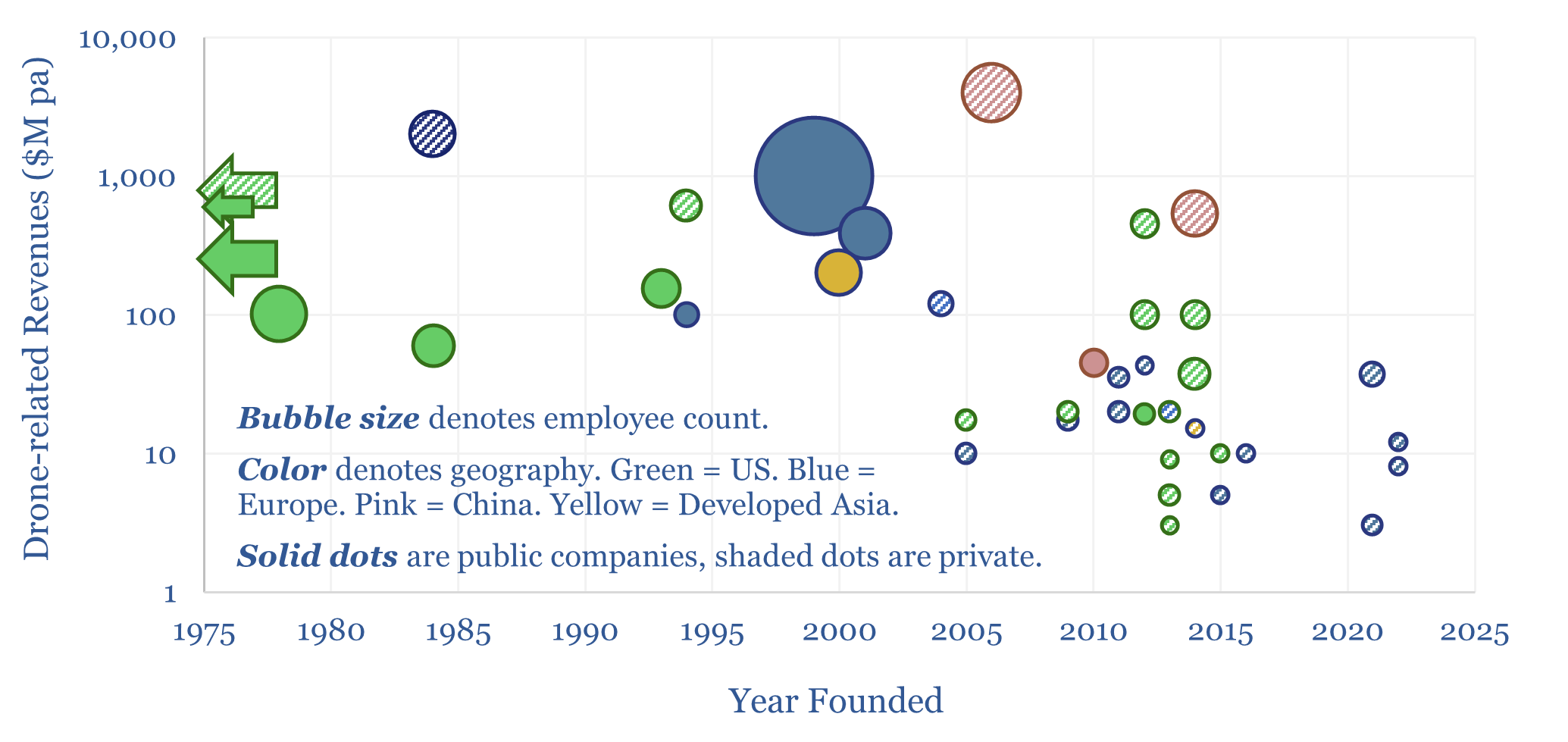

This data-file is a screen of 40 leading drone companies, which either manufacture drones for consumer, commercial and defense purposes; offer drone inspection services; or offer drone delivery services. It is a vibrant landscape, with over half of the companies founded after 2010, worth c$40bn pa, and creating c$120bn pa of economic benefits.

The global drone market has been quantified at $40bn in 2024, while DJI says that the world’s drones are currently supporting around $120bn pa of economic benefits. In 2019, we started getting excited about drone deliveries. In 2025, we have updated our outlook for drones in the energy transition.

This screen of leading drone manufacturers captures 40 companies, with c$12bn pa of revenues. Our best guess at the missing numbers is that they are in China, in the military (where companies do not always disclose good breakdowns of revenue by product), and across a tail of smaller drone producers which we have not been able to capture yet in our screen.

