Written Research

-

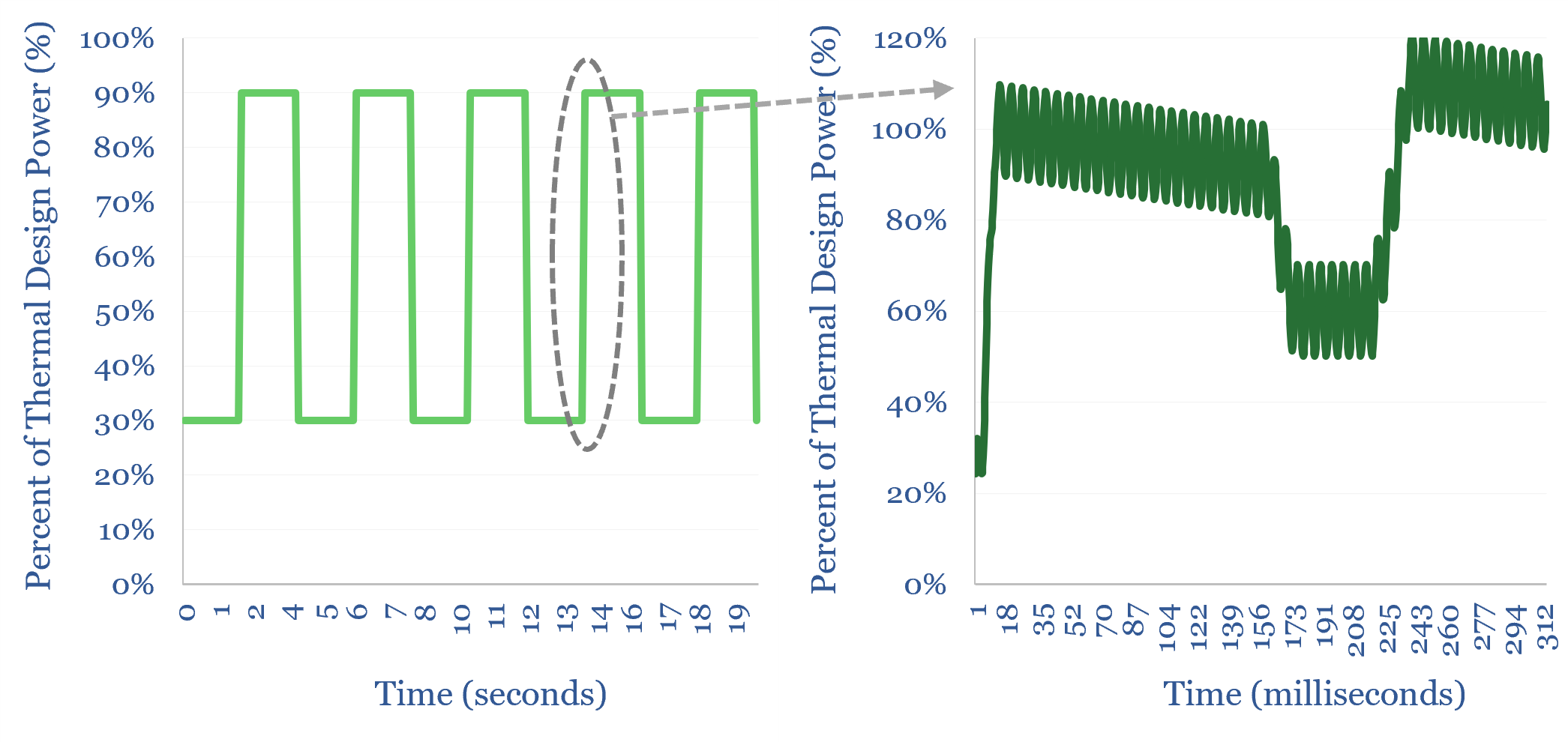

Data center energy: caps lock?

