Batteries

-

Energy storage: top conclusions into batteries?

Thunder Said Energy is a research firm focused on economic opportunities that can drive the energy transition. Our top ten conclusions into batteries and energy storage are summarized below, looking across all of our research.

-

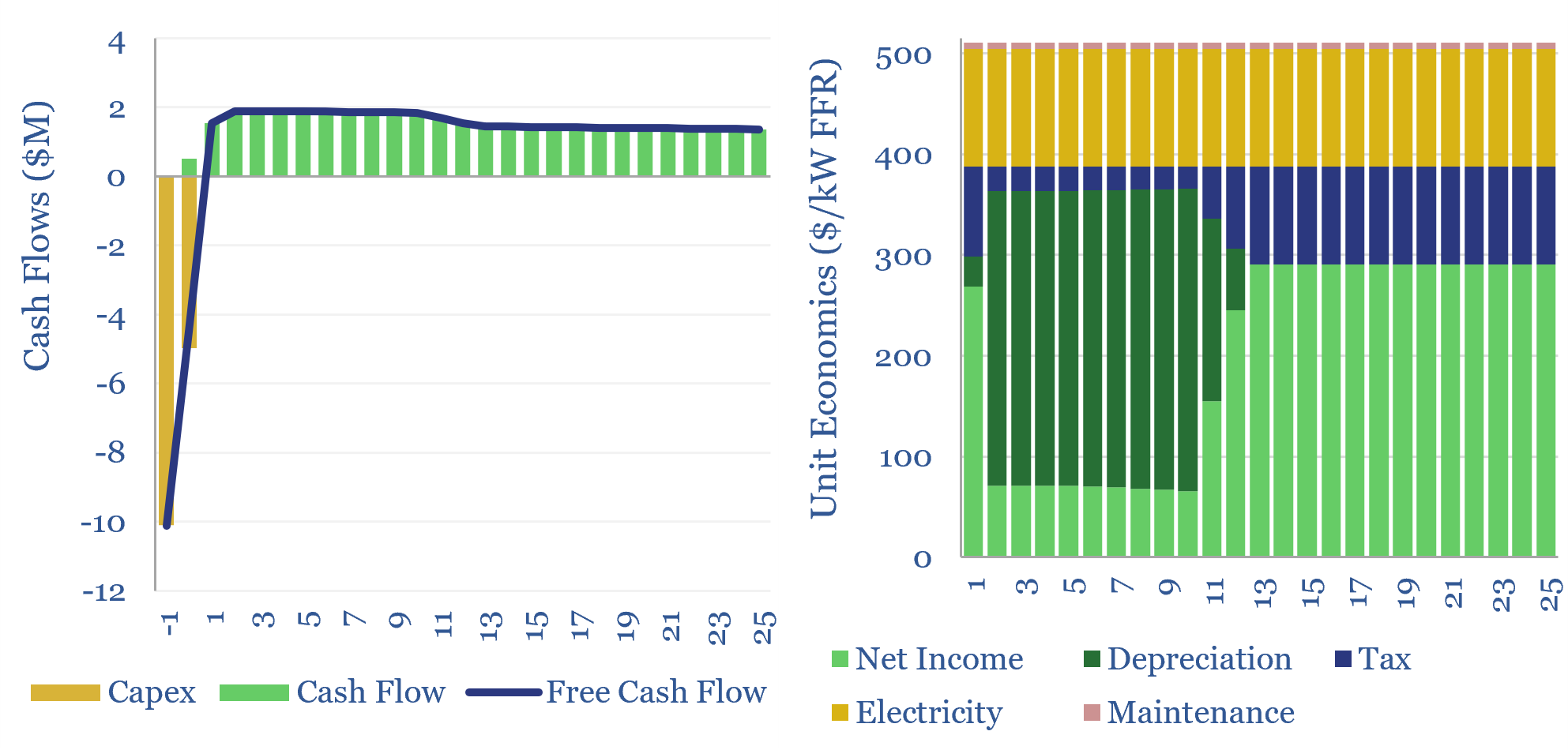

Economics of flywheels: fast frequency response?

