-

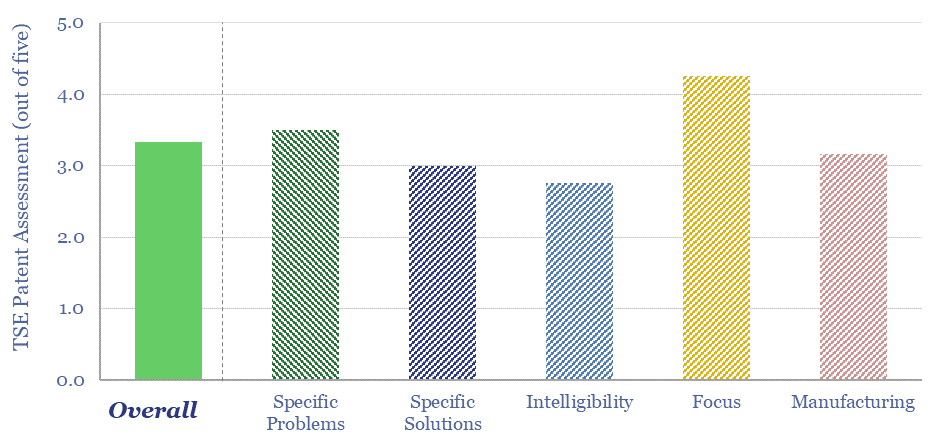

Enhanced geothermal: technology challenges?

This data-file tabulates the greatest challenges and focus areas for harnessing deep geothermal energy, based on reviewing 30 recent patents from 20 companies in the space. We conclude that recent advances from the unconventional oil and gas industry are going to be a crucial enabler.

-

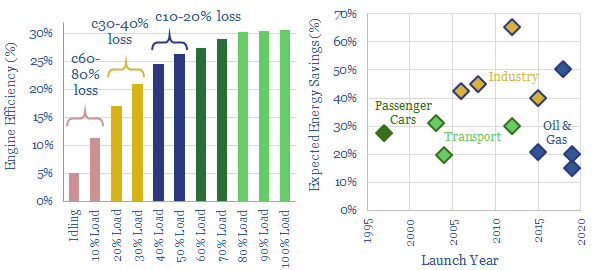

Hybrid horizons: industrial use of batteries?

Gas and diesel engines can be 30-80% less efficient when idling, or running at low loads. This is the rationale for hybridizing engines with backup batteries. Industrial applications are increasing, achieving 30-65% efficiency gains, across multiple industries. In 2018-19, the biggest new horizon has been in oil and gas, including hybrid rigs, supply vessels, construction…

-

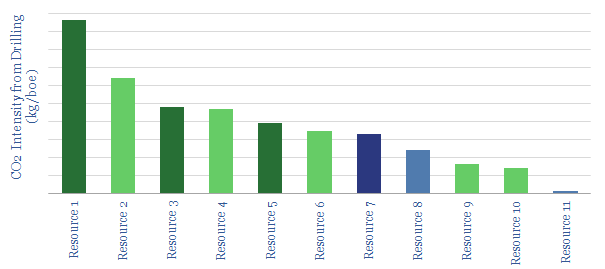

CO2 Intensity of Drilling Oil Wells?

This data-file estimates the CO2 intensity of drilling oil wells, based on the fuel consumption of different rig types. Drilling wells is not the largest portion of the oil industry’s total CO2 intensity. Nevertheless there is a 50x spread between the best barrels at prolific onshore fields and the worst barrels at mature deepwater assets.

-

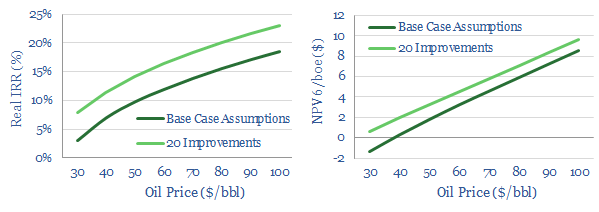

Can technology revive offshore oil?

Can technology revive offshore and deep-water? This note outlines our ‘top twenty’ opportunities. They can double deep-water NPVs, add c4-5% to IRRs and improve oil price break-evens by $15-20/bbl.

-

U.S. Shale: Winner Takes All?

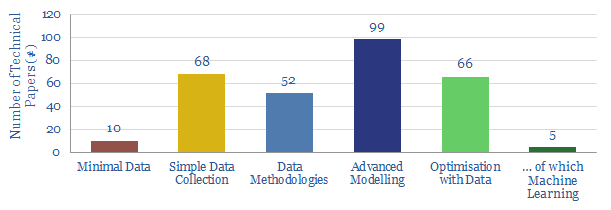

Shale is a ‘tech’ industry. And the technology is improving at a remarkable pace. But Permian technology is improving faster than anywhere else. These are our conclusions after reviewing 300 technical papers from 2018. We address whether the Permian will therefore dominate future supply growth.

-

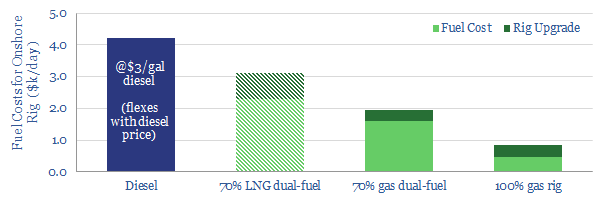

Should a shale rig switch to gas-fuel?

Should a shale rig switch to gas-fuel? We estimate that a dual-fuel shale rig, running on in-basin natural gas would save $2,300/day (or c$30k/well), compared to a typical diesel rig. This is after a >20% IRR on the rig’s upgrade costs. The economics make sense. However, converting the entire Permian rig count to run on…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (355)