Stem Inc. went public via SPAC in April-2021, in a combination with Star Peak Energy Transition Corp, valued at $1.35bn. Its offering is concentrated on software to manage and optimize grid-scale batteries, which can lower energy bills by 10-30% and uplift IRRs. Revenues are targeted to grow at a c50% CAGR.

Stem’s patents are visibly focused on software (>80%) rather than hardware (c20%). What surprised us about the patents is that they are mostly focused on smoothing short-term, second-by-second, minute-by-minute volatility caused by increasing renewables deployment (70%). Not moving excess renewable power over longer timeframes.

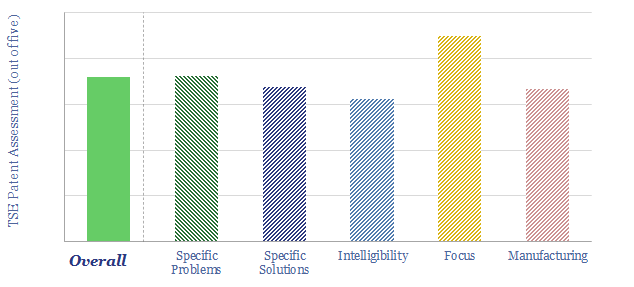

Stem scored well on our usual patent framework. We found the high-level problem statements and proposed solutions in its patents to be compelling and innovative. But it is also inherently harder to assess the fine details of optimization software with patent analysis.

Specific challenges, solutions and back-up is outlined in the data-file.