Decarbonization

-

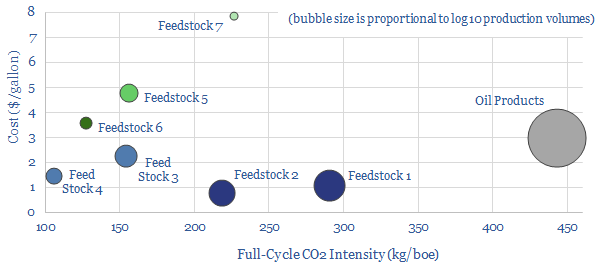

Biofuel technologies: an overview?

Biofuels are currently displacing 3.5Mboed of oil and gas. But they are not carbon-free, and their weighted average CO2 emissions are only c50% lower. This data-file breaks down the biofuels market across seven key feedstocks, to help identify which opportunities can scale for the lowest costs and CO2, versus others that require further technical progress.

-

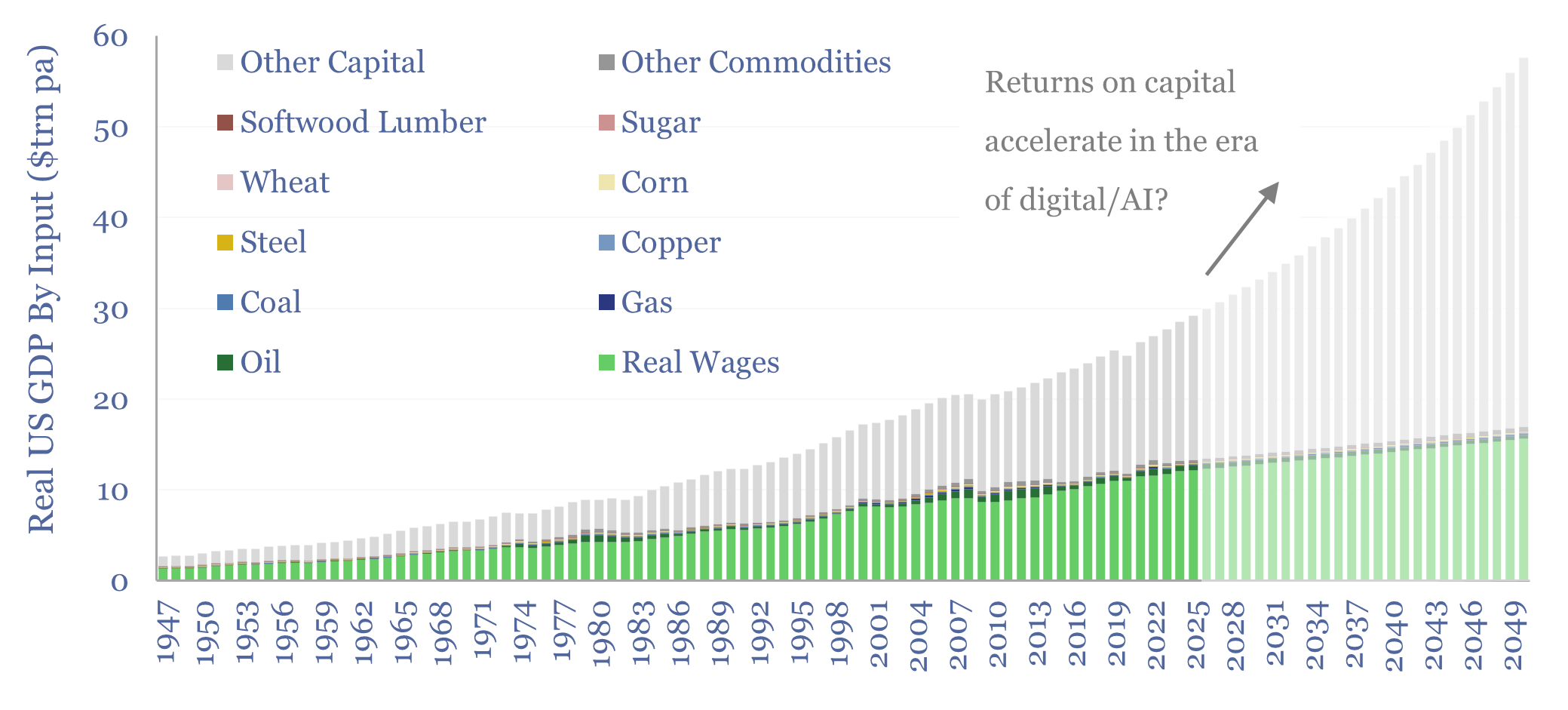

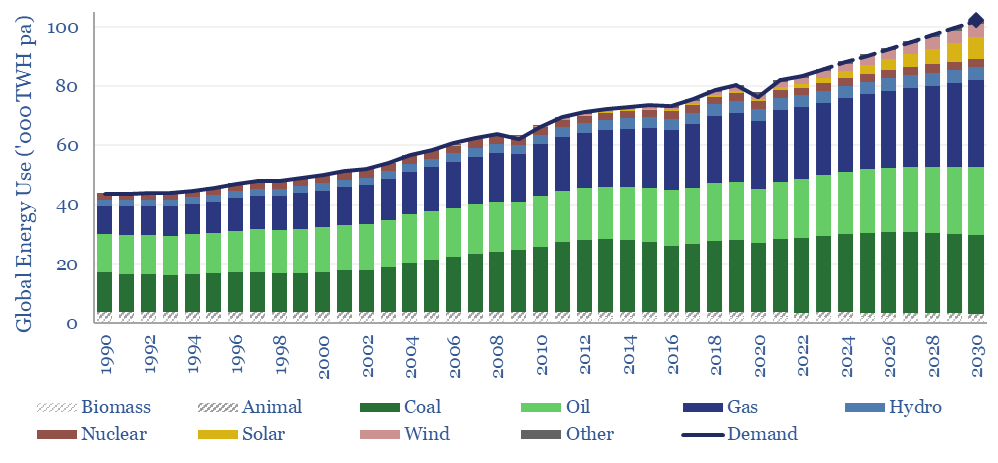

Energy transition: a new era? (driven by AI)

Energy transition remains among the most important and exciting topics in the world. But it is now less driven by Net Zero ambitions, and more so by digital and AI technologies. These offer world-changing possibilities; re-accelerating GDP, returns on capital, and commodities. This 13-page report captures our latest outlook on energy transition, and the opportunities…

