Patents

-

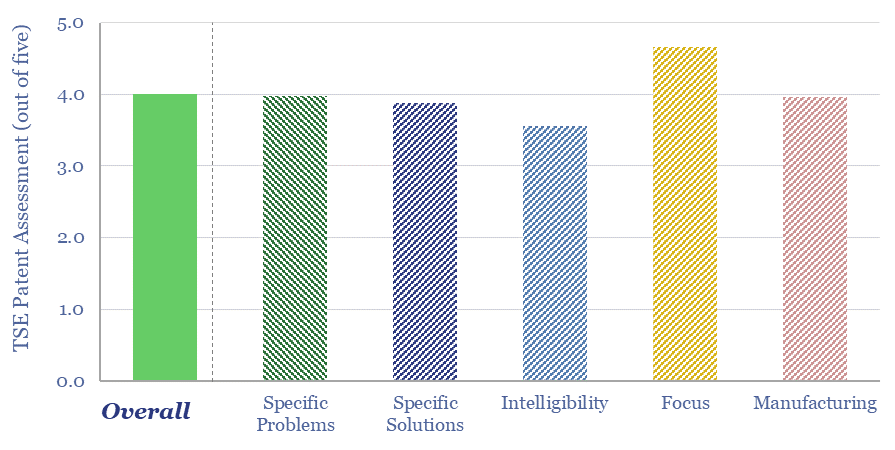

Mainspring Energy: linear generator breakthrough?

Linear generator technology can convert any gaseous fuel into electricity, with c45% electrical efficiency, and >80% efficiency in CHP mode. This data-file reviews Mainspring Energy’s patents. We conclude that the company has locked up the IP for piston-seal assemblies in a linear generator with air bearings, but longevity/maintenance could be a key challenge to explore.

-

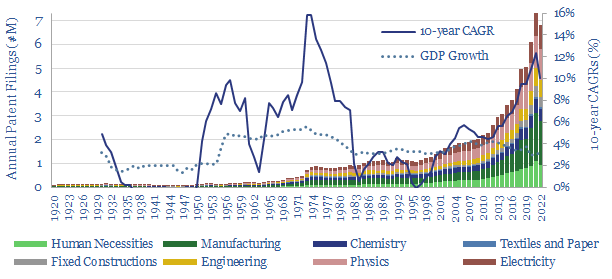

Global patent filings: by region, by industry, over time?

Global patent filings numbered 7M in 2022, rising at a 10% CAGR, suggesting that the pace of global technology is accelerating. The patent filings also provide support for megatrends such as rising commodity demand, digitalization and electrification. However, 79% of all patents globally are now filed in China, while the US is also very strong,…

-

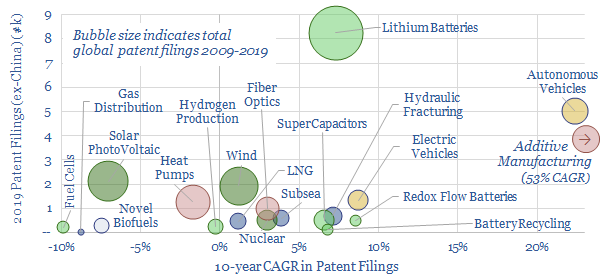

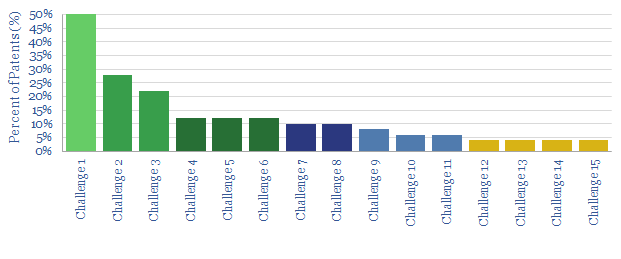

Energy transition technologies: the pace of progress?

This data-file captures over 250,000 patents (ex-China) to assess the pace of progress in different energy transition technologies, yielding insights into batteries (high activity), autonomous vehicles and additive manufacturing (fastest acceleration), wind and solar (maturing), fuel cells and biofuels (waning) and other technologies.

-

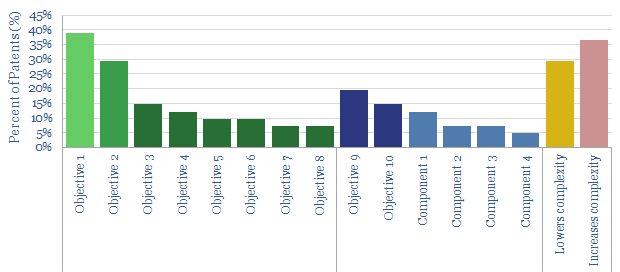

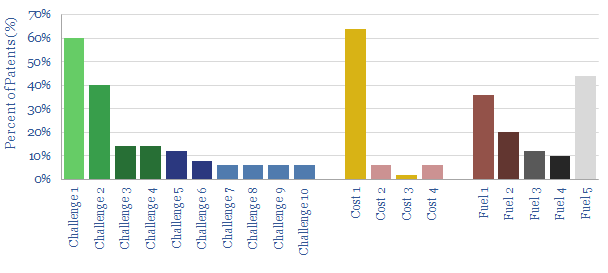

LNG liquefaction: what challenges and opportunities?

