Materials

-

Energy economics: an overview?

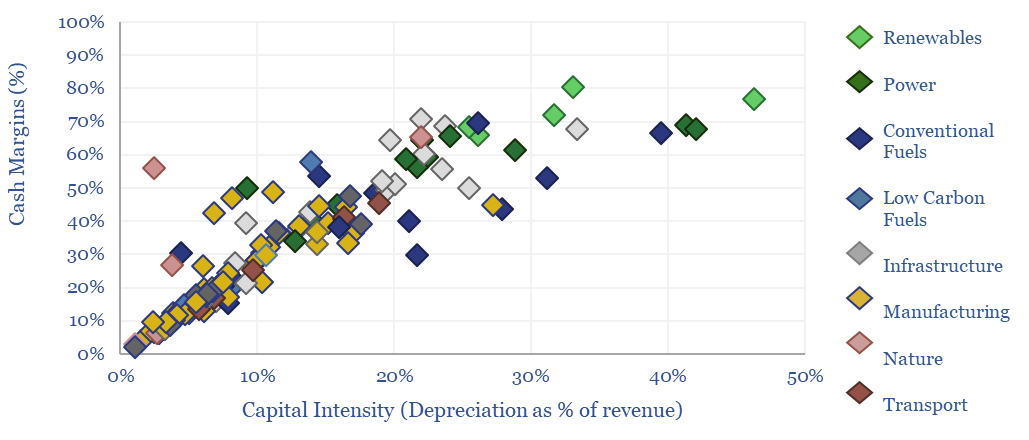

This data-file provides an overview of energy economics, across 175 different economic models constructed by Thunder Said Energy, in order to put numbers in context. This helps to compare marginal costs, capex costs, energy intensity, interest rate sensitivity, and other key parameters that matter in the energy transition.

