Power Grids

-

Overview of inertia in renewable-heavy grids?

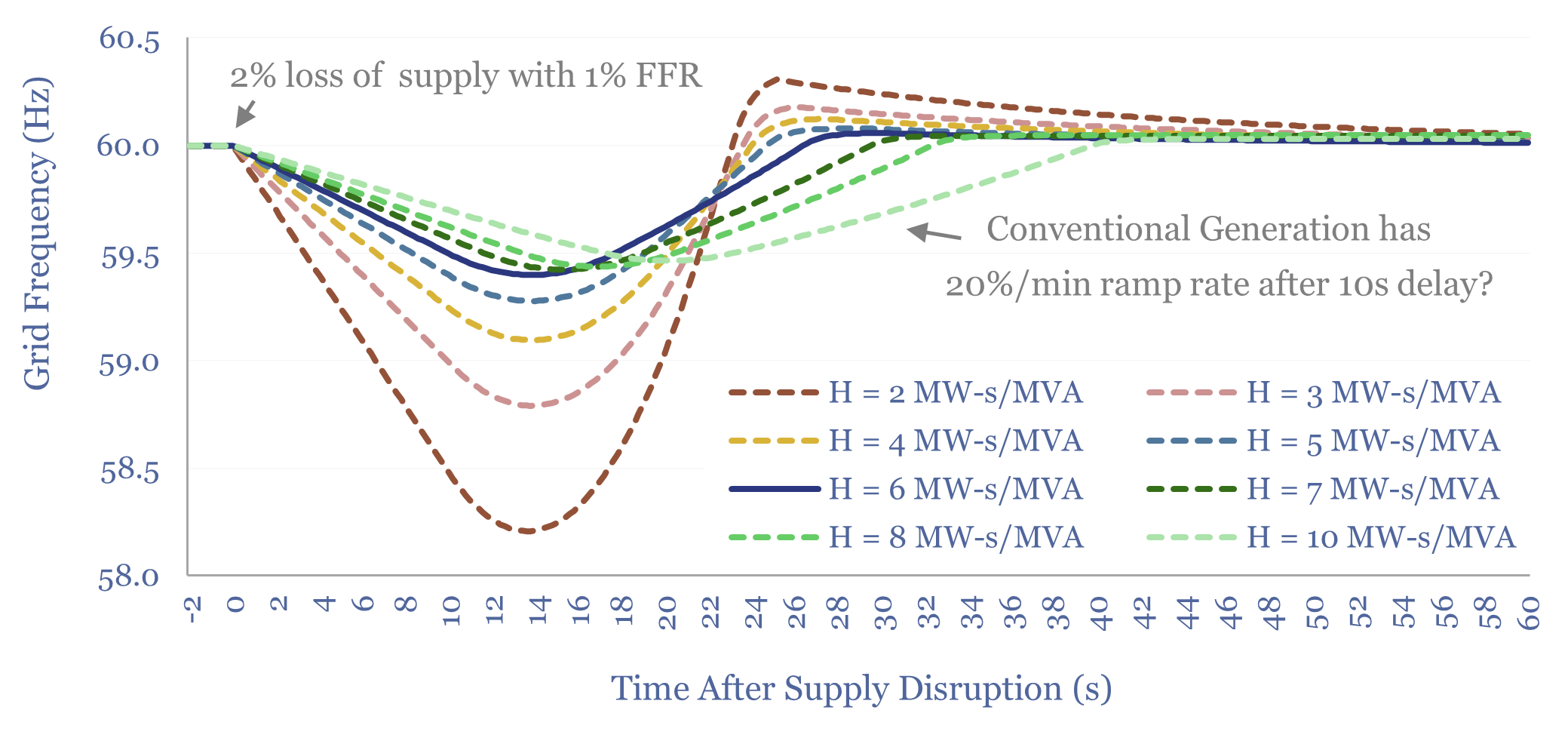

This overview of inertia in renewable-heavy grids tabulates the typical inertia of rotating generators, then models the resultant Rate of Change of Frequency (ROCOF) during supply-disruptions. In our base case, a grid with 6 MW-s/MVA of inertia rides through a 2% supply-disruption, buffered by 1% fast frequency reponse (FFR), via lowering grid frequency from 60Hz…

-

Data center energy: caps lock?