The economics of flywheels can be stress-tested in this data-file, requiring a $500/kW fee for fast-frequency response, to generate a 10% IRR on c$10,000/kWh of capex costs, on a typical flywheel plant with around 15-minutes of energy storage. The rise of renewables and AI increasingly requires adding inertia to power grids. Flywheels may be one…

-

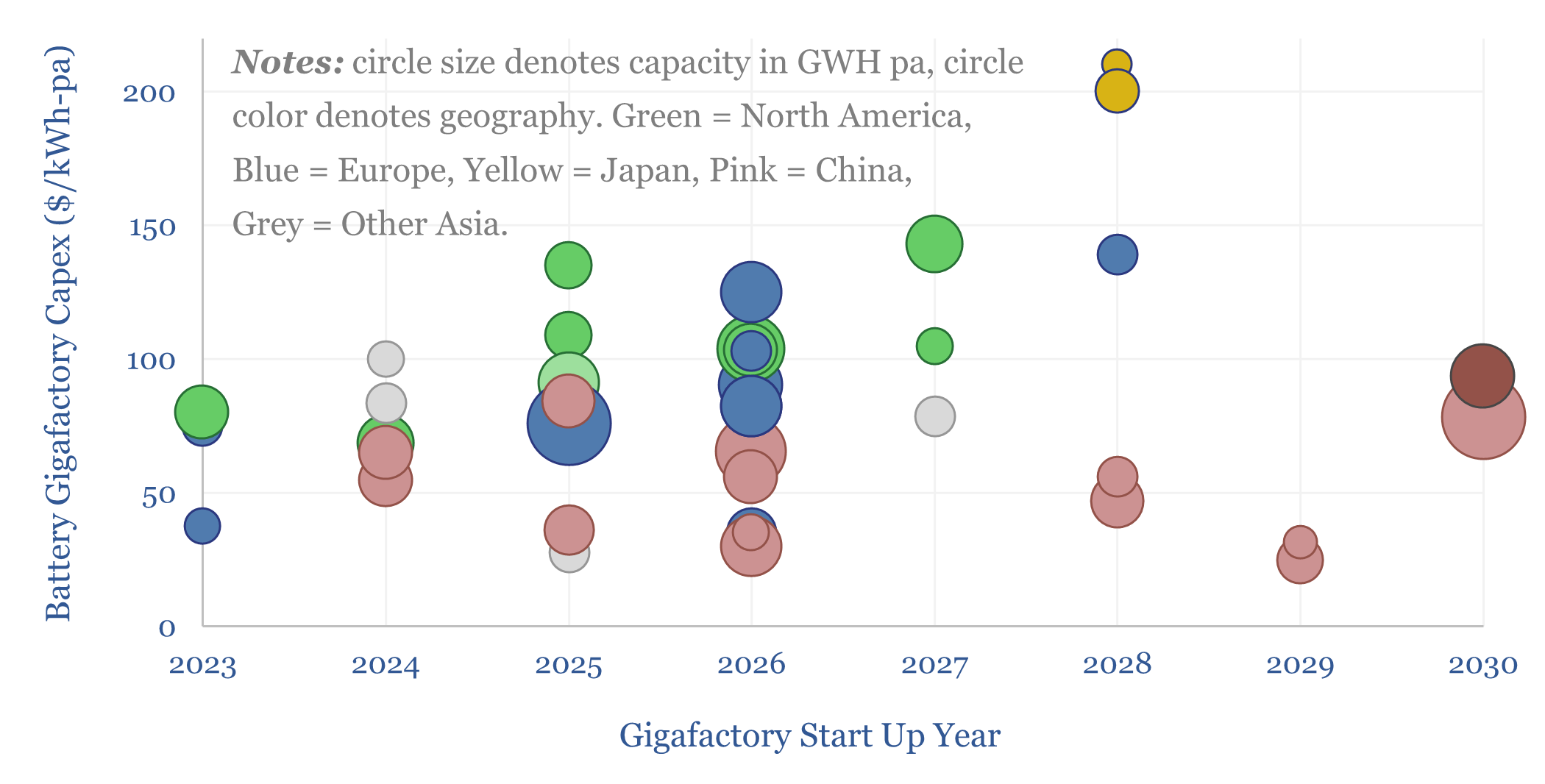

Battery gigafactory capex costs?

