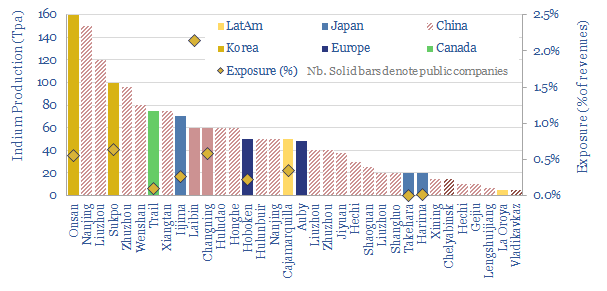

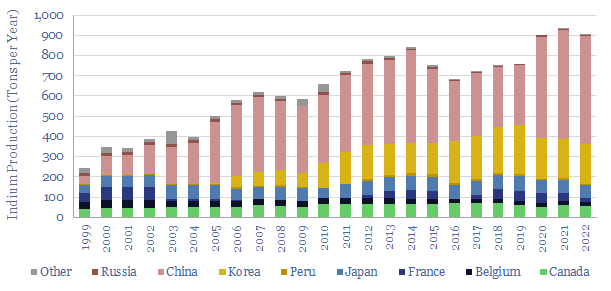

35 indium producers are screened in this data-file, as our energy transition outlook sees primary demand quadrupling from 900 tons in 2022 to over 3.5ktons in 2050, for uses in HJT solar cells and digital devices. 60% of global supply is produced by 20 Chinese companies. But five listed materials companies in Europe, Canada, Japan and Korea also stand out.

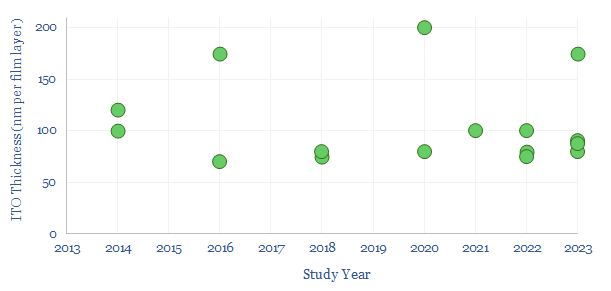

Indium is a metal of interest in the energy transition as its main use is in indium tin oxide (ITO), a transparent, conductive material (TCO), increasingly used in solar (especially HJTs), but also in the flat screens within televisions, computers and portable electronic devices, all associated with the rise of the internet and AI.

Rising demand for solar and digital technologies will easily quadruple global demand for indium from around 900 tons per year to 3.5ktons per year, on a primary production basis. Supply breakdowns and demand forecasts are in the data-file.

This all requires indium prices to recover back up above $500/kg, we think, and indium prices are also tabulated in the data-file.

How is indium produced? In the data-file, we look facility by facility, aggregating and adding to excellent data from the USGS. We think 80% of the world’s indium is currently produced as a by-product of non-ferrous metals refining, especially zinc refining.

There are 35 indium production facilities in the world. But indium is rarely more than 2% of the total revenues of non-ferrous metals companies and gets produced on the order of magnitude of 100 grams of indium per ton of zinc.

Who are the leading indium producers? 60% of the indium market is controlled by a constellation of 20 relatively opaque Chinese companies, of which two are listed leaders.

Elsewhere, five public companies producing indium are listed in Korea, Japan, Canada and Europe and may be interesting for decision makers to explore. Many are also exposed to metal value chains such as silver and battery recycling, which matter in the energy transition.

For each indium producing company in the screen, we have assessed the type of company, when it was founded, how many employees it has, recent revenues (in $M), co-production of zinc, refinery details (e.g., production capacity in tons) and 3-10 lines of notes that stood out to us from reviewing published company materials.