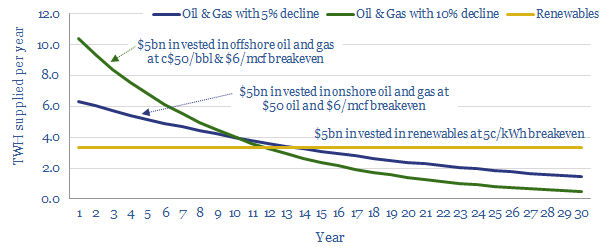

Wind, solar, oil and gas are all capable of supplying comparable energy at comparable prices: 5c/kWh wind and solar is economically competitive with c$50 oil and $6/mcf gas, over a 30-year project-cycle.

But production profiles matter. Oil and gas assets generate 2-3x more energy than renewables in early years; and 50-80% less energy in later years. So dollars invested in oil and gas go 2-3x further in the short-run. To meet the same initial demand from renewables, one must currently spend 2-3x more.

Further renewables deflation of c50-70% is required before the world can truly “re-allocate” capital from fossil fuels to renewables without causing near-term shortages. In the mean time, it is necessary to attract adequate capital for both resource types.

This short data-file underpins the chart and considerations discussed above.