This data-file captures battery Gigafactory capex costs, by region, by chemistry, by company and over time, by looking across a sample of 40 major projects. Capex costs average $80/kWh-pa of capacity. Each GWH pa of capacity is associated with 70 full-time employees.

-

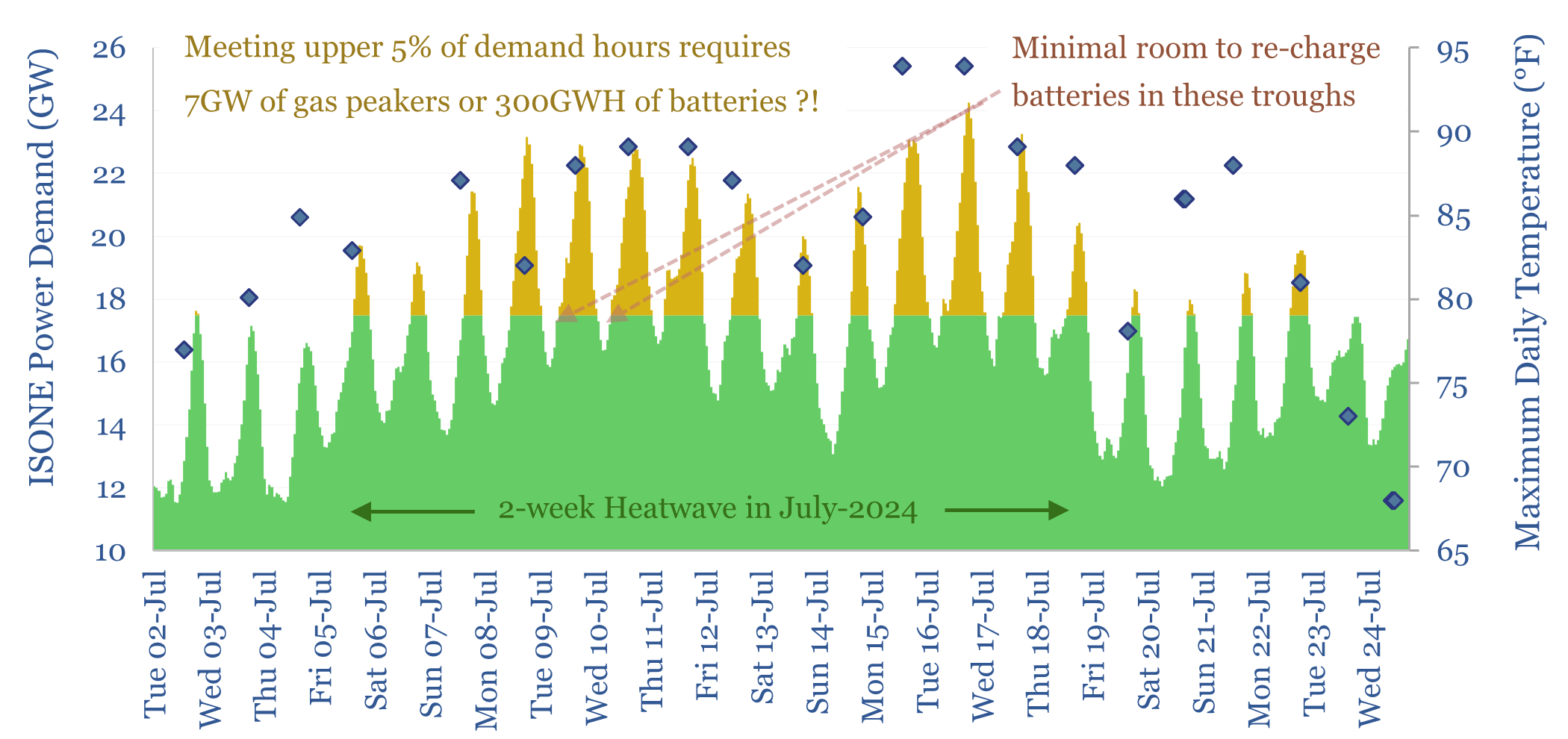

Peak loads: can batteries displace gas peakers?

