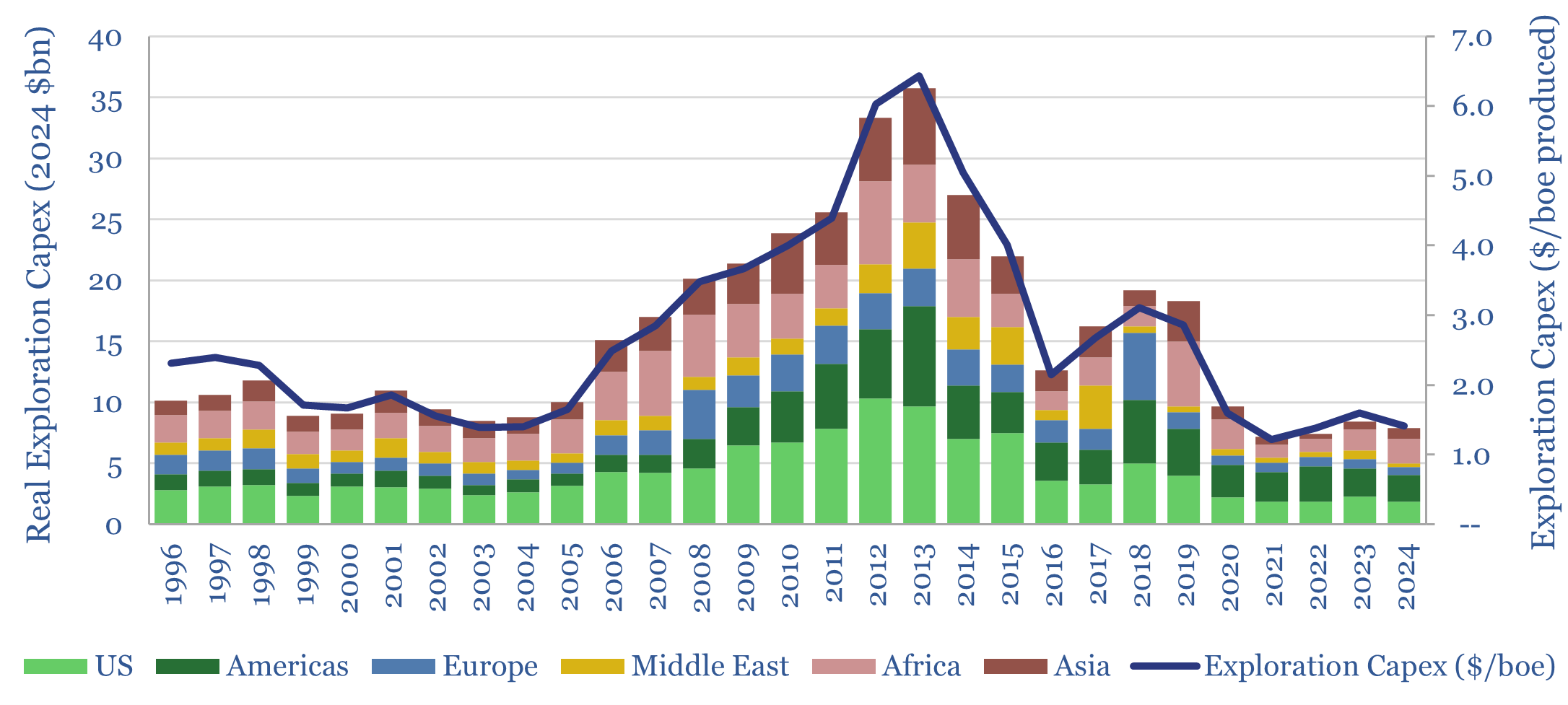

This data-file tabulates the Oil Majors’ exploration capex from the mid-1990s, in headline terms (in billions of dollars) and in per-barrel terms (in $/boe of production). Exploration spending quadrupled from $1/boe in 1995-2005 to $4/boe in 2005-19, and has since collapsed like a warm Easter Egg. Exploration has been de-prioritized. Perhaps wrongly?

The peer group comprises ExxonMobil, Chevron, BP, Shell and TOTAL, which comprise c10% of the world’s oil production and 12% of the world’s gas production. As a good rule of thumb, this group can be thought of as c10% of global production.

This peer group quadrupled its exploration expenditures, from $5bn pa spent on exploration in 1995-2005 to an average of $20bn pa on exploration at the peak of the 30-year oil and gas cycle in 2010-2015. Exploration spend ramped from $1/boe to $4/boe over this timeframe. It has since fallen back to $1.4/boe, or around $1-2bn per company pa in 2024.

It is scary to consider that the industry needed to spend an average of $2.5/boe on exploration from 2005-2019 in order to hold its organic production “flattish”.

The US has always been the most favored destination, attracting c25% of all exploration investment, both offshore (e.g., Gulf of Mexico) and increasingly for short-cycle shale. During the last oil and gas cycle, the largest increases in exploration investment occurred in Africa, other Americas, Australasia; and to a lesser extent Europe and the Middle East.

One possible scenario for the future is that this peer group continues to limit its exploration expenditures to the bare minimum, of $1-2bn per company per year, or around $1-2/boe of production; under the watchwords of “capital discipline”, “value over volume” and “energy transition”.

Although we think the tide is turning, and themes such as AI and returning European focus on competitiveness may incentivize higher exploration expenditures, especially where the US energy industry is focused domestically instead.

This data-files aggregates the Oil Majors’ exploration capex, across ExxonMobil, Chevron, BP, Shell and TOTAL disclosures, apples-to-apples, back to 1995.