Everybody knows “AI data centers use round-the-clock power”. Yet one of the biggest power challenges for AI data data centers is precisely that they do not use round-the-clock power. They incur large load transients that cannot be handled by batteries, power grids or most generation. This 15-page report explores data center load profiles, which may…

-

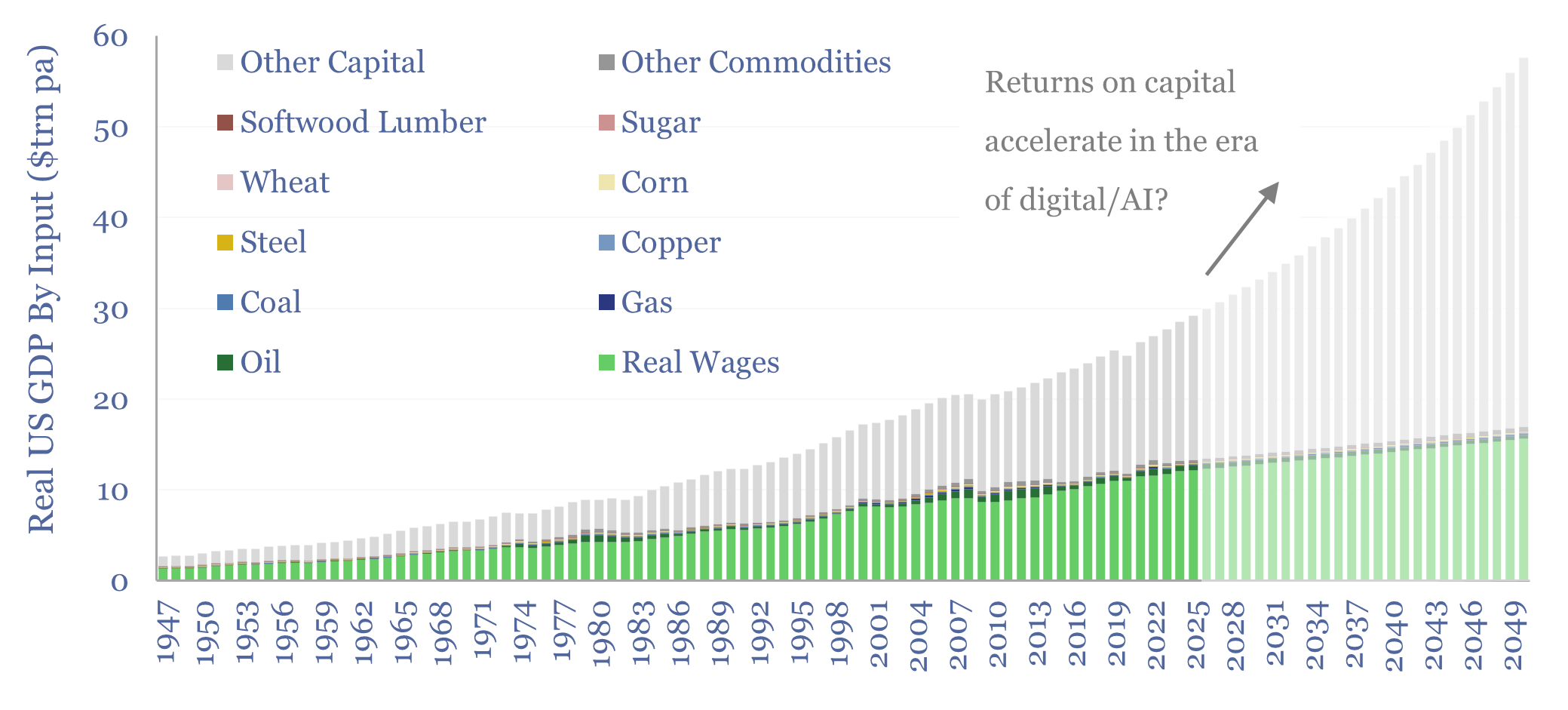

Energy transition: a new era? (driven by AI)

Energy transition remains among the most important and exciting topics in the world. But it is now less driven by Net Zero ambitions, and more so by digital and AI technologies. These offer world-changing possibilities; re-accelerating GDP, returns on capital, and commodities. This 13-page report captures our latest outlook on energy transition, and the opportunities…

-

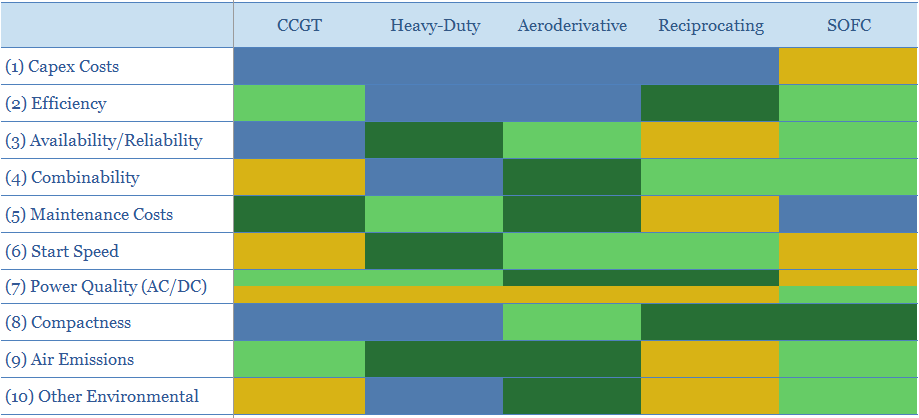

Gas generation: what kind of bear is best?