Peak loads in power grids are caused by heatwaves (in the US) and cold snaps (in Europe), which last 2-14 days. This 16-page report finds that very large batteries would be needed to ride through these episodes, costing 2-20x more than gas peakers. But the outlook differs interestingly between the US vs Europe.

-

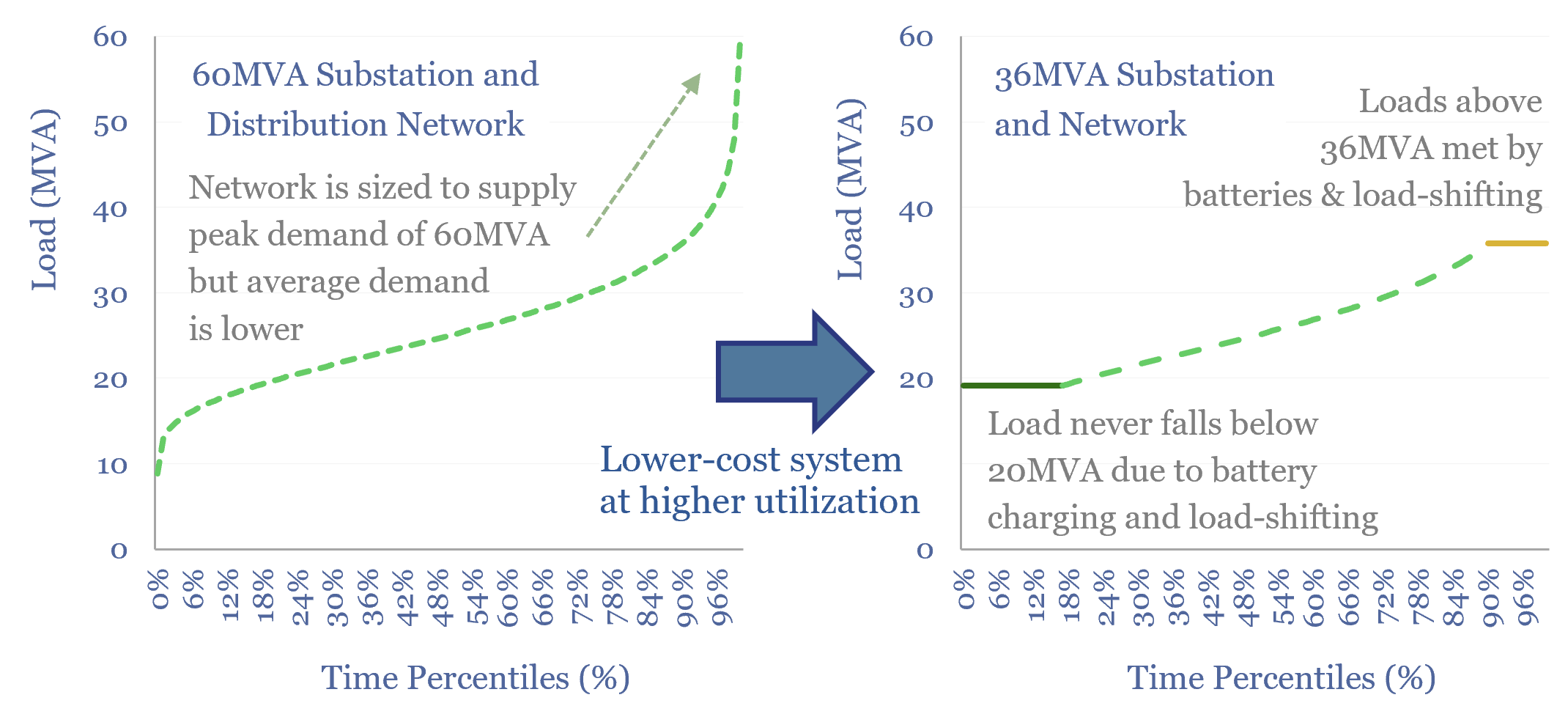

Power grid bottlenecks: flattening the curve?

