Industry Data

-

Overview of inertia in renewable-heavy grids?

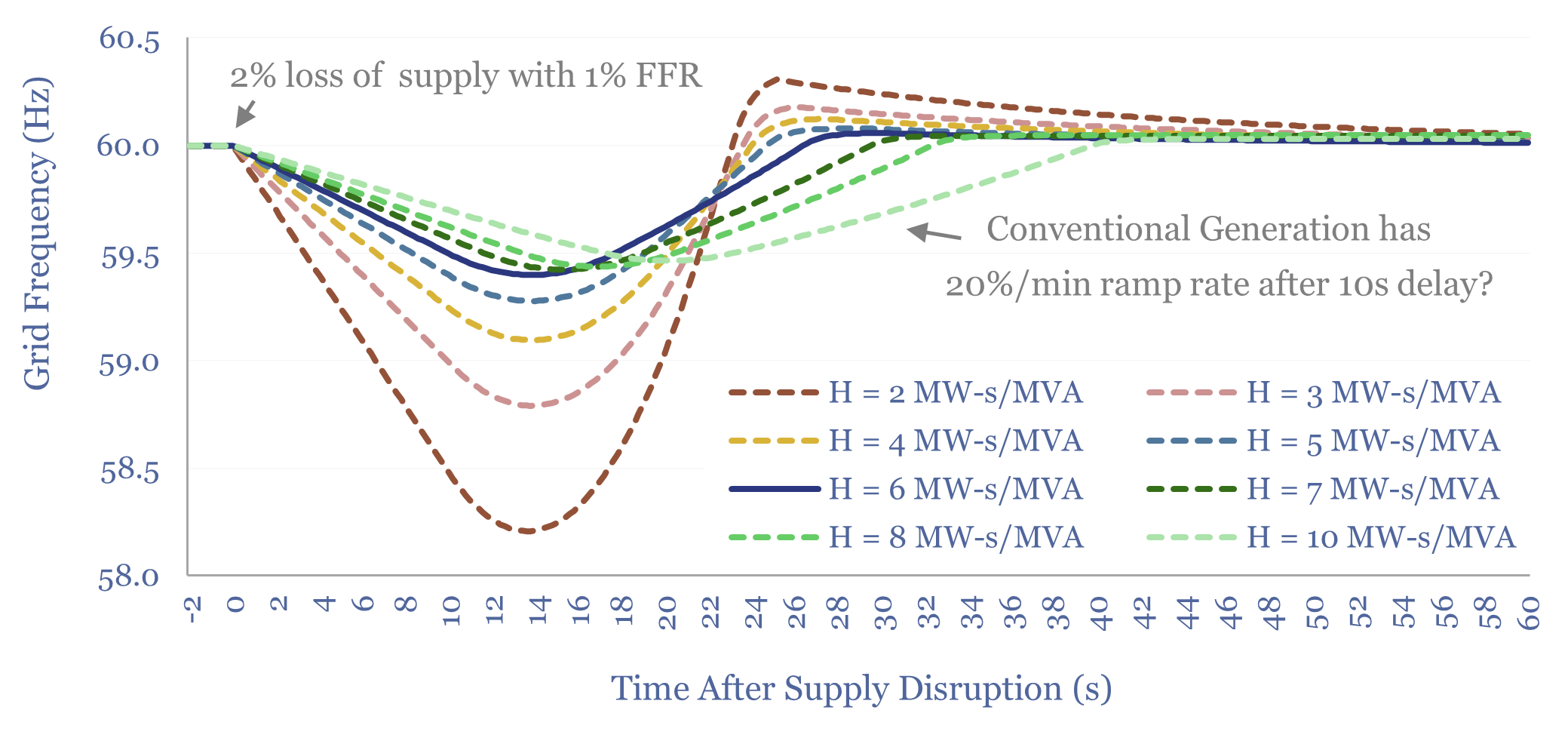

This overview of inertia in renewable-heavy grids tabulates the typical inertia of rotating generators, then models the resultant Rate of Change of Frequency (ROCOF) during supply-disruptions. In our base case, a grid with 6 MW-s/MVA of inertia rides through a 2% supply-disruption, buffered by 1% fast frequency reponse (FFR), via lowering grid frequency from 60Hz…