-

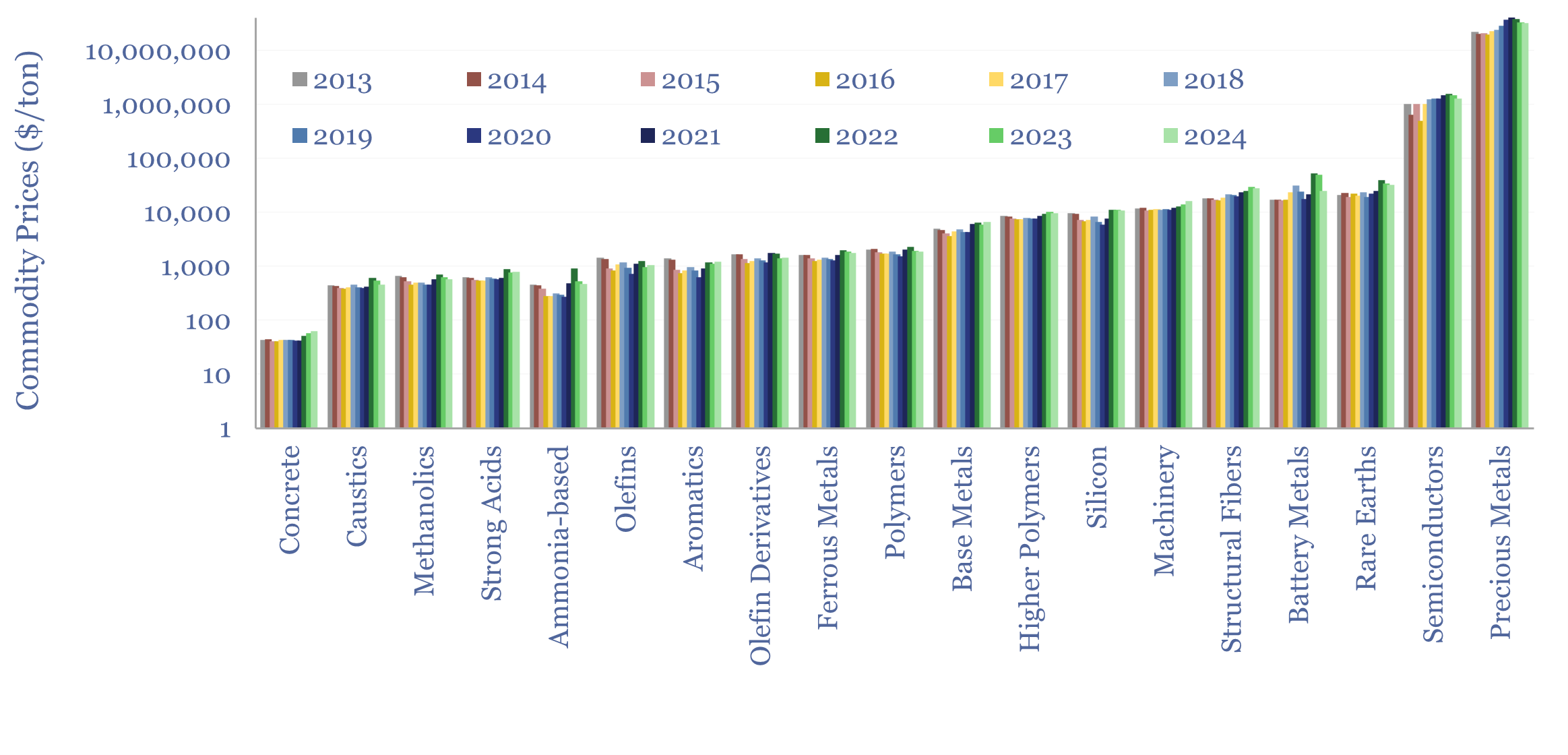

Commodity prices: metals, materials and chemicals?

Annual commodity prices are tabulated in this database for 70 material commodities, as a useful reference file; covering steel prices, other metal prices, chemicals prices, polymer prices, with data going back to 2012, all compared in $/ton. We have updated the data-file for 2024 data in May-2025.