Will persistent grid bottlenecks de-rail electricity growth? This 18-page report explores using batteries and smart energy systems to reduce the need for new power lines. This option can be surprisingly economical, when back-tested on real-world load profiles. Hence we are upgrading our battery outlook.

-

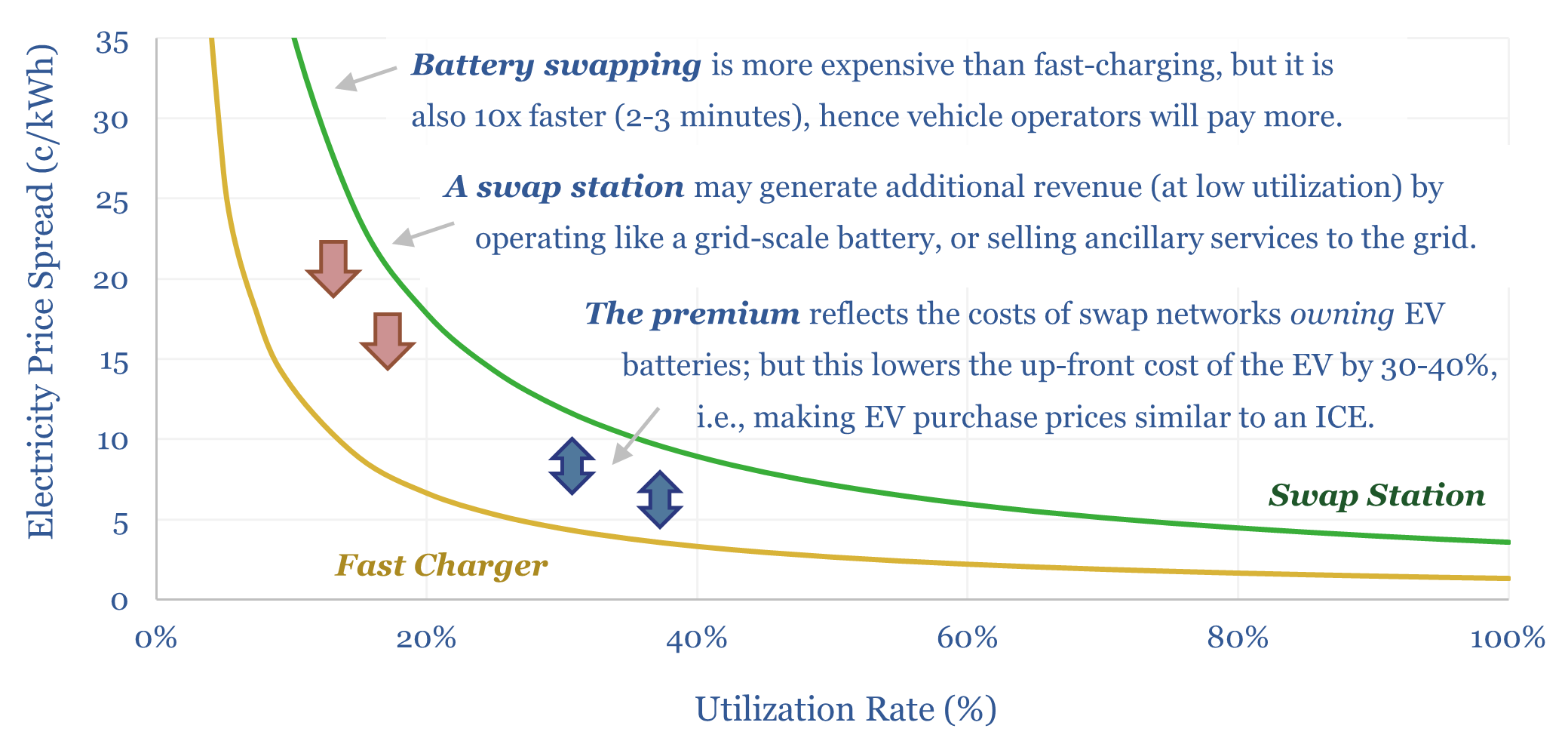

Battery swapping: off to the races?