-

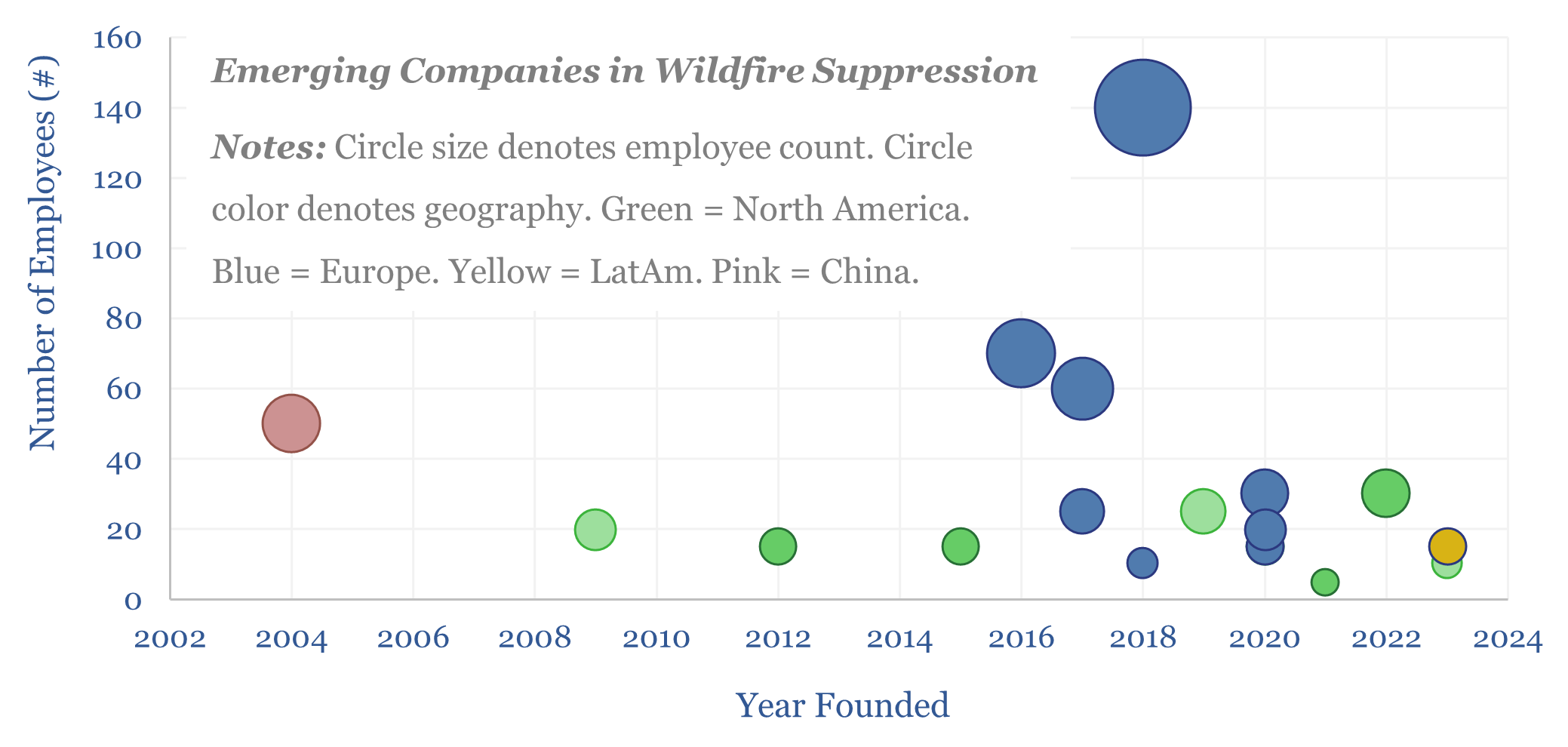

Wildfire suppression companies?

1-2bn acres of land burns globally each year, which could increase by over 35% due to climate change. Hence this data-file screens emerging companies in wildfire suppression, which are focused on preventing, detecting and containing wildfires. The most commonly used methods are drones and AI. Thus adapting to climate change requires more energy not less?