This 17-page report compares combined cycle gas turbines (CCGTs), heavy-duty gas turbines, aeroderivative gas turbines, reciprocating engines and solid oxide fuel cells (SOFCs), on ten dimensions. No one gas generation technology is best. But modular solutions may increasingly rival CCGTs, especially for energizing AI data-centers?

-

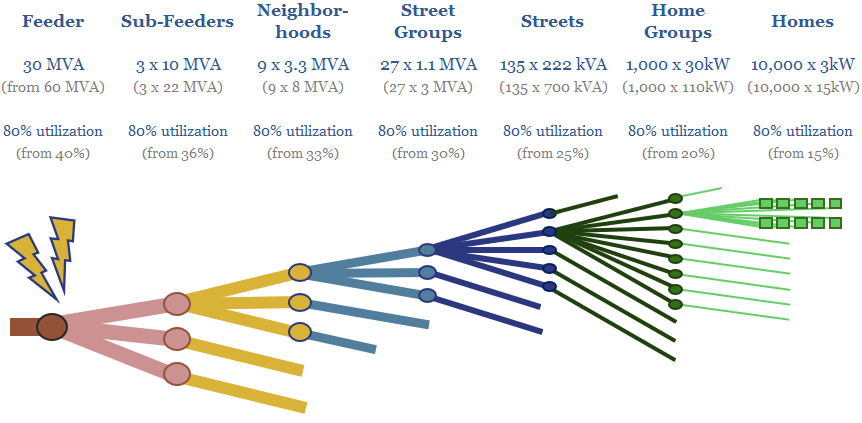

Wicked smart: what if AI re-shaped the power grid?

What if AI re-shaped the power grid? This 16-page report sees potential to halve levelized T&D costs; de-bottleneck 4.5% pa of global electricity demand growth; and shift over $100bn pa of spending away from high-voltage capital goods to low-voltage smart devices and networking equipment.