-

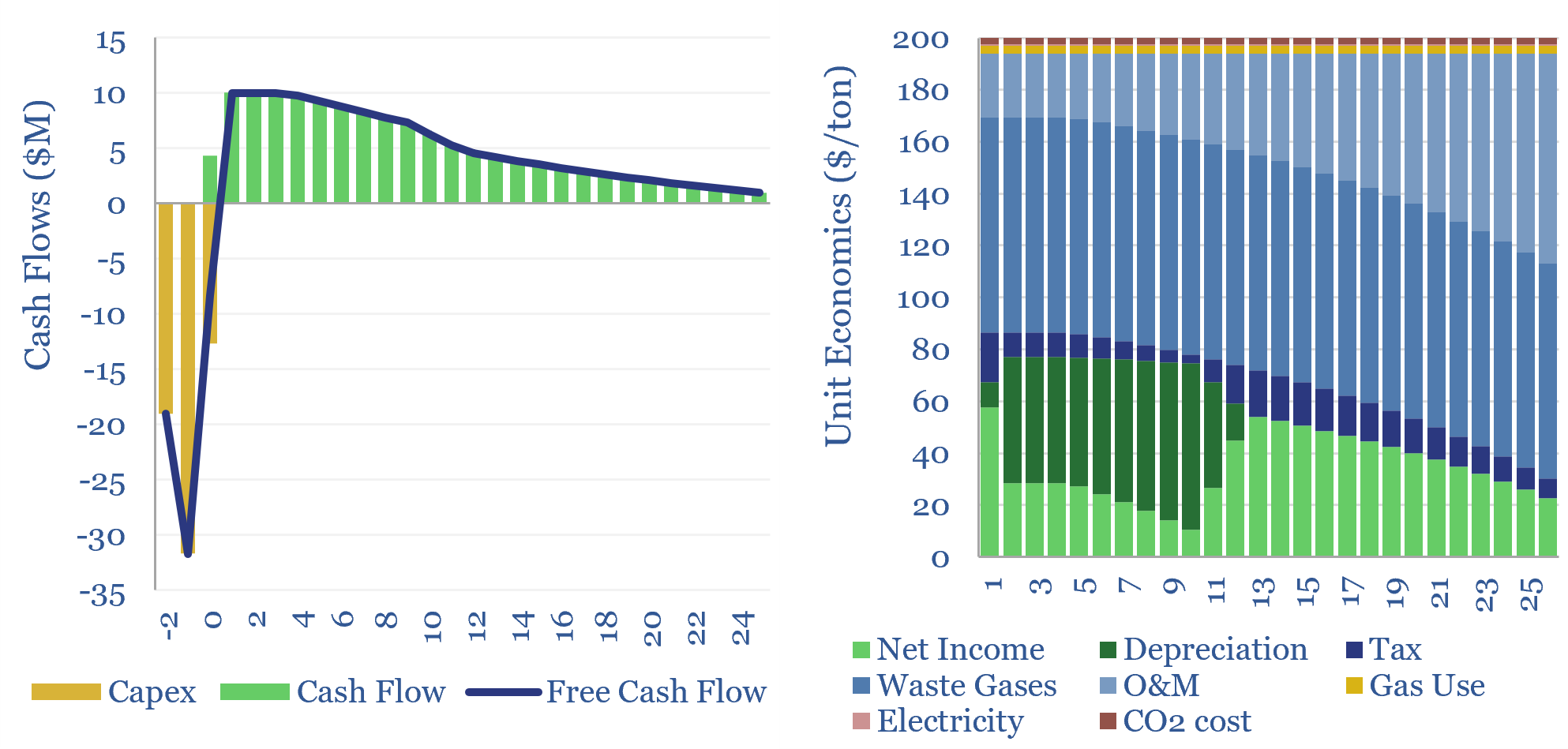

Helium production: the economics?

This economic model captures the production costs of helium, which is cryogenically extracted from low concentrations in natural gas. $200/mcf helium prices can support 10% IRRs on a resource with 2% helium content. $400-1,000/mcf spot prices can unlock 50-100% IRRs and trigger a capex boom. Economics can be stress-tested in this data-file.