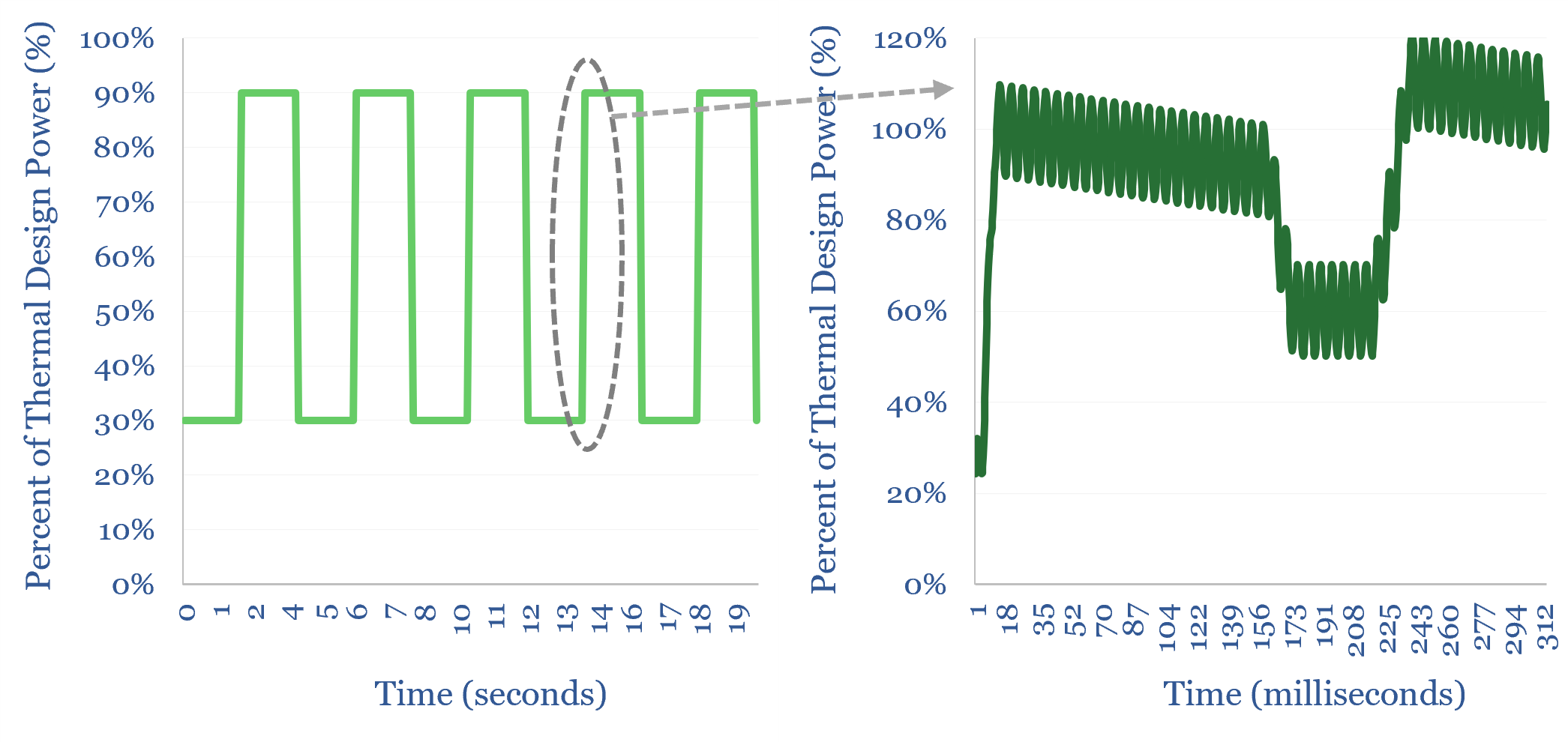

Everybody knows “AI data centers use round-the-clock power”. Yet one of the biggest power challenges for AI data data centers is precisely that they do not use round-the-clock power. They incur large load transients that cannot be handled by batteries, power grids or most generation. This 15-page report explores data center load profiles, which may…

-

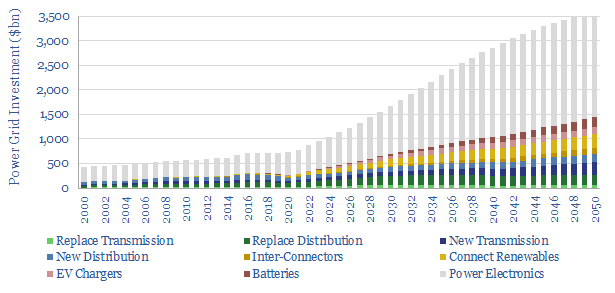

Power grids: opportunities in the energy transition?

