This economic model captures the production costs of helium, which is cryogenically extracted from low concentrations in natural gas. $200/mcf helium prices can support 10% IRRs on a resource with 0.75% helium content. $400-1,000/mcf spot prices can unlock 50-100% IRRs and trigger a capex boom. NPV10 economics can be stress-tested in this data-file, and adapted for different resources.

The global helium market, at 6.5 bcf pa, turns out to be critical for the rise of AI. It is locked in a supply crunch. Pricing trebled over the past decade, to $400/mcf in 2023-24, with some spot cargoes trading as high as $1,000/mcf.

The largest global uses of helium are still for cryogenics, especially in MRI machines, at 23% of demand; and “lift gas” at 15%. But helium is increasingly used for semiconductors (14%) and fiber-optics (11%). Here, helium is an inert carrier gas during deposition. And it is used for rapid cooling, e.g., to avoid air bubbles, when “drawing” newly formed optical fibers, of <100μm diameter, from 1,500ºC furnaces. These two sources were only c7% of the market, a decade ago.

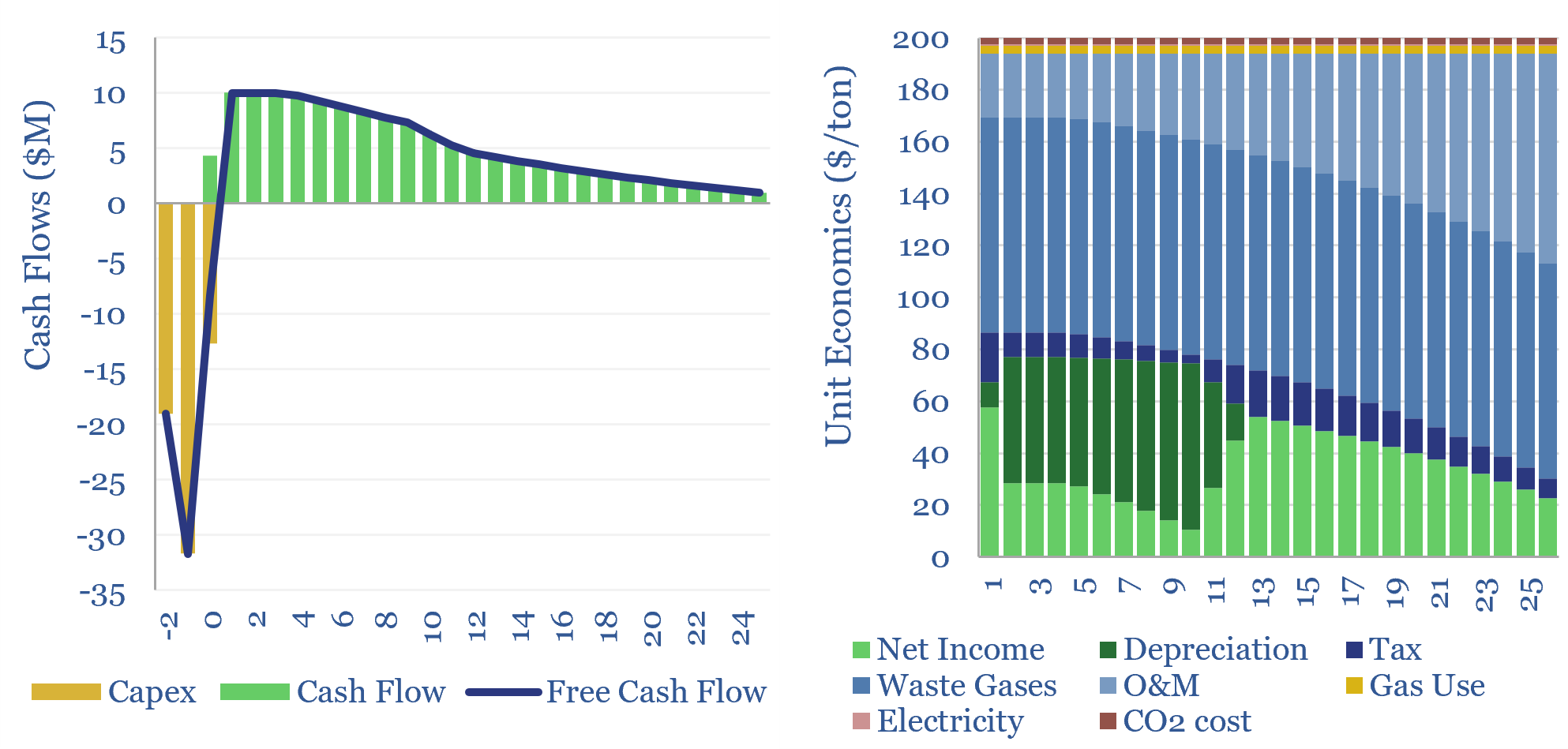

Hence this data-file captures the costs of helium production via the economics of purification plants. Helium is extracted from natural gas, mostly via cryogenic separation, or sometimes via pressure swing adsorption.

