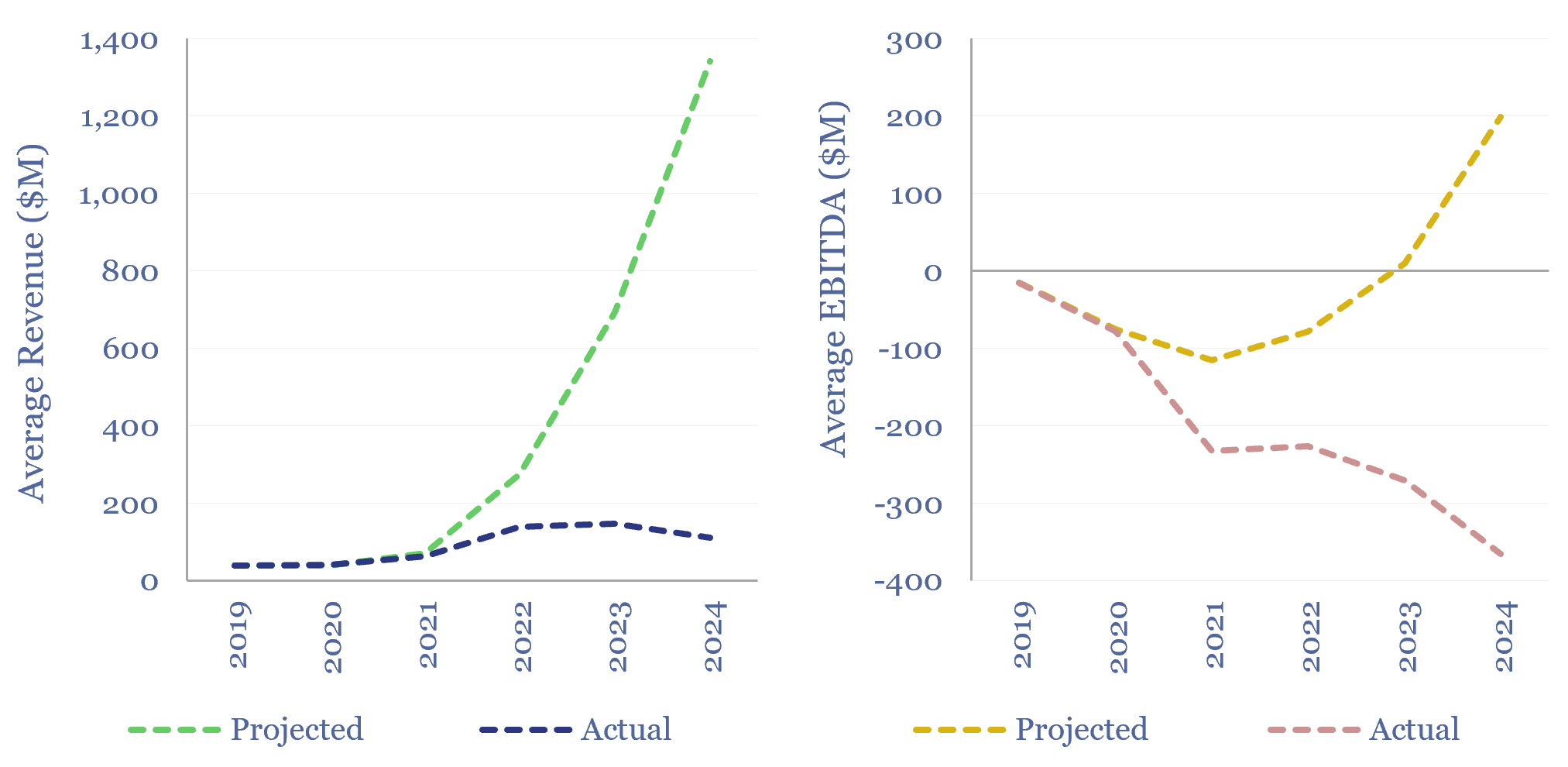

Early-stage companies’ growth versus projections is assessed in this data-file, tabulating the performance of 20 new energies SPACs from 2020-21. The average of these companies was projecting that its revenues would explode to $1.3bn by 2024, but in reality, revenue only trebled to $110M. On average, 2024 EBITDA also missed aspirations from 2020-21 by $350M. Three of the twenty companies have gone bankrupt. Companies with less aggressive forecasts, and pre-existing revenues fared better.

Thunder Said Energy is a research firm focused on energy technologies, assessing new technologies across energy, materials, capital goods and clean-tech, including via research reports, economic models and company patent analysis. We have huge respect for companies that are developing new technologies.

Although it is often quite challenging, with many technologies taking longer to commercialize than is first anticipated, as discussed in our deep-dive note into technology development times, and our video admission of classic analyst blunders (both are below).

One virtue of the SPAC boom from 2021-22 is that most of these companies published financial forecasts through 2024-30, as part of their SPAC decks. We are not writing this note to ‘have a go’ at new energies SPACs, but simply to quantify early-stage companies’ growth versus projections. How do companies tend to do?

The average of 20 SPACs that went public in 2020-21 was projecting that by 2024 they would inflect their revenue from $40M in 2019-20 to $1.3bn by 2024. The reality was somewhat less stellar, but did rise to $110M by 2024. They did grow on average, albeit 94% less than their SPAC-time aspirations. Or in other words, it is not overly Scrooge-like to risk the projected growth of early-stage companies by about 90-95% when you are perusing their presentations.

The average of 20 SPACs that went public in 2020-21 was also projecting that their EBITDA would follow a classic J-curve, losing $100M pa by 2021, but inflecting to $200M pa by 2024. Again, reality was somewhat less stellar, and the average company lost $350M in EBITDA last year.

On the positive side, performance was better for companies that offered up less dizzying future forecasts, projected that their growth would come later, and interestingly, companies that had some revenue at the time of going public. Companies really ought to have some revenue, at the time of going public. Those that did only missed their revenue growth projections by 90%, on average, in 2024. Those that didn’t, missed by 98%.

On the less positive side, three of the SPACs in the data-file have now made bankruptcy filings, including Nikola, Tritium and Hyzon Motors. Interestingly, the performance of many of these companies does seem to have been presaged by our findings when evaluating their patents.

We do remain selectively excited by some technologies, both among earlier-stage companies, and all the more so, among relatively mature companies which have featured in our research (and have the cash flow to fund pilots and technology development, where it is warranted). More around these ideas in the video below.