Renewables

-

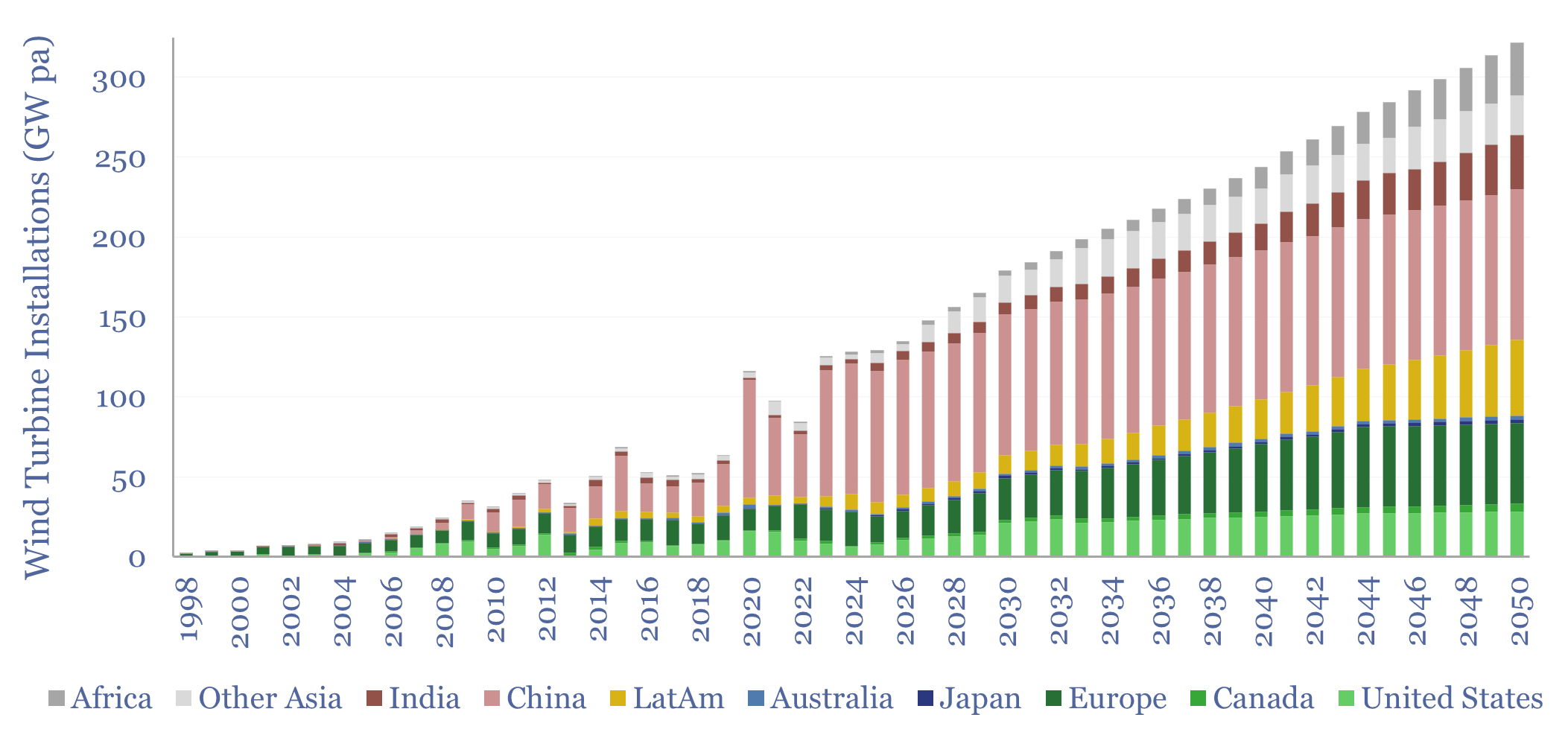

Wind energy: beyond good and evil?

