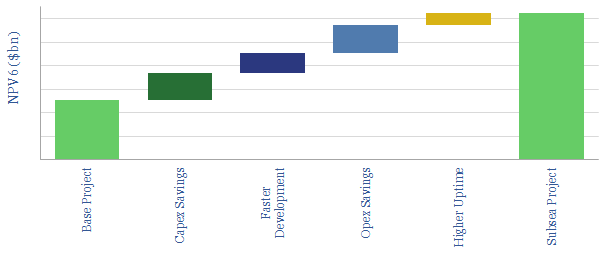

This model presents the economic impacts of developing a typical, 625Mboe offshore gas condensate field using a fully subsea solution, compared against installing a new production facility.

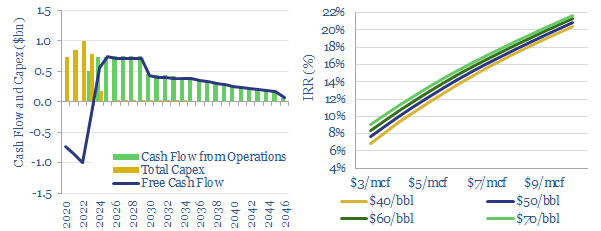

Both projects are modelled out fully, to illstrate production profiles, per-barrel economics, capex metrics, NPVs, IRRs and sensitivity to oil and gas prices (e.g. breakevens).

The result of a fully offshore project is lower capex, lower opex, faster development and higher uptime, generating a c4% uplift in IRRs, a 50% uplift in NPV6 (below) and a 33% reduction in the project’s gas-breakeven price.

Please download the model to interrogate the numbers and input assumptions.