-

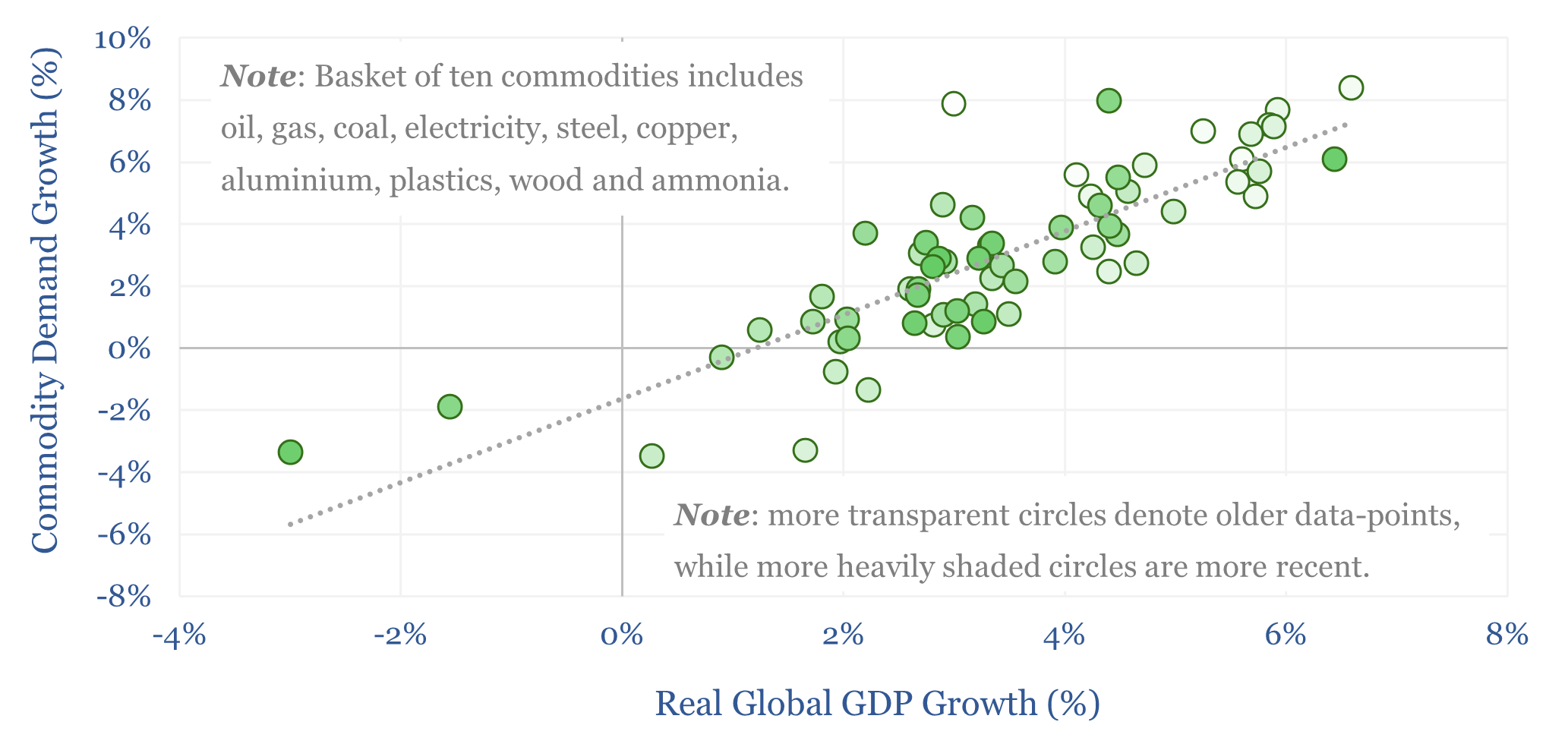

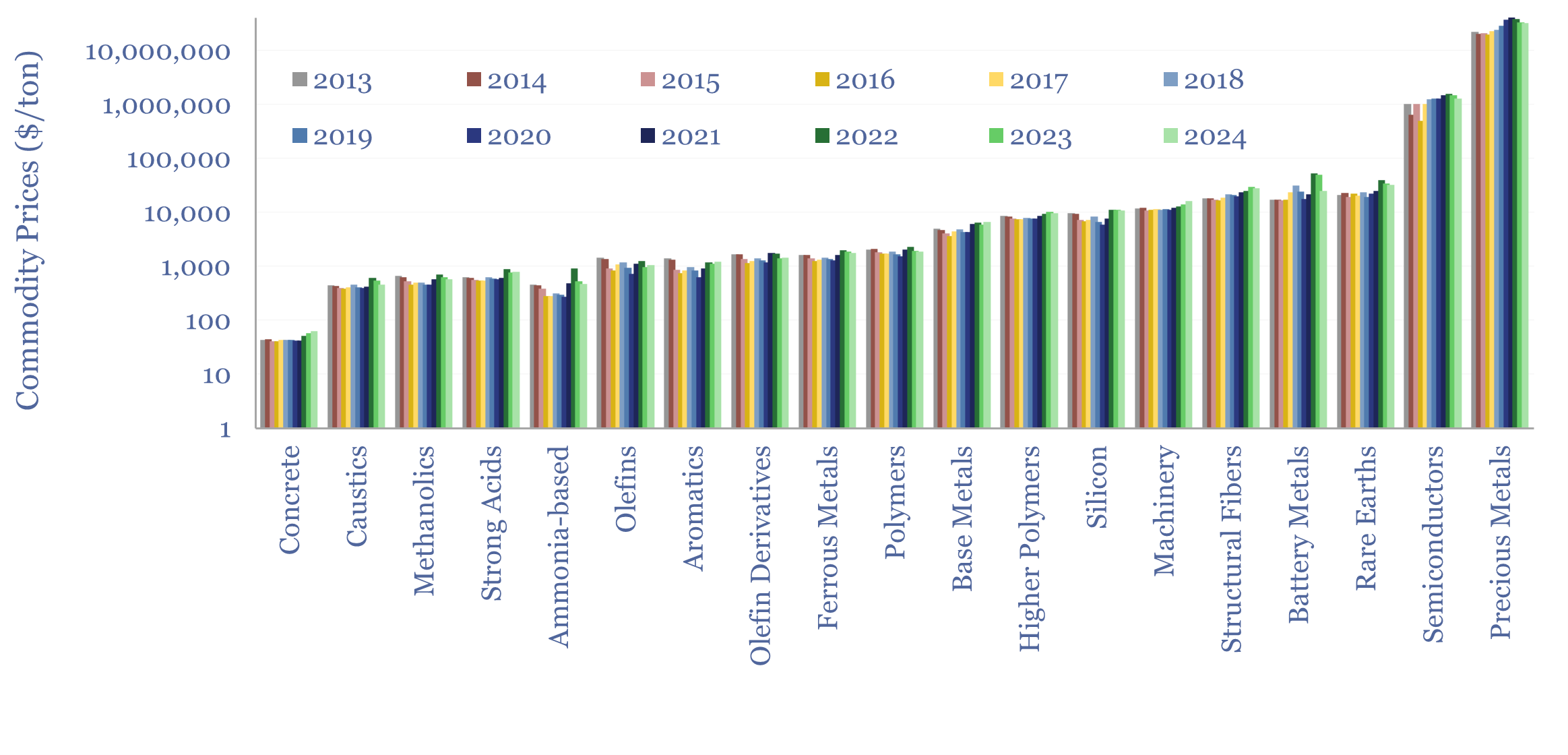

Commodity prices: metals, materials and chemicals?

Annual commodity prices are tabulated in this database for 70 material commodities, as a useful reference file; covering steel prices, other metal prices, chemicals prices, polymer prices, with data going back to 2012, all compared in $/ton. We have updated the data-file for 2024 data in May-2025.

