This screen of Rare Earth miners and refiners captures 20 Rare Earth companies, their flagship projects, and economic parameters such as capex, ore grades, end products and NPVs. A vibrant landscape is evolving, especially for NdPr and DyTb, although the market is still risking pre-production projects heavily.

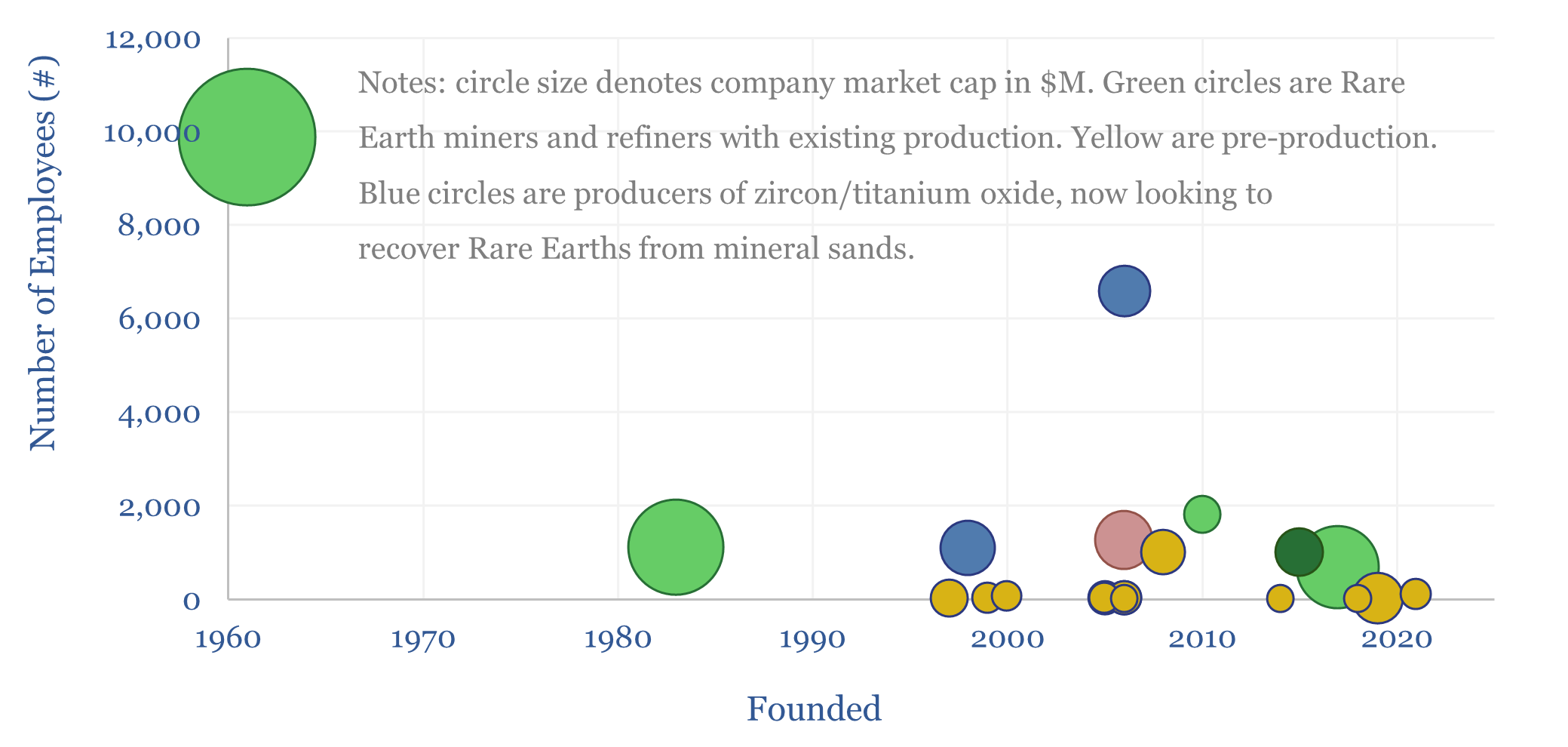

This data-file captures 20 Rare Earth miners and refiners, their projects, and their progress. The average of these companies has roots going back to 2005, but a new wave of momentum is seen in 2025. Almost all of these companies highlight a strategic push to re-shore Rare Earths production, as China controls 60% of the mining, 90% of the refining, 90% of the metal conversion and >90% of the magnet production.

Australia and the US are the two leading geographies for these Rare Earth companies’ projects. 10 of the companies are headquartered in Australia. Five are in the US. 2 are in Canada.

Only a small number of companies have producing assets today, and these assets are generally front of the queue to be expanded: Lynas at Mount Weld, MP Materials at Mountain Pass, Neo Performance Materials ramping in Estonia.

A dozen greenfield projects are also being specced out by earlier-stage companies, with an average market cap of c$100M.

The resources vary. Ore grades average around 2% Rare Earths, across the projects we have sampled, with a range of 0.05% to 6%. This connotes a lot of crushing/grinding, flotation and later mixer-settlers. Some companies are prioritizing mineral sands and clays, which are easier to mine and do not require as much crushing work.

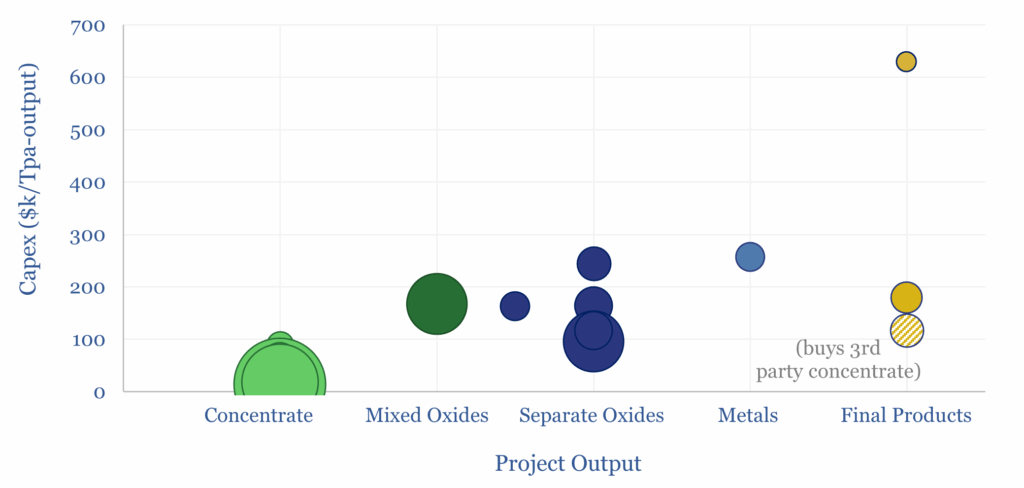

Their project proposals vary. Producing concentrates of Rare Earth-containing minerals carries the lowest capex at $50k/Tpa, but the highest commercial risk, as an offtaker is needed for the concentrate. Most projects are producing mixed Rare Earth oxides, and/or separating out a few Rare Earth oxides, with capex costs of $150k/Tpa, as captured in our Rare Earth mining and refining model. NdPr is most in focus. Only a handful of projects are integrating across the entire value chain, to produce metals, or even final products such as magnets, as this is more capex-intensive again (chart below).

The market does seem to be risking these projects heavily. The average company is quoting a c$1bn post-tax NPV on their developments. If we divide these companies’ market caps by their stated project NPVs, then present market capitalizations imply a c90% risking of these ambitions, which is reminiscent of the early-stage E&P industry.

The full data-file captures our notes on these Rare Earth companies, and their Rare Earth mining and refining projects.