-

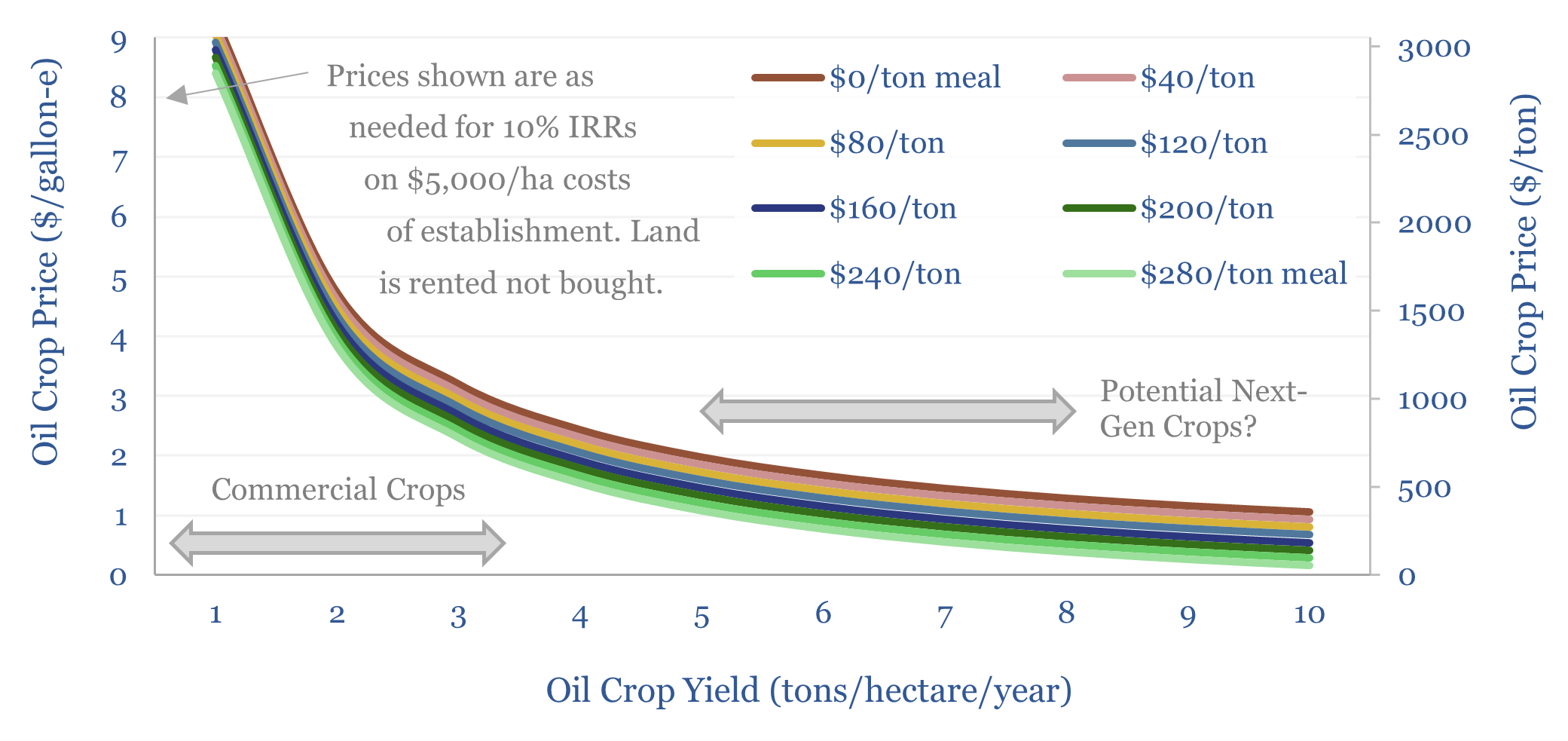

Sustainable aviation fuel: flight path?

As things stand, we argue Europe will be forced to scale back its SAF targets, due to Sustainable Aviation Fuel costs and land constraints. However, our 17-page report asks what could improve the outlook. Specifically, what yields, costs and other properties would we need to see from an oil crop to get excited about unlocking…