-

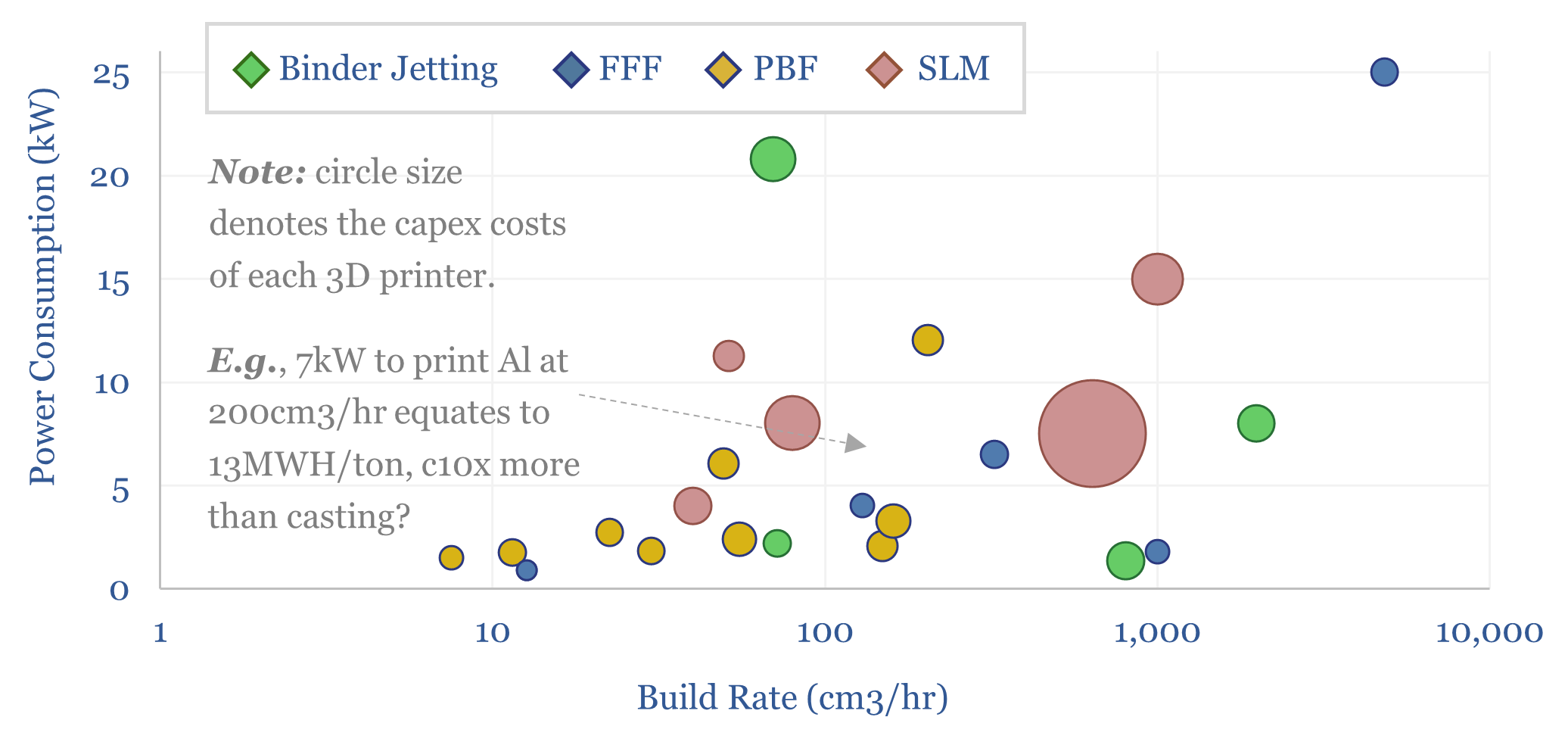

Additive manufacturing: fine print?

Can additive manufacturing overcome bottlenecks in gas turbine components, aerospace-related capital goods, and custom products that are unlocked by AI? This 16-page report re-evaluates the outlook for 3D printing, its economics, energy use, and company implications.

-

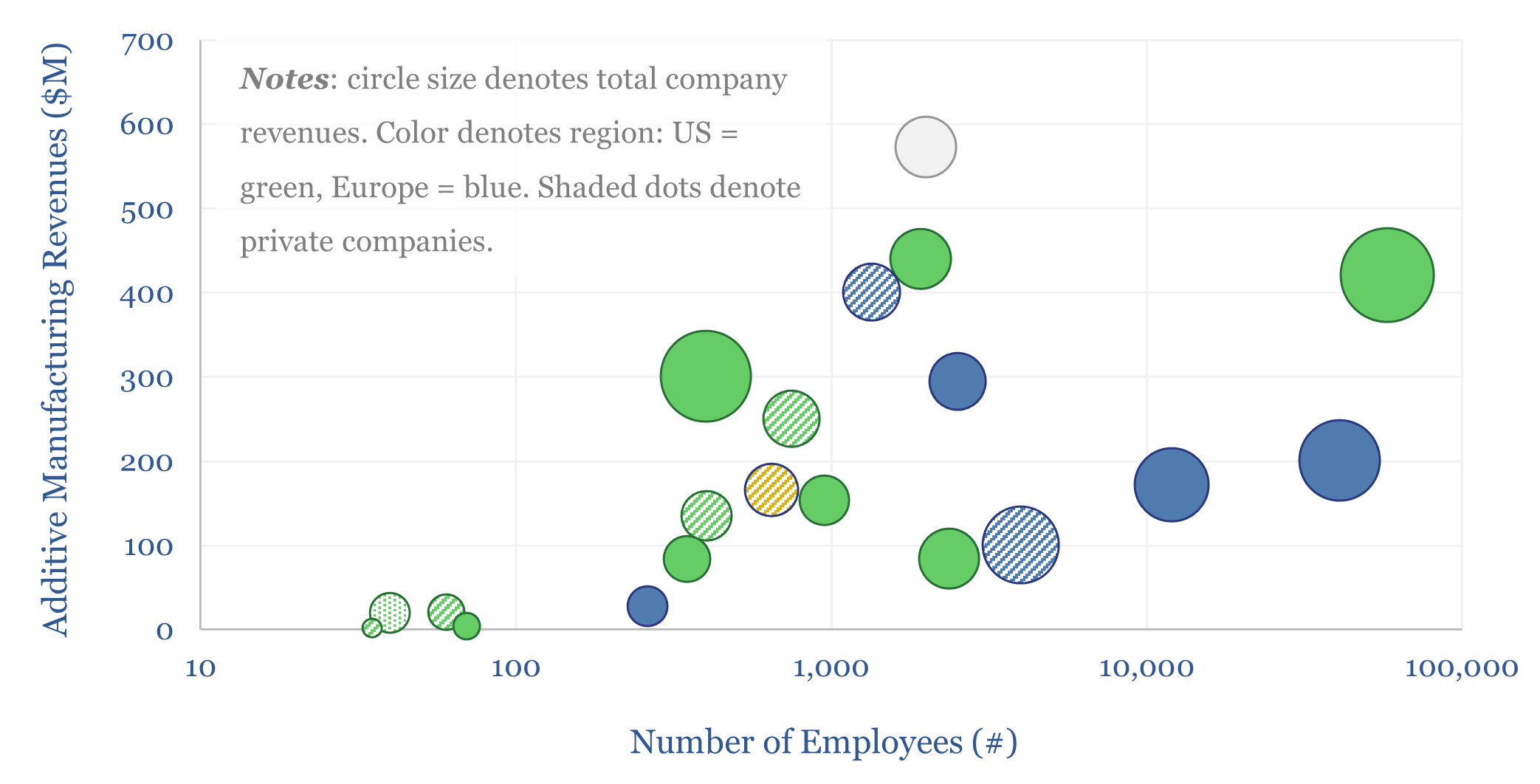

Additive manufacturing: technology leaders?