Power grids move electricity from the point of generation to the point of use, while aiming to maximize the power quality, minimize costs and minimize losses. Broadly defined, global power grids and power electronics investment must step up 5x in the energy transition, from a $750bn pa market to over $3.5trn pa. But this theme…

-

Economics of flywheels: fast frequency response?

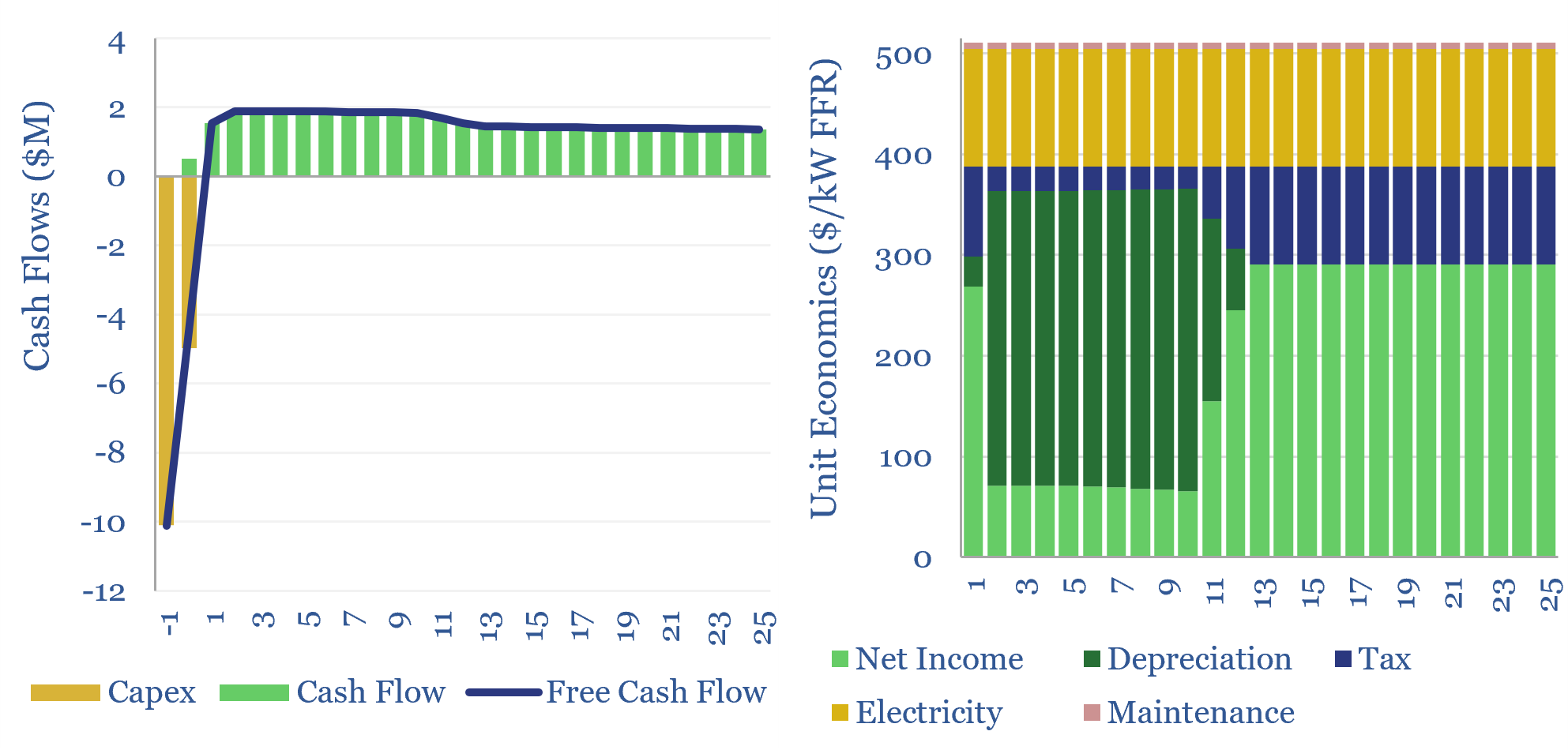

The economics of flywheels can be stress-tested in this data-file, requiring a $500/kW fee for fast-frequency response, to generate a 10% IRR on c$10,000/kWh of capex costs, on a typical flywheel plant with around 15-minutes of energy storage. The rise of renewables and AI increasingly requires adding inertia to power grids. Flywheels may be one…