Wind economics are not good or bad in absolute terms. They depend on capacity factors, which average 26% globally, but can range from 10% to 60%. In the best locations, levelized costs are below 4c/kWh. Hence this 16-page note explores global wind capacity factors and updates our wind outlook by region throgh 2050.

-

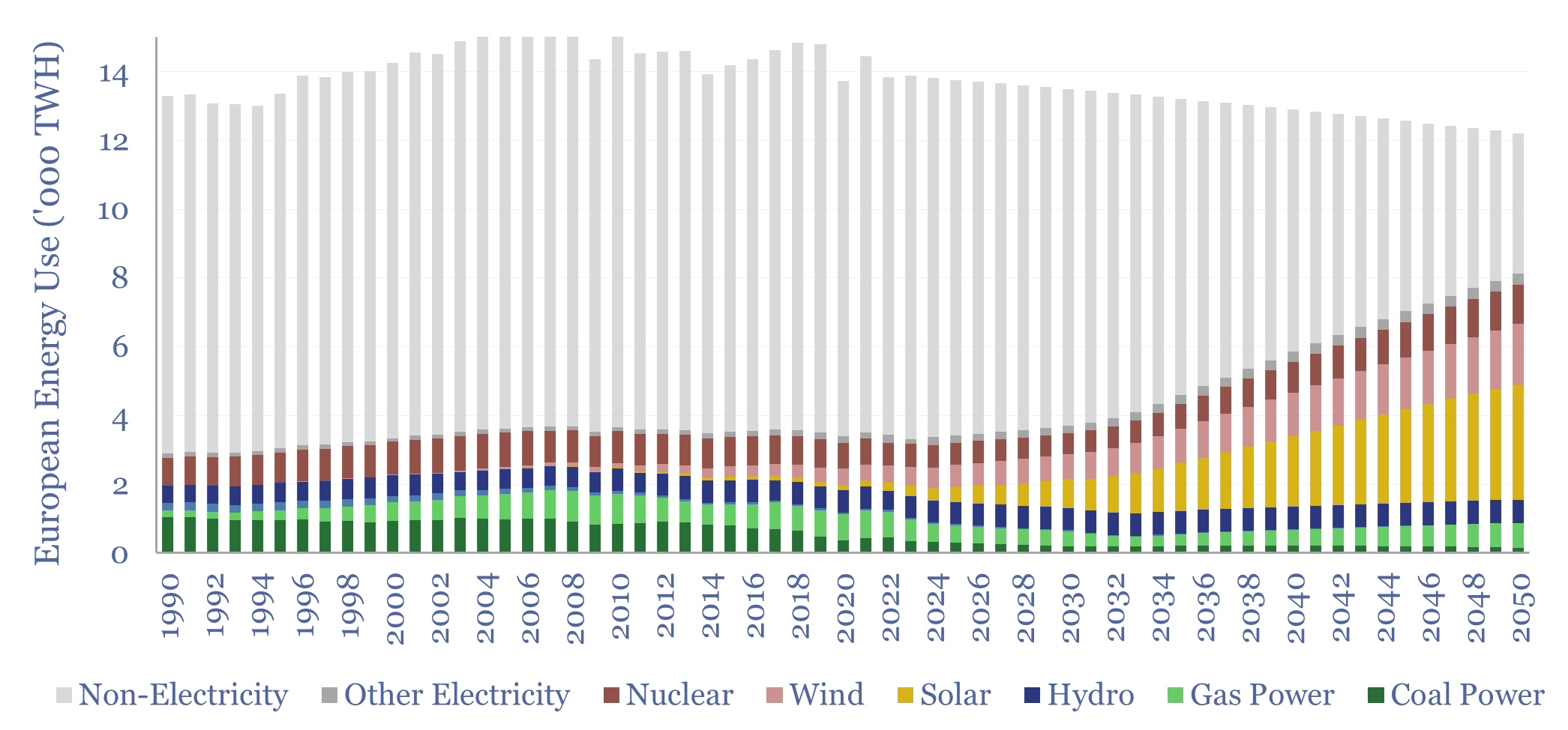

European energy: the burial of the dead?