DJI is the largest drone company, privately owned, headquartered in Shenzhen, said to have 70-90% share of the consumer drone market. By 2023, over 300,000 of its drones were in operation globally, and revenues are quoted at $4bn pa.

Skydio is the largest drone manufacturer in the US, and has built around 40,000 drones, increasingly focused on commercial systems. The company raised $400M via a Series E Round in 2023-24, at a $2.2bn valuation. 50% of the company’s order book was for defense customers, and Skydio has sent 2,000 drones to Ukraine, which is representative of a pattern repeating across our drone company screen.

Other types of companies include specialists in software, drone inspection (especially for power grids, substations, wind, solar and mining assets) and defense-focused companies (small drones costing $500 have decisively proved that they can ‘kill’ large-scale hardware costing $5M, in combat situations in Ukraine).

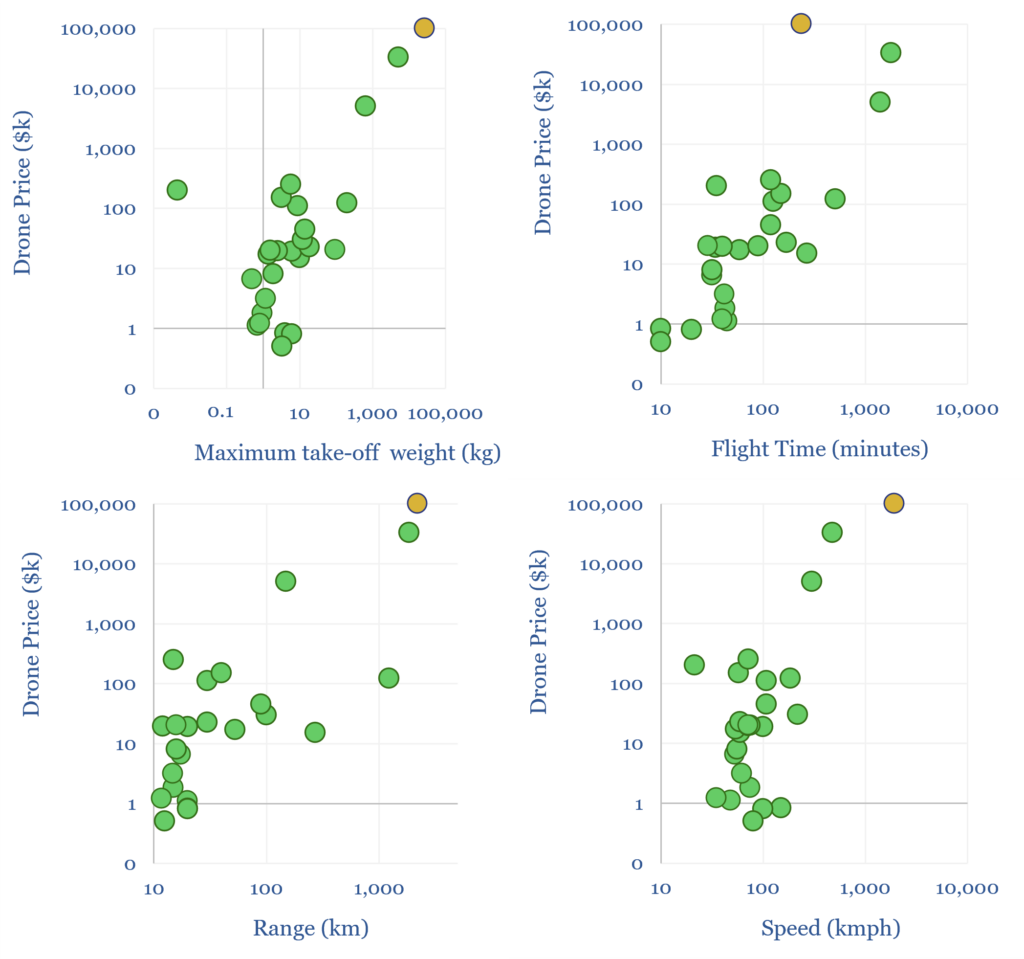

The full screen captures 40 companies in total. In each case we note the company’s focus area, when it was founded, headquarters, number of employees and patents, drone-related revenues, and 6-10 lines of notes on the product range and performance. The screen also captures the costs and performance metrics of 25 leading drones on the market where we have been able to get data (charts above).