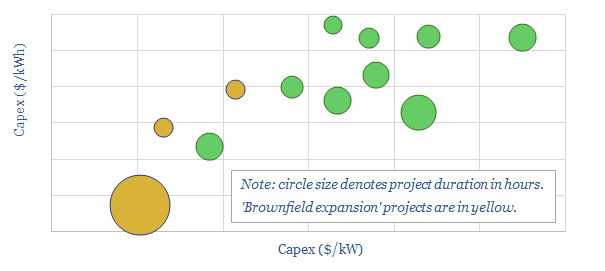

This data-file assesses pumped hydro costs, as a means of backing up renewables. A typical project might have 0.5GW of capacity, 12-hours storage duration, and capex costs of $2,250/kW.

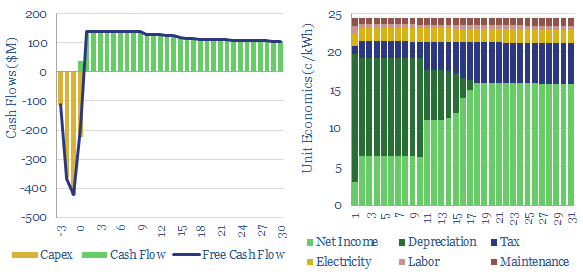

Our base case model of pumped hydro costs and economics therefore requires a ‘storage spread’ of around 25c/kWh, in order to generate a 10% IRR, which is not dissimilar from the economics of lithium ion batteries (recent notes here and here).

Inputs to the data-file include an overview of past projects and technical papers, in order to quantify capex drivers (chart below).

The data-file allows you to stress-test the impacts of lowering hurdle rates, capex costs, improving utilization, lower input power prices, higher round-trip efficiency, lower maintenance costs, lower labor costs, improved capex schedules or lower taxes.

In a best case scenario, it may be possible to reduce total storage spread to around 10c/kWh; while more marginal projects will require above 50c/kWh.

To read more about pumped hydro costs and economics, please see our article here.