Europe’s energy ambitions are now intractable: It is just not feasible to satisfy former climate goals, new geopolitical realities, and also power future AI data centers. Hence this 18-page report evaluates Europe’s energy options; predicts how policies are going to change; and re-forecasts Europe’s gas and power balances, both to 2030 and to 2050.

-

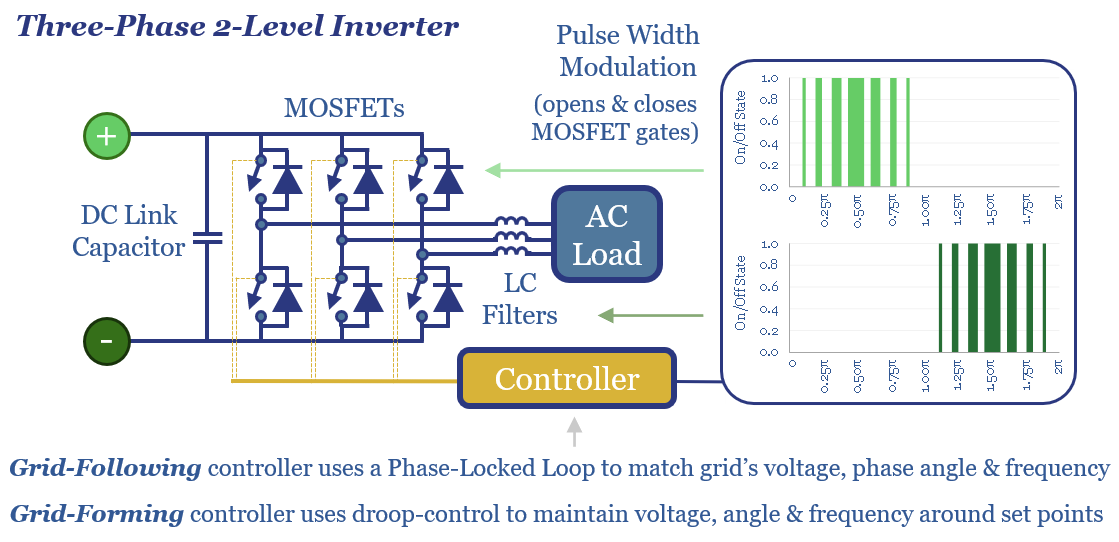

Grid-forming inverters: islands in the sun?

The grid-forming inverter market may soon inflect from $1bn to $15-20bn pa, to underpin most grid-scale batteries, and 20-40% of incremental solar and wind. This 11-page report finds that grid-forming inverters cost c$100/kW more than grid-following inverters, which is inflationary, but integrate more renewables, raise resiliency and efficiency?

-

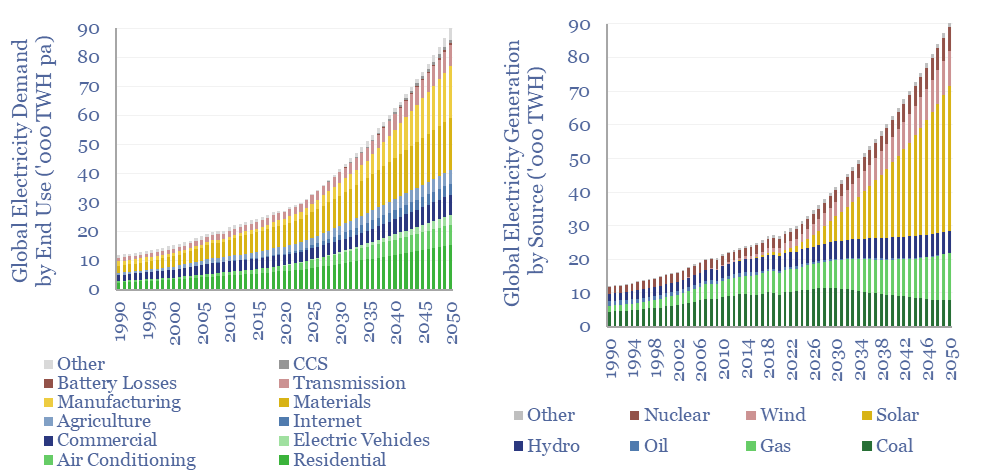

Global electricity: by source, by use, by region?