-

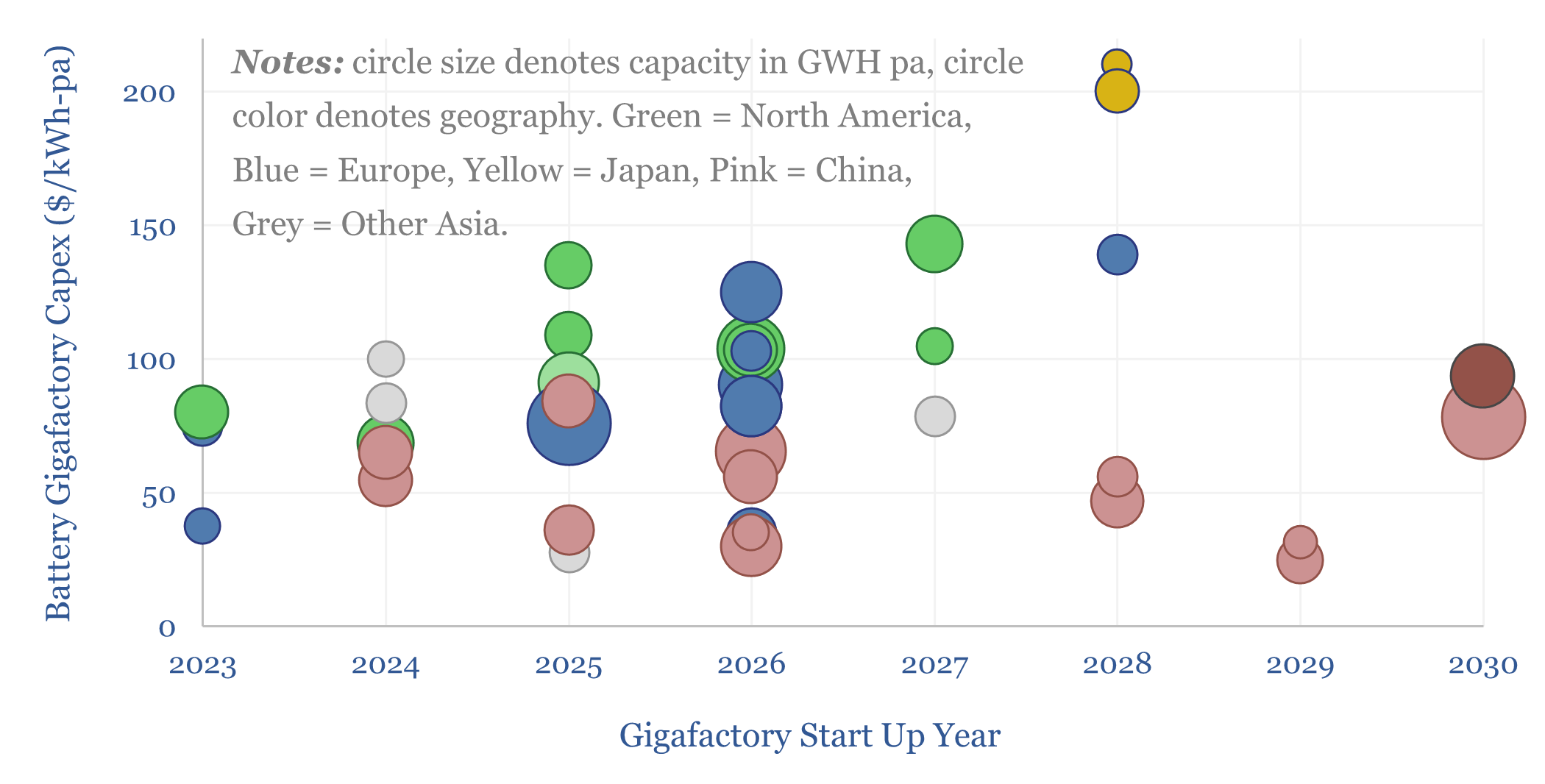

Battery gigafactory capex costs?

This data-file captures battery Gigafactory capex costs, by region, by chemistry, by company and over time, by looking across a sample of 40 major projects. Capex costs average $80/kWh-pa of capacity. Each GWH pa of capacity is associated with 70 full-time employees.