Battery swapping has seen a sudden surge of interest, especially for cars in China, some heavy vehicles, and two-wheelers throughout emerging markets. Can the theme re-accelerate EVs? This 19-page report finds many advantages, controversies over costs, and profiles leading companies.

-

Solar plus batteries: the case for co-deployment?

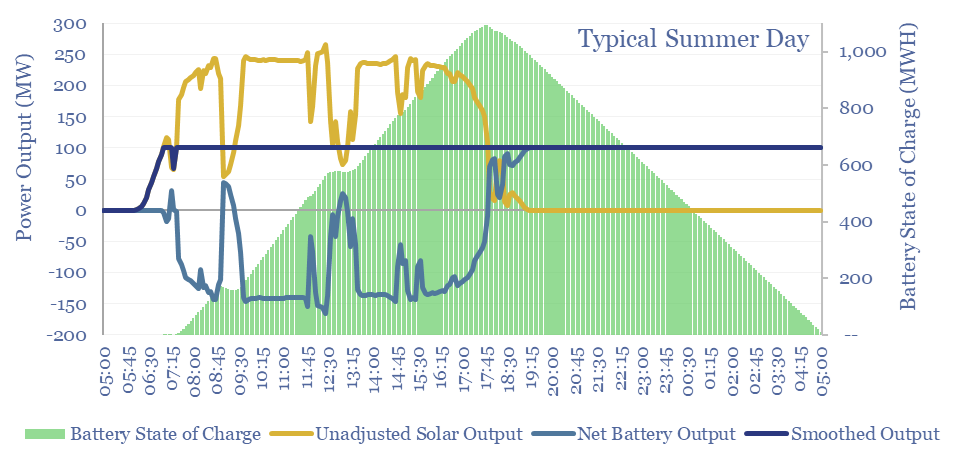

This 9-page study finds unexpectedly strong support for co-deploying grid-scale batteries together with solar. The resultant output is stable, has synthetic inertia, is easier to interconnect in bottlenecked grids, and can be economically justified. What upside for grid-scale batteries?

-

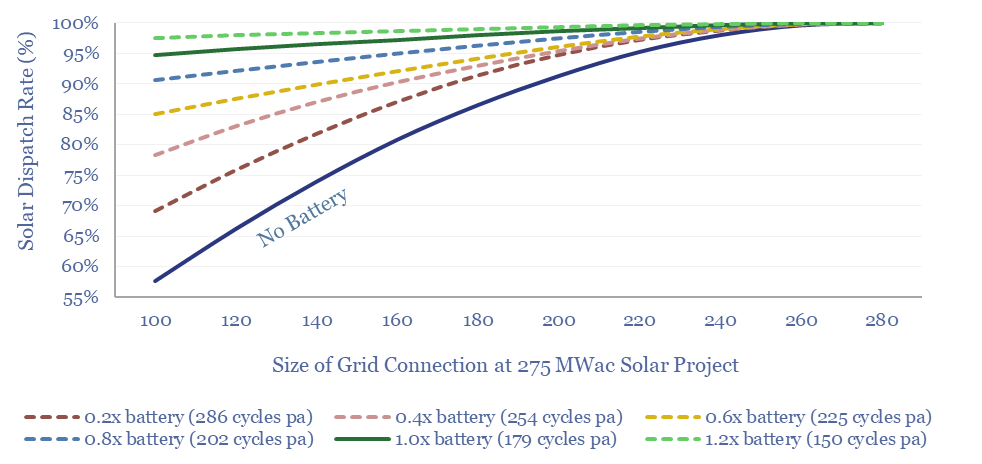

Solar+battery co-deployments: output profiles?

Solar+battery co-deployments allow a large and volatile solar asset to produce a moderate-sized and non-volatile power output, during 40-50% of all the hours throughout a calendar year. The smooth output is easier to integrate with power grids, including with a smaller grid connection. The battery will realistically cycle 100-300 times per year.