Our base case marginal cost is $200/mcf, for a 10% IRR on a cryogenic facility, which buys $3/mcf gas, chills it to -165ºC to separate out the methane, -200ºC to separate out the nitrogen, and then-270ºC to isolate the 2% methane.

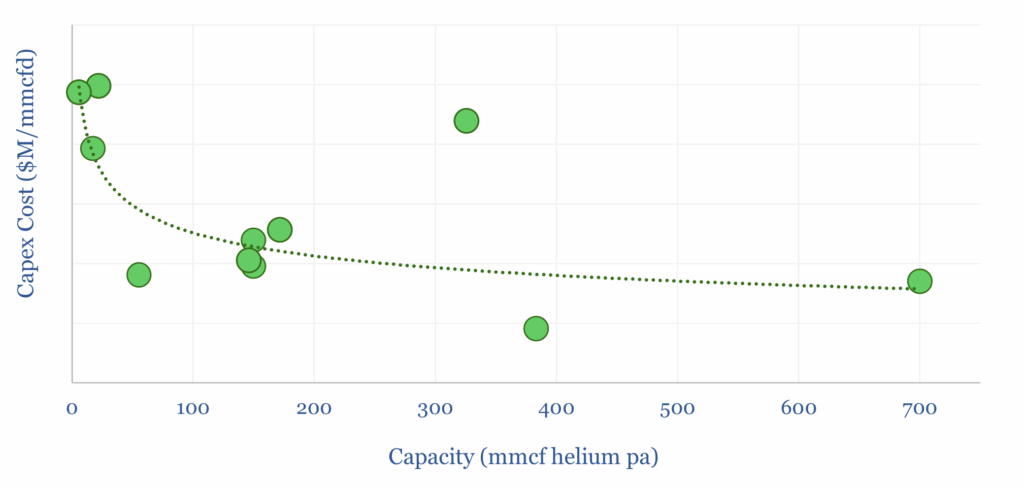

Capex costs of helium processing facilities are captured in $M/mmcfd of production capacity, based on ten project examples in the Capex tab of the model. Generally larger facilities have lower capex costs. Interesting notes on each project, and involved companies, are in the data-file.

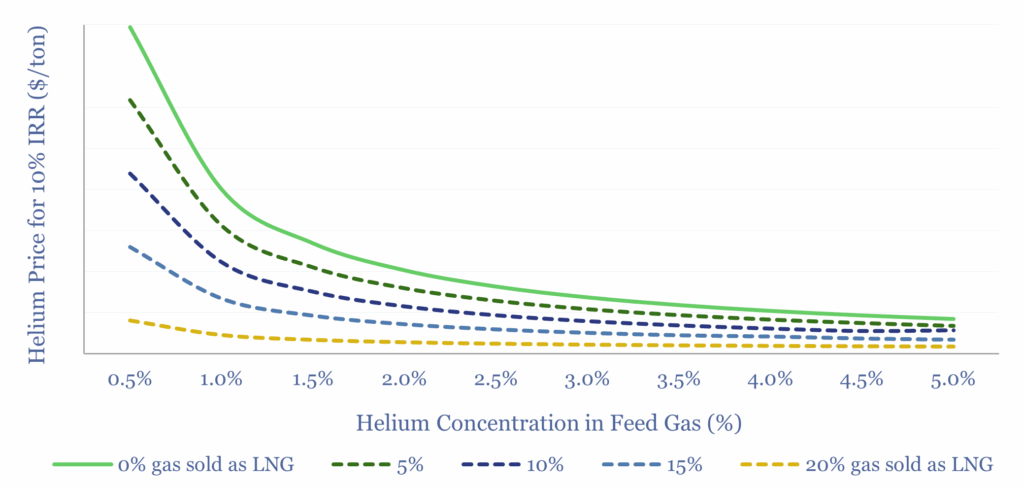

Helium production economics improve with higher product purity. Generally, economical production of helium will require a gas stream to contain at least 0.3% helium content. Our $200/mcf marginal cost requires 2% helium in the input. Economics improve further at higher helium concentrations.

Costs of helium production also improve if some of the gas that is liquefied can be sold as small-scale LNG, at $13.5/mcf, or around a 30% energy-equivalent discount to $3/gal oil products. Although this does require more energy input.

The energy intensity of helium production, and the CO2 intensity of helium production, are both captured, for a cryogenic plant, in kWh/ton and in kg/kg.

Interestingly, if you are a gas producer with just 1.5% helium in your gas stream – which is typical in the Hugoton gas play in Kansas – then at $400/mcf, the helium may be worth about 2-3x more than the methane itself.

Two companies control over half of all global helium. Early stage companies are also exploring for, and developing helium assets, in North America, and globally. Company-related notes are in the data-file.