-

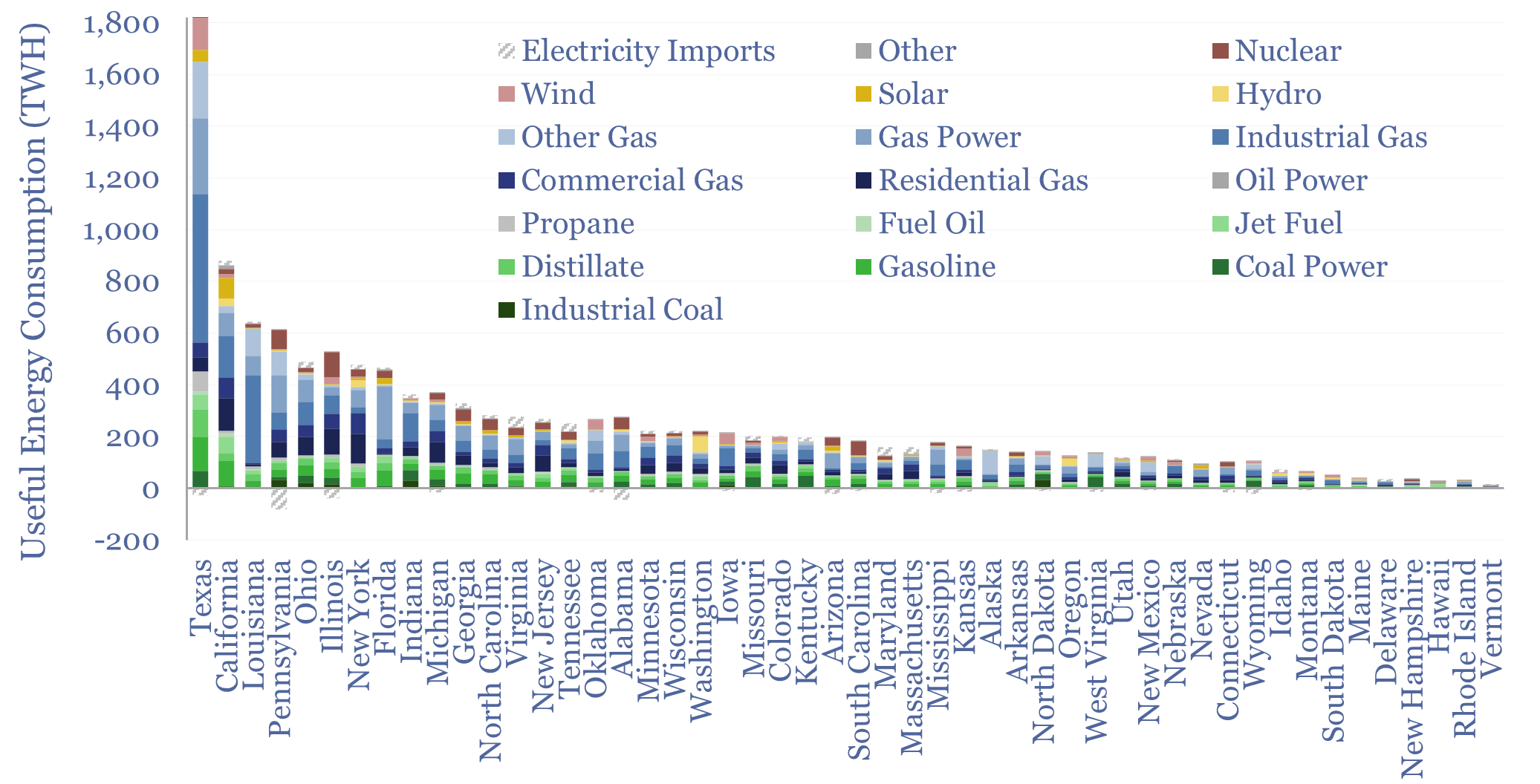

US energy consumption by State and by source?

Total useful energy consumption in the US runs at 12,500 TWH pa, or 37 MWH pp pa. But this data-file disaggregates useful US energy consumption by State and by energy source, from 2000 to 2024. The US energy system is not a monolith, but full of amazing regional variation.