Additive manufacturing companies are screened in this data-file, across 20 technology leaders. We have also tabulated 25 case studies, where AM reduces weight by 40%, cost by 50%, and lead-time by 60%. The industry remains highly competitive. But could it be turning a corner? Especially for metal components in capital goods and aerospace?

-

Investment casting: the economics?

Investment casting is fast and scalable, especially when producing hundreds-thousands of metal parts. $5/kg unlocks a 10% IRR on a 70% utilized metal-casting plant with $2,000/Tpa of capex, producing a typical 10kg aluminium product. This data-file captures the costs of investment-cast products, which can be stress-tested. 115MTpa of metals are cast every year, of which…

-

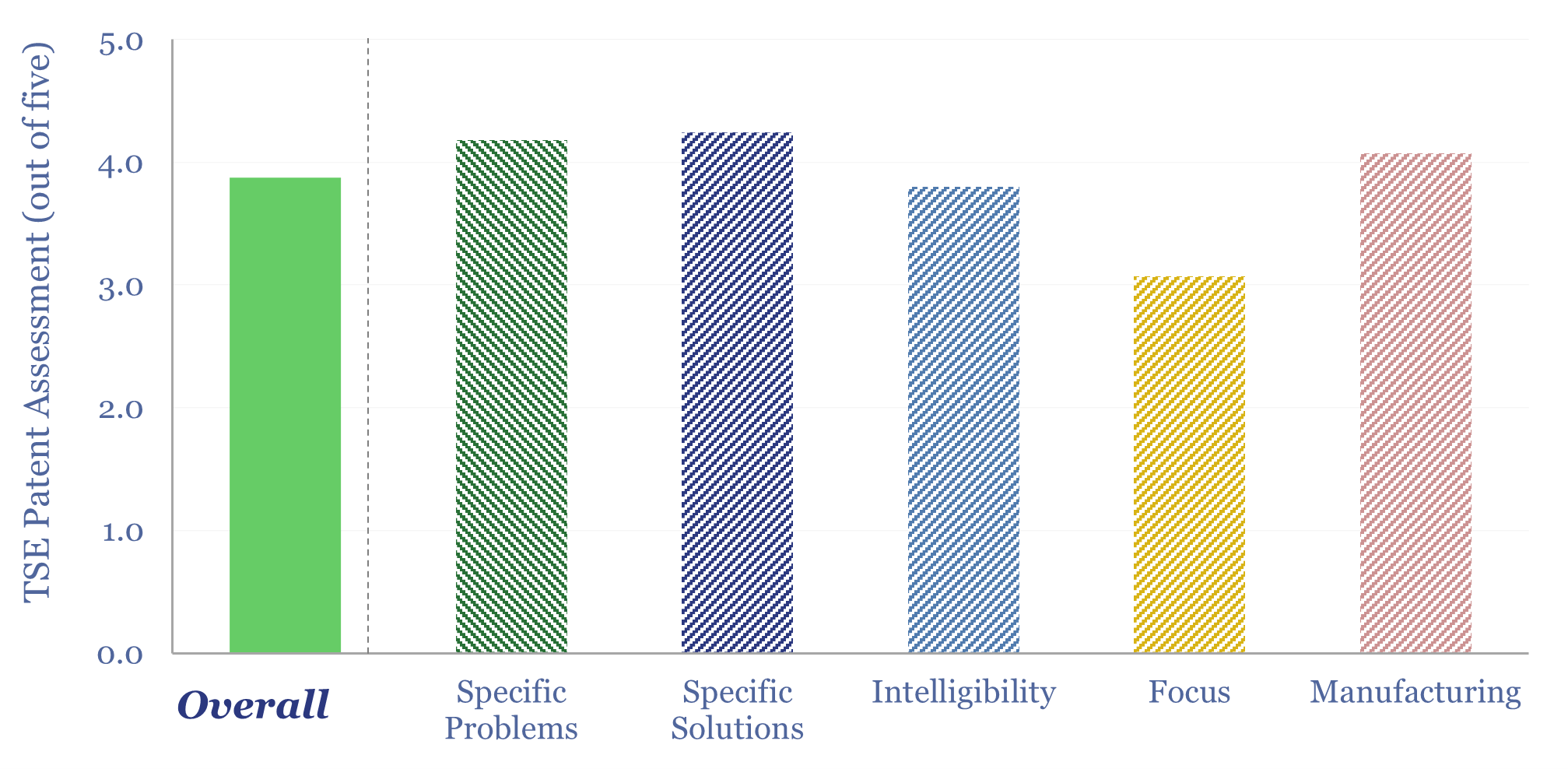

Microwave Chemical: electrical heating?