This data-file reviews 40 recent LNG patents, to draw conclusions and identify leading companies. Lowering capex costs matters, but should not be done at the expense of higher opex or emissions. The next generation of modular plants offer a step-change improvement. And new process technologies are also coming through.

-

Enhanced geothermal: technology challenges?

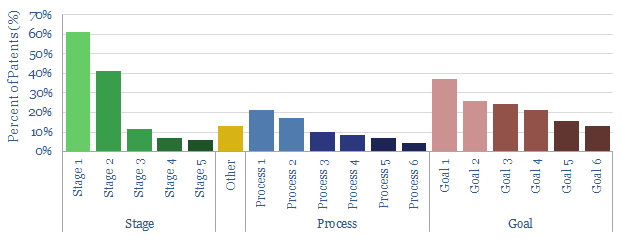

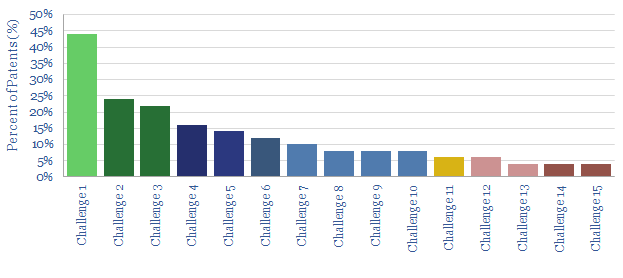

This data-file tabulates the greatest challenges and focus areas for harnessing deep geothermal energy, based on reviewing 30 recent patents from 20 companies in the space. We conclude that recent advances from the unconventional oil and gas industry are going to be a crucial enabler.

-

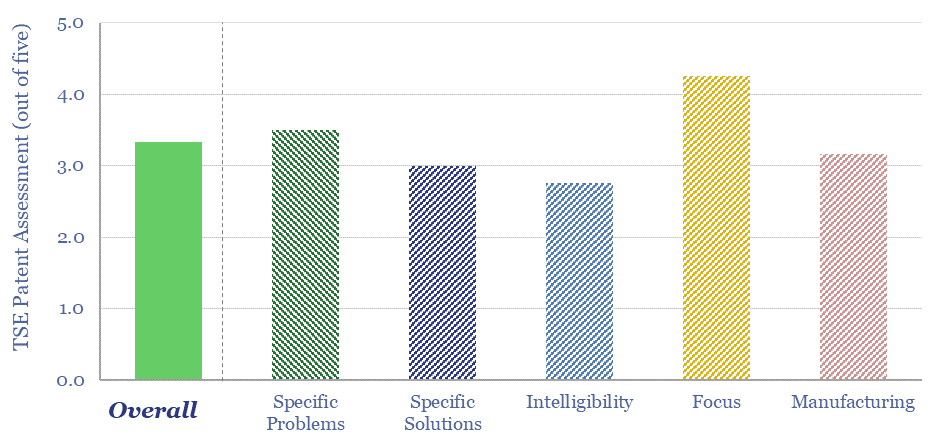

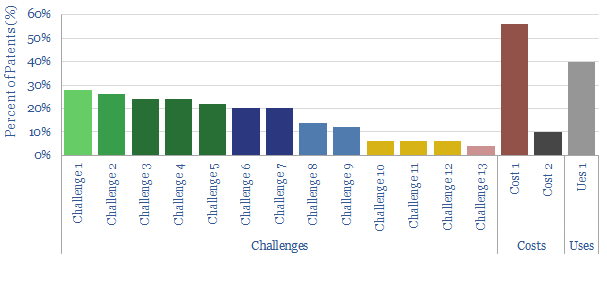

Proton exchange membrane fuel cells: what challenges?

This data-file reviews fifty patents into proton exchange membrane fuel cells, filed by leading companies in the space in 2020, in order to understand the key challenges the industry is striving to overcome. The key focus areas are controlling temperature, humidity and longevity, but unfortunately this will tend to increase costs.

-

Solid oxide fuel cells: what challenges?

This data-file reviews fifty patents into solid oxide fuel cells, filed by leading companies in 2020. The key focus areas are improving the longevity and efficiency of SOFCs. But unfortunately, we find many of the proposed solutions are likely to increase end costs. Potential is interesting, but deflation may take longer.

-

Electric vehicle charging: what challenges?

We review fifty patents from leading companies in EV charging. Complex algorithms will be required to ensure grid stability. Vehicle-manufacturers are concerned about balancing convenience and costs. While interestingly, “fast charging” does not appear to be a primary focus.

-

Solar power: what challenges?

This data-file reviews 70 patents filed by leading solar manufacturers in 2020. We expect double-digit deflation to continue, while solar panels will also gain greater efficiency and longevity. The cutting edge is now in current collectors. Examples and improvements areas are described for each company.

-

Hydrogen production via electrolysis: what challenges?

This data-file tabulates challenges for the production of green hydrogen via the electrolysis of water, based on the recent patent literature. Our overall conclusion is to be circumspect. Some sources of deflation compromise efficiency, safety, longevity and reliability.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (837)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (278)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (129)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (353)