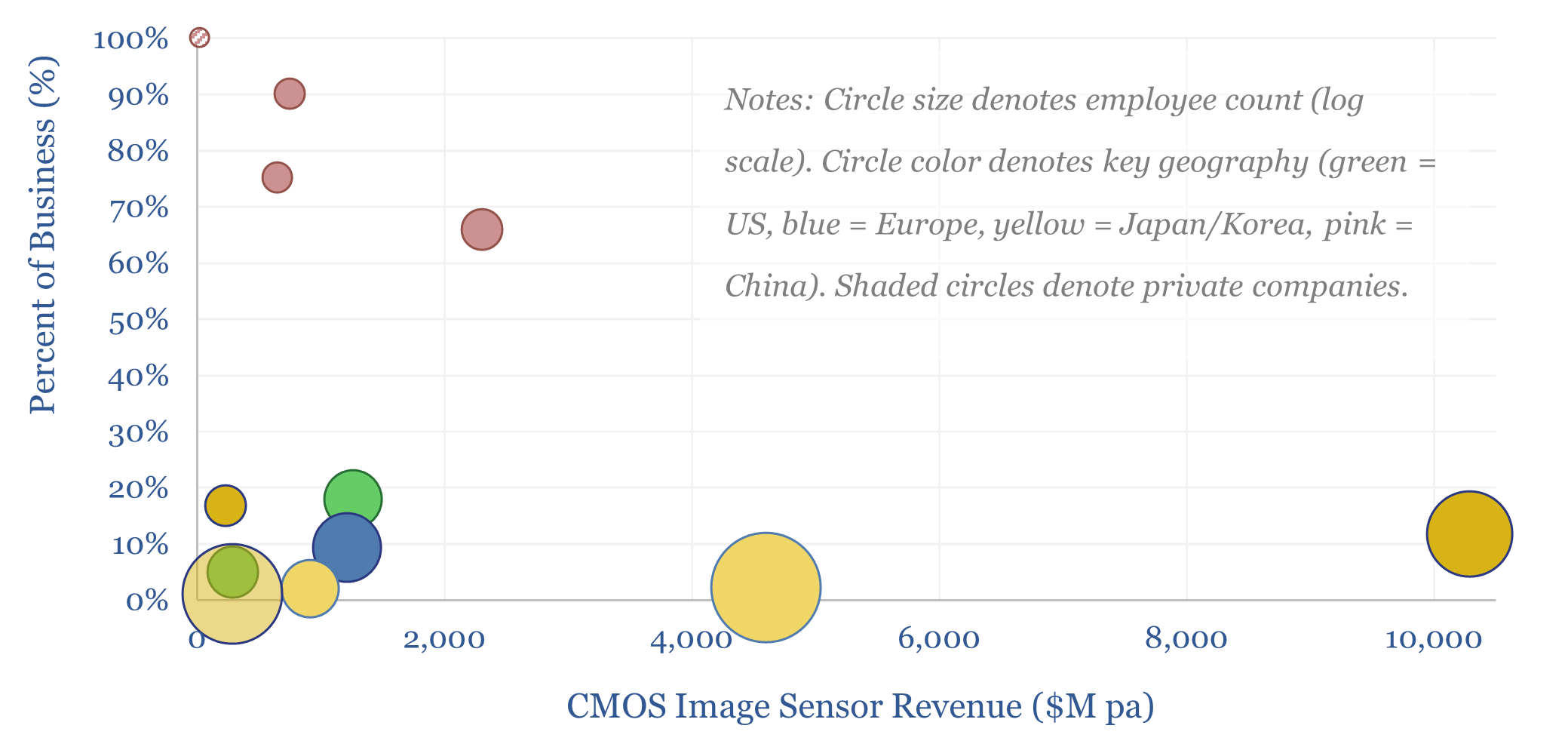

This screen captures a dozen leading companies in CMOS image sensors, which underpin modern digital imagery, from cell-phone cameras to vehicle applications to industrial robots with “machine vision”. It is a concentrated landscape, with incumbents in Japan, Korea, the US and Europe, and fast-growing Chinese competitors. What upside here amidst the rise of AI?

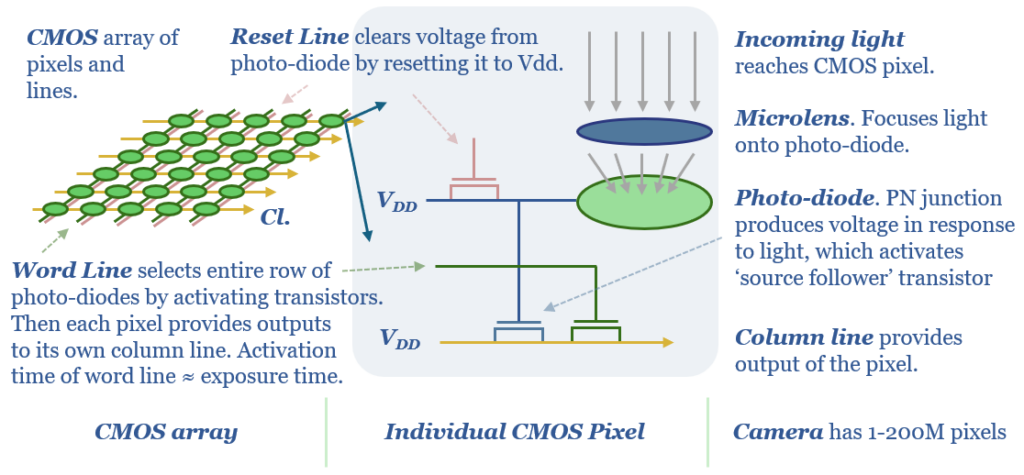

CMOS image sensors are a $23bn pa market in 2024, underpinning effectively all modern digital cameras. They are so-called because they use a pair of complementary MOSFETs, which are used to read out the amount of light reaching sequential rows of photo-diode pixels (schematic below).

We wonder whether the rise of AI will create more demand for sensors, especially image sensors for “machine vision”, hence we have screened the companies making up the CMOS image sensor market.

The largest five companies – Sony, Samsung, Omnivision, Onsemi and STMicro – comprise about 80% of the global CMOS image sensor market. The other 20% is composed of specialized imagery companies and fast-growing Chinese entrants.

Sony is the largest producer of CMOS image sensors, having shipped 20bn units by the end of 2024. 75% of its Image Sensing Solutions comprises sales into mobiles (cell phones).

However, online sources have suggested Samsung’s LSI segment is aiming to supplant Sony’s decade-long run as the exclusive camera supplier to the iPhone, possibly with its 48 Megapixel technology. Another example, its ISOCELL HP2 sensor has 200M x 0.6μm pixels in a 1/1.3″ optical format, which is the size used in smartphone main cameras.

Onsemi claims to have the #1 global position in auto and industrial image sensors, with 46% market share in autos in 2022, and 68% in ADAS systems. Typically with 8 Megapixel resolution. Its solutions are installed in 450M autos. The company also says it will be “enabling industry 4.0 with our intelligent sensing technologies for smarter factories and buildings”.

In Feb-2025, China’s SmartSens launched a 5MP automotive-grade image sensor, noting that the global shipments of automotive image sensors would increase from 380M in 2023 to 480M in 2028.

Other companies stood out in our screen of leading companies in CMOS image sensors. Full notes on each company, its size, revenue mix, exposure to CMOS Image Sensors, are detailed in the data-file.