-

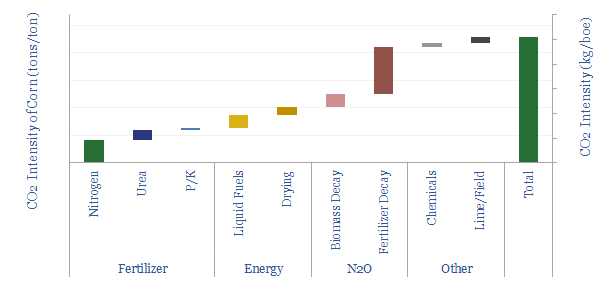

Crop production: what CO2 intensity?

The CO2 intensity of producing corn averages 0.23 tons/ton, or 75kg/boe. 50% is from N2O emissions, a powerful greenhouse gas, from the breakdown of nitrogen fertilizer. Producing 1 kWh of food energy requires 9 kWh of fossil energy.

-

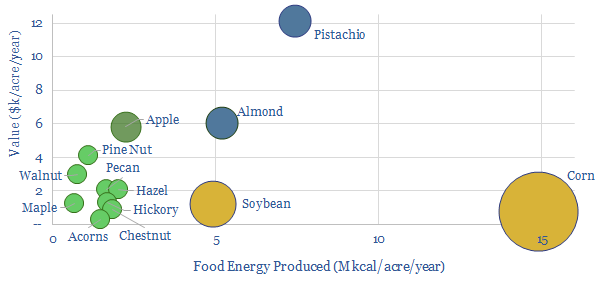

Tree crops: financial and agricultural yields?

This data-file compiles the estimated calorific and financial yields of tree crops versus conventional crops such as corn and soybean. Tree crops absorb more CO2 and have strong economic potential. Value is 2x higher than conventional agriculture although calorific yields may be 50-90% lower.

-

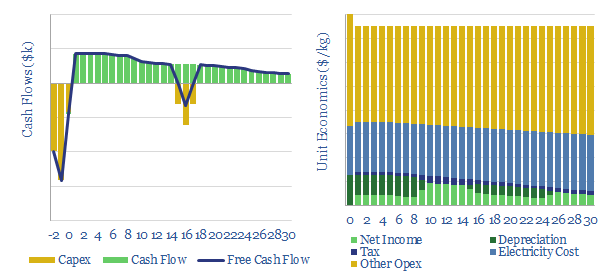

Vertical greenhouses: the economics?

This data-file models the economics of vertical greenhouses, for growing greens, fruits and vegetables close to the consumer, in large multi-story facilities, lit by LED lighting. Our base case yields 10% IRRs off $1.25k/m2 capex and 50kg/m2/year yields. CO2 intensity depends heavily upon the CO2 intensity of the underlying grid.

-

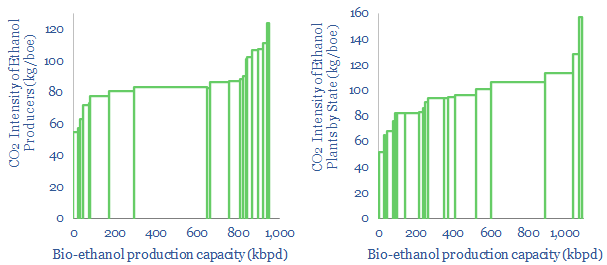

US ethanol plants: what CO2 intensity?

US bioethanol plants produce 1Mbpd of liquid fuels, with an average CO2 intensity of 85kg/boe. Overall, corn-based bioethanol has c40% lower CO2 than oil products. We screened the leaders and laggards by CO2-intensity, covering Poet, Valero, Great Plains, Koch, Marathon and White Energy.

-

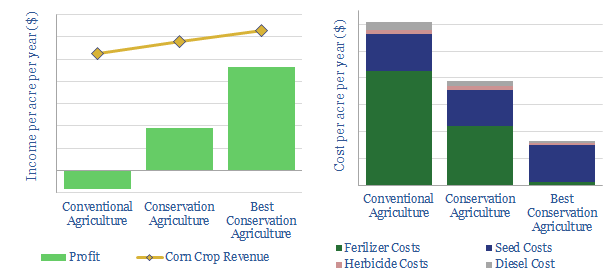

Restoring soil carbon: the economics?

We model the economics for conservation agriculture to restore soil carbon. 5-30T of CO2 can be sequestered per acre per year, while deflating farm costs by 36-73% and raising yields 10-20%. This would transform crop-growing economics from marginal to material.

-

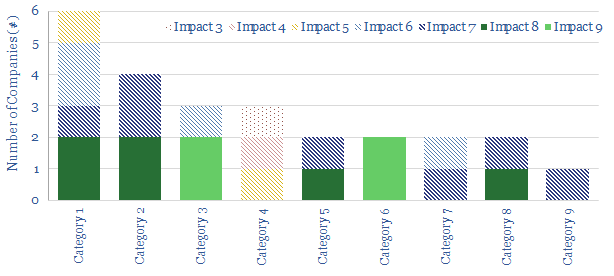

Make CO2 into valuable products?

What if CO2 was not a waste product, but a valuable commercial feedstock? We have assessed the top 27 companies at the cutting edge, commercialising CO2 into next-generation plastics, foams, concretes, specialty chemicals and agricultural products. Each company is assessed in detail. 13 are particularly exciting. 21 are start-ups. Aramco, Chevron, Repsol also screen well.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)