Microwave Chemical is a small-cap company, developing microwave-based heating solutions, across over a dozen use cases, from acrylic recyling, to producing food/cosmetic compounds, to carbon fiber (particularly interesting!). We reviewed a dozen of the company’s patents in this data-file, which is a Microwave Chemical technology review and finds a moat in efficient microwave heating.

-

Leilac low-carbon cement technology?

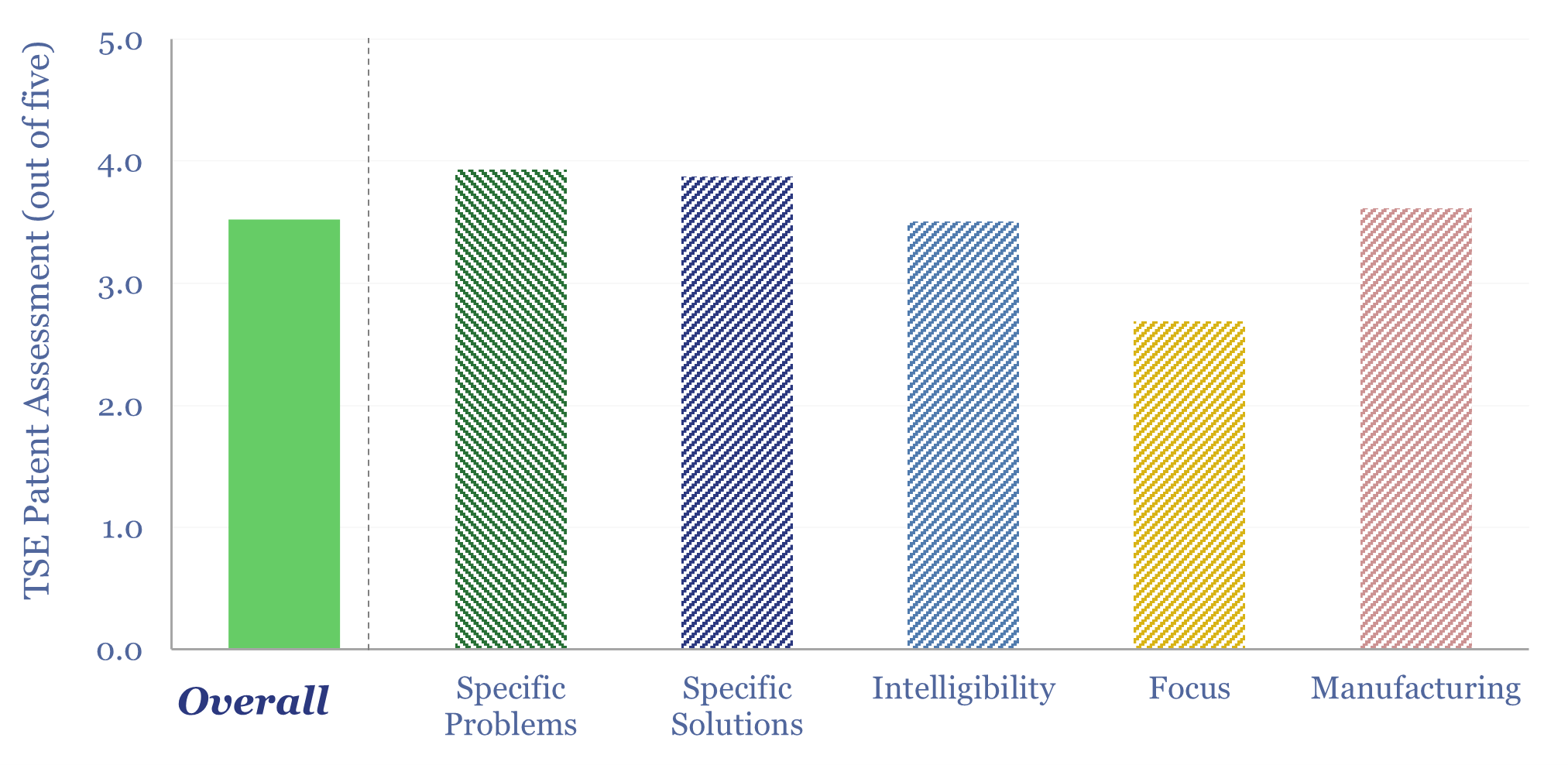

This data-file explores Leilac low-carbon cement technology, which separates the calcination stage, within an indirectly heated reactor, so that 98% pure CO2 can be gathered and sequestered, with requiring post-combustion CCS (amines). Patents from parent company, Calix, lock up the technology, with clear and intelligible details, although this also shows where the challenges are.

-

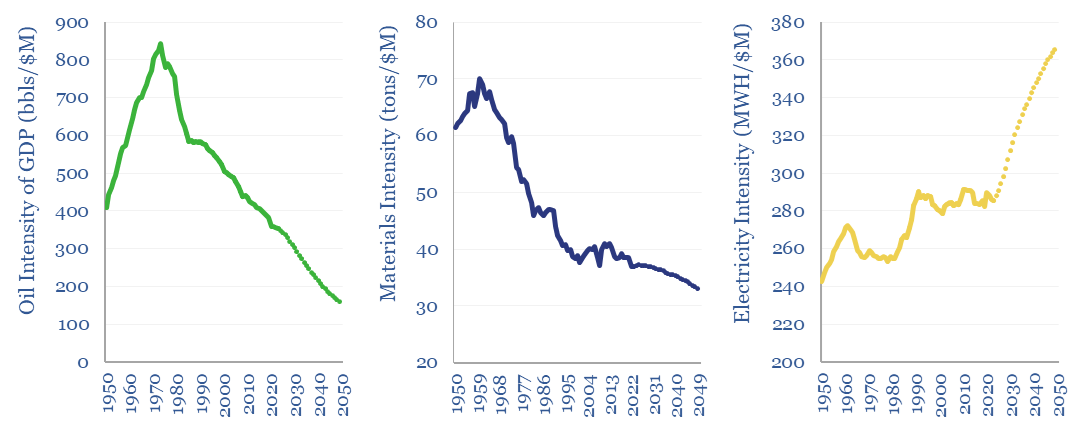

Commodity intensity of global GDP in 30 key charts?