-

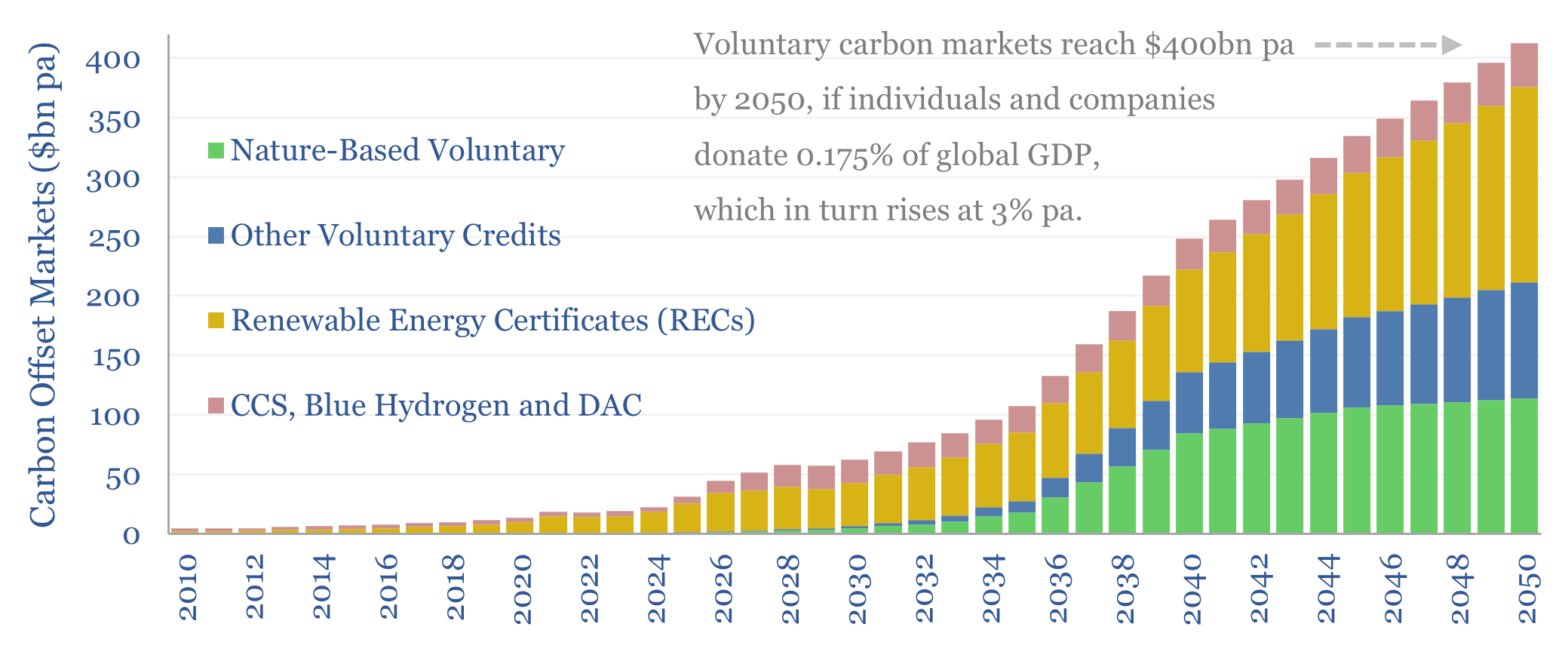

Carbon markets: charity case?

Carbon markets incentivize renewable energy, CCS, DAC, nature-based solutions and other CO2 offsets. In the past, we naïvely assumed these would grow as much as needed to reach Net Zero by 2050. This 14-page note revises our forecasts, by analogy to other forms of charitable giving. We see voluntary carbon markets reaching $400bn pa by…