Global electricity supply-demand is disaggregated in this data-file, by source, by use, by region, from 1990 to 2050, triangulating across all of our other models in the energy transition, and culminating in over 50 fascinating charts, which can be viewed in this data-file. Global electricity demand rises 3x by 2050 in our outlook.

-

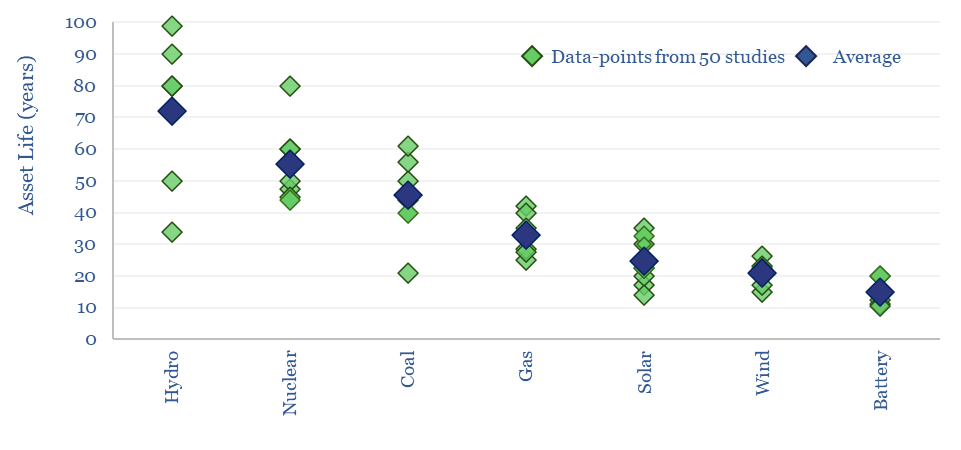

Power generation: asset lives?

Power generation asset lives average c70-years for large hydro, 55-years for new nuclear, 45-years for coal, 33-years for gas, 20-25 years for wind/solar and 15-years for batteries. This flows through to LCOE models. However, each asset type follows a distribution of possible asset lives, as tabulated and contrasted in this data-file. Asset lives of power…

-

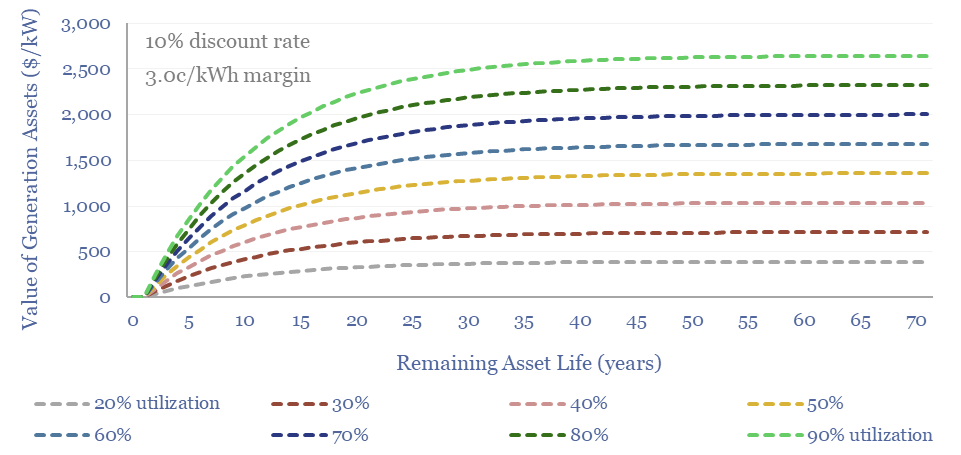

Purchasing power: what are generation assets worth?