-

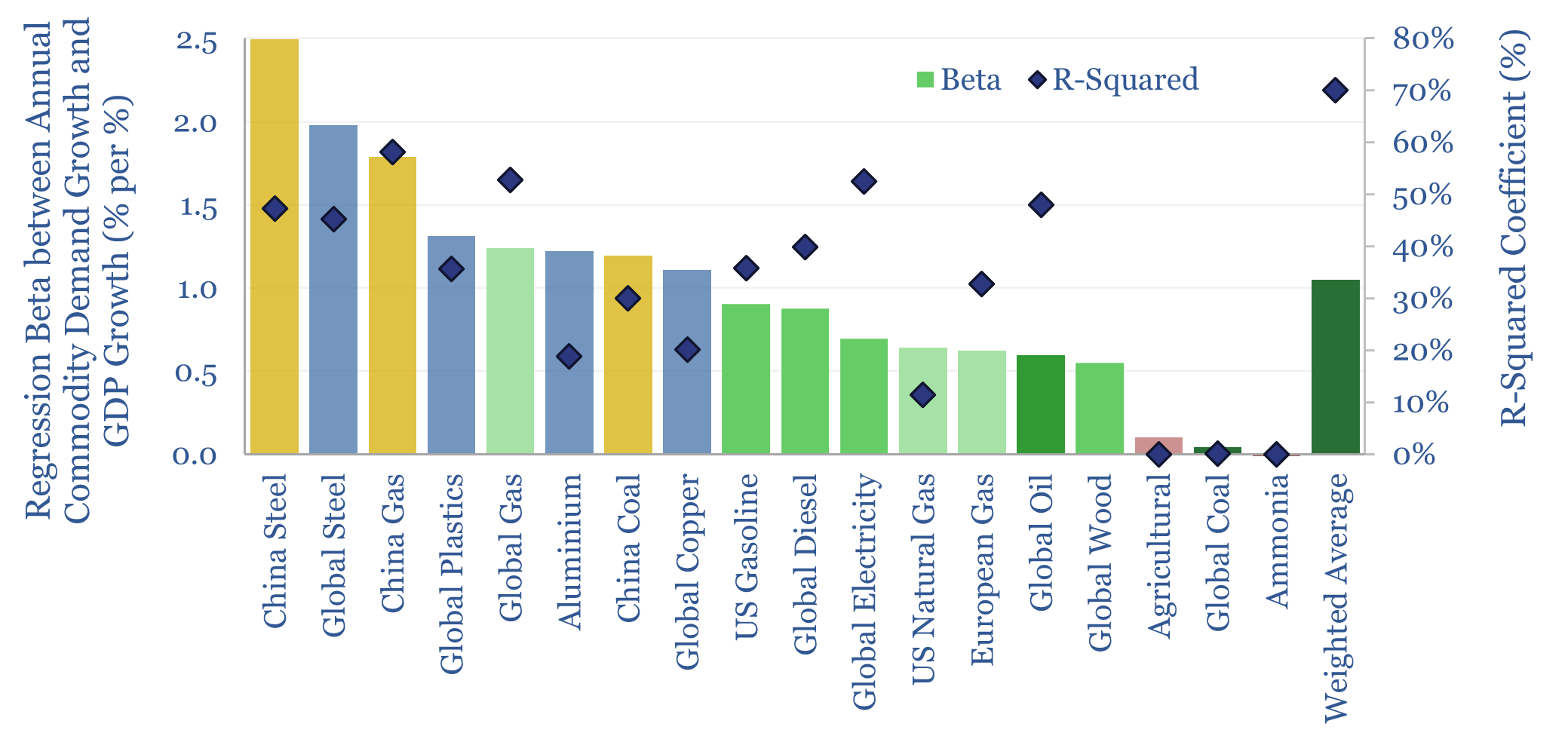

Commodity demand: how sensitive to GDP growth?

How sensitive is global commodity demand to GDP growth? This 15-page report runs regressions for 25 commodities. Slower GDP growth matters most for oil markets, which are entering a new, more competitive, era. China is also slowing. But we still see bright spots in gas, metals, materials in our 2025 commodity outlook.