-

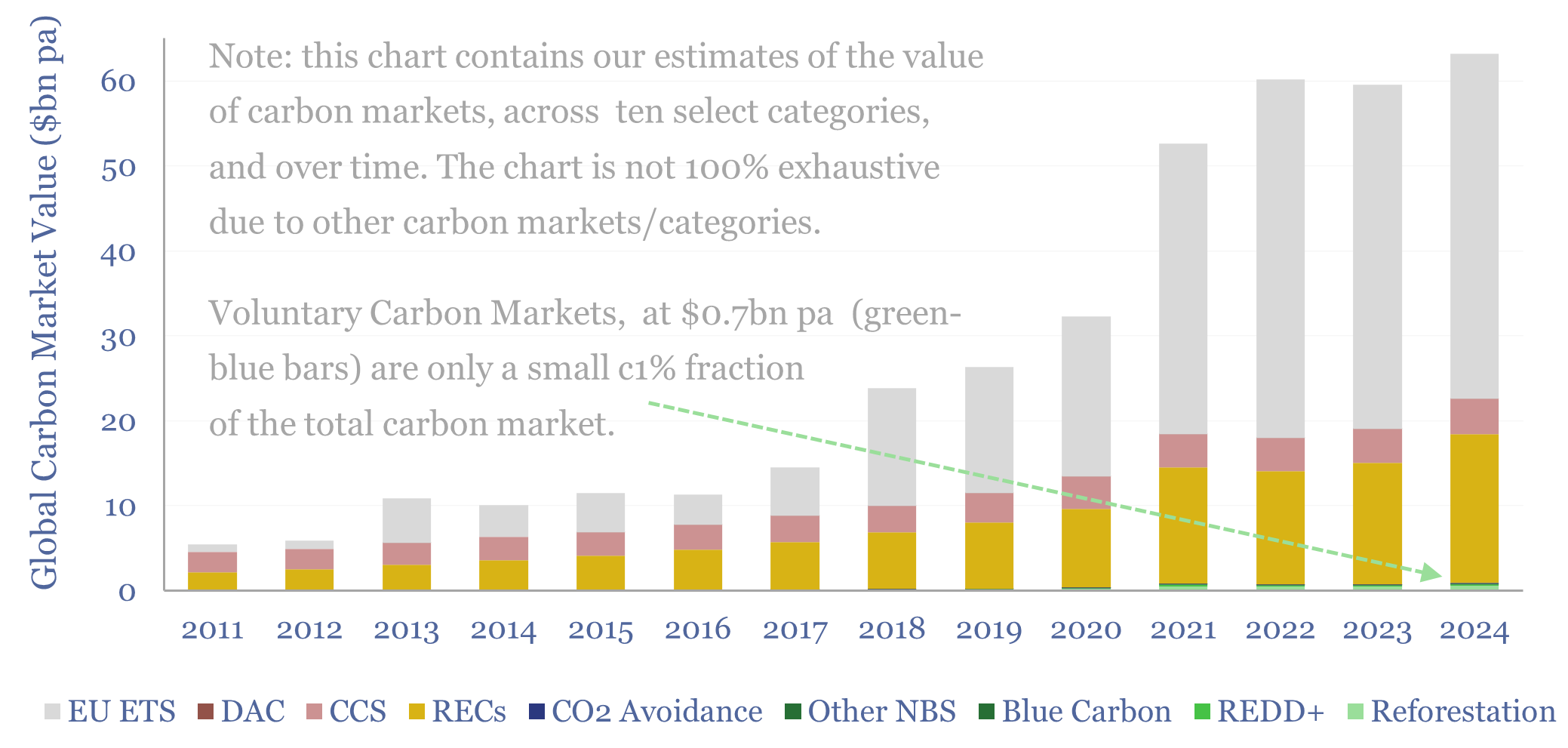

Carbon markets: by category over time?

This data-file quantifies global carbon markets by category over time, including the EU ETS as an example of a compliance market, RECs, CCS and VERRA-certified “carbon credits”, across categories such as REDD, reforestation and other “carbon offsets”. We also draw analogies with charitable giving and forecast carbon markets out to 2050.

-

Ten Themes for Energy in 2025?

This 11-page report sets out our top ten predictions for 2025, across energy, industrials and climate. Sentiment is shifting. New narratives are emerging for what energy transition is. 2025-30 