-

Gas generation: what kind of bear is best?

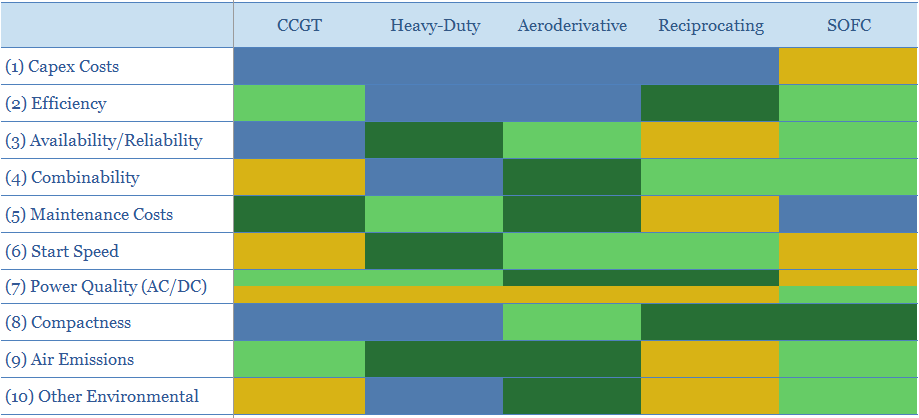

This 17-page report compares combined cycle gas turbines (CCGTs), heavy-duty gas turbines, aeroderivative gas turbines, reciprocating engines and solid oxide fuel cells (SOFCs), on ten dimensions. No one gas generation technology is best. But modular solutions may increasingly rival CCGTs, especially for energizing AI data-centers?

-

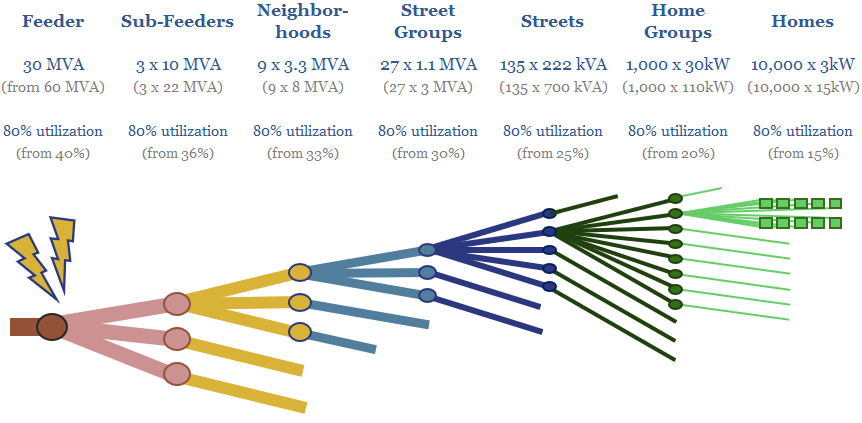

Wicked smart: what if AI re-shaped the power grid?

What if AI re-shaped the power grid? This 16-page report sees potential to halve levelized T&D costs; de-bottleneck 4.5% pa of global electricity demand growth; and shift over $100bn pa of spending away from high-voltage capital goods to low-voltage smart devices and networking equipment.

-

Smart meter installations by region over time?

