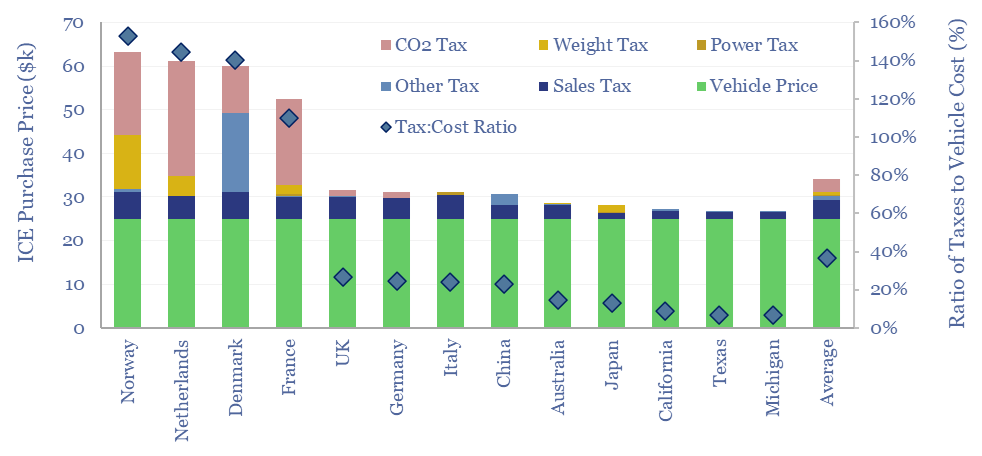

Vehicle taxes by country are tabulated in this data-file, based on vehicles’ pre-tax prices, tailpipe emissions, weight, engine size and power. They range from <10% of the cost of the underlying vehicle in the US, through to 150% in Norway, and can also be well above 100% in other Northern European countries such as Netherlands, Denmark and France.

Super-high taxes on ICEs have been successful in promoting EV adoption, especially in Northern Europe, but how palatable is this option more broadly, especially in countries with large domestic auto industries?

In one of the most entertaining energy-themed advertisements of all time, Will Ferrell laments Norway’s lead over the United States in electric vehicle ownership. 90% of Norway’s new vehicle purchases were BEVs/PHEVs in 2023, and electric vehicles make up 26% of the fleet. What is not in the advertisement is the tax policy that has propelled EVs to such high adoption in many Northern European economies.

This data-file quantifies vehicle taxes by country, which turns out to be a complex calculation, with sliding-scale formulae linked to vehicles’ tailpipe CO2 emissions (Norway, Netherlands, France, Denmark, UK, Germany), weight (Norway, France, Australia, Japan), value (all geographies, but especially Denmark) and engine power (Italy, France, Japan, Germany).

ICE vehicle taxes by country are plotted above, for a vehicle with a $25k pre-tax vehicle purchase price, 1.8 ton gross weight, 30mpg fuel economy, and 2.0L engine with 180hp of engine power. You can stress-test all of these variables in the data-file, and the tax consequences flow through the file. Typical vehicle parameters are available here.

In the average country globally, taxes add c35% onto the pre-tax purchase price of an ICE vehicle. However, the range is wide, varying from <10% in many US States, to >100% in France, Denmark, Netherlands and of course Norway, which reaches 150%. Yes, a vehicle with these parameters costs 1.5x more in taxes in Norway than the vehicle itself.

Tax exemptions for electric vehicles are offered in almost all of these countries. Norway, for example, has exempted new vehicles from both VAT and other purchase taxes. In Denmark and the Netherlands, EVs receive large deductions from vehicle purchase taxes. In many countries, EVs also receive direct fiscal incentives.

Decelerating EV sales growth has been a theme that has worried us in our 2024 research. One factor that could re-accelerate EV sales growth is the ratcheting up of taxes on ICE vehicles. But on the other hand, it is interesting to note that the countries that have implemented large vehicle taxes tend not to have a large domestic auto industry. Whereas for obvious reasons, there may be opposition to inflating the costs of new vehicle purchases by 2x from leading vehicle makers in their home markets.