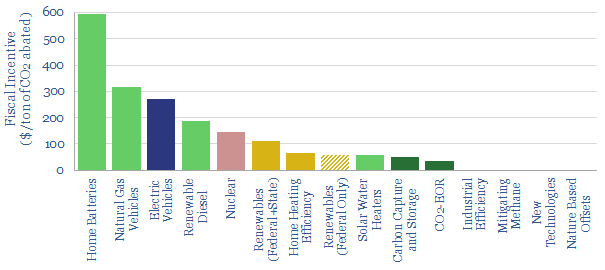

This data-file tabulates fiscal incentives that exist to abate CO2, across individual categories in the energy transition, based on current legislation, predominantly in the United States.

In each case, we have calculated the implied cost to abate CO2, under the various policies, as measured in dollars per ton ($/ton). Included in the file are Production Tax Credits, Blenders Tax Credits, Investment Tax Credits, Equipment Tax Credits and Section 45Q.

Our view is that the current system is overly-complex and arbitrary. It provides large incentives for specific technologies that happen to have policy support, and no incentives (or small incentives) for other technologies that could make a larger decarbonization impact at a much lower cost.