Shanghai Electric gas turbine technology is contrasted against the Western gas turbine leaders in this data-file, based on reviewing 20 patents from 2021-24. Shanghai Electric is clearly trying to compete in this space. Our patent review uncovered interesting details into turbine temperatures, efficiencies, reliability, AI+sensing and manufacturing costs.

Shanghai Electric is a Chinese manufacturer of power generation equipment, established in 2000, with 75,000 employees, headquartered in Shanghai, listed in Shanghai and Hong Kong. Main business areas include coal power, elevators in a partnership with Mitsubishi, energy storage, wind and nuclear.

However, in October-2024, Shanghai Electric said it had ignited China’s first domestically developed 300MW F-class heavy-duty gas turbine, which had the “highest power output and technological class among domestically developed turbines” and “specifications on par with international, mainstream F-class turbines”.

Hence to what extent will Shanghai Electric compete with Western gas turbine makers, such as GE Vernova and Siemens Energy, to meet the growing global demand for global gas turbines, which was described in our gas turbine outlook below?

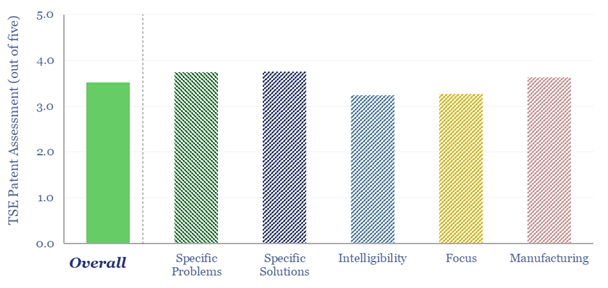

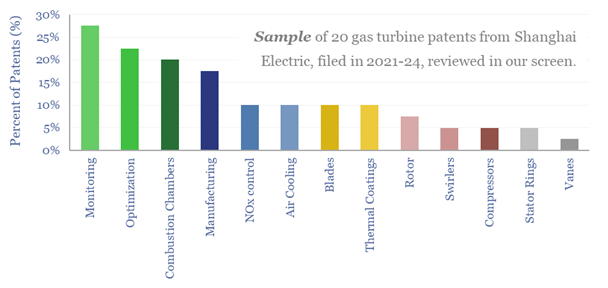

Shanghai Electric gas turbine technology is explored in this data-file. The company has filed c100 patents containing the words “gas turbine” from 2021-24. We reviewed 20 of these patents as a sample, which are focused mainly on monitoring performance, raising reliability, keeping NOx emissions low, and incremental improvements in manufacturing.

Other interesting angles included the use of sensors+AI to optimize different dimensions of gas turbine performance, and comparisons between the cooling technologies in Shanghai Electric’s patents versus those developed by the Western leader, Howmet, which then find their way into gas turbines from GE Vernova and Siemens Energy.

Several patents gave a sense that Shanghai Electric is specifically trying to compete with Western leaders in gas turbines. However, the details in this data-file suggest to us that Western turbine makers still have an edge on efficiency and reliability, which may directly backstop paying $100-400/kW capex premia on the economics of CCGTs.

Further details on Shanghai Electric’s gas turbine technology are in the data-file. We also added Shanghai Electric’s AE94.3A gas turbine into our data file comparing gas turbine operating parameters.