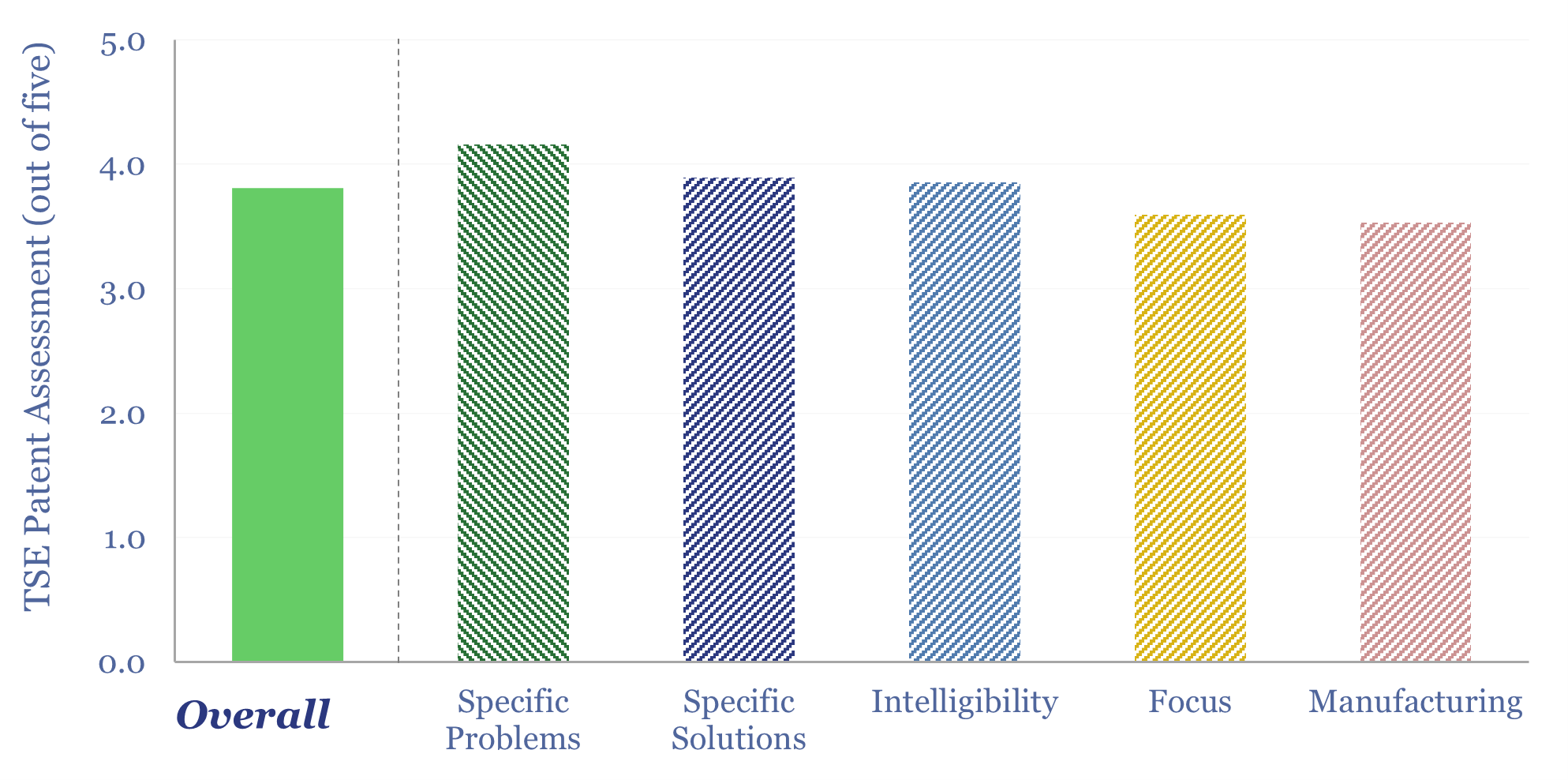

This data-file aggregates all of our patent assessments into a single reference file, so different companies’ scores can be compared and contrasted. Our average score is 3.5 out of 5.0. Skew is to the downside. Intelligibility is the biggest challenge. Scores correlate with TRL and revenues.

-

VoltaGrid: mobile micro-grid technology?

VoltaGrid has become the largest provider of mobile, natural gas reciprocating engines in the US, reaching GW-scale in 2025, in order to rapidly energize data centers, e-frac operations in shale, and other micro-grids in mining and industry amidst power grid bottlenecks. This data-file reviewed VoltaGrid’s mobile micro-grid technology and patents.

-

Itron: smart energy network technology?

Itron is a US-leader in smart energy meters and smart energy networks. Once you have these smart meters widely deployed across the electricity network, you can start to do really interesting things. This data-file gathers concrete examples of Itron’s smart energy network technology, based on reviewing 15 patents.

-

Cognex: machine vision technology?

Cognex machine vision technology is used to ID products, inspect products, guide robotics and gauge sizes. This data-file reviews 20 case studies, with payback periods typically below 1-year. Increasing capabilities of AI are already extending use cases for these systems. We conclude this trend will continue, and also unlock more demand for industrial robots.

-

Ecolab: water management technology?

Water is used in heat exchangers, in data-center cooling and power plant cooling. These are interesting areas, which have featured in our research. But what opportunities to raise performance and lower water use? Ecolab water management technology monitors the composition of industrial water and then optimizes additives against scaling, fouling and corrosion. Recent patents will…

-

Exail: inertial navigation technology?

Exail Technologies is listed in Paris and focuses on navigational and maritime robotics. It has a range of maritime drones, with applications from mine-sweeping to assisting with offshore wind, offshore oil and gas and civil infrastructure projects in coastal waters. A key to these drones is incorporating Exail’s Inertial Navigation Systems. We have reviewed the…

-

Doosan Enerbility: gas turbine technology?

Doosan Enerbility is a power plant manufacturer, headquartered in Korea, specializing in nuclear plant construction, gas plant construction, offshore wind, civil engineering and parts manuacturing. In this patent review, we assessed Doosan Enerbility gas turbine technology. We can de-risk its claims for a 43%-efficient simple-cycle turbine, 60%+ efficient CCGT, and 1,600ºC turbine inlet temperatures.

-

Microwave Chemical: electrical heating?

Microwave Chemical is a small-cap company, developing microwave-based heating solutions, across over a dozen use cases, from acrylic recyling, to producing food/cosmetic compounds, to carbon fiber (particularly interesting!). We reviewed a dozen of the company’s patents in this data-file, which is a Microwave Chemical technology review and finds a moat in efficient microwave heating.

-

Leilac low-carbon cement technology?

This data-file explores Leilac low-carbon cement technology, which separates the calcination stage, within an indirectly heated reactor, so that 98% pure CO2 can be gathered and sequestered, with requiring post-combustion CCS (amines). Patents from parent company, Calix, lock up the technology, with clear and intelligible details, although this also shows where the challenges are.

-

Smart Wires: grid capacity breakthroughs?

This Smart Wires technology review finds that Static Synchronous Series Compensators (SmartValve) and dynamic line rating software (SUMO) can increase throughput along existing transmission lines by 20-100%+. The patents confer a visible moat around SmartValve and focus on improving electrical performance reducing deployment costs.

Content by Category

- Batteries (88)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (93)

- Data Models (834)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (203)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (278)

- LNG (48)

- Materials (82)

- Metals (79)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (127)

- Renewables (149)

- Screen (116)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (352)