There has never been more controversy over the fair values of power generation assets, which hinge on their remaining life, utilization, flexibility, power prices, rising grid volatility and CO2 credentials. This 16-page guide covers the fair values of generation assets, hidden opportunities and potential pitfalls.

-

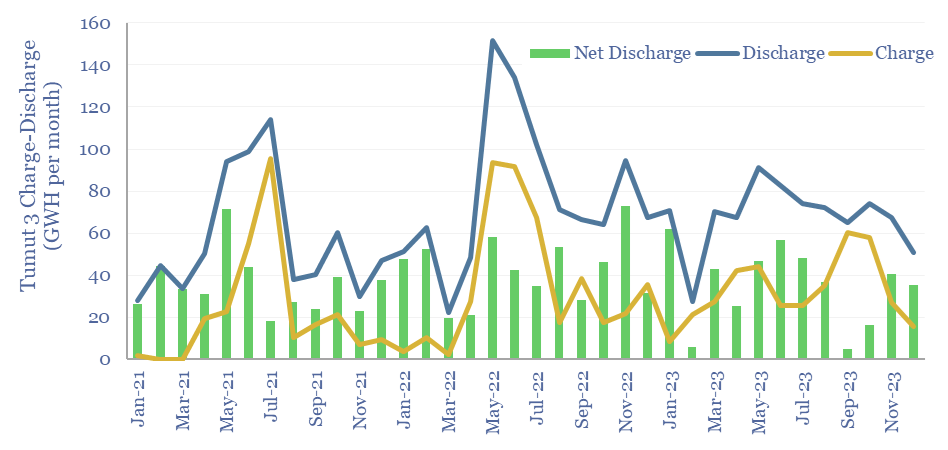

Pumped hydro: generation profile?

Pumped hydro facilities can provide long-duration storage, but the utilization rate is low, and thus the costs are high, according to today’s case study within the Snowy hydro complex in Australia. Tumut-3 can store energy for weeks-months, then generate 1.8 GW for 40+ hours, but it is only charging/dischaging at 12% of its nameplate capacity.

-

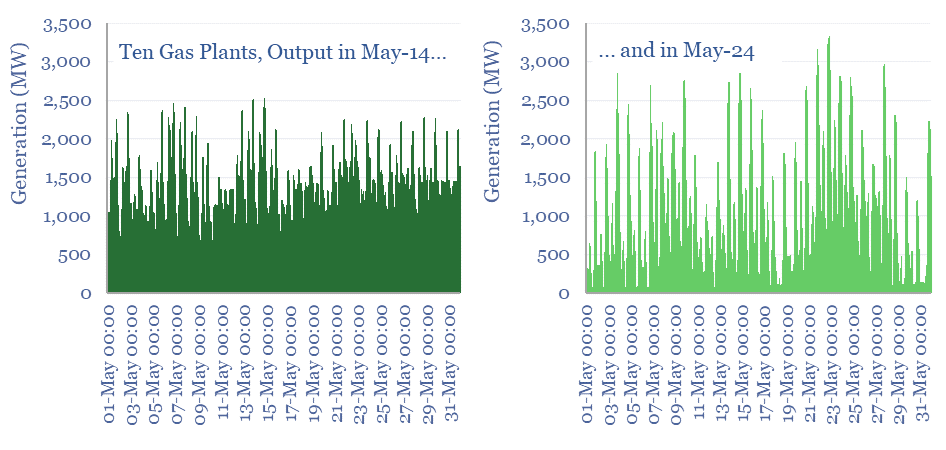

Back up: does ramping renewables displace gas?

This 12-page note studies the output from 10 of the largest gas power plants in Australia, at 5-minute intervals, comparing 2024 versus 2014. Ramping renewables to c30% of Australia’s electricity mix has not only entrenched gas-fired back-up generation, but actually increased the need for peakers?