The commodity intensity of global GDP has fallen at -1.2% over the past half-century, as incremental GDP is more services-oriented. So is this effect adequately reflected in our commodity outlooks? This 4-page report plots past, present and forecasted GDP intensity factors, for 30 commodities, from 1973->2050. Oil is anomalous. And several commodities show rising GDP…

-

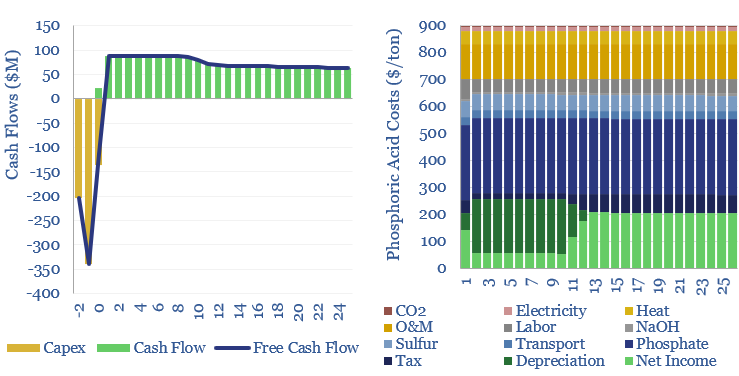

Phosphoric acid production costs?

Phosphoric acid production costs are $500-900/ton, for a 10% IRR on a new facility, with $1,000-2,000/Tpa of capex. This is using the ‘wet process’, where phosphate ores are reacted with sulfuric acid. CO2 intensity is 0.6 tons/ton. However, the numbers depend on product purity. There is also a 10x higher carbon, yet potentially lower-cost process,…

Content by Category

- Batteries (88)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (93)

- Data Models (834)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (203)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (278)

- LNG (48)

- Materials (82)

- Metals (79)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (127)

- Renewables (149)

- Screen (116)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (352)