-

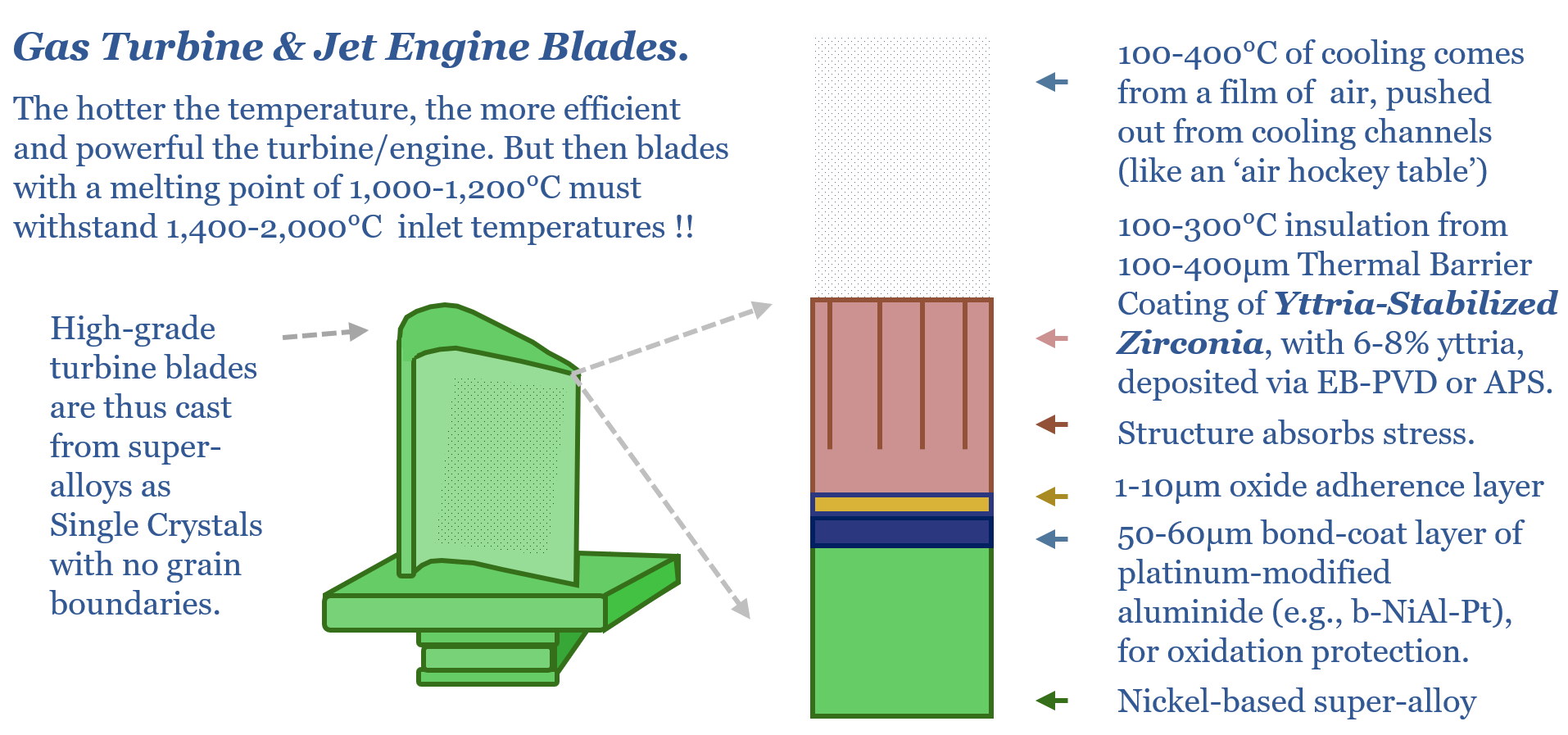

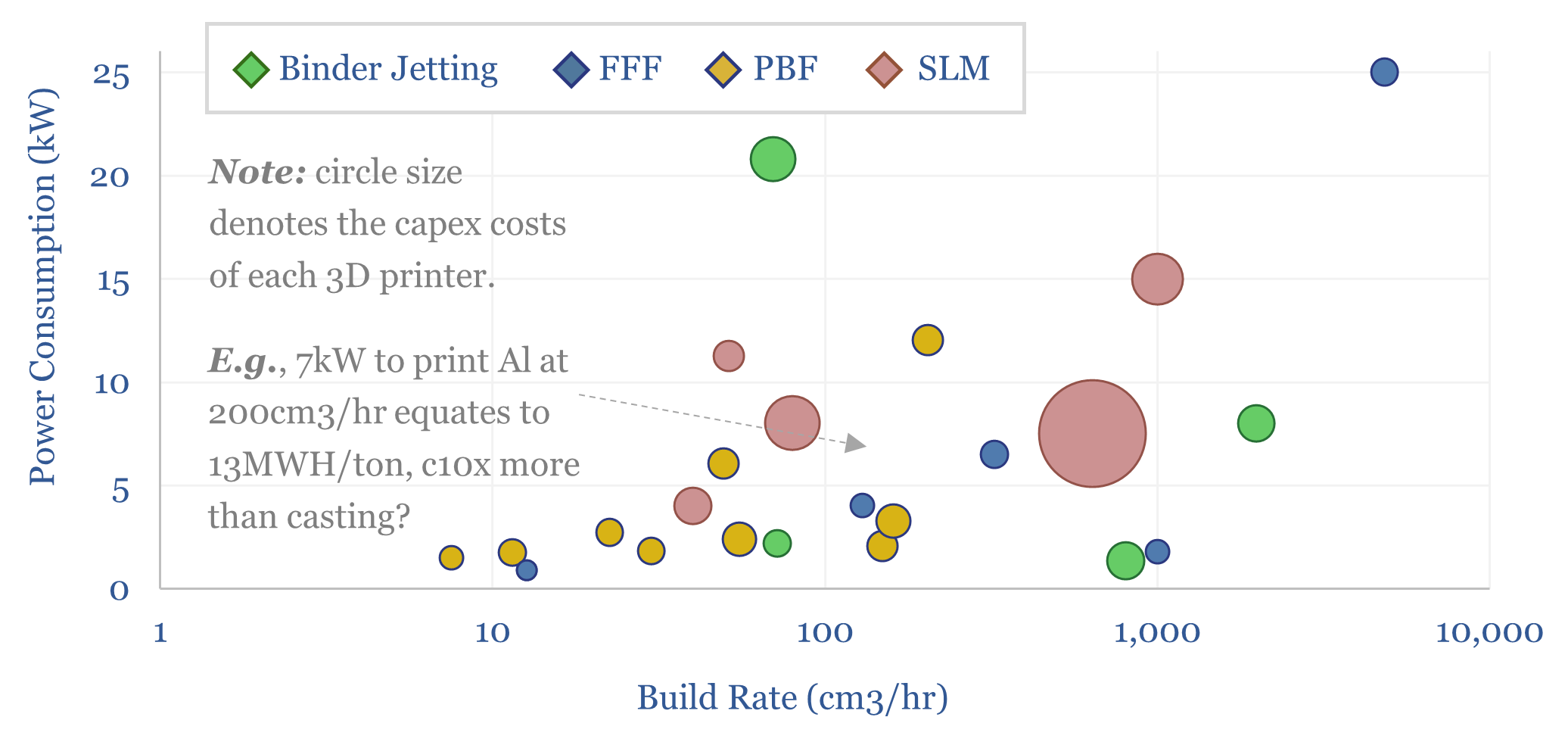

Additive manufacturing: fine print?