-

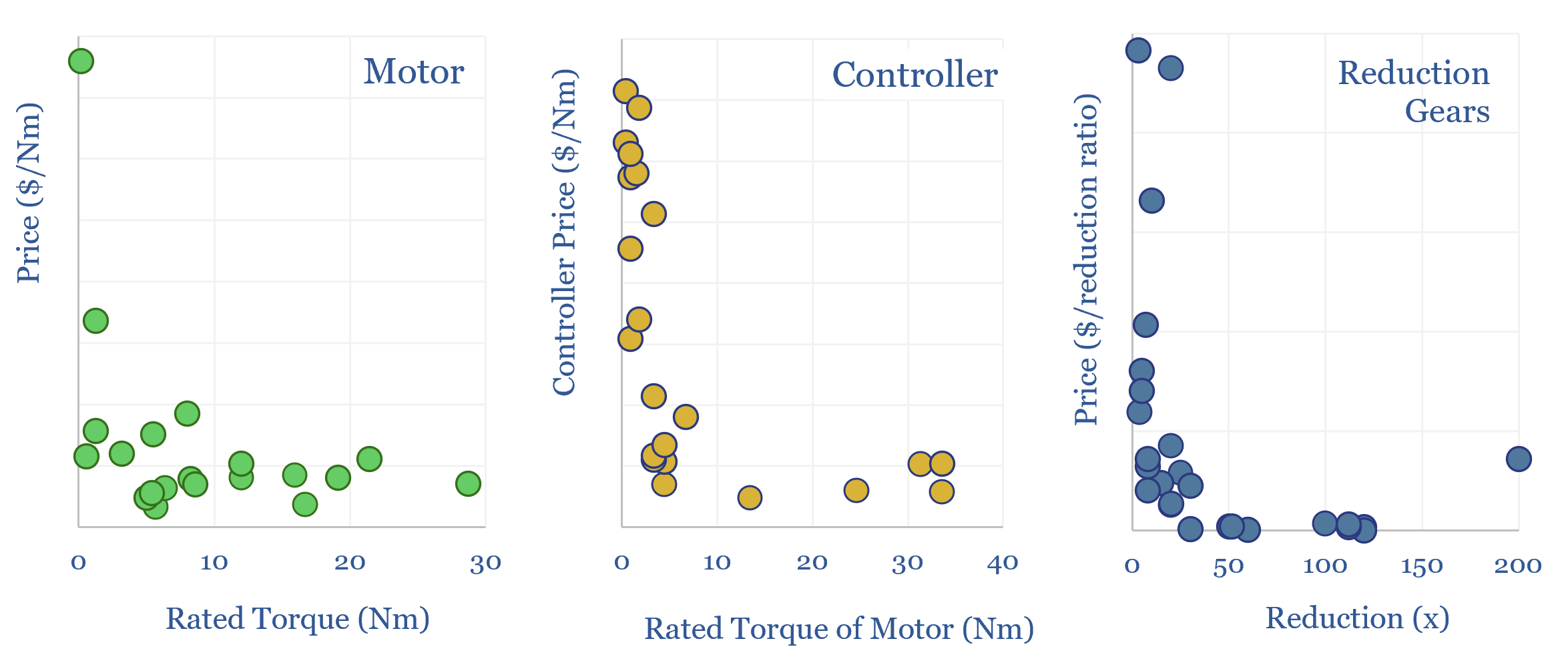

Servo motors: cost calculator?

Servo motors form a $16bn pa market, used in robotics, precision manufacturing equipment, CNC machines, aerospace and med-tech. This data-file estimates the costs of servo-motors, based on underlying controller costs, motor costs and reduction gear costs. Hence we have attempted a simple servo motor cost calculator.