energy markets look well supplied. The value is in regional arbitrage, volatility, grids, AI and solar.

-

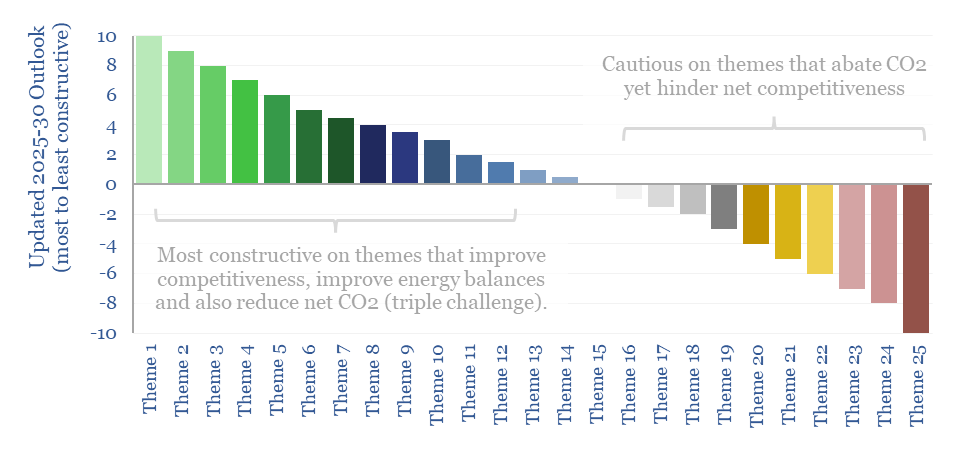

Energy transition: the triple challenge?

Energy transition is a triple challenge: to meet energy needs, abate CO2 and increase competitiveness. History has now shown that ignoring the part about competitiveness gets you voted out of office?! We think raising competitiveness will be the main focus of the new administration in the US. So this 15-page report discusses overlooked angles around…

-

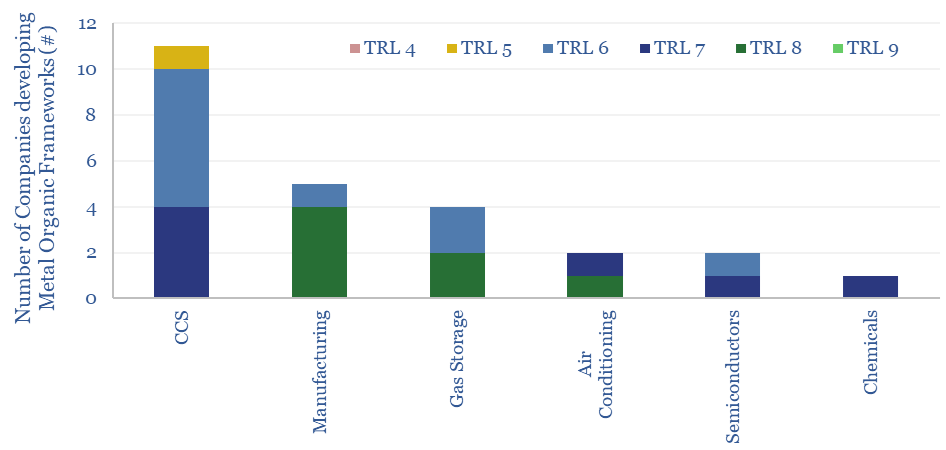

Metal organic frameworks: challenges and opportunities?