Can additive manufacturing overcome bottlenecks in gas turbine components, aerospace-related capital goods, and custom products that are unlocked by AI? This 16-page report re-evaluates the outlook for 3D printing, its economics, energy use, and company implications.

-

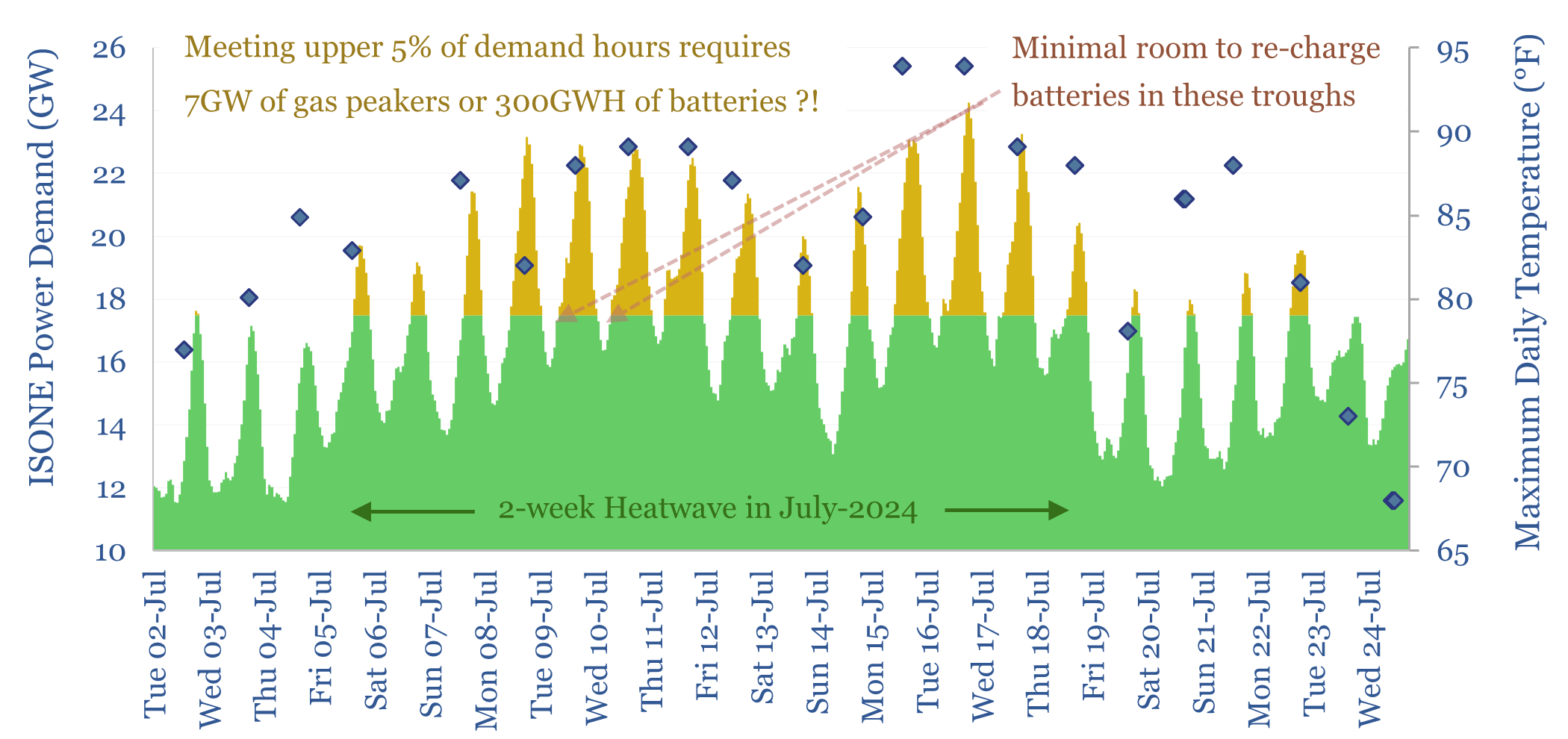

Peak loads: can batteries displace gas peakers?