Our smart meter data-file cpatures 1.1bn global smart meter installations by region and over time. Smart meters automate the submission of consumption data to the grid, while opening the door to real-time monitoring and load disaggregation, which can reduce total demand by 9% and peak demand by 13%. Opportunities are growing alongside AI. Leading companies…

-

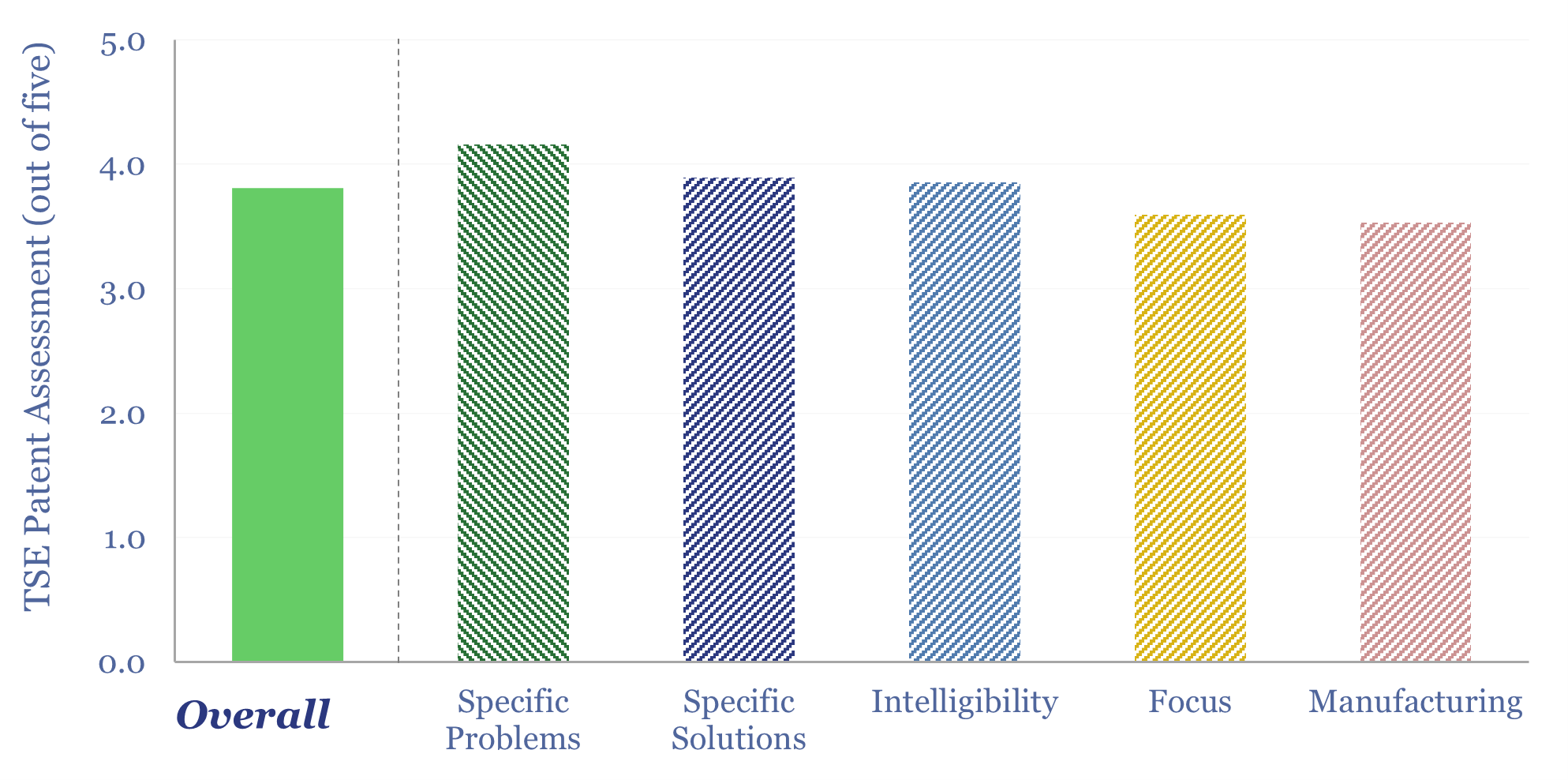

Itron: smart energy network technology?

Itron is a US-leader in smart energy meters and smart energy networks. Once you have these smart meters widely deployed across the electricity network, you can start to do really interesting things. This data-file gathers concrete examples of Itron’s smart energy network technology, based on reviewing 15 patents.