-

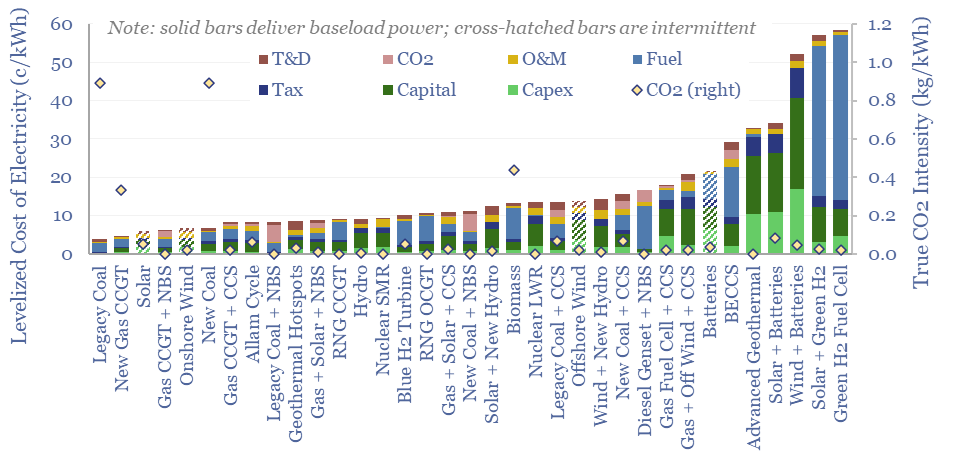

Levelized cost of electricity: stress-testing LCOE?

This data-file summarizes the levelized cost of electricity, across 35 different generation sources, covering 20 different data-fields for each source. Costs of generating electricity can vary from 2-200 c/kWh. The is more variability within categories than between them. Numbers can readily be stress-tested in the data-file.

-

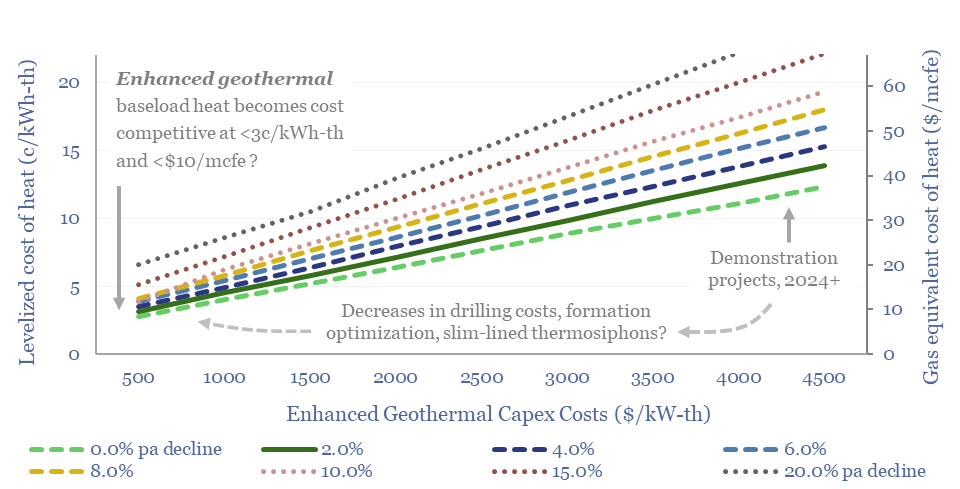

Enhanced geothermal: digging deeper?

Momentum behind enhanced geothermal has accelerated 3x in the past half-decade, especially in energy-short Europe, and as pilot projects have de-risked novel well designs. This 18-page report re-evaluates the energy economics of geothermal from first principles. Is there a path to cost-competitive, zero-carbon baseload heat?

Content by Category

- Batteries (88)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (93)

- Data Models (834)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (203)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (278)

- LNG (48)

- Materials (82)

- Metals (79)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (127)

- Renewables (149)

- Screen (116)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (352)