Peak loads in power grids are caused by heatwaves (in the US) and cold snaps (in Europe), which last 2-14 days. This 16-page report finds that very large batteries would be needed to ride through these episodes, costing 2-20x more than gas peakers. But the outlook differs interestingly between the US vs Europe.

-

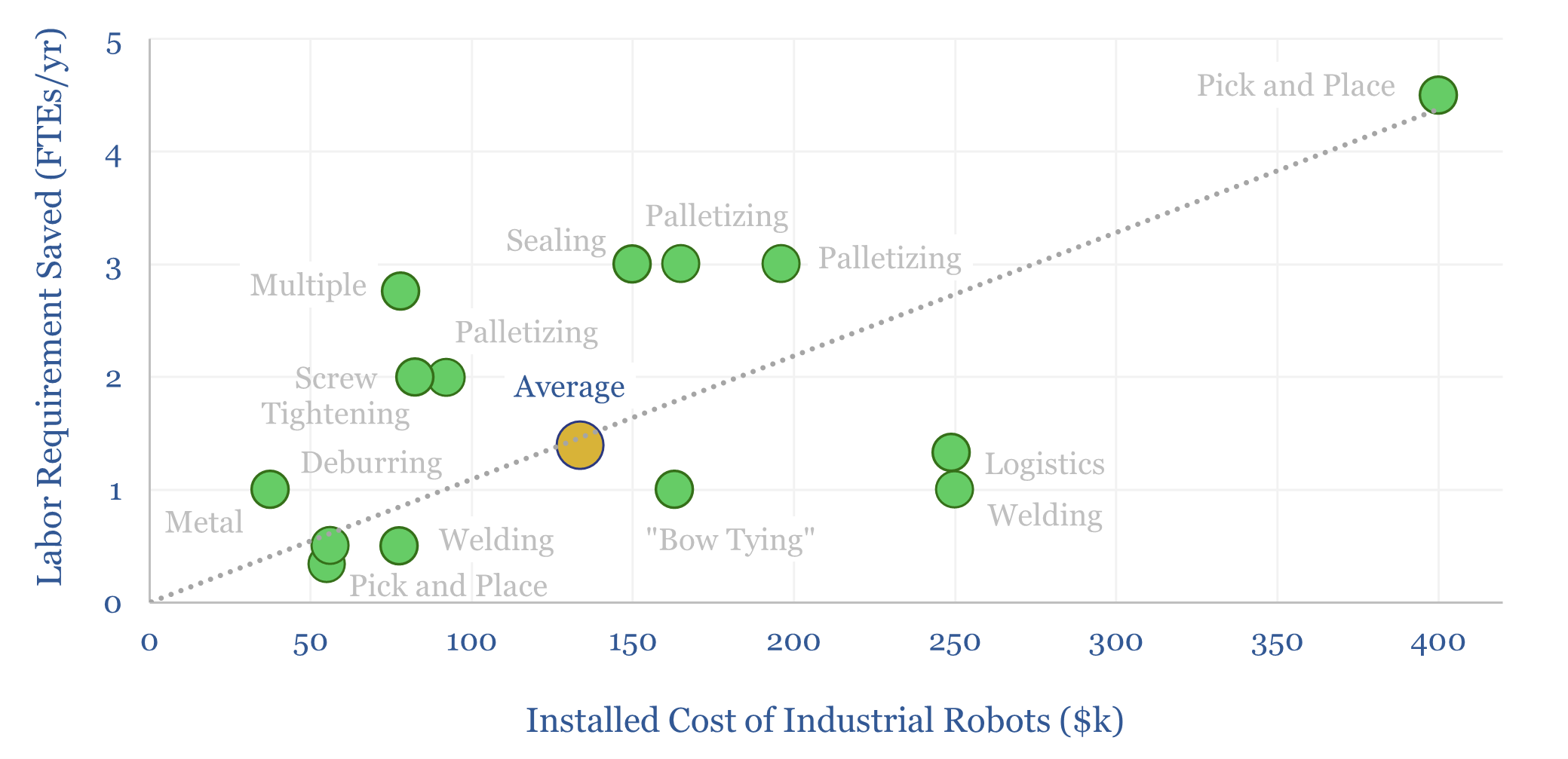

Industrial robots: arm’s reach?

5 million industrial robots have now been deployed globally, in an $18bn pa market. But growth could inflect, with the rise of AI, and to solve labor bottlenecks, as strategic value chains are re-shored. Robotics effectively substitute labor inputs for electricity inputs. Hence today’s 18-page report compiles 25 case studies, explores the theme and who…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (837)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (278)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (129)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (353)