-

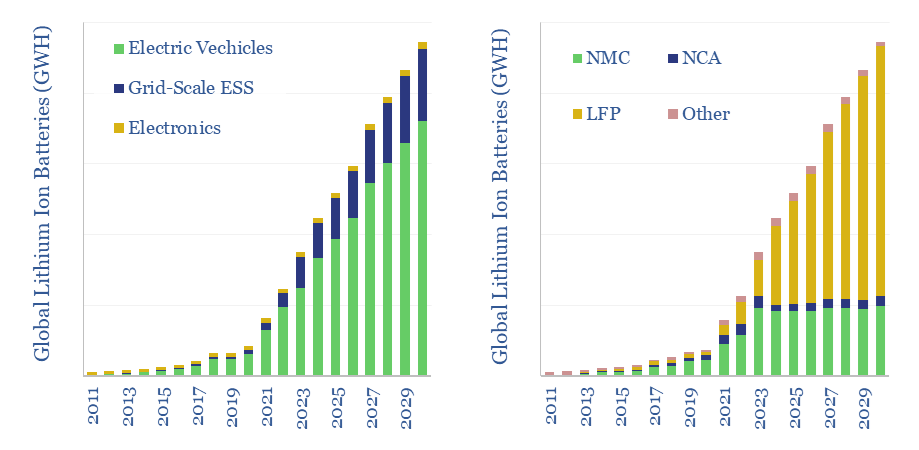

Lithium ion battery volumes by chemistry and use?

The lithium ion battery market reached 900GWH in 2023, representing 7x growth in the past half-decade since 2018, and 20x growth in the past decade since 2013. Volumes treble again by 2030. This data-file breaks down global ithium ion battery volumes by chemistry and be end use. A remarkable shift to LFP is underway, and…

-

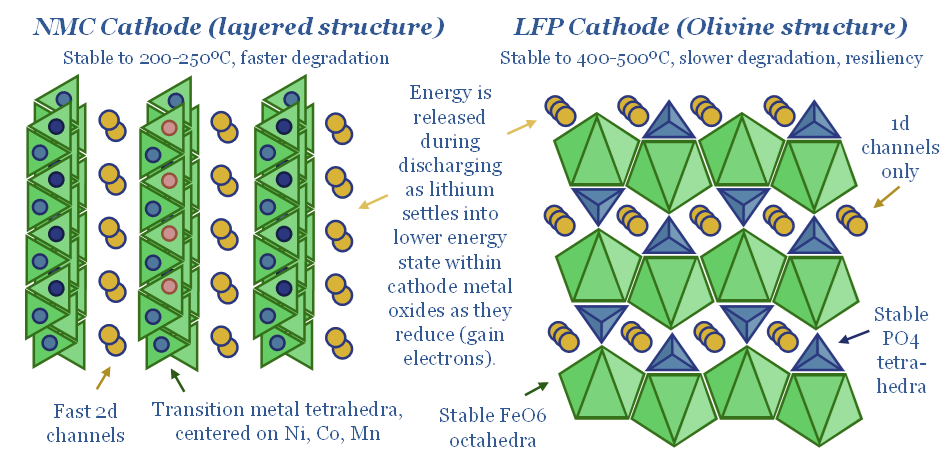

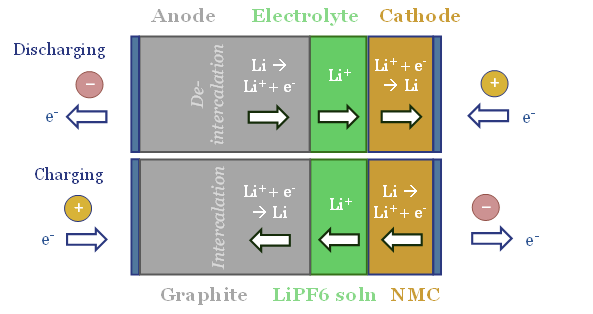

LFP batteries: cathode glow?

LFP batteries are fundamentally different from incumbent NMC cells: 2x more stable, 2x longer-lasting, $15/kWh cheaper reagents, $5/kWh cheaper manufacturing, and $25/kWh cheaper again when made in China. This 15-page report argues LFP will dominate future batteries, explores their costs, and draws implications for EVs and renewables.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)