Europe comprises 7% of the world’s population, and 17% of its energy use. The purpose of this data-file is to disaggregate the energy use across 25 industries, six energy types and 28 countries. The data-file were updated in 2025, reflecting lagged Eurostat data from 2023.

Europe consumed 12,000 TWH pa of useful energy in 2023, a full 1,400 TWH lower than in 2019.

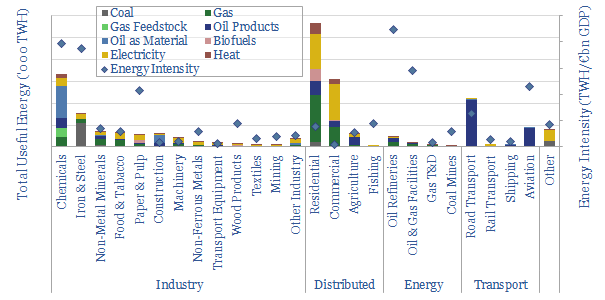

Out of the 12,000 TWH, 28% is used as electricity (up from 26% in 2019), 24% is for heat (25%), 21% for transport (19%), 20% for industry (20%) and 8% for feedstock (9%).

The 12,000 TWH comes 35% from oil (up from 34% in 2019), 30% gas (33%), 11% renewables (8%), 10% coal (12%), 7% nuclear (6%). The biggest individual categories are oil-fired transport (20% of total) and gas-fired heating (15% of total).

Remarkably, 23 out of 26 sub-sectors in Europe are using less energy in 2023 than they were in 2019 (and the others are merely flat).

The biggest declines since 2019 have been in residential consumption (-300TWH), chemicals (-300TWH), commercial (-150TWH) and metals (-120MWH).

The energy intensity of GDP has fallen from 0.68 TWH/€bn to 0.59TWH/€bn on an inflation adjusted basis. Real EU28 GDP has grown by 1.0% from 2019-2024, to €18.4trn.

But the European Chemicals industry declined at -1.9% pa, shedding €20bn pa of real GDP and €100bn pa of compensation paid to workers; and the European aviation industry shed –€20bn pa of real GDP.

The European construction industry grew at 1.7% pa, adding €70bn pa of real GDP, paying €32bn pa more in real compensation; which is among the largest absolute gains, and points to modernization of buildings and insulation.

The underlying data covers 25 industries, across materials, manufacturing, fuels and the CO2 emissions of each line-item; with underlying data spread across a dozen tabs.

We can also compare each industry’s energy consumption with its GDP (value added) and compensation paid to employees. This suggests which industries might be least painful to scale back amidst energy shortages.