-

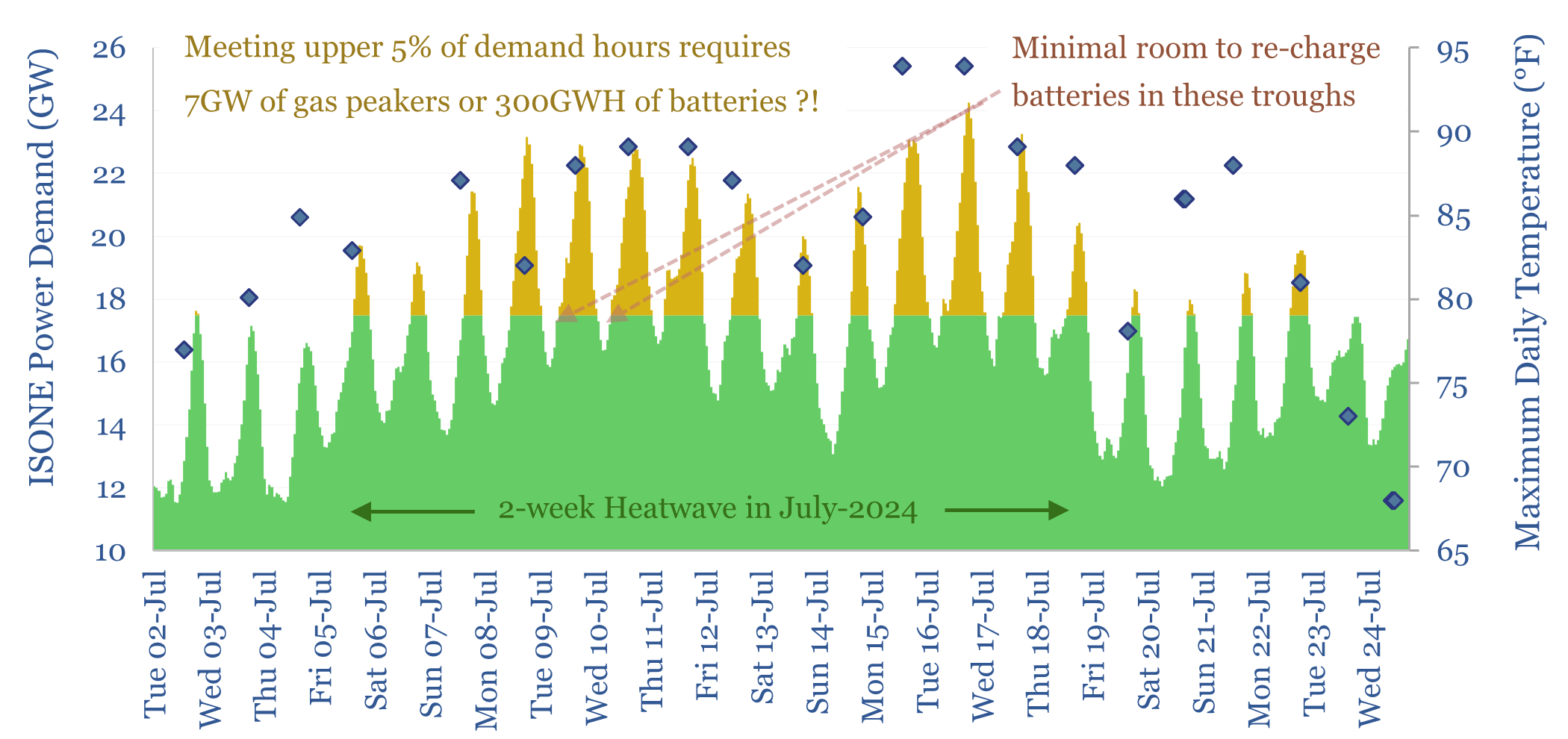

Peak loads: can batteries displace gas peakers?

Peak loads in power grids are caused by heatwaves (in the US) and cold snaps (in Europe), which last 2-14 days. This 16-page report finds that very large batteries would be needed to ride through these episodes, costing 2-20x more than gas peakers. But the outlook differs interestingly between the US vs Europe.

-

Peak power demand by region (and case studies)

This data-file tracks the timing and magnitude of peak power demand, across different grids in the North Hemisphere, with case studies. This matters for grid-planning, gas peakers and batteries. In the US, peak demand is typically driven by high AC loads in summer heatwaves. In Europe’s milder climate, only c10% of homes have AC, and…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (353)