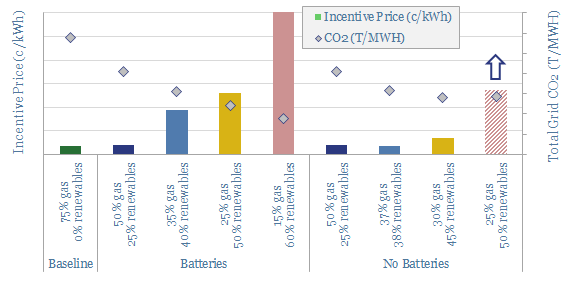

This model aims to calculate the average costs and the incentive prices required to scale up renewables in a typical developed world grid, from 25% to 40%, then to 50%, then to 60%.

The economics are modelled as a function of renewable costs, battery costs, curtailment rates, gas prices and carbon prices, which you can flex.

The calculations are based on Monte Carlo simulations using real-world data on wind and solar volatility, which dictates the curtailment rate of renewables and the utilziation rates of batteries that are built as a backstop.

We conclude that renewables will cap out at 45-50% of fixed-demand grids, even with the benefit of batteries. Beyond 50%, curtailment surpass 70%, trebling incentive pricing. Large-scale batteries also increase incentive prices 5-25x. Natural gas is the best complement for renewables, with both between 25-50% of grid demand.

What can help integrate more renewables into grids is demand-shifting, per our recent note, which effectively accommodates another 10pp share of renewables at no incremental cost.