Metal organic frameworks (MOFs) are an exciting class of materials, which could reduce the energy penalties of CO2-separation by c80%, and reduce the cost of carbon capture to $20-40. This data-file screens companies developing metal organic frameworks, where activity has been accelerating rapidly, especially for CCS applications.

-

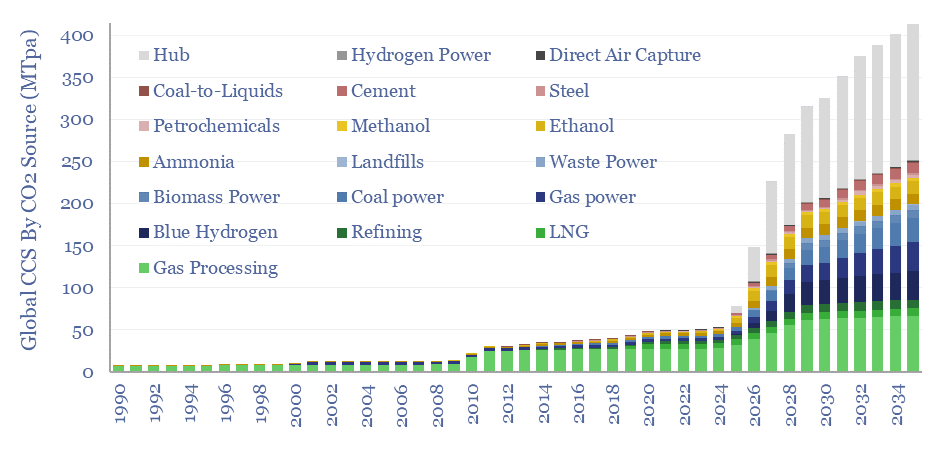

Global CCS Projects Database

Over 400 CCS projects are tracked in our global CCS projects database. The average project is 2MTpa in size, with capex of $600/Tpa, underpinning over 400MTpa of risked global CCS by 2035, up 10x from 2019 levels. The largest CO2 sources are hubs, gas processing, blue hydrogen, gas power and coal power. The most active…

-

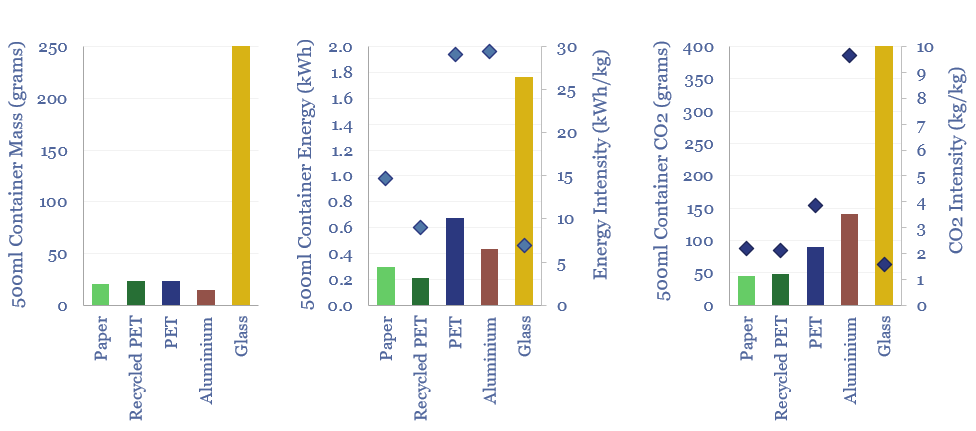

Plastic products: energy and CO2 intensity of plastics?

The energy intensity of plastic products and the CO2 intensity of plastics are built up from first principles in this data-file. Virgin plastic typically embeds 3-4 kg/kg of CO2e. But compared against glass, PET bottles embed 60% less energy and 80% less CO2. Compared against virgin PET, recycled PET embeds 70% less energy and 45%…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (355)