-

Peak power demand by region (and case studies)

This data-file tracks the timing and magnitude of peak power demand, across different grids in the North Hemisphere, with case studies. This matters for grid-planning, gas peakers and batteries. In the US, peak demand is typically driven by high AC loads in summer heatwaves. In Europe’s milder climate, only c10% of homes have AC, and…

-

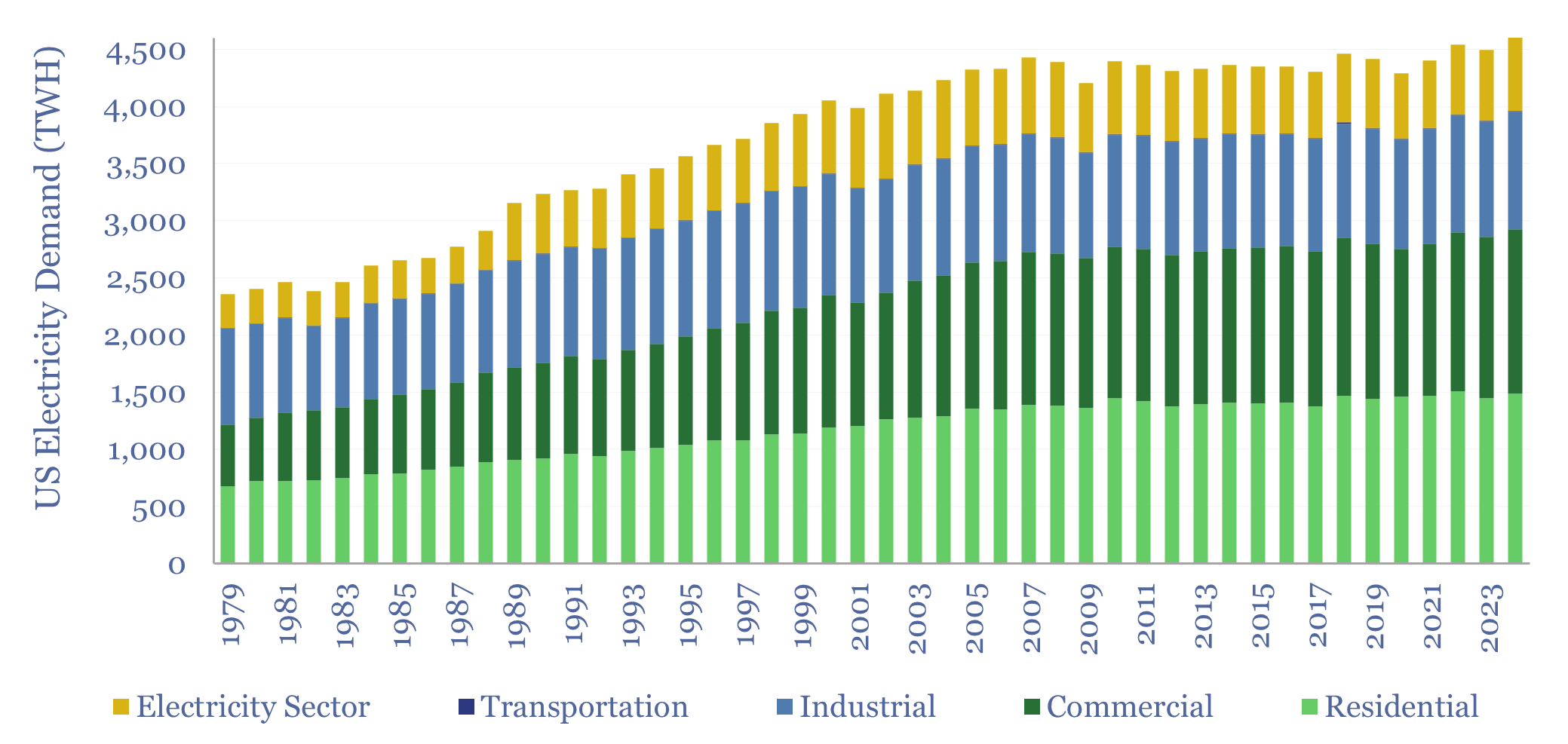

US electricity demand: by sector, by use, over time?

US electricity sales reached 4,000 TWH in 2024, rising +2.3% YoY, and bringing the trailing ten-year CAGR to 0.5% pa. The current breakdown is 38% residential, 36% commercial, 26% industrial. All three are now growing. To help understand load growth, this data-file is a breakdown of US electricity